Back in August, when I wrote If It Isn’t Hurting, It Isn’t Working, there was a persistent belief that we had achieved either a “soft landing” or “no landing.” Although these outcomes would be hard to differentiate, they both assume a “goldilocks” outcome where the Federal Reserve – and other global central banks – had tightened just the right amount such that inflation would be tamed and we would avoid a recession – or a “hard landing.” As discussed in that piece, it was “not hurting – not at all in fact. As such, it is likely that the inflationary impulse remains with us, and it will be very difficult to discern the next steps of the Federal Reserve.”

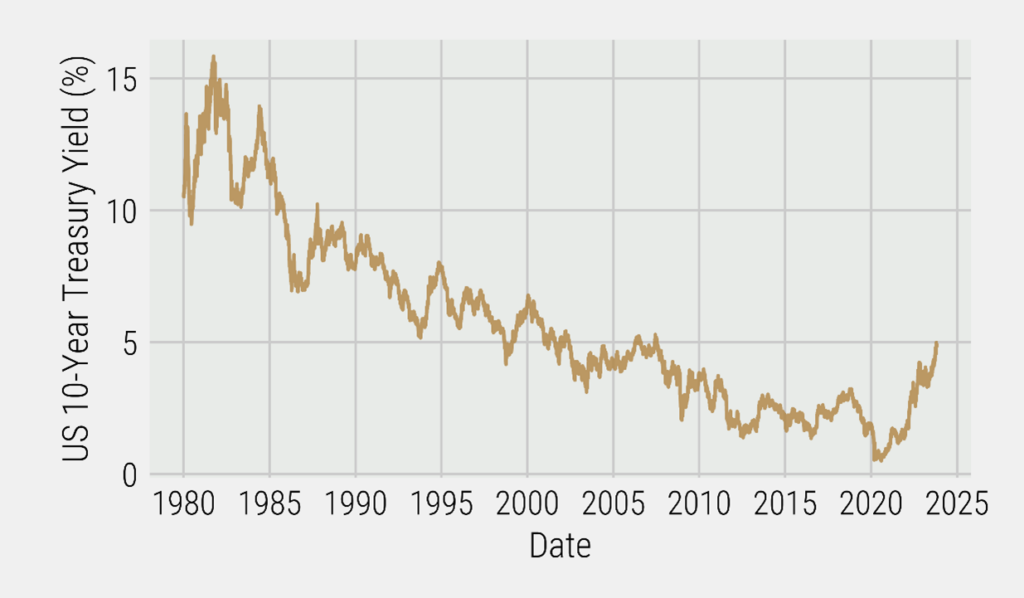

Since that piece was published, things have begun to hurt – in the bond market at least. Over that time, the yield on the 10-year U.S. Treasury Note has surged a further ~1% to approach 5%, a level not seen since 2006. (Figure 1)

U.S. 10-Year Treasury Yield (1980 to 2023)

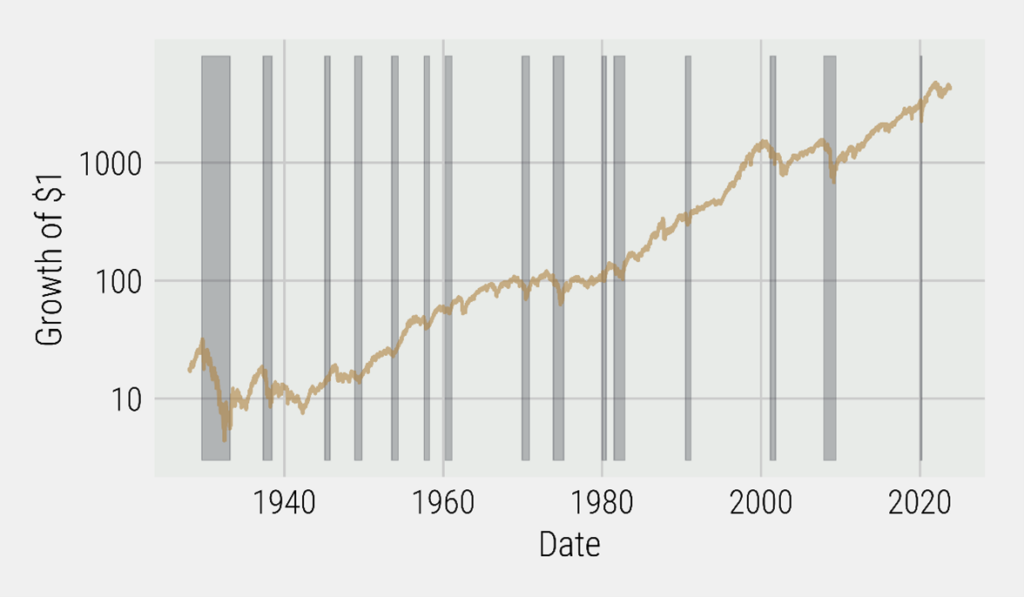

However, much of the equity market still does not seem to be paying attention to the inherent risks of higher bond yields and persistent inflation. If we look at prior recessions, equities tend to follow a similar pattern. They perform quite well right up until a recession has begun. (Figure 2) This makes sense because we can never tell when a recession will commence; we will only know it has started once we are well into the recessionary period. The difficulty in predicting a recession comes from the fact that economic data tends to be revised regularly. Further, economic data points are revised most often and most heavily during turning points in the economy – like recessions. As noted by Bloomberg’s Simon White in MacroVoices #395, this is when we are “most blind and the data is most wrong.” We will know a recession has started once the negative revisions in economic data are completed and the National Bureau of Economic Research (NBER) makes the determination. Another interesting facet as to why equities have a hard time predicting recessions is that excess liquidity builds up as economic activity begins to slow and less capital is required by the economy. For a time, this excess liquidity can find its way into risk assets like equities.

Log Scale Performance of S&P 500 (1930 to 2023)

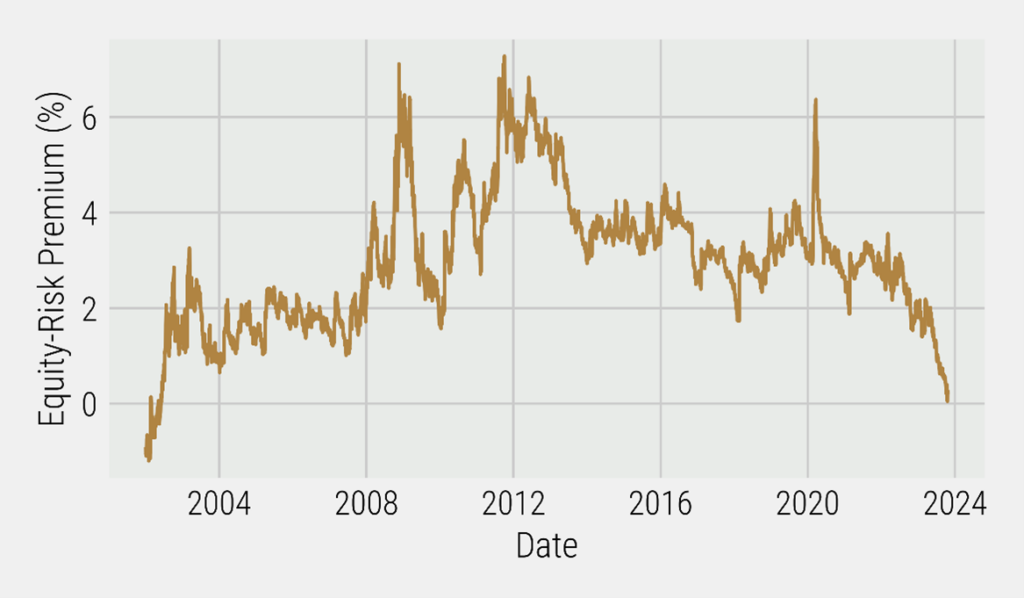

As noted above, yields on longer-dated bonds have increased significantly. With these increases, it seems that the bond market has stopped “fighting the fed.” However, the equity market has yet to consider the spiking yields and we now sit at the lowest equity risk premia in decades. (Figure 3) This means that longer-dated bonds may offer more value than equities, as the return expectations of equities are too low in comparison to bonds.

Equity Risk Premium (2014-2023)

Another reason why bonds may be spiking is the potential that longer-term inflation will be stickier than expected. Simon White believes that this is due to the process of central banks monetizing large fiscal deficits. If he is correct, we are only at the beginning of the post-COVID inflationary impulse, because we continue to see large fiscal deficits that will need to be monetized. This monetization with a rebound in growth from China may lead to another period of higher inflation in the coming quarters. On the Wealthion podcast, Dr. Ed Yardeni highlights a related explanation for the recent surge in bond yields – that “bond vigilantes” are back. Although they had disappeared for many years, Dr. Yardeni thinks that the bond market now sees the high level of bond issuance that will be required by the U.S. Government to monetize its continuing deficits and that the bond market is showing its frustration with the supply-demand dynamics of the treasury bond market. He notes that, “the bond market is repricing the yield to a level that will bring back demand or calibrate or rebalance the bond market. And I’m hoping that’s somewhere around 4.75% or 5%.”

What both commentators agree with is that bond markets have likely repriced to a level that provides a higher likelihood of better performance over the medium term. If we experience Simon White’s world of higher levels of inflation, an added level of diversification from commodities will benefit investors. Dr. Yardeni’s expectation, however, would see inflation moderate and equities provide supportive performance. At Viewpoint, we are comforted by the stance that we do not need to know the future, as structural alpha can be harvested over long periods of time by purposefully built portfolios that focus on diversification across all major liquid asset classes.

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.