Please fasten your seatbelts and return your tray table to its full upright and locked position. Hopefully, the economy isn’t flying on a Boeing 737 MAX…

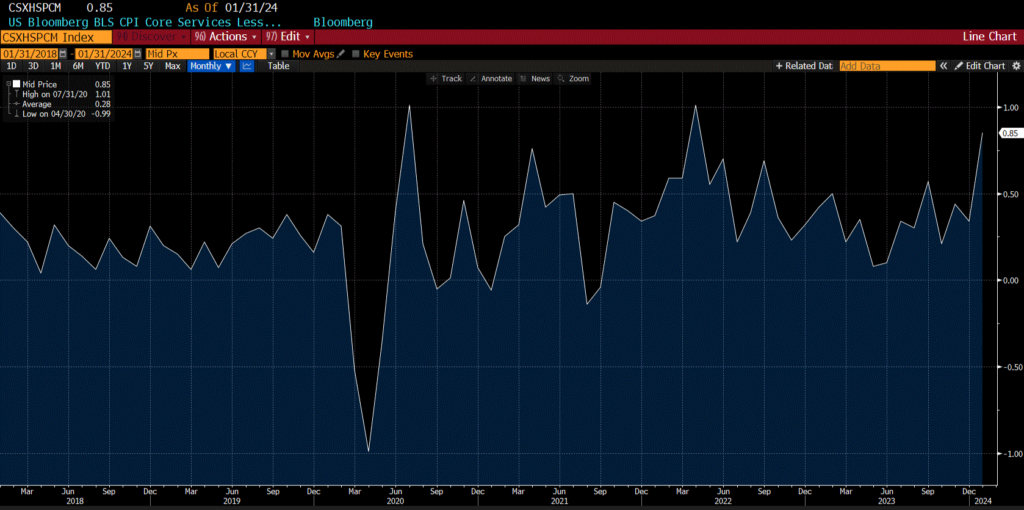

Financial markets hit some turbulence yesterday, with both equities and bonds seeing broad based selling pressure after a warmer than anticipated U.S. inflation print. The headline reading for January came in at a +3.1% annualized pace, disappointing estimates that U.S. inflation would fall below the 3% handle and come in at +2.9%. Looking at the core inflation reading, which strips out food and energy, the annualized rate of inflation increased to +3.9%, hotter than the +3.7% that was expected and the same pace as the previous month. Perhaps the most challenging piece of the inflation reading is that while goods prices continue to remain flat, services inflation rose sharply on a month-over-month basis, with an acceleration in the core services category. The share of core spending categories experiencing monthly deflation also declined relative to last month, which will not give the Fed confidence that we’re seeing a broadening of disinflationary pressures in the economy.

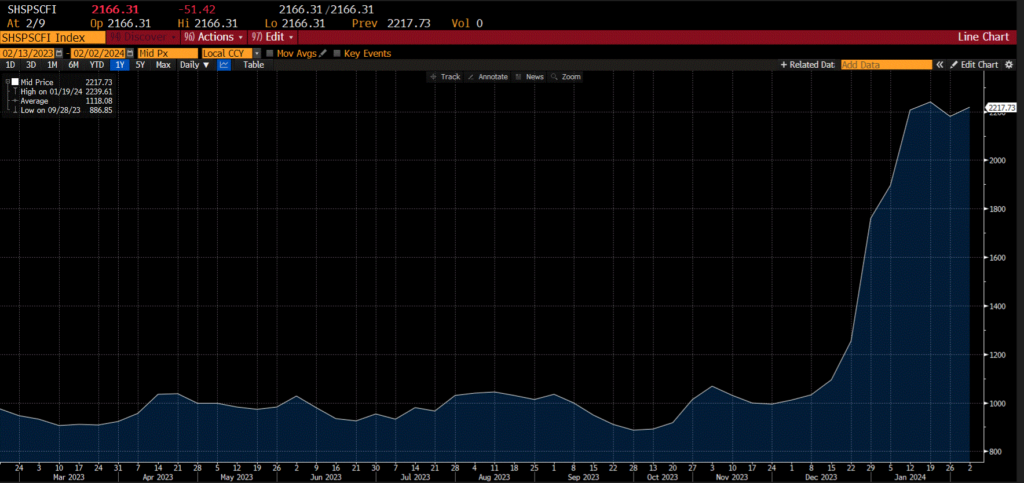

Yesterday’s inflation print reinforces our view that the trajectory towards a sustainable 2% inflation target, and subsequent interest rate cuts, will continue to be a bumpy one. It is interesting that goods inflation continues to remain sanguine, highlighting that pressure on supply chains hasn’t ratcheted up. This run of positive goods inflation prints may also hit a bumpy patch soon, as higher shipping costs due the Red Sea conflict will likely begin to filter through into consumer prices. However, with the service industry being the much larger share of the U.S. economy, a broadening of service inflation is a more worrisome development for the Fed, and I would expect that this development notches up the importance of incoming labour market data for the Fed. Given that the Fed has little control over what is happening with supply chains or geopolitical events, their focus will be on labour market tightness and how wage pressures influence service-related inflation.

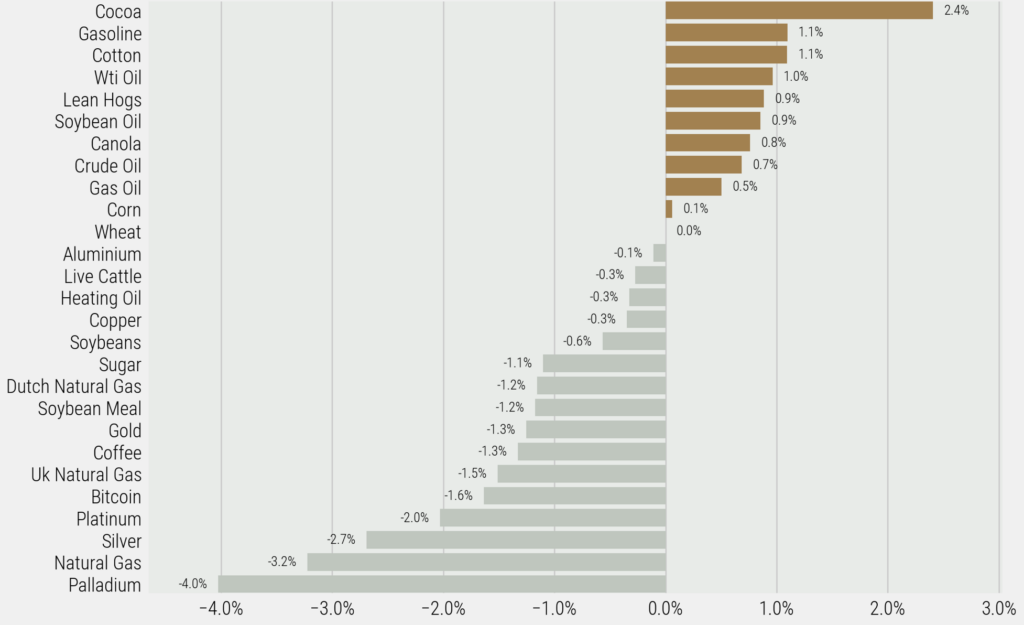

While there are some worrisome pieces to this stronger than anticipated January inflation reading, it’s important to note that we would need to see additional data before confirming this is a reacceleration of inflation versus a pothole in the road towards a sustainably lower inflation profile. Regardless, the market has pushed back its expectations on when to expect the first rate cut from the Fed. March is essentially now off the table, with the market now anticipating the first rate cut to come at the June meeting. Equities and bonds both reacted negatively to the news, with the S&P 500 ending the day down -1.4% and the U.S. 10-year bond decreasing by -1.0%. The USD rose by +0.7% against a basket of global currencies, benefiting from the increase in yields. The idiosyncratic nature of commodity markets was beneficial for portfolios yesterday, as the various markets (other than precious metals) continue to march to the beat of their own drum. Precious and industrial metal took a leg lower on the CPI print given their sensitivity to the future direction of interest rates, but other commodities like cocoa, gasoline, oil, cotton, lean hogs, and canola had strong sessions.

While I believe we’re in a favourable long-term cycle for commodity markets given an extended period of underinvestment in supply, days like yesterday reinforce the diversification benefits that commodities can provide to portfolios, especially when changes in market expectations on the direction of the short-term interest rates can have such an outsized influence on equity and bond prices. Furthermore, yesterday’s price action highlights the importance of obtaining commodity exposure through direct futures contracts as opposed to the equity of commodity producers. Getting exposure to commodity markets through the equity of producers conflates the commodity beta with equity beta and can make days like yesterday challenging for portfolio performance. While front month crude was up around 1% yesterday in USD terms, popular ETFs that track commodity producers (such as XOP, XLE, and COW) were down anywhere from -1% to -3% in USD terms. Not exactly the inflation hedge that investors might have been hoping for, which is why we advocate for owning the commodity, not the company. Buckle up out there!

Happy investing,

Scott Smith, Chief Investment Officer

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.