Canadians were able to breathe a sigh of relief this week after an agreement was reached with the United States that delayed the implementation of tariffs on Canadian imports for 30 days. Not only would the proposed tariff schedule have put a dramatic dent in Canadian economic growth, but Canada was ready to fire back with retaliatory tariffs on $155bn worth of American imports. Those retaliatory tariffs on American imports would have increased prices for Canadian consumers, and while the pace of inflation has eased in recent months, many Canadian consumers are still battling with rising food and grocery prices. High consumer prices aren’t just a Canadian phenomenon, as various economies around the world are dealing with elevated prices, and a global trade war wouldn’t help the situation. However, many of the factors that have been affecting consumer prices are due to underlying commodity prices rising, and the increase in raw input prices is pushing up the prices consumers see at the proverbial till. While many corporations that are purchasers of agricultural commodities have been absorbing the increase in prices through margin compression, we’re starting to see those corporations throw in the towel.

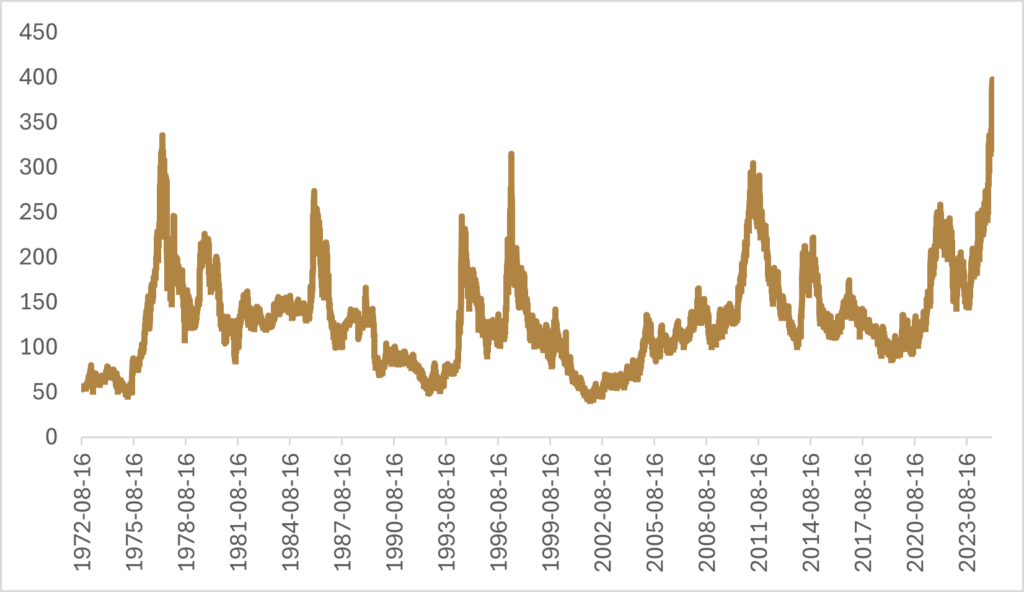

As an avid consumer of Nespresso capsules, I received an email early in January that the price of those capsules would be increasing, generally in the range of 3-15%, depending on your choice of coffee and region. Given our reporting last year on the price of green coffee—the raw beans used to make espresso and coffee pods—the email from Nespresso wasn’t a shock. In fact, I was surprised this email didn’t arrive sooner. Our last note on the coffee market detailed how arabica and robusta coffee futures had risen ~35% and ~80% respectively during 2024, and even after those eye-watering figures, there was little in the way of reprieve for arabica buyers. While robusta future prices eased into the end of the year, both arabica and robusta futures finished 2024 up ~70%. In fact, since our note in September, robusta futures have effectively been flat, while arabica futures have risen by 50% and now sit at record highs.

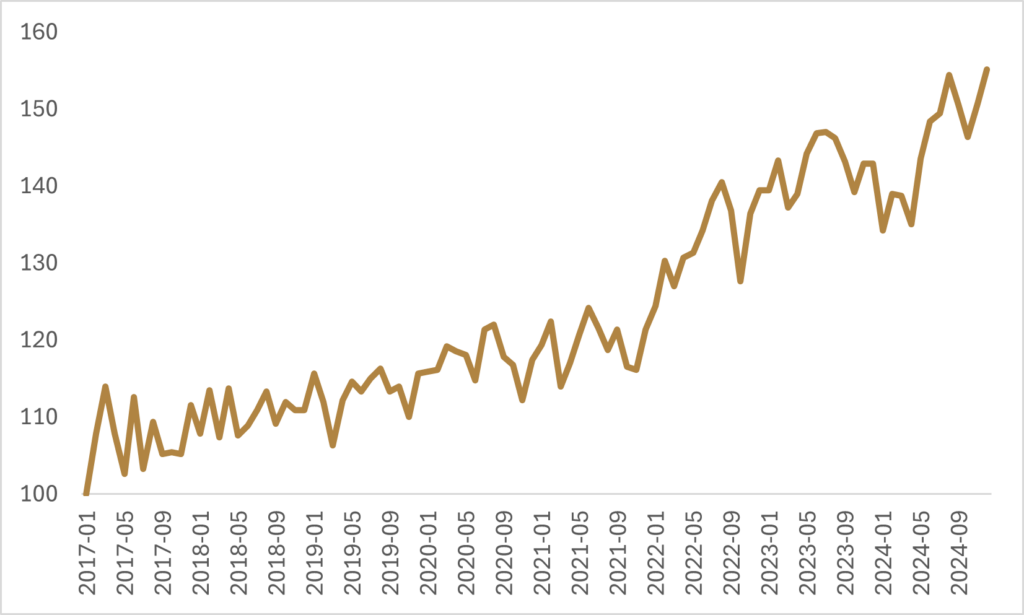

While I was surprised that Nespresso waited as long as they did to increase their prices, Canadian consumers were already feeling these increases at the grocery store. Data from Statistics Canada shows that while coffee prices have been trending higher since 2017, there has been a real ramp in the prices flowing through to the Canadian Consumer Price Index since April of 2024.

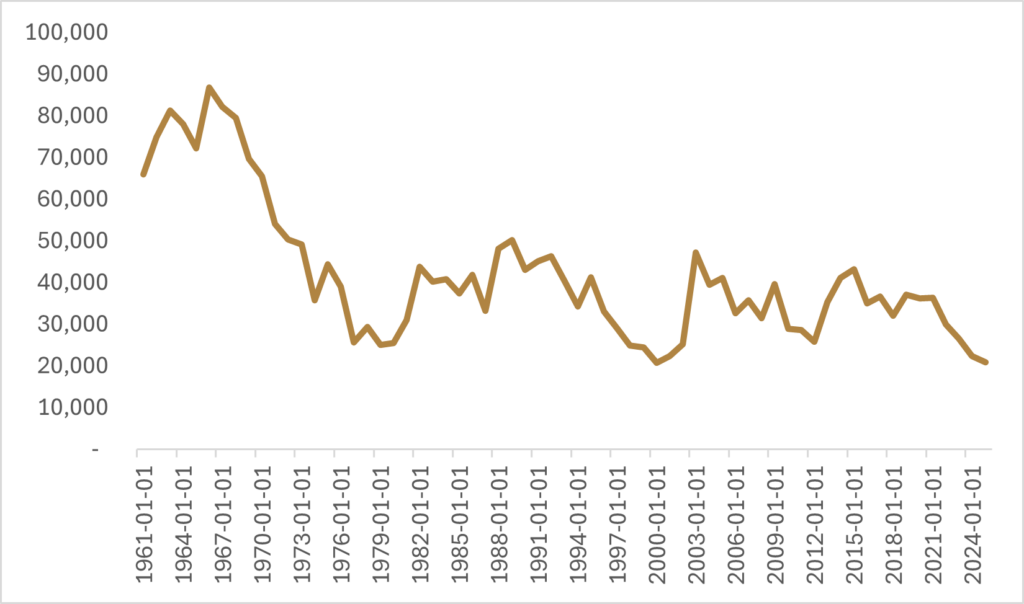

The USDA is forecasting that production from Vietnam, which mainly produces the robusta variety of coffee, will likely rebound this year as higher prices will incentivize growers to ramp up their output. The growing season for the new crop in Vietnam wasn’t accompanied by weather that would suggest bountiful yields, but high prices are prompting farmers to pick smaller, less profitable cherries to boost revenue, which in turn is helping to put a lid on futures prices. The more immediate issue for global coffee stocks is the arabica variety, with Brazil (the largest producer of this variety) continuing to experience challenging weather that is affecting yields. Although the Brazilian crop in the middle of last year was forecasted to see a rebound in production, excessive heat during the flowering period has again sparked worries that the 2025 crop will be underwhelming, putting increased pressure on already depleted stocks.

Complicating the situation for arabica coffee beans is the fact that Colombia recently drew the ire of the Trump administration when the country refused two repatriation flights of migrants from the U.S. in late January. Colombia is the third largest producer of global coffee supplies, only grows the arabica variety, and supplies roughly 30% of the coffee imports into the U.S. While the tariff situation has ultimately resolved itself for now, there are pockets of the coffee market that are on edge should a trade war start to impact export markets for certain coffee growing regions.

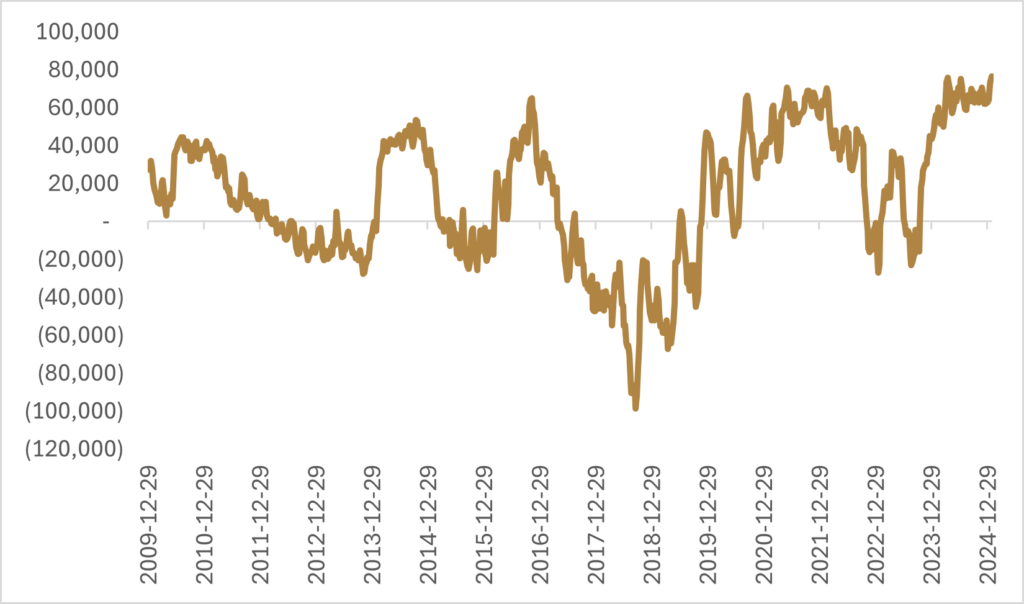

Adding to the pressure on the arabica supply chain, speculators in the futures market have pushed their net long positioning to a record number of futures contracts. While it may be tempting to conclude that we are experiencing a similar situation to what has transpired in the cocoa market, this Bloomberg article from Javier Blas sheds some light on how the coffee market doesn’t suffer from the same lack of investment in supply and husbandry that exists in the cocoa market. The coffee market is much more industrialized, with plantations “run as commercial businesses, rather than the hand-to-mouth version of smallholders in cocoa.” This means that weather is the main factor in determining production yields and therefore the market clearing price, but Blas notes that the recent type of extreme weather is something the Brazilian region hasn’t had to deal with before. As Blas notes, for generations crop yields have needed to deal with frost and drought, but it’s only recent that excessive heat during the flowering period has been affecting crop yields.

Unfortunately for coffee lovers like me, it doesn’t appear that we will be getting a reprieve for our daily fix anytime soon, with the full passthrough effect of higher green coffee prices yet to be fully realized. However, before you rush out to hedge your daily cup of joe by purchasing coffee futures, participants in the futures market should be bracing for increased volatility given the stretched nature of speculative positioning and how quickly sentiment can shift based on changing weather patterns.

Happy investing!

Scott Smith

Chief Investment Officer

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.