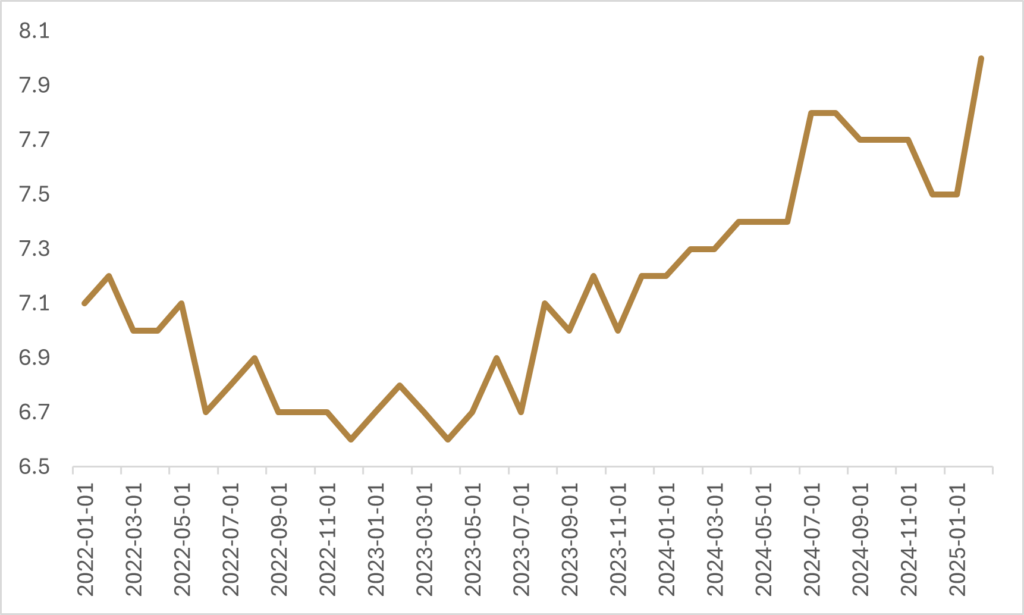

Is the U.S. economy on the verge of a major reset? As the U.S. administration continues to signal a shift toward fiscal discipline aimed at fostering a more entrepreneurial, pro-business environment, warnings of a short-term growth shock are permeating through financials markets. Last Friday’s February Non-Farm Payroll Report, though not disastrous, hinted at a slowing labour market. While overall payroll changes and unemployment numbers were close to expectations, a striking spike in the U-6 unemployment rate—the broader measure capturing discouraged and underemployed workers—suggests underlying slack in the labour market. With the U-6 rate at its highest since late 2021, and government layoffs likely to further soften the labour market, the coming months may reveal additional weakness as the economy goes through a period of fiscal stimulus detoxification.

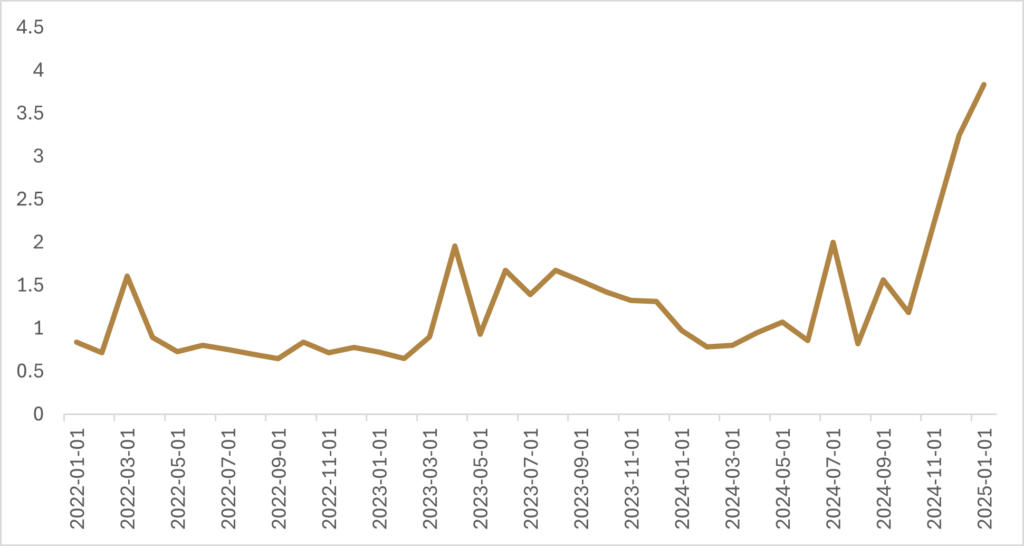

Despite the above, Friday’s employment report offered a silver lining: its performance was better than the Atlanta Fed GDPNow model had been predicting, prompting the Atlanta Fed to revise its Q1 growth forecast from -2.4% to -1.6%. Meanwhile, the January U.S. trade balance report (released March 6) revealed that a surge in gold imports—driven by rising investor demand amid geopolitical uncertainty— was the main culprit in widening the U.S. trade deficit. Gold imports accounted for nearly 60% of the deficit expansion, contributing approximately -2% to the Q1 GDP slowdown as estimated by the Atlanta Fed. A “gold-adjusted” GDPNow model would have shifted the forecast from -0.4% to +0.4% post-Friday’s jobs data, suggesting a more manageable slowdown rather than an outright economic collapse, despite ongoing spending cuts and trade policy uncertainties.

This Wednesday, U.S. inflation data for February drops, and it is expected to confirm a trend of cooling economic activity, with economists estimating a print of +2.9% for the headline rate. Real-time metrics like Truflation already show a dramatic decline to +1.4% in early March, though this dip likely won’t show up until the March inflation report. As economic activity cools, lower consumer prices and bond yields could empower the Federal Reserve to resume rate cuts after a brief pause. Initially, market participants expected only one additional rate cut in 2025, but increased fiscal restraint from the U.S. administration has shifted sentiment towards three cuts to help combat a more pronounced slowdown in economic growth.

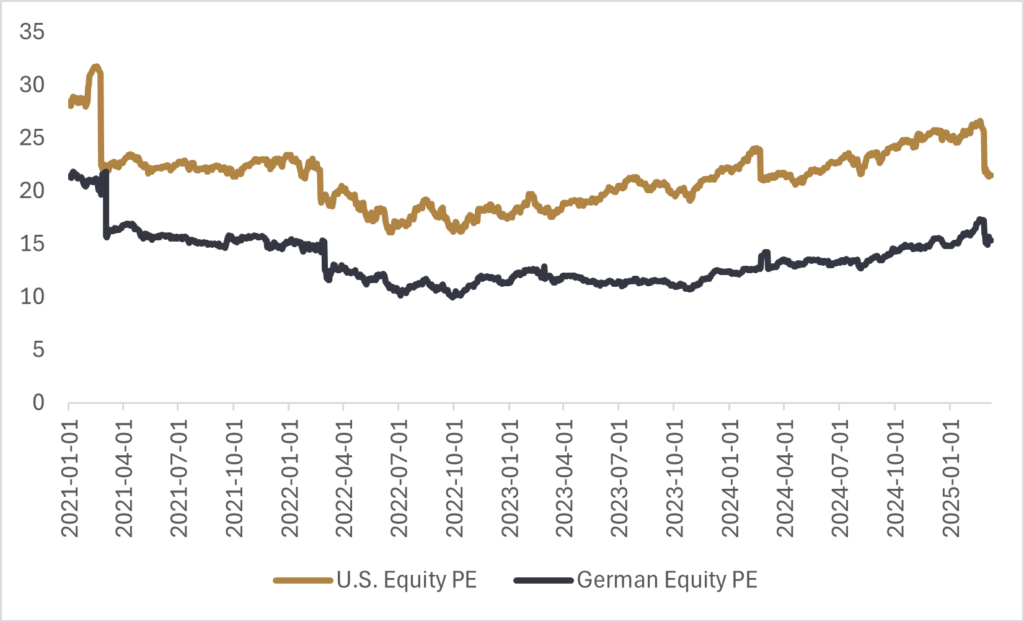

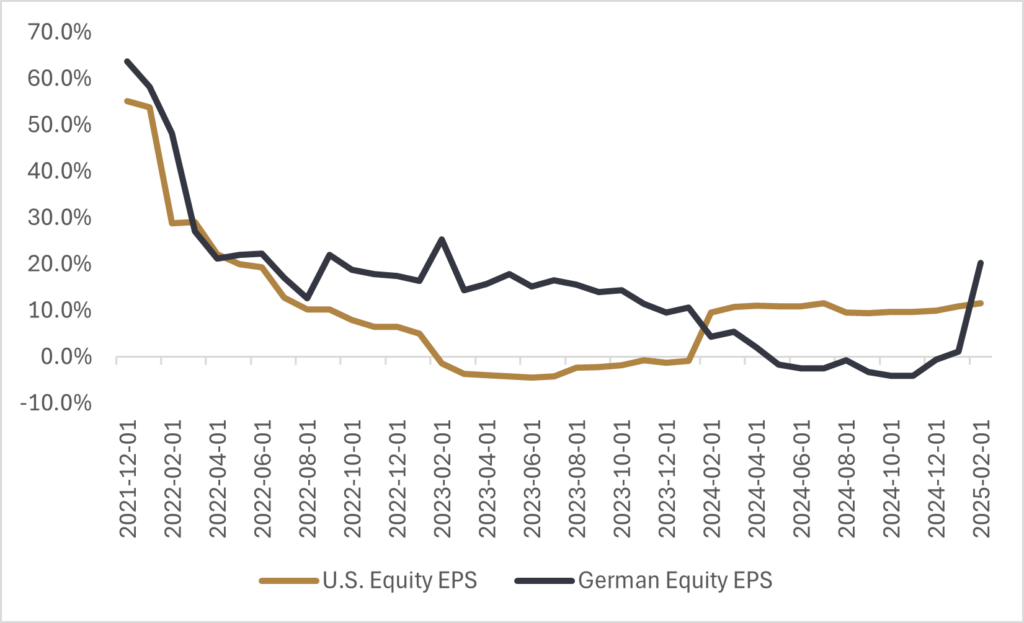

Last week, we discussed the case for rotating out of U.S. equities into international markets, particularly European equities. The idea was that a U.S. fiscal stimulus detox would slow growth, while revitalized European defense spending could trigger fiscal stimulus and boost stagnating economic growth. Shortly after our note, Germany unveiled a bold fiscal plan that surpassed many analysts’ optimistic expectations. The new government announced a €500 billion infrastructure fund, exempted defense spending over 1% of GDP from the debt brake, and eased fiscal rules for states to borrow up to 0.35% of GDP. While there is still some political wrangling required to shepherd the legislative package through parliament, it is expected that new Chancellor Friedrich Merz will be able to rely on the support of the Greens in order to shore up the super-majority that is required to pass the legislation.

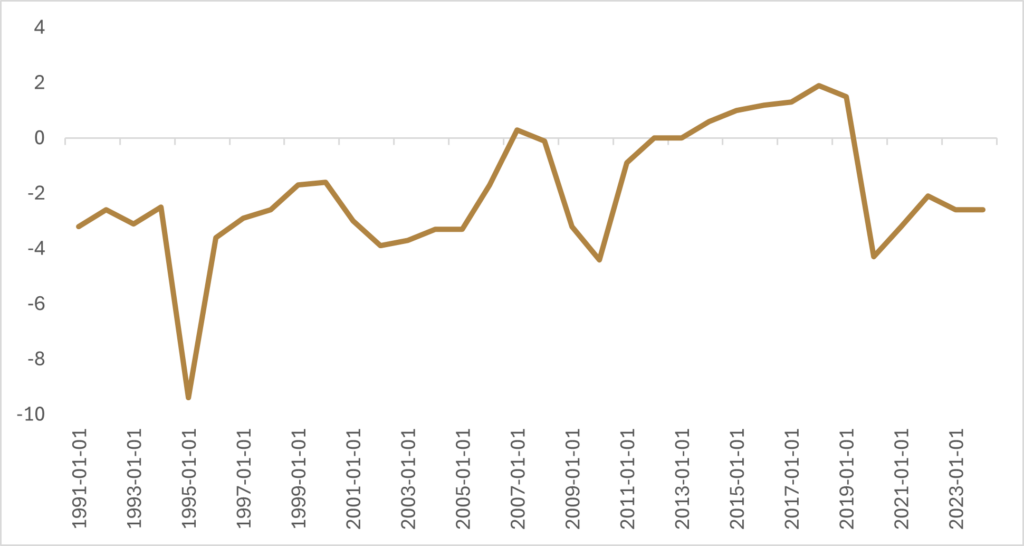

George Saravelos, Head of Global FX Strategy at Deutsche Bank, was on the Bloomberg Oddlots podcast last week and he estimates that the recently announced measures are bigger than the fiscal stimulus that was implemented following the fall of the Berlin Wall and German reunification. Saravelos estimates that the combined announcements will amount to fiscal spending of between 3-3.5% of GDP, bringing the fiscal deficit from around 2.5% to 5.5-6% of GDP. This fiscal package is expected to be more than just a “one-time” jolt to the economy, with the infrastructure fund having a 10-year life and the exemption on defense spending allowing Germany to increase defense spending from 1.5% of GDP to an estimated 3-3.5% of GDP annually.

Last week’s announcements were a watershed moment in German politics, signaling a U-turn from the historical fiscal discipline. While Germany’s forecasted government deficit would be widening to the likes of what the U.S. is currently trying to pivot away from, Germany does have fiscal capacity to increase their indebtedness to spur economic growth. Germany’s gross debt-to-GDP is the lowest in the G7 and approximately half of the U.S. debt burden. Financial markets have responded favourably to the news that Germany will be easing off the fiscal restraint and focusing on domestic infrastructure and defense spending to boost economic growth. The Euro rose by 4.4% against the greenback last week, while the German stock index advanced by +6.4% in USD terms, compared to -3.1% for the S&P 500. The German 10-year bond saw yields rise by the largest amount since the fall of the Berlin Wall last Wednesday, with the 10-year German bond futures falling by -3.5% (EUR terms) over the course of the week as markets reprice an increase in government borrowing.

Shifting market sentiment will continue to require vigilance, but with the U.S. economy showing signs of deceleration, the current landscape offers a compelling contrast across the Atlantic. A German fiscal package that reflects both the scale of today’s security threats and the urgency to rejuvenate the domestic economy contrasted with a U.S. administration’s desire for lower government spending highlights the importance of a diversified approach to portfolio construction. With U.S. equity valuations still relatively rich compared to international equity markets, there is the potential for the continuation of a rotation out of U.S. equities and into international markets like Germany. As these economic shifts continue to unfold, staying adaptable will be key to capitalizing on global opportunities amid contrasting growth prospects and valuation landscapes.

Happy investing!

Scott Smith

Chief Investment Officer

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.