The historic rise in cocoa prices is showing little signs of slowing down, with prices having doubled in less than three months. While chocolate manufacturers typically buy beans months ahead of time, the surge in prices will likely soon flow through to consumers, as inventories are being whittled down due to the mad scramble for supply currently underway. The recent push higher in prices has been accompanied by a decrease in open interest (by about a third) on the front-month futures contract, signaling that speculative interest may be stepping away from the market while physical buyers continue to push prices higher in their bid to secure supply.

This Bloomberg Opinion article from Javier Blas has some great background on how the seeds for the recent supply shortage were sowed (pun intended), and why the current cocoa crisis could take a few years before supply is ultimately rebalanced. At Viewpoint, we’ve been warning that depressed prices from the downswing of the last commodity supercycle from 2008 to 2020 (podcast recording coming soon) have resulted in underinvestment across the commodity complex. What is happening in the cocoa market is a magnifying glass on what can happen when supply chains are not adequately prepared for extreme weather and disease, while demand continues to increase.

As Blas notes, there are four countries that produce almost 75% of the world’s cocoa, though the Ivory Coast is the heavy hitter, producing about 40% of global consumption. Low prices for cocoa beans since the 1980s have resulted in dramatic underinvestment in the supply chain, with little in the way of new trees being planted and a decreased focus on husbandry through a reduced use of fertilizer and pesticides on older trees. The older trees are now not only producing lower yields but are more susceptible to extreme weather and disease. Unseasonable rains in West Africa this year have affected the flowering of cocoa trees, combined with an increase in “swollen shoot” disease that was more widespread than anticipated during the growing season. The result is the third consecutive crop season where global consumption will surpass supply, with the estimated deficit of between 300k to 500k tons resulting in an industry running on hardly any inventory.

While a more expensive Easter season may be painful for consumers’ wallets – and to some extent the Federal Reserve, as “cakes and cookies” make up 0.19% of headline inflation – the chocolate crisis is a stark reminder of the challenges for supply chains that have undergone decades of underinvestment. In this situation, higher prices and a cash infusion for West African farmers next season will encourage the replanting of older trees, as well as better maintenance for the existing trees. However, production won’t be able to recover overnight, leaving the demand side of the equation as the short-term lever on how cocoa prices will ultimately evolve from here. For consumers, this could mean higher prices for the Easter Bunny, “shrinkflation” through smaller bars, or the potential for new product substitutions that use palm oil instead of cocoa.

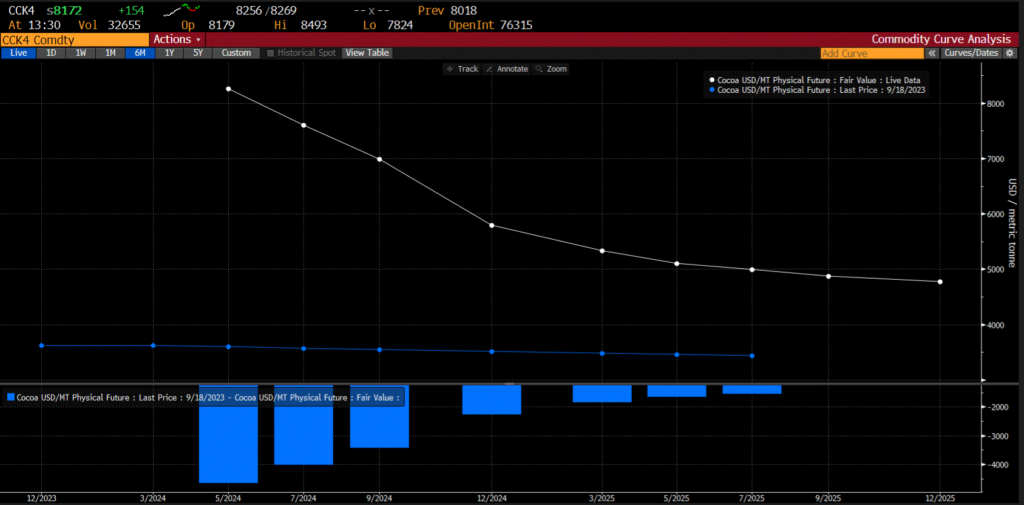

For investors utilizing exposure to commodity markets to help diversify their portfolios, there are a few interesting takeaways. One, constructing a portfolio of commodities based on equal risk allocation – as opposed to production volumes – gives an investor a much more diversified exposure to broad commodity markets outside of just energy and precious metals, providing a greater ability to harvest an inflation beta through an improved breadth of commodity markets. Two, we expect the cocoa market is not the only commodity market that will be exposed to inadequate investment in supply chains, which increases the risk of supply disruptions due to extreme weather and/or disease. Three, investing in commodity futures near the front-end of the curve is an efficient way to capture supply or demand disruptions that may have an inflationary impact on consumer goods and services. Trying to optimize the roll costs associated with investing in commodity futures can leave you underexposed to shock events like what we’ve witnessed in the cocoa market. If the goal is to harvest an inflation risk premium, it may be worth the negative carry to achieve outsized gains when there is an event that impacts short-term supply and/or demand considerations.

Happy investing,

Scott Smith, Chief Investment Officer

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.