Harvesting the diversification premium

At Viewpoint, we approach portfolio construction differently. Our strategies are based on risk contribution and correlation analysis, which provide a more comprehensive view of diversification than return expectations or capital markets optimization. We aim to deliver a premium to investors within their desired risk and return outcomes, rather than merely reducing risk. This approach to diversification offers a better way to increase portfolio returns while avoiding concentration risk.

The diversification premium in action

Click next or help to start your interactive journey.

What do we do?

We capture the diversification premium that is available in markets.

What is the benefit?

Our strategies add diversification into a portfolio without sacrificing returns or liquidity

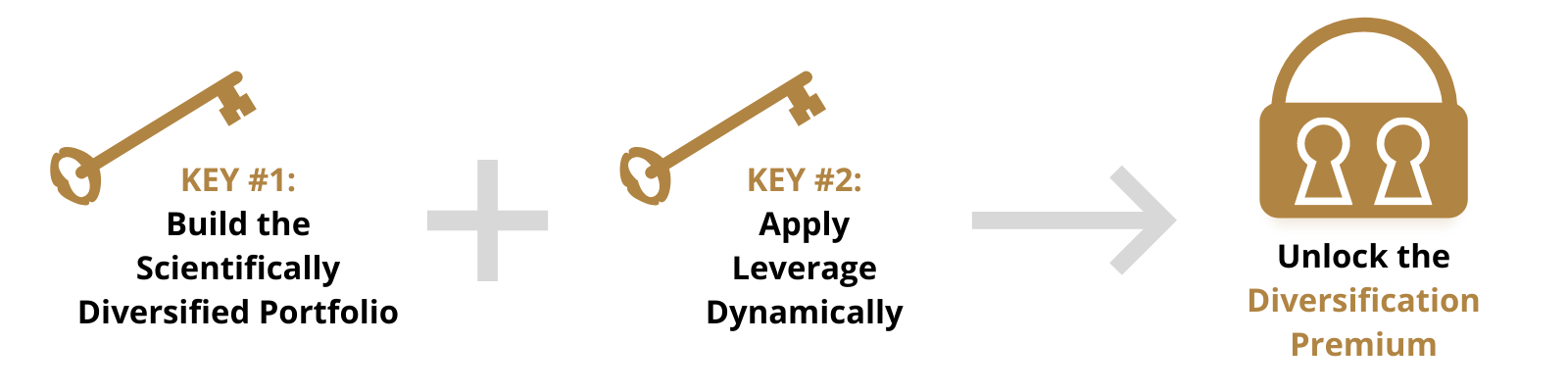

How do we do it?

We use advanced data science to build robust, diversified portfolios, and then dynamically apply liquid leverage to them.

Why does it exist?

The diversification premium exists because investors typically choose concentration over leverage.

Research process

Advancing data-based investing with continuous, innovative research

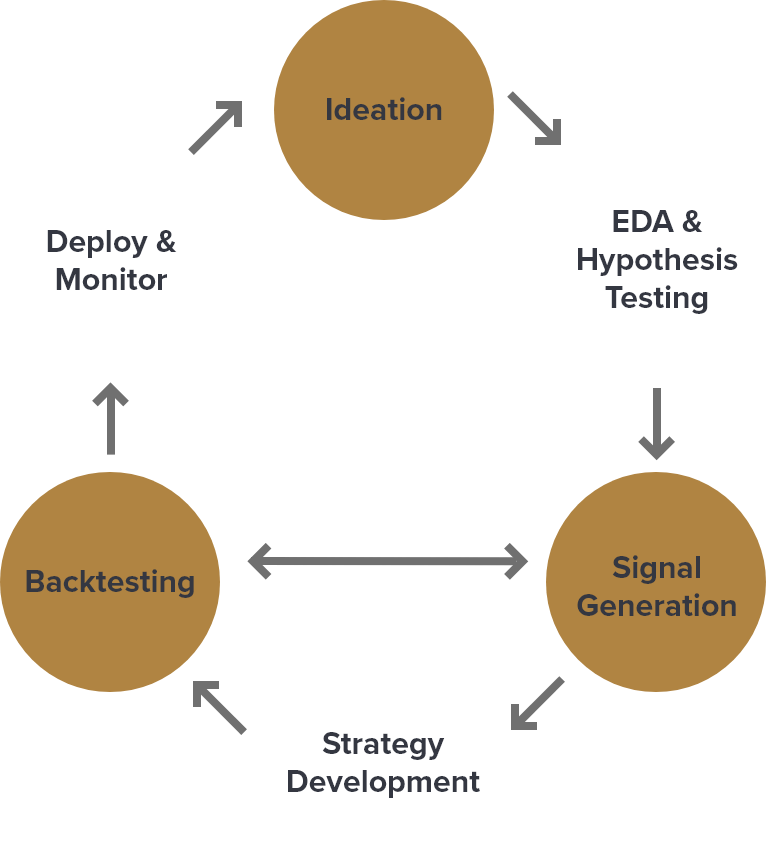

Our Quantitative Strategy Delivery Lifecycle represents a significant advancement in investment research. This empirical, rules-based system addresses the limitations of traditional approaches through the integration of advanced data science and a well-defined analytical framework. The result is a consistent and repeatable method for portfolio construction and delivery, grounded in both human insight and vast amounts of data. We do not deviate from it.

Quantitative Strategy Delivery Lifecycle

Our convictions

Building success with a strong foundation

Diversification is the only free lunch in financial markets.

This time-tested principle is perhaps the most widely quoted in portfolio management, and for good reason.

Leverage aversion creates an inefficiency in markets.

The prudent use of liquid leverage can unlock the power of diversification, and is a powerful tool when applied judiciously and systematically.

There are indisputable benefits to investing globally.

Most investor portfolios are heavily weighted towards their home country, which can have detrimental effects on their portfolio.

An orientation towards research will result in superior outcomes.

Combining time-tested research with a learning mindset and commitment to continuous improvement will lead to great results.

Having a long-term mindset is a competitive advantage.

Investors who have the ability to take a long-term view should do so, as the best investment strategy is one that an investor can stick to.

Markets are macro-inefficient, and micro-efficient.

Due primarily to the structure of the money-management industry, multi-asset strategies can take advantage of structural alpha.