Please note, none of the information contained in this blog post should be construed as investment advice. The opinions expressed within the content belong solely to the author and do not reflect the opinions and beliefs of Viewpoint or its affiliates.

I come from an oil & gas family. After World War II, my engineer grandfather came to Canada from Holland armed with an entrepreneurial and ambitious spirit, and he pioneered the Canadian oil & gas business. Subsequently, my dad, along with his partners, built Canada’s largest energy-focused, private equity investment firm, as well as an extraordinarily successful and well-respected public oil & gas production company.

My own path took me in a different direction, as I developed passions in finance, portfolio management theory, technology, and data science. But, over the past few years, I feel like a few things have become glaringly obvious about our energy industry. Firstly, as Canadians, we have a moral obligation to invest in and support our oil & gas industry for many reasons, including environmental. And secondly, it’s my personal belief that the current environment is set up to provide extraordinary returns for oil & gas investors over the next five+ years. Regarding the latter, I have not felt this way at any other time in my career, to which my partners and friends can attest.

In my view, the most important underpinning when thinking about Canada’s oil & gas industry is that the world consumes and demands over 102 million barrels of oil per day (2023 is expected to be an all-time record) and over 4.0 TCM (trillion cubic meters) of natural gas. The reason that this is so important for Canadians to keep in mind is that this demand needs to be and will get filled by the global market. And, if at some point in the future global oil demand begins to fall – which does seem inevitable – those barrels still need to be supplied.

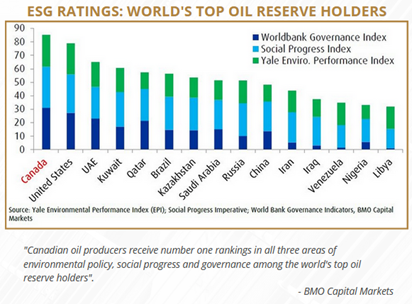

The Canadian oil & gas industry has the highest ESG standards in the world. Ironically, not supporting and not investing in it – in the name of protecting the planet – is likely to lead to further detrimental impact on the planet as other countries with low ESG standards fill the gap. There is a growing group of thinkers who believe that the oil & gas divestiture movement is actually counterproductive to its own goals, and politicians and policy makers are starting to pay attention.

“Canada can and will be that solution [referring to the world needing more energy]. Oil & gas is going to continue to be a part of that [energy] mix for a long time, particularly as we move forward on things like carbon capture and storage. And decarbonization of processes, so that those last barrels around the world that are almost carbon-free, have a good chance of being from Canada because of the technology we’re laying on top of it because of the expertise of our energy workers.”

If you can believe it, the quote above is from Prime Minister Justin Trudeau at a town hall at the University of Ottawa on April 24th of this year. I believe that even three years from now, we’re going to see materially different public perception and a more supportive policy framework in regard to the Canadian oil & gas industry. And, aside from the obvious economic and social reasons (economic opportunity, jobs, tax revenue), we have a moral obligation as Canadians to support it for environmental reasons.

One of my good friends, and one of Canada’s leading experts on energy research and policy, recently told a group of us that “we are past peak dysfunction in domestic energy policy.” While celebrating such a statement might highlight how low the bar is on evaluating such things, it’s becoming apparent that energy security has risen significantly in importance as a social and political issue, and the political machine is taking notice. This should result in more constructive and supportive policy in the future. But, this is only one of the many reasons as to why I believe the next five years will be lucrative to Canadian oil & gas investors:

- The rise of energy security as an important political issue;

- The recognition that Canada’s industry has the highest ESG standards in the world;

- Structural, multi-year under-investment in the industry;

- Global oil & gas demand continues to rise;

- North American natural gas is clean, cheap, and reliable, and takeaway capacity is going to dramatically increase over the next five years; and,

- Record low valuations combined with near-record profitability.

I believe that over the past five years especially, we have been watching a great example of cognitive dissonance unfold, where Canadians are happy to consume oil & gas but unhappy at the “others” who are producing it within our borders. While this is certainly not new, it’s time we pay proper attention.

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.