In Chinese mythology, the white dragon symbolizes death and rebirth. This analogy seems applicable for foreign investors in Chinese equity markets this year. The recent rout in Chinese equity markets has come as a shock to many market participants, especially considering the downdraft in risk is isolated (for now) to this geographical region.

Source: Bloomberg

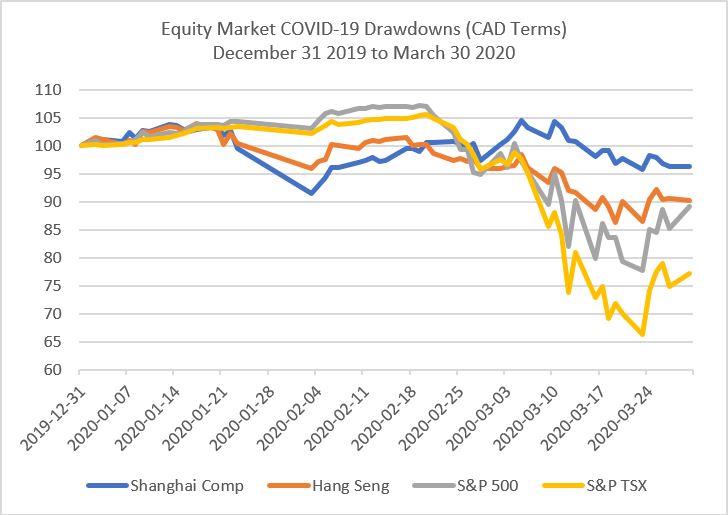

One of the more surprising factors is that Chinese equities emerged from the crisis induced by the Great Lockdown of 2020 in relatively good shape from a performance perspective, and it looked like they were set to continue their strong performance in 2021. From the end of 2019 to March of 2020, the Shanghai Composite and the Hang Seng (Hong Kong) returned -3.1% and -7.9% respectively in CAD terms. This is relative to -12.1% for the S&P 500 and -20.9% for the S&P TSX, both in CAD. Obviously, there are currency movements to take into consideration, but even if we denominate the equity indices in local currencies, the Shanghai Composite was only down -9.8% (CNY) and the Hang Seng down -16.1% (HKD) over that period; relative to -19.6% for the S&P 500 (USD) and -20.9% for the S&P TSX (CAD). For the full year of 2020, the Shanghai Composite far outpaced both the S&P 500 and the S&P TSX. Investors were optimistic that the outperformance would continue, given policymakers in China had more “room to maneuver” as both fiscal and monetary policy responses to the Great Lockdown were more muted than that of Western economies. Investors are now re-thinking this position, as the Shanghai Composite and Hang Seng have both drastically underperformed in 2021 so far.

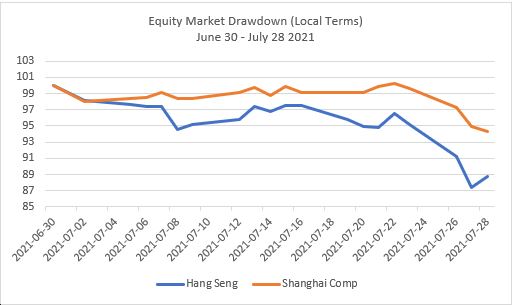

What gives? For the month of July (to the 28th) The Shanghai Composite and Hang Seng are down -5.7% and -11.3% respectively in local terms, with most of that drawdown coming in the last three days. This last bout of selling pressure has brought YTD returns for the Shanghai Composite and Hang Seng to -2.5% and -6.6% respectively (to July 28th) in CAD terms for 2021, compared to +16.2% for the S&P 500 (CAD) and +17.9% for the S&P TSX (CAD).

How can the prevailing narrative change so fast that investor capital is fleeing China leading to drastic risk-off moves in local equity markets?

Source: Bloomberg

For all the recent commentary from financial market pundits worried about stretched valuations as a result of fiscal stimulus and central bank balance sheets, valuations do not appear to be the cause of the recent rout in Chinese equities. Prior to the recent bout of bloodletting, both the Shanghai Composite and Hang Seng were trading with a forward price to earnings ratio of ~13x. When compared to the US stock market at just under 23x, that’s a screaming bargain. For many macro investors, China (as well as Asian markets in general) was viewed as a value play, offering exposure to the growth potential of Asian economies at valuation multiples that were relatively attractive compared to Western markets.

The quick answer to what has spooked investors is a regulatory crackdown in China, with investors again reminded of the power and influence policymakers have on how private capital is controlled. The recent set of sweeping reforms takes aim at private education, which is one of the fastest growing industries in China, as well as food delivery companies, as a way to protect low-income gig workers. By turning the private education sector into a not-for-profit industry, China is hoping to curtail the amount of foreign private investment flowing into this sector, thus regaining control of the curriculum and the education process of its citizens. These regulatory crackdowns have alarmed investors that similar reforms could spill over to other areas of Chinese capital markets, which has already happened with food delivery companies, as the government has ordered that all food delivery workers must earn at least the local minimum wage.

The optimistic view is that these reforms have been put in place to make sure that foreign capital inflows are sustainable and won’t overheat certain areas of the economy, all while trying to protect social inequality through enforcing minimum wage requirements for gig workers. Effectively, capital markets are being managed by policymakers for the good of their citizens. The pessimistic view is that Sino-US relations are deteriorating, and while China is not averse to foreign investment, they are making it clear that it will be on their terms going forward. This may be stemming from last December when Congress voted to de-list US-listed Chinese companies whose auditors have not been allowed to be inspected by the Public Accounting Oversight Board, which is a US regulator. The opinion from famous short-seller Carson Block is that these Chinese reforms are the way for the government to pressure Chinese companies back to listing on local exchanges, withdrawing from the US before they are forced out due to lack of accounting transparency.

Source: Internal Calculations

Either way, the sweeping reforms make the outlook too clody to have an accurate forecast of what this means for Chinese equity markets going forward. Without understanding the true intentions of the Chinese government, it makes it hard to provide a forecast of whether this is a good buying opportunity, or whether these reforms will act as a drag on equity multiples and investor sentiment in the region until restrictions on capital markets start to loosen and foreign investors become more comfortable that they won’t be blindsided by regulatory reform. I’m inclined to believe the latter hypothesis has a higher probability of materializing, though the outlook is far from certain. The good news for Viewpoint Investment Partners (VIP) investors is that the tactical nature of the Global Fund has been reducing exposure to Emerging Markets over the course of July as trend ensemble algorithms have soured. The latest of moves to de-risk from the region has the strategy allocating capital away from Emerging Markets to safe-haven asset classes like US treasuries and Japanese government bonds. While this isn’t a global risk-off event, it is clear that the risk-off atmosphere in China isn’t only affecting domestic equities, with this regulatory crackdown creeping into bonds and demand for their domestic currency. In this event, Emerging Market bonds are unlikely to act as the ballast investors are looking for in the face of domestic equity volatility, and thus it makes sense to allocate that capital to traditional safe-haven asset classes. It’s too early to know how the regulatory reforms will impact foreign investor capital flows, but for the time being, we’re comfortable having a systematic, rules-based strategy to tactically tilt away from China until investor sentiment stabilizes.

DISCLAIMER:

This post and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this post were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this post appropriately.