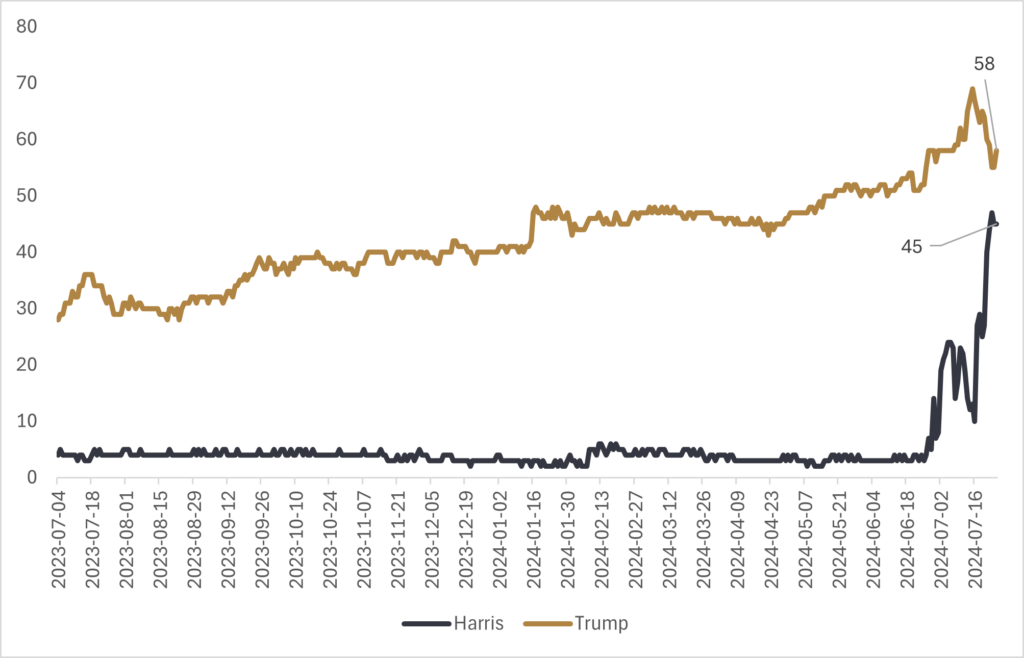

In what has been dubbed as “the year of the elections” with approximately half of the world heading to the voting box in 2024, focus is now shifting to what is arguably the main event for the election calendar. The U.S. presidential election had been a relatively sleepy affair for the first half of 2024, but things have started to heat up in earnest to begin the second half of the year. A disastrous debate performance from incumbent Joe Biden at the end of June led to Republican nominee Donald Trump opening a yawning gap in the polls, with Trump’s popularity further bolstered after a failed assassination attempt at a rally in early July. The confluence of events led to panic in the Democratic camp, ultimately resulting in Biden dropping out of the race and handing the reins (and fundraising) to his vice president, Kamala Harris. While the structure of the Harris ticket is still taking shape, the addition of J.D. Vance as Trump’s running mate has solidified the Republican platform. With Harris stepping in to replace Biden on the Democratic ticket, polls have started to move in the Democrats’ favour, either narrowing the gap or outright leading in some, albeit all within a normal margin of error. Betting markets are still giving the advantage to Trump, and while this will likely be a fluid situation over the coming months, I thought this would be a good time to investigate what a Trump presidency may mean for certain asset classes and to what extent markets have begun to price this in.

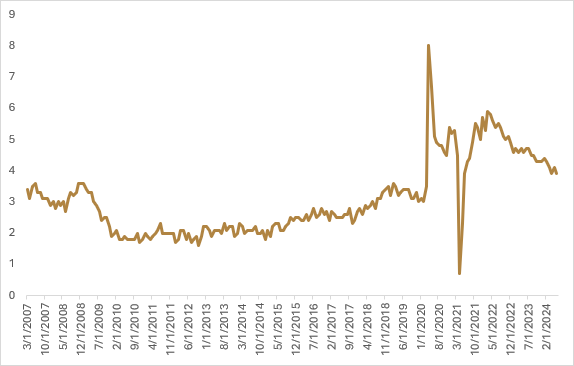

One of the major factors that has underpinned the “goldilocks” U.S. labour market over the last year has been an abundant supply of labour, helping to keep job creation strong without putting too much upward pressure on wages. A tougher stance from the Republicans on immigration will likely upend this trend, forcing companies to offer higher wages to supplement the shrinking labour pool. Without any productivity gains, a reduction in the supply of labour should be inflationary. The U.S. labour market has been softening over the last quarter as unemployment has risen, and this has increased the probability that the Federal Reserve (Fed) will cut rates prior to the election in November. However, a reversal in the labour market pool that puts upward pressure on wages could complicate matters for the Fed into 2025.

Protectionist trade policies are another major pillar of the Republican platform, with the potential for tariffs of 60% on Chinese imports and 10% for all products produced outside of the U.S. In a vacuum, tariffs and other protectionist trade policies are stagflationary, as they increase the cost of imports and increase tax revenue, reducing fiscal deficits. The hope is that protectionist trade policies will encourage more savings and investment into manufacturing and production facilities within the U.S., but that is unlikely to do much for inflationary pressures as impairment of capital flows won’t lead to efficiency gains. In fact, productivity in the U.S. could be harmed if it leads to a shift where workers are effectively forced to manufacture widgets and lower-value items instead of something perceived as higher-value and more productive. We’ve previously written on how protectionist trade policies should be beneficial for the U.S. dollar in the short term, as interest rate differentials rise due to the inflationary nature of trade barriers. However, if tariffs spark a more holistic global trade war, as the volume of global trade decreases, the amount of U.S. dollars demanded decreases, putting downward pressure on the currency.

While protectionist trade policies do have the benefit of reducing the budget deficit by raising taxes on imports, extending the colloquially known “Trump Tax Cuts” will outweigh the tariff revenue and add fuel to the already fiscally expansive policies that are in place. The Peterson Institute for International Economics estimates the tariff proposals will bring in $225 billion in tax revenue per year should trade volumes remain stable (which they highlight is very likely an overestimation), though the Congressional Budget Office (CBO) projects that extending the tax cuts will cost approximately $330 billion per year over the next 10 years.

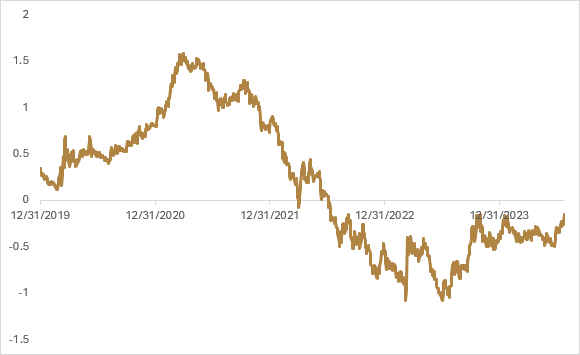

The one thing most of these policies have in common is an inflationary thrust, which should be at odds with Trump’s wish for lower interest rates and a lower U.S. dollar. While Trump has stated that he would let Fed Chairman Jerome Powell finish out his appointed term, it isn’t too far of a stretch to assume that a Trump presidency would ratchet up rhetoric around lower interest rates (and the dollar) in the hopes of making the U.S. export sector more competitive. And while the U.S. economy has been softening to the point where it is likely that the Fed will cut interest rates in September, a slowing economy combined with the potential for a U.S. policy agenda that is broadly inflationary could indicate that we should continue to see the U.S. yield curve steepen as short-term interest rates fall by a faster clip than longer-term rates.

As we head into the meat of the U.S. election cycle, the focus for financial markets will be the implantation of the incoming administration’s economic agenda, and currently the Republican platform broadly seems to be inflationary. To position for the event risk and the probability of a Republican administration, a steepening yield curve and long commodities like gold and silver are effectively what financial markets are dubbing the “Trump” trade. You can decompose this further into a high-level asset allocation where an investor would likely want to be decreasing exposure to long-term bonds and increasing exposure to commodities. The outcome for equities is a bit murkier, as protectionist trade policies are likely to be challenging for large-cap multinationals that rely on international trade. Expansionary fiscal policy should support the real economy, so the stocks of companies with the ability to pass through inflationary pressure to consumers should continue to do well in this environment.

At Viewpoint, we believe that in an environment where macroeconomic uncertainty is high, risk-balanced, global multi-strategy solutions are well suited for this landscape. The combination of elevated interest rates and a political landscape that is shifting to a populist framework could indicate that the risk premium should be more adequately compensated than it has been in the past, and we should see greater diversification across global markets as local events have a greater influence on domestic asset prices in a world where global cooperation is receding.

Happy investing!

Scott Smith

Chief Investment Officer

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.