Geek Level:

Read Time:

The Speed Read:

- Social proof is a behavioural bias that can lead to decision making errors.

- By embracing a process-driven research flow to guard against behavioural biases and data peeking, Viewpoint can distinguish between true and false alpha.

- Previous academic research showed the potential for alpha in commodity markets by gaining exposure to longer-dated futures contracts.

- Instead of using the more actively traded “front month” futures contracts for exposure to a commodity, investors could harvest alpha by replacing that same exposure with a futures contract that expires in twelve months.

- Using a more robust testing framework to correct for data peeking, research from Viewpoint shows that the ‘maturity premium’ is too unstable out of sample to be included in investment strategies.

- Future research on this topic may include how the shape of the futures curve could better inform a ‘modified’ maturity premium.

Jonah Berger is a marketing professor at The Warton School at the University of Pennsylvania. In 2013, Berger wrote a book called Contagious: Why Things Catch On, exploring why certain products, stories, or ideas go viral. One of the major catalysts that influences human behaviour is called “social proof.” When individuals have uncertainty about a specific product or idea, they will often look to what their peer group is doing to help them decide. For a modern-day example, look no further than how TikTok influences pop culture. Social proof is such a strong behaviour that it can play a role in life and death matters. In Berger’s book, he tells the story of a researcher at MIT exploring why such a high proportion of kidney transplants are incorrectly refused, even after controlling for incompatibility between donors and recipients. Kidney transplant lists are operated on a first-come-first-serve basis, so when kidneys become available to individuals lower down on the list, sometimes those people deem the kidney as lower quality and end up refusing the transplant. Not understanding that the kidney has become available because of incompatibility between the donor and recipients higher on the list, social proof bias (believing the kidney is of inferior quality) leads one in every ten people on the list to end up refusing a kidney in error.

In a previous note from Viewpoint, we showed that an allocation to direct commodity exposure can make investment portfolios more robust. Not only can commodities protect against inflation shocks, but they provide fantastic diversification to a traditional balanced portfolio. The low correlation to equities and fixed income helps to provide a ballast in certain economic environments (e.g., high inflation) when other areas of a portfolio can be negatively impacted. This diversification protects the portfolio against more pronounced drawdowns that impair the ability of the portfolio to compound in future periods. The ability to guard against volatility drag lowering the overall terminal value of a portfolio is something that should interest all investors.

While an allocation to commodities can help fortify investment portfolios, at Viewpoint we are always on the hunt for how we can make improvements to our investment strategies. These improvements may take the shape of return enhancement, risk mitigation, or both. Our goal is to constantly evaluate if the Viewpoint strategies are providing value relative to investment products offered in the marketplace, and how we can make improvements to consistently and repeatably drive value creation.

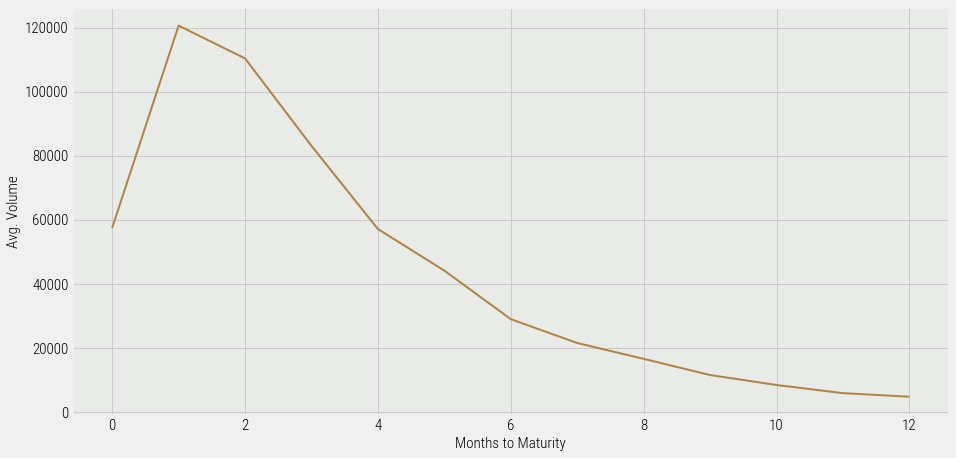

With this goal in mind, our research team set out to answer whether commodity markets exhibit what is known as a “maturity premium.” The idea of enhancing a long-only commodity futures portfolio by including exposure to longer-dated futures contracts was put forward in an academic paper by Rallis, Miffre, and Fuertes in 2012. Most activity in commodities futures markets takes place in the first or second expiry months (i.e., prompt, front month) (Figure 1), and that liquidity creates a positive feedback loop where market participants generally use prompt futures contracts to express their view of the market. However, Rallis et al. showed that for a long-only commodity portfolio, increasing the tenor of the futures contracts (relative to the prompt contract) can provide both return enhancement and a reduction in realized volatility.

Figure 1: Corn Futures Volume Curve’ and adjust title/source formats to match cell k8.

Source: Bloomberg, VIP Internal

An example of this would be if an investor has decided they would like to get exposure to corn futures. Instead of using the more actively traded prompt futures contract for the exposure, an investor could buy corn via the futures contract expiring in twelve months. By gaining exposure to longer-dated futures contracts, an investor should be able to harvest a “maturity premium” relative to if they were just using the prompt contract for their exposure.A maturity enhancement strategy could make economic sense from a theoretical perspective. While most trading activity takes place in the prompt contracts, if there are commodity producers that would like to hedge their production (selling futures) for a specific date in the future, utilizing longer duration futures contracts should provide exposure to a new set of premia as price risk from commodity hedgers is transferred to speculators. To entice speculators to take the other side of a commodity hedger’s transaction further out in the future (say an oil producer hedging a portion of their production by selling futures contracts out twelve months), there theoretically should be an insurance premium available to a speculator that is not just compensation for illiquidity risk.This is effectively what Rallis et al. found in their work. By targeting contract tenors of twelve months across a broad range of commodity futures, Rallis et al. showed that maturity enhancements yielded an alpha of +5.5% annualized relative to maintaining exposure to the prompt contract, and that this alpha was not merely compensation for illiquidity risk. In addition, this maturity premium appeared to be consistent given the alpha increased in conjunction with the tenor of the futures contract (i.e., greater compensation for owning twelve-month tenors relative to six-month tenors).

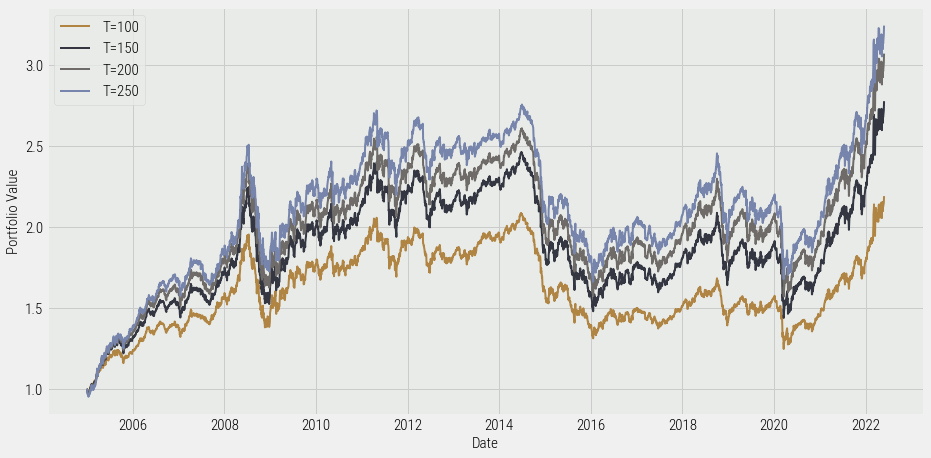

Figure 2: Constant Maturity Commodity Portfolio Backtests (T denotes contract maturity in number of days)

Source: VIP Internal

With the Rallis et al. paper in hand, and some initial exploratory analysis from Viewpoint’s research department that broadly confirmed there may be a maturity premium (Figure 2), this could have been an open and shut case for implementation into the Viewpoint Commodities strategy. However, at Viewpoint we’ve built a “Quantitative Strategy Delivery Lifecycle” (QSDL) which is a proprietary set of policies, practices, and procedures to ensure that our rigorous research process not only adds value to how we construct investment portfolios, but also guards against taking short cuts by basing our decisions off what others have previously done (i.e., succumbing to the social proof bias). The Chairman and Co-Founder of Viewpoint Investment Partners, Mac Van Wielingen, likes to use the phrase “if we do things like everybody else, we’ll end up like everybody else.” Our QSDL research process ensures we address the traditional behavioural bias pitfalls that befall other investment management companies, so we can truly be “Active. Where it Counts.”

While we want to highlight the positive work that Rallis et al. have contributed to this space, the point of science is to constantly question what we believe we know, and to put existing theories through rigorous testing; investment management should be no different. In this spirit, there were items in the Rallis et al. paper that we needed to explore before we could get comfortable with exploring an implementation for the maturity premium.

First, the analysis in the Rallis et. al paper was done over one period (1988 to 2008), which poses the question as to whether the alpha presented in the paper is stable across various periods. When you are analyzing data from one sample period, and then using the optimized output for a trading strategy over the same period, this is known as data peeking (i.e., using forward-looking data not available at the time.) In addition to correcting for data peeking issues, the inclusion of transaction costs needed to be incorporated into the analysis. Transaction costs are especially important given futures contracts with longer tenors are less liquid than prompt contracts and generally exhibit wider bid/ask spreads. While the Rallis et al. paper did specify how they incorporated roll methodology into their work, there was no mention on how transactions costs were incorporated into the results.

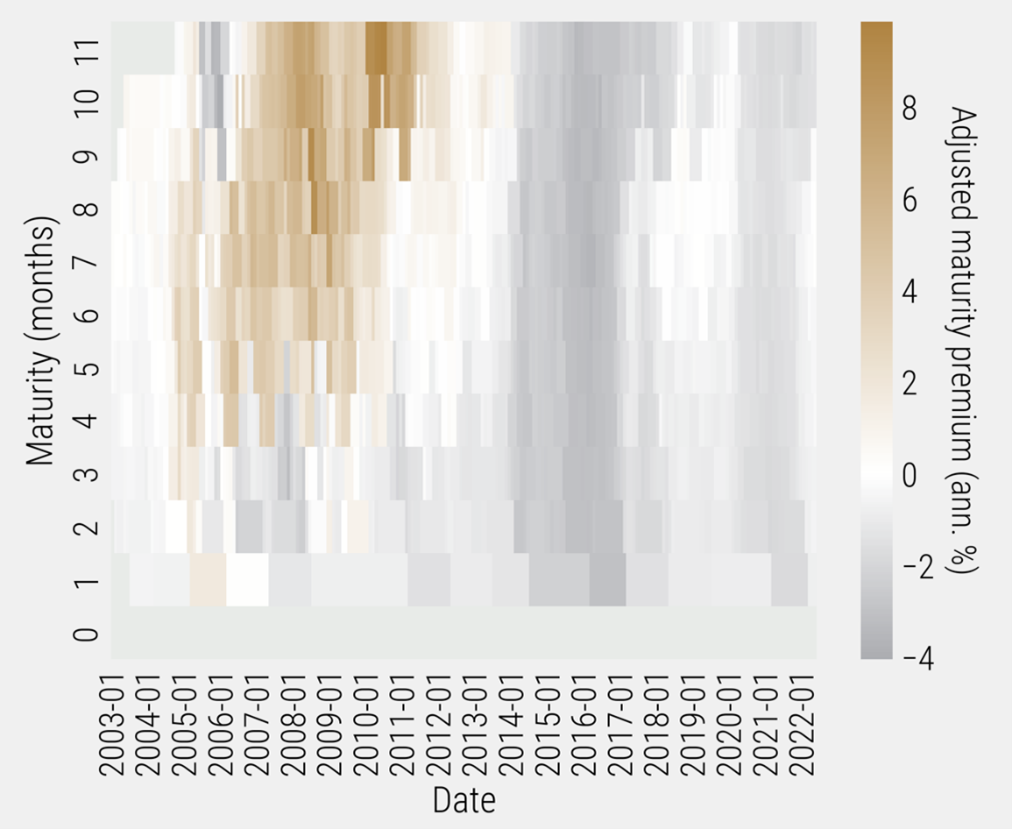

Figure 3: Copper Futures – Persistence of Maturity Alpha Over Time

Source: VIP Internal

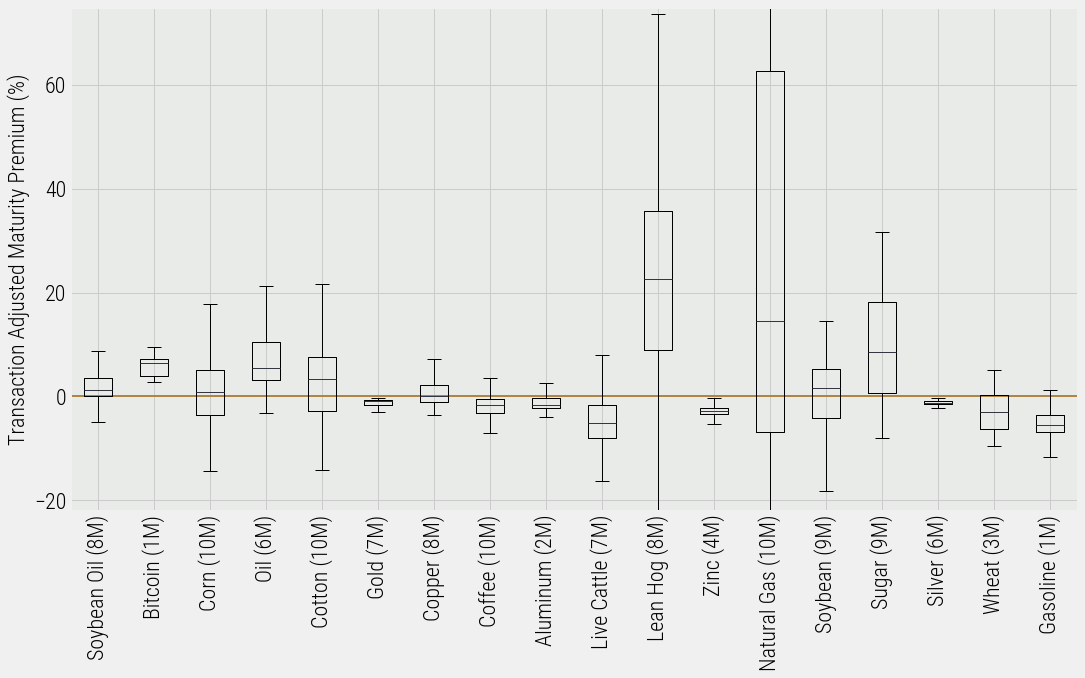

To analyze the stability of the maturity alpha over various time periods while correcting for data peeking bias, we re-ran the analysis with data from January 2000 to May 2022 using a rolling three-year observation window, while including transaction costs in the data. To keep a constant exposure to our desired maturity tenors, when the prompt futures contract expires, we also roll our longer-dated futures contracts back to the desired maturity. Therefore, each time the prompt contract expires, the maturity strategy needs to incorporate transaction costs to rebalance back to its desired maturity. For commodity futures with large volume and open interest like crude oil, the impact of incorporating bid/ask spreads is not as material for commodities such as lean hogs. While transacting in the oil futures contract that expires in twelve months may cost 0.20% round trip (versus 0.03% for the prompt contract), lean hog spreads for the same tenor could be in the neighbourhood of 1.4% (versus 0.10% for the prompt contract.)After adjusting the analysis to incorporate those factors, the results were different from what Rallis et al. observed back in 2012. By using a rolling three-year window, we were able to visualize how the maturity premium has evolved over time. Figure 3 shows an example of charting the maturity premium in copper futures over time. The colour gradient indicates the size of the premium, with grey indicating a lower or negative value and gold indicating a higher or positive value. The pattern illustrated in Figure 3 is similar for many commodities in the opportunity set we analyzed. While there may have been a maturity premium up until the early 2010s, any alpha to be harvested has since decayed. Even if you were to theorize the most recent period could just be a bout of underperformance for the factor, analyzing a cross-section of commodity markets illustrated there wasn’t a consistent maturity across all markets which produced the highest Sharpe (Figure 4) like in the Rallis et al. work. Not only was there not a uniform contract tenor that performed the best for all commodity markets, but the highest median return tenors were not statistically significant. Based on Viewpoint’s QSDL process, we can conclude that maturity alpha is not consistent nor stable over time and is therefore not practical to implement into our existing investment strategies.

Figure 4: Contract Maturity with Highest Sharpe for Each Commodity Market

Source: VIP Internal

The insights uncovered through this research project will be useful in the future, as it has illuminated potential areas of continued research into how the stability of maturity premiums could be impacted during different time periods. Namely, additional work can be done on the hypothesis that maturity premiums may be harvestable when the futures curve moves into contango and less so when the curve is in backwardation. The practicality of this work would be to estimate when convenience yields may arise for spot/prompt delivery of various commodities, which could also incorporate how momentum impacts the shape of the futures curve. Additionally, posting liquidity instead of taking liquidity during roll periods is another avenue of continued research, as reducing transaction costs to a more reasonable level (or a level consistent with transacting in the prompt contracts) could resurface the feasibility of a persistent maturity premia. Finally, additional work on segmenting and quantifying which commodity futures are dominated by commercial hedgers that are net short could help to provide further insight into the theoretical assumption for long-only maturity premium as price risk transfers from hedgers to speculators.While on the surface the results of this research analysis may seem suboptimal, it highlights the strength of Viewpoint’s QSDL framework by avoiding judgment errors due to social proof bias. In this situation, uncovering and avoiding the unintended consequences of data peeking is a strong result, and Viewpoint’s investment strategies will be more robust out of sample as a result.

Image: Matt Squire / Source: Vogue

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.