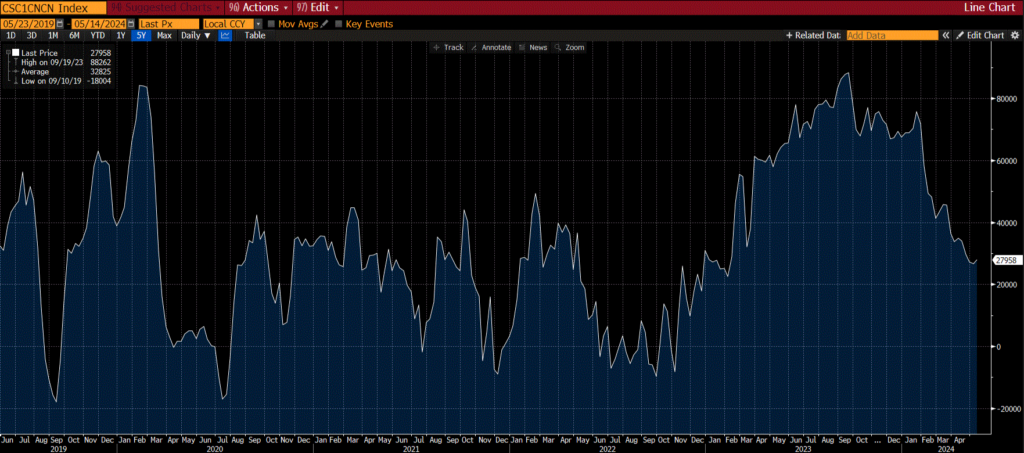

The rollercoaster ride for cocoa prices has continued throughout May with front-month futures prices down roughly -40% from the top in late April. For commodity managers that use volatility to adjust their position sizing, these managers would have sidestepped a good chunk of the negative price action. The increasing volatility of cocoa would have signaled a reduction in capital weighting to keep risk contribution stable, resulting in taking profits on the parabolic price action. Looking at the Commitment of Trader’s Report from the Commodity Futures Trading Commission (CFTC), we can certainly see that speculative long positions have been trimmed throughout 2024. Coincidentally, the reduction in net longs from speculative players came at a time where commercial players (generally hedgers) were reducing their net shorts on a run-up in prices, and the combined reduction in open interest (a proxy for liquidity) has led to a further increase in volatility.

Despite the -40% drop from the late-April highs, front-month cocoa prices are still up +135% year to date, and the underlying fundamentals haven’t changed drastically. The recent slump in prices has been attributed to long liquidations on increased volatility, combined with better weather conditions that have eased some of the short-term supply concerns. Notable hedge fund manager Pierre Andurand was on a Bloomberg Odd Lots podcast last week, re-affirming his bullish outlook for cocoa despite the pullback in price. For many of the reasons that we at Viewpoint have highlighted in previous notes (here & here), there are continued structural risks to ongoing cocoa supply, as it takes about five years for new cocoa plantings to go from seed to pod. Combined with new regulations in the E.U. around traceability of cocoa beans to ensure they haven’t contributed to deforestation, absent perfect weather and growing conditions for this year’s harvest, a new wave of supply may still be years down the road. Andurand noted that cocoa prices could jump to $20k/ton over the next few years, which is close to the inflation-adjusted high of the late 1970s, if the extreme weather doesn’t improve, continuing to strain already thin supplies.

The International Cocoa Organization (ICCO) estimates that the stocks-to-grindings ratio (i.e., stocks of cocoa relative to expected demand from processors who grind beans into paste and butter) will fall from 35.2% after the 2022/2023 season to 29.2% for the 2023/24 crop season, which would be below the low last seen in 1984. Andurand is forecasting that ongoing supply strains could push this ratio to 13% by 2025 and doesn’t see demand for cocoa letting up, which is the recipe for another parabolic move in price. As we’ve highlighted previously, cocoa demand is very inelastic, and therefore we are unlikely to see much demand destruction if prices move higher. Because cocoa beans comprise a relatively small component of the overall cost of a chocolate bar, combined with the fact that chocolate itself isn’t a big expenditure for developed economies, the larger fundamental driver of equilibrium price will be how much supply comes to market. The next update from the ICCO on global supply and demand will be at the end of May and will likely provide more colour on how well the mid-crop in West Africa has held up as weather patterns have eased.

Despite the recent pullback in cocoa prices, we remain bullish on the outlook for cocoa given its structural supply concerns. We see similar factors playing out across the soft commodity subsector, with erratic weather patterns contributing to heightened volatility in everything from coffee to orange juice. While increased volatility may make it such that your position sizing is smaller, we feel that it is integral to have a well-diversified portfolio of commodities that can harvest these structural supply issues when they materialize.

Happy investing!

Scott Smith

Chief Investment Officer

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.