Executive Summary

Cocoa’s 2023–2026 price cycle was one of the most extreme agricultural commodity moves in recent decades, compressing years of commodity dynamics into 24 months. Structural supply deficits, critically low inventories, and inelastic demand led to a tripling in price followed by a sharp retracement as supply responded. For investors with a static position in cocoa futures, the round-trip left little to show for the volatility.

For Viewpoint Diversified Commodities, however, the episode became a case study in how the utilization of risk-parity portfolio construction can convert nonlinear commodity price behavior into durable return contribution for investment portfolios. While front-month futures ultimately completed a round-trip, Viewpoint Diversified Commodities generated a +6% net contribution from cocoa across the full period through its risk-parity framework.

Cocoa serves as a real-time demonstration of why we construct investment portfolios based on risk contribution rather than static notional weights. Convex markets require disciplined position sizing, taking the evolution of volatility and correlation into account.

The cocoa episode illustrates a broader point central to our commodity philosophy. Commodity futures are not just ways to hedge inflation related to increases in demand; they also react to physical capital constraints that can shock fragile supply chains. When capital is scarce and inventories are depleted, volatility and correlations expand. A rules-based risk allocation framework allows investors to participate in those nonlinear environments without allowing any single commodity to dominate portfolio risk. Risk parity is designed for exactly for these environments.

The From the Desk of the CIO note below is a fulsome review of the cocoa cycle, highlighting how structural fragility eventually elicited a capital supply response, and how disciplined risk-parity position sizing translated that cycle into positive portfolio contribution for Viewpoint Diversified Commodities.

Cocoa’s Round-Trip and the Case for Risk-Parity Portfolio Construction

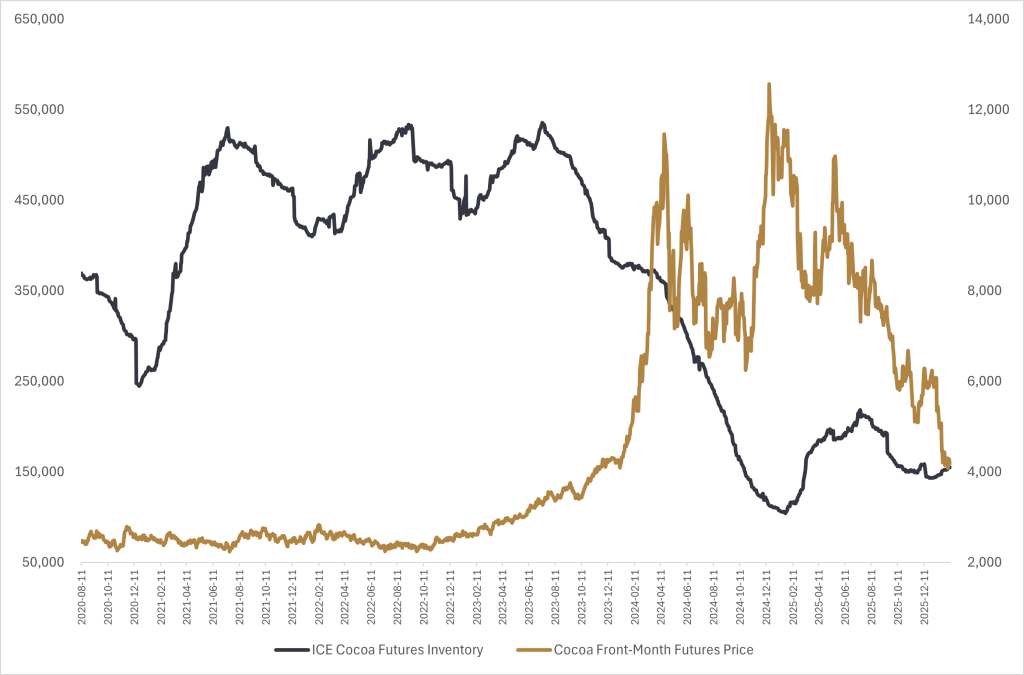

Between late 2023 and mid-2024, cocoa futures experienced one of the most dramatic agricultural commodity rallies in recent decades. Prices surged from roughly $4,000 per tonne to $12,000, before retracing sharply and ultimately normalizing throughout 2025 and into 2026.

We wrote extensively throughout 2024 (here, here, here, here, & here) about the structural fragility embedded in the cocoa market, where concentrated geographic production and decades of underinvestment collided with erratic weather and disease. Unseasonable rains in West Africa, combined with a surge in swollen shoot disease, widened supply deficits at a time when global inventories were already critically low.

Compounding the tightness of low global inventories, cocoa demand is highly inelastic. Because cocoa represents only a small portion of the final retail price of chocolate, cost pass-through tends to be slower than in many other commodities. Despite cocoa prices nearly tripling in early 2024, consumer demand remained resilient. Low inventories, inelastic demand, and under-hedged commercial buyers created the conditions for a reflexive price spike.

By May of 2024, cocoa was running at annualized daily volatility of roughly 100%, up from a more normal environment of 20%. Margin requirements were raised to manage counterparty risk, pushing some participants out of the market. Open interest declined, liquidity thinned further, and price moves became increasingly exaggerated. The market transitioned from a fundamental supply deficit story to a full-blown liquidity event.

The cocoa episode reinforced an often-overlooked point in commodity markets. Commodity futures are not just ways to hedge inflation that arises due to increases in demand; they are also convex instruments tied to physical constraints. Most of the time, it’s not just scarcity of the commodity that matters, it’s scarcity of capital required to access it.

When inventories are depleted and supply chains are concentrated, price moves can become nonlinear. In these environments, expanding volatility is not dysfunction; it is the mechanism by which markets signal scarcity and attract capital back into the production process. Unlike equities, where volatility typically rises during declines, commodities often experience rising volatility during upside price spikes.

For investors looking to gain exposure to commodity markets, a disciplined risk allocation framework that sizes capital exposure based on volatility and correlation to other commodities allows participation in these nonlinear events without having them dominate portfolio risk.

As volatility accelerated during the first quarter of 2024, the Viewpoint Diversified Commodities risk-parity framework reduced the capital allocated to cocoa. In a risk-parity structure, position sizing is driven by risk contribution, how volatile a commodity is and how correlated it is to other commodities, rather than production-weights, economic significance, or trend strength. In cases when realized volatility materially expands, notional exposure falls proportionately to maintain a stable risk profile. By reducing capital exposure on the spike in volatility during early April 2024, the strategy was able to reduce the magnitude of losses during the initial air pocket in late spring and summer, and then when prices ultimately normalized throughout 2025.

Importantly, the risk-parity framework does not attempt to forecast peaks or troughs. It removes discretionary decision-making and responds adaptively to changing volatility and correlation dynamics. Cocoa’s contribution to return for Viewpoint Diversified Commodities during the spike was meaningful, but its risk contribution remained stable relative to the broader commodity portfolio, limiting downside impact during the unwind.

While 2024 was defined by fragility, 2025 became the year of supply response and normalization.

Governments in Côte d’Ivoire and Ghana raised farmgate prices materially in late 2024, improving farmer economics and incentivizing reinvestment. While new plantings require approximately five years to reach full productivity, improved maintenance and husbandry of existing trees can enhance resilience to disease and pests, providing a near-term boost to yields. Higher farmgate prices also reduced smuggling distortions, helping normalize market conditions.

On the weather front, the transition away from El Niño conditions improved flowering and pod development across key producing regions. Early fears of another severe mid-crop shortfall did not materialize, and global production for 2025 ended up bouncing back after a dreadful 2024 season, allowing the market to stabilize and post a small surplus on the year, ending three consecutive years of deficit.

At the same time, sustained price levels more than double historical norms pressured chocolate manufacturers. Producers responded through reformulation, shrinkflation, and selective substitution. Demand did not collapse, but higher consumer price points contributed to slower grind growth in Europe and some substitution effects in emerging markets, easing pressure on inventories.

As prices retreated, commercial buyers extended hedge coverage and exchange inventories stabilized. Even modest buffer rebuilding materially reduced convexity. With improved weather, better maintenance, and restored liquidity, volatility compressed and cocoa transitioned from a scarcity-driven squeeze to a more balanced market environment. Prices ultimately retraced much of the 2024 spike, completing a remarkable round-trip.

The cocoa episode reinforced several key principles embedded in the Viewpoint Diversified Commodities strategy. Risk-parity portfolio construction through volatility and correlation-based position sizing reduced capital exposure to cocoa as volatility rose, ultimately keeping risk contribution stable and mitigating negative return impacts during the price normalization period of 2025. This is opposed to a static approach to portfolio construction, where both capital and risk contribution would have increased during the price spike, leading to a larger drawdown during the unwind as conditions normalized. The result was a smoother return profile while still capturing meaningful upside during the parabolic phase. During the 2024 price spike, the allocation to cocoa contributed +7% to the underlying return of the Viewpoint Diversified Commodities strategy, while in 2025 it only contributed -1% to the underlying portfolio return. So even though the underlying commodity ultimately saw a round trip in price, and a static holder of front month cocoa contracts would have seen very little in terms of total return, Viewpoint Diversified Commodities saw a +6% contribution to total portfolio return by virtue of the dynamic risk-parity portfolio construction it employs.

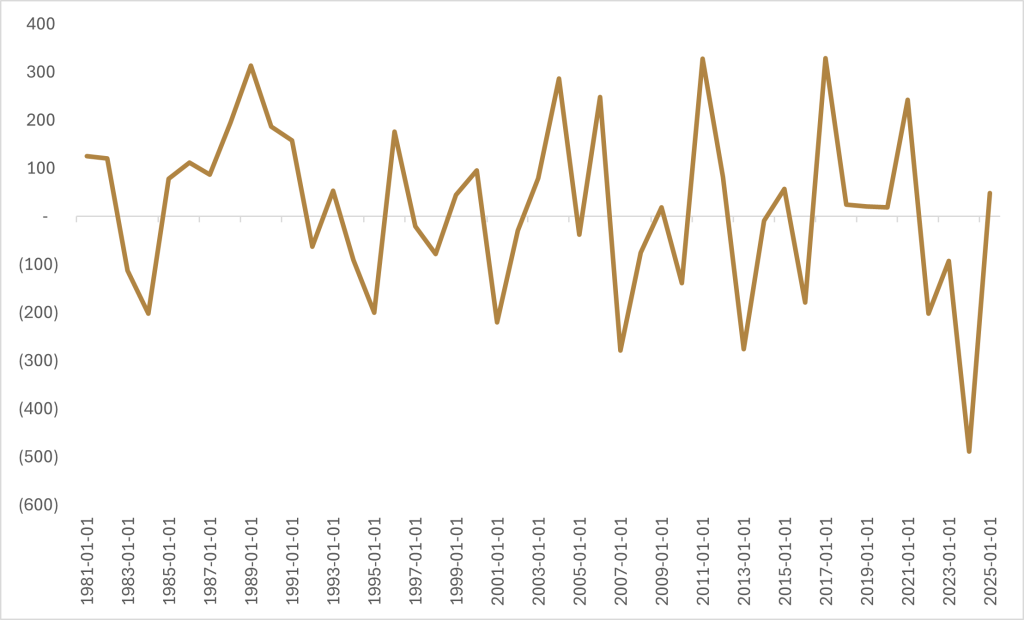

Cocoa’s full 2023–2026 cycle compressed years of commodity dynamics into a short window, and one that we think is representative of many other commodity markets, from agricultural markets to precious and industrial metals. Underinvestment, supply shock, inventory depletion, parabolic pricing, liquidity stress, and eventual supply response as capital become less scarce and chases more attractive economics.

The Viewpoint Diversified Commodities strategy is not built to forecast peaks or troughs, but rather to build a portfolio of commodities designed to withstand, and participate in, episodes of structural fragility in commodity markets. This provides investment portfolios with an efficient expression of commodity beta, helping to improve robustness in an environment where climate variability, regulatory shifts, and geopolitical fragmentation continue to influence physical supply chains. We do not view cocoa as a one-off event. It serves as a reminder that we are in a macroeconomic regime where de-globalization and supply chain diversification are increasing demand for commodities, which is destined to bump up against the real-world constraint that a decade of capital scarcity is starting to spill over into physical commodity scarcity.

Happy investing!

Scott Smith

Chief Investment Officer

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.