As our regular readers might ascertain from prior pieces like FOMC Gymnastics and a Potential Policy Misstep, Walking a Tightrope with the Fed, and Policy Pivots & the Federal Reserve Reaction Function, it has always been important to consider the Federal Reserve (the “Fed”) and actions of its Federal Open Market Committee (the “FOMC”) when assessing market risks and constructing portfolios. However, the level of importance of the Fed and other global central banks seems to have increased dramatically since the Great Financial Crisis in 2008.

In Market Tremors, Hari Krishnan and Ash Bennington provide a valuable framework to understand this dramatic shift in Central Bank importance and suggestions on how to adjust traditional risk measures such as volatility during this era of unprecedented balance sheet expansion. On Flirting with Models S05E11: Market Tremors and Tail Hedging, Hari Krishnan discusses the rationale of the book and its main lessons. The book provides a framework to discern and model latent risks in markets that may not be reflected in the price action of financial assets.

When quantitative investment models use historic price action as a main input of their models, there is an implicit assumption that the historic prices provide a reasonable basis for current portfolio optimization. Similarly, mean-field theory holds that the analysis of the average configuration is good enough when agents behave in approximately the same way across the network. A crucial condition that the mean-field theory requires is indistinguishability, which means that if you took out any agent, or any handful of agents, the system would look about the same.

For financial markets, the condition of indistinguishability fails when there are major players, or ‘whales,’ who distort the network. Risks to this assumed model emerge when players get too large, too levered, or are too directionally active in a market. When certain agents in the financial network behave differently or in larger scale than they have in the past, traditional portfolio theory breaks down. The London Whale and Sumitomo Copper Affair are two examples of this impact. The goal is to develop an adjusted risk model by taking an initial random draw from the original distribution and see if it would force the whale into action. If so, the model would then estimate the impact and calculate an adjusted risk model.

Given the size of their balance sheets and the impact they have on market expectations and risks, many market commentators like Lyn Alden and Darius Dale have concluded that the Fed and global central banks should be analyzed as ‘whales.’ Both have developed interesting models that show correlations between central bank balance sheet size and equity market movements. These models are informative but provide a single perspective through which prospective market returns and portfolio robustness should be assessed. In fact, single-factor models that rely on a black-box approach can lead to overfitting, overconfidence, and sub-optimal bet sizing. The development of robust models requires an understanding of the differential relationships within historical data and a diversified approach for optimizing portfolios.

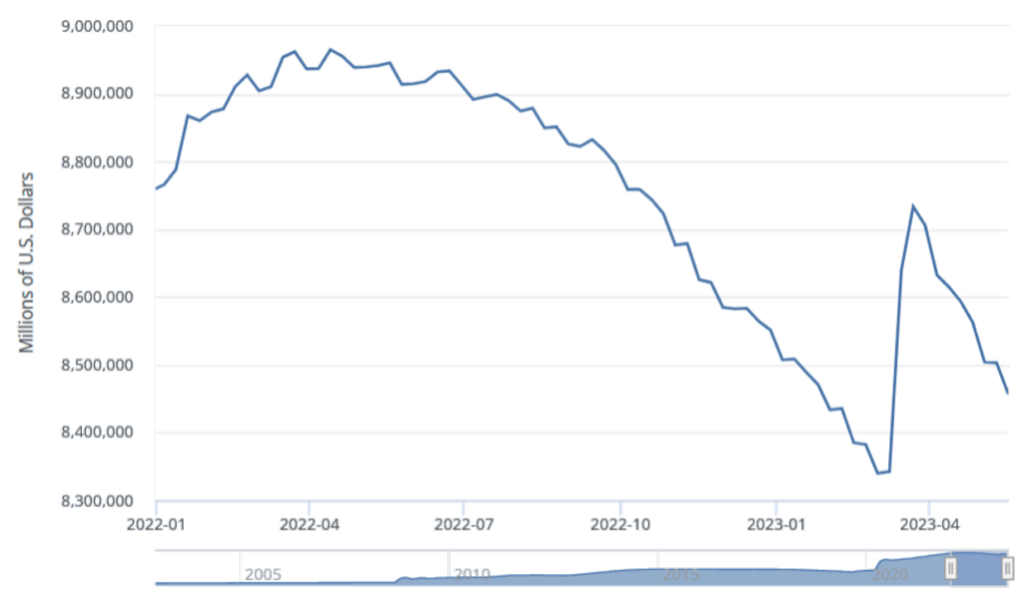

Investors concentrated in equities may want to consider the “whale” status of the Fed in connection with the ~9% rally seen in the S&P 500 and broad equity markets since mid-March. Due to the impending debt ceiling crisis, the Fed was forced to pause quantitative tightening in March, with the balance sheet level bottoming at $8.3 trillion on March 8, 2023.

We cannot predict whether the recent correlations will hold and a renewal of quantitative tightening will lead to more financial market weakness, nor can we predict whether the current debt ceiling negotiations will lead to a structural default by the U.S. government. We can predict that the market will remain uncertain. As discussed in Navigating the Sea Change, we believe that prospective financial market returns should be driven more by fundamentals than liquidity, but both continue to be important. As such, investors may want to re-evaluate their portfolios to ensure that they have sufficient diversification and an asset mix that provides a balanced exposure to various macroeconomic risk factors – including renewed quantitative tightening and a potential structural default by the U.S.

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.