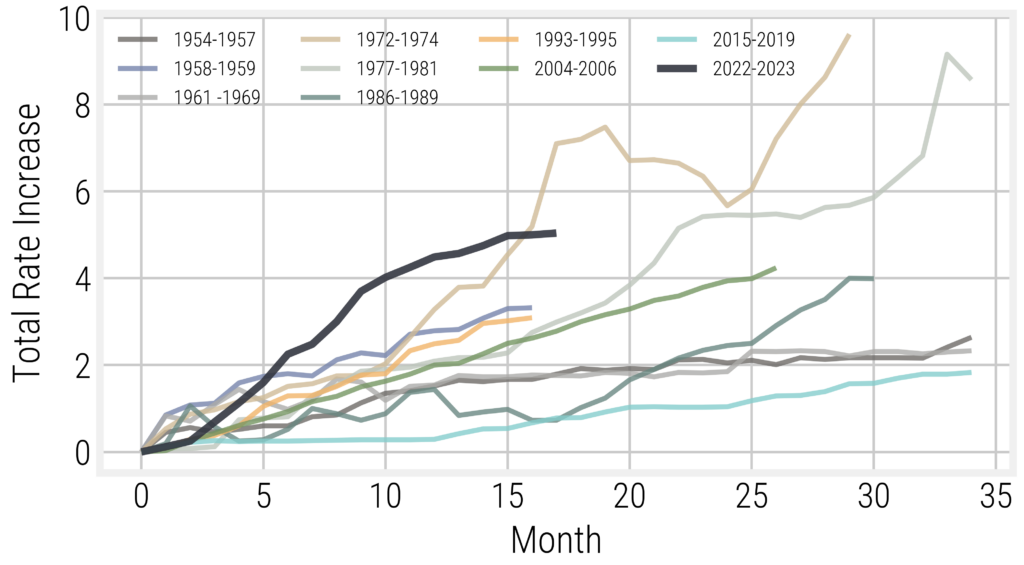

Having experienced the sharpest rate hike cycle ever seen in the United States, it is shocking to many that the impact has been so limited. Figure 1 shows the incremental monthly increase in the Fed Funds rate from the initiation of rate hikes. (Federal Reserve Economic Data, 2023) This chart shows that the 2022 rate hike cycle saw the Fed Funds rate increase by 4.25% in 12 months. The next closest rate hiking cycle was 1972, which saw an increase of 2.6% in 12 months. With Fed Chairman Jerome Powell’s most recent hawkish pause, the 1972 cycle and the 2022 cycle are now more similar.

Fed Funds Rate: Increase in Rate Over Lowest Rate by Month

With the resolute actions and hawkish language from Powell and the Federal Open Market Committee, it is no surprise that the consensus opinion was quite bearish exiting 2022. The atmosphere reminded me of a slogan from a t-shirt: “The beatings will continue until morale improves” – or in this case, the beatings will continue until the economy slows. Common wisdom at that time did not question whether we would have a recession, but simply when the eventual recession would occur. With much of 2023 now in the rear-view mirror, the economy did not slow, and the performance of financial markets has surprised many investors.

When investors and economists miss the mark like they have in 2023, it is important to ask what was missed and how we can adjust our expectations of the future. With articles like Policy Pivots & the Federal Reserve Reaction Function(McLean, 2023) and Walking the Tightrope with the Fed(McLean, 2022), it is likely that our regular Invested readers have a good handle on the actions of the Federal Reserve and how they may impact portfolios. However, focusing on the Fed’s monetary policy may have led some investors to misallocate capital and miss the surge we have seen in equity prices so far in 2023.

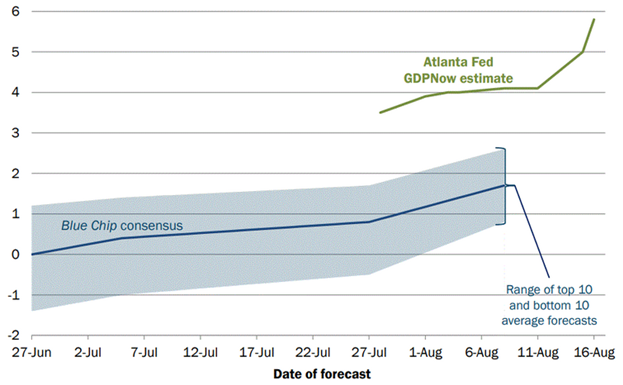

Even now, there continues to be a massive gulf between economic indicators and the projections of many leading economists who seem to remain focused on the monetary policy actions. To underscore the breadth of these differences, it is worth looking at the GDPNow estimate of Q3 U.S. GDP from the Atlanta Fed. Using available economic data, the GDPNow model estimates Q3 U.S. GDP growth of 5.8%. This estimate is a full 4% higher than the average economic forecast.

Evolution of Atlanta Fed GDP estimate for Q3 2023: Quarterly Percent Change (SAAR)

While many investors continue to focus on the aggressive policy actions of the Federal Reserve, most have underestimated or ignored the impact of the continued aggressive fiscal stimulus of the current U.S. administration. This is understandable because monetary policy was the only game in town for many years. The impact of fiscal policy was muted as it was unacceptable for governments to run large deficits outside of wartime. The fiscal response to the COVID pandemic has changed that. Prior to COVID, it would have been unthinkable to make direct fiscal transfers to households and businesses. However, there are now much higher expectations that fiscal policy will be used to combat future downturns and for governments to direct the economy more aggressively.

There is no overstating the profound impact of the misnamed Inflation Reduction Act and other fiscal programs. To underscore the magnitude of spending of the current U.S. administration, it is worth looking at some other large deficit years. In 2009, the U.S. deficit to correct for the “Great Recession” totaled -$1.4 trillion for the full year. The 2020 COVID deficit was -$3.1 trillion. As of July 2023, the U.S. federal budget deficit totaled -$1.6 trillion, more than double the -$0.7 trillion deficit seen in 2022 and already above the total 2022 deficit of -$1.4 trillion. (Peter G. Paterson Foundation, 2023) Even though the Federal Reserve is attempting to tamp down inflation with restrictive interest rate policies, the U.S. federal government is currently running a budget deficit that will be similar to the 2020 COVID deficit.

As we assess the ongoing dissonance between a sharp rate hike cycle and aggressive fiscal stimulus, it appears that fiscal stimulus is winning the day. This will make the job of central bankers to bring inflation back to target levels much more difficult. As so aptly stated by James Aitken:

“If on the one hand, the Fed taketh away and on the other hand President Biden giveth, then effectively it is like running a heater and an air conditioner at the same time.” ~ James Aitken (Capital Allocators Podcast, 2023)

With so many fiscal and monetary cross currents, it might be time for investors to question the celebratory mood of the market and the conclusion that we have managed a soft landing and the Fed is done hiking. Although we often focus on nominal policy rates, financial history guides us that we are unlikely to arrest an inflation issue with a peak nominal policy rate that remains negative on a real basis. This means that we will likely need to see a combination of more interest rate hikes and softer inflation indicators. In the end, real policy rates will need to be higher to arrest the inflationary impulse we continue to experience. For the Fed to be successful, they will likely need to be more hawkish and more persistent for longer than we have experienced so far. As we consider the next moves of Jerome Powell and the Federal Reserve, it might be worth considering the simple conclusion of John Major on his policy towards controlling inflation when he was Chancellor of the Exchequer in 1989:

“If it isn’t hurting, it isn’t working!” ~ John Major (John Major Archives, 1995)

In conclusion, it is not hurting – not at all in fact. As such, it is likely that the inflationary impulse remains with us, and it will be very difficult to discern the next steps of the Federal Reserve. At Viewpoint, we are comforted by the stance that we do not need to know the future as structural alpha can be harvested over long periods of time by purposefully built portfolios that focus on diversification. (Haji, 2023)

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.