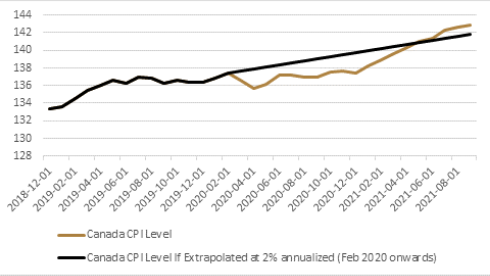

The question of whether inflation is transitory (or is facing a structural shift higher) continues to dominate the narrative in financial markets. Alarm bells are sounding that a hyperinflationary environment is unavoidable and right around the corner, given that the “base-effects” have rolled off the year-over-year readings while consumer prices have nonetheless remined high. The reality is that inflation in Canada is now just slightly higher than if the CPI had grown at the two percent annualized trendline that was in place prior to COVID; Weimar Germany this is not.

Last week, the Bank of Canada put plans in place to end its balance sheet expansion, and its hawkish language suggested that the overnight interest rate may be on the rise by the middle quarters of 2022 as opposed to the latter half of the year, as previously thought. The bond market may be sniffing out hawkish monetary policy as “too fast, too furious” as we’ve recently seen the yield curve for Government of Canada bonds flatten (two-year yields have risen 50 basis points over the last month relative to 25 basis points for 10-year yields), suggesting that if interest rates on the short end of the curve rise too fast, this could choke off longer term economic growth potential.

In conjunction with monetary policy tightening somewhat, the fiscal side of the equation and its impact on prices appears to be flipping from tailwind to headwind. Cullen Roche released a good article last week on the fiscal headwinds facing inflation in the United States, citing research from the Hutchins Center, which estimates that fiscal policy will detract roughly two and a half percent from GDP growth in 2022. It’s hard to find similar research on Canadian fiscal policy as it relates to contribution to GDP, but it is likely that there will be some level of continued support to economic growth with debt-to-GDP forecasted to rise slightly over the next four years; though nowhere near as much of a thrust with the budget deficit expected to narrow in fiscal 2021 to six and a half percent of GDP, essentially half of the fiscal 2020 figure.

Although the probability of a hyperinflationary episode in the developed world should be viewed as a low probability, the potential for inflation to run hotter than two percent for a period of time is a still very real possibility. Investors should still be cognizant of how to bulletproof their portfolios should the scenario of higher-than-expected inflation come to fruition. AQR released a paper last week titled “When Stock-Bond Diversification Fails,” which explores the sensitivity of traditional markets (stocks and bonds) to inflation. The researchers at AQR find that a 60/40 portfolio of stocks and bonds has a negative correlation to inflation, underperforming when there is an inflationary episode. What may be surprising is that empirically, equities do not perform well in inflationary environments. Equity underperformance may be a result of companies not being able to pass on price increases to consumers, investors discounting real cash flows with nominal rates, or the anticipation of higher real rates due to inflation, to name a few examples. While AQR explores a number of different unconventional asset classes and techniques to improve portfolio robustness when dealing with inflation surprises, one of the interesting points of the paper was the recommendation for investors to seek macroeconomic diversification across compensated return sources, making commodities an attractive allocation for core portfolio holdings given their long-term risk premium and positive inflation exposure. The author goes on to say the addition of commodities in a risk parity framework where asset classes are given equal prominence confirms their earlier work that “risk parity portfolios may be more resilient to inflation shocks.” Furthermore, a broad commodity basket has an empirically stronger positive correlation to inflation than any individual commodity sector due to its heterogeneity across sectors, “highlighting the benefits of a diversified allocation, which may provide protection in a broader array of inflationary scenarios.” We at Viewpoint agree with this analysis and see similar diversification benefits within our own research of a broad commodity opportunity set, even going a step further to implement equal risk allocation between the commodities’ sub-sectors which make up the broader basket.

For Canadian investors that have traditionally achieved their commodity exposure by investing in resource-based equities through the TSX, it might be time to re-evaluate whether the company-specific risk still makes sense in an environment where there will be continued regulatory pressure on emissions. At Viewpoint, we believe that in order to construct portfolios with the best possibility of being robust to upside inflation surprises, investors should be looking to directly own the commodity, not the company.

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.