“The test of a first-rate intelligence is the ability to hold two opposing ideas in mind at the same time and still retain the ability to function. One should, for example, be able to see that things are hopeless yet be determined to make them otherwise.”

– F. Scott Fitzgerald

Readers of Viewpoint’s publications over the last six years will be familiar with our views about the difficulty related to adding value for investors through stock picking on a consistent basis. While this is an important part of price discovery in markets, when it is the only strategy employed, there is a significant concentration risk on a specific style of portfolio construction. We have often quoted SPIVA data to show how infrequently active managers who are focused on security selection outperform their benchmarks and how certain market cycles are more difficult than others in this regard. We have also commented on the fact that professional forecasters do an incredibly poor job of predicting where markets or the broad economy will go. This, along with the fact that markets are often driven by irrational decision making and human emotion, makes the prospect of running an investment management firm seem like a losing battle.

Despite this perceived hopelessness, we have built a series of investment strategies that we feel certain will outperform and add value for investors over the long term. The only other belief we feel certain about is that we are uncertain about what markets will do next. This drove us to create a portfolio that not only accepts uncertainty as a feature of markets, but thrives on it.

The key tool we use to build these intelligent strategies is diversification. That’s right. One of the most widely accepted concepts in portfolio and risk management happens to be our secret weapon. But, to be clear, there are many flavours of diversification. Those familiar with stock portfolios might know the 20-stock rule, where one should have adequately diversified away most company-specific risk from a portfolio. Or some might be familiar with the ubiquitous 60/40 portfolio, in which one holds a 60% allocation to stocks and the other 40% in bonds so that the portfolio has exposure to both asset classes. In its most basic form, we can even define diversification as simply holding the global market portfolio, a concept we have defined as Global Beta. Global Beta is the one true passive portfolio – the average of all liquid investor holdings in the world. But is a market-cap weighted portfolio of literally every single investible asset in the world even diversified enough? This question became the seed that led us to where we sit today, as an investment manager that purposefully targets maximal diversification as the foundation upon which each strategy is built and evolves. We have dedicated countless hours of rigorous research into building and improving this beautiful concept that allows us to optimally harvest the Diversification Premium.

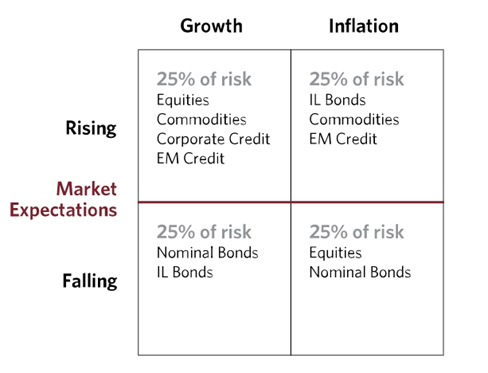

You may ask: why are we so obsessed with diversification? Aside from the structural alpha that can be harvested over long periods of time, which I wrote about here, it allows investors to be comfortable with the feeling of uncertainty that comes with putting our invested capital into global markets – a place where it seems no one is really clear about what happens next. In 1996, Bridgewater, the largest hedge fund company in the world, brought the All-Weather Portfolio to the market. The concept was simple. They wanted to build a portfolio that could perform well in a multitude of economic environments and could be held for the long term so that no matter what was around the corner, they had a good chance of performing well. A true Uncertainty Portfolio. They defined four market environments in which both inflation and growth were either falling or rising and allocated roughly a quarter of the portfolio’s risk to assets that should perform well during these environments (see below).

Source: Bridgewater

Around eight years later in 2004, Edward Qian, current CIO of Panagora Asset Management, coined the term “Risk Parity,” in which equal portfolio risk is allocated to a number of different asset classes or risk factors. After this, many others – like Cliff Asness’s AQR – further built off this concept of creating an optimally diverse portfolio by way of balancing the overall contribution of portfolio risk by asset class through advanced quantitative methods. It seems like we’re not the only ones obsessed with diversification.

Risk Parity, or more generally, risk budgeting, is about allocating capital to different portfolio components on the basis of each one’s contribution to portfolio risk. This risk is most often measured as volatility, which is the variability of portfolio returns. Each dollar allocated to a low volatility asset will be less impactful to the overall portfolio’s fluctuations than a higher volatility asset. Digging a bit deeper, the correlations between asset classes also matter. Assets that have lower correlations with the rest of the portfolio than ones with higher correlations have a relative risk dampening effect, as they tend to move in opposite directions to the rest of the assets more often than their more highly correlated counterparts. Why does all of this matter? If we take a step back and think about Bridgewater’s simple grid and, as an example, the bottom right tile (falling inflation) and say for simplicity’s sake that both equities and nominal bonds have an equal probability of doing well during the environment. If we simply allocated this basket on a capital basis – that is, 50% of dollars invested in equities and 50% of dollar invested in bonds (which are a significantly less volatile asset) – the tile’s performance will be mostly determined by how the equities perform during each specific deflationary environment that is coupled with low growth. To more intentionally express the view represented by that tile, we should allocate based on a risk basis. If bonds currently have 5% volatility and equities have 15% volatility (a 4-to-1 ratio), we should be investing 25% of the capital allocated to that tile to equities and 75% to bonds.

The mathematics (and therefore the required techniques) become more complex as we add assets, hierarchical structures, risk premium overlays, etc. Lucky for us, those that came before us have laid a lot of the groundwork, have proven a lot of what works and what doesn’t, and have done so with long track records. This affords us the ability to stand on the shoulders of giants and continue to break new ground day after day with an obsessive focus on research. Accessing the best of everything that came before and sprinkling in some innovation driven by the exponential growth in computing power, data availability, and advanced quantitative methods leads to the ability to create an even more purposeful Uncertainty Portfolio. The style may feel unconventional to some, but there is large area of finance dedicated to this style of investing that has been proven in both academia and in practice. In fact, as of 2016, around $120B was being managed in Risk Parity style strategies in the U.S. alone, according to this paper by the CFA Institute. This doesn’t include the large swatch of big institutions (endowments, pension funds, etc.) that have an allocation to Risk Parity built by their own in-house teams. What’s more is that these types of strategies that are built around diversification can further complement a more conventional asset management style. Investors can hold two competing ideas in their mind at once – that markets are unpredictable and that there is a way to navigate the uncertainty by building portfolios that thrive on it.

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.