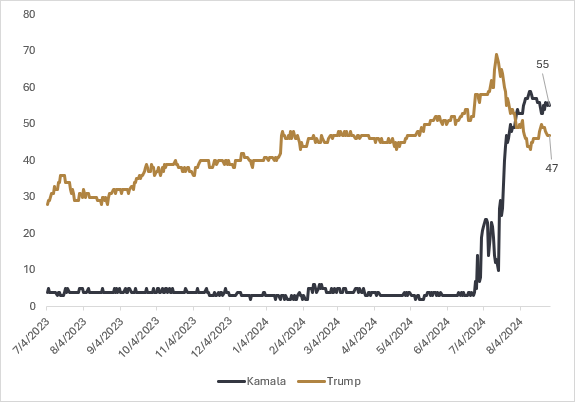

A little over a month ago we released a note detailing the pillars of Donald Trump’s economic platform, and if Trump were to win the presidential election in November, how these policies from the campaign trail could influence price action in financial markets. The note was released just after Joe Biden dropped out of the race to be replaced by Kamala Harris, and while Harris had already started to make up ground in both polling numbers and betting markets, Trump was still the odds-on favourite to win the election.

Over the last month, the momentum from replacing Biden with Harris combined with the fanfare of the Democratic National Convention, Harris has opened almost a four-percentage point lead in polling numbers and is now leading Trump in betting markets. While this is a dramatic reversal in fortunes for the Democrats to be back in the race, Nate Silver has noted that due to the Republican edge in the electoral college map, the presidential election is still a coin flip even if Harris is leading in the polls by one and half percent heading into the election. With over two months until the election, the race is still very close, and the debate on September the 10th will provide the next catalyst to potentially narrow or widen the current polling gap.

Now that the Harris campaign has started to release some of the key pillars of their economic platform, I thought this would be a good time to review how these policies could impact financial markets should Harris become the president-elect.

Unsurprisingly, a major issue for voters is consumer prices, and while these have come down in recent months, both candidates have promised their economic platform will help to lower prices and make everyday goods more affordable for constituents. The Harris campaign has proposed legislation aimed at banning “price gouging” to lower food and drug costs for consumers, taking aim at the consolidated meat packing industry while giving the Federal Trade Commission more latitude to scrutinize mergers in the food and drug industry like the proposed merger between Kroger and Albertsons.

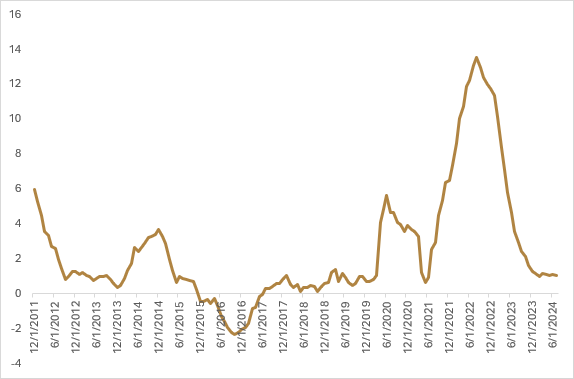

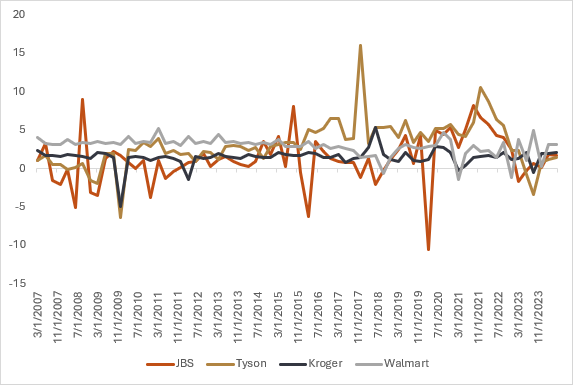

Price gouging is already illegal in several states, however there is no federal restrictions currently in place. The current administration has already highlighted the consolidation of the meat packing industry as being anti-competitive for both farmers and consumers, with four large conglomerates controlling anywhere between 55-85% of the market for pork, beef, and poultry. Grocery stores have also come under fire as part of the proposed federal price gouging legislation, but it doesn’t seem immediately apparent from the data that any price gouging is happening, with net profit margins of both meat packers and major grocers currently at relatively subdued levels.

From an economics perspective, government involvement in setting prices generally leads to a mismanagement of supply which creates shortages of goods. The cure for higher prices tends to be higher prices themselves. Higher prices incentivize new supply to come online, and the increased supply helps to balance demand at the market clearing price. On the other hand, oligopolies also create deadweight loss for the economy, and from an economic standpoint are not efficient in setting market clearing prices. Understandably, the worry with additional federal oversight into anticompetitive practices is that it could spill over into more literal price controls, which are never a good thing for normal supply and demand functions.

As the legislation currently stands it is being framed as a consumer protection measure, but it is unlikely that this will result in any short-term reduction in consumer prices given net profit margins of the industries that are under scrutiny. From an equity market perspective, the overhang of uncertainty around the proposed federal legislation is likely to weigh on consumer staples and healthcare stocks should Harris win the upcoming election.

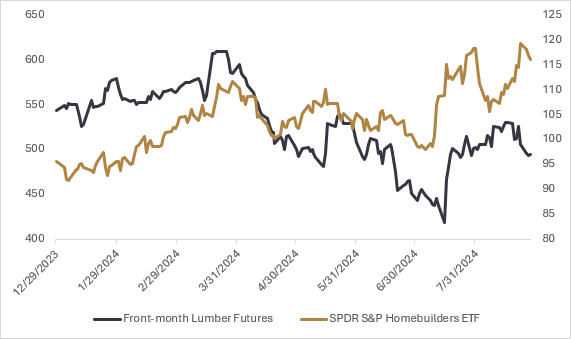

Continuing with the issues of high prices for consumers, housing affordability is another key pillar of the Harris campaign. The campaign proposal put forth by Harris is to create a $40 billion innovation fund to incentive homebuilders to increase supply of housing units, along with a $25,000 tax credit (likely to be advanced) for first-time homebuyers. While the details around how the rollout of these policies would take place is limited, without setting aside money to encourage the construction of up to 3 million new housing units through the innovation fund, the $25,000 tax credit would only exacerbate the housing affordability issue. For this reason, the timing of the rollout will be important, as you wouldn’t want excess demand from the first-time homebuyer tax credit coming into the market when there is already a housing shortage.

To put some numbers around what the first-time homebuyers tax credit would cost the government, Congress passed a similar credit for $8,000 during the Great Financial Crisis, which 1.4 million people took advantage of, costing the government about $10 billion. The proposal by the Harris campaign is roughly three times as large, so we could estimate that a similar policy would run the government about $30 billon; combined with the tax incentives for homebuilders through the innovation fund, the total price would amount to approximately $70 billion of government spending.

Also, something to consider is that the rollout of this policy would likely be happening at a time when the Federal Reserve is decreasing interest rates which should stimulate housing demand through lower mortgage rates, putting upward pressure on house prices. However, Kris Abdelmessih from Moontower had a good blog post on why, counterintuitively, we could see housing prices in the U.S. fall as interest rates come down, as the reduction of interest rates could lead to a more housing supply coming on-line. The rationale is that a lot of homeowners in the U.S. locked in 30-year mortgages at super-low interest rates during the COVID pandemic, and because mortgages in the U.S. can’t be ported over when you buy a new home, these low mortgage rates have embedded value in them relative to what you can get a mortgage for at today’s current rates.

Because of the value of having a 30-year mortgage at 3% versus 6%, homeowners are only incentivized to move if they can be adequately compensated to “give-up” the present value of their financing costs, which leads to less housing supply and higher prices. The potential affect on housing supply from lower interest rates aside (as the present value of the old financing costs fall this will make it more attractive for homeowners to list their homes), the focus of the Harris campaign on increasing housing supply while at the same time stimulating demand is likely going to be a boon for homebuilders and building materials.

The SPDR ETF that tracks U.S. homebuilders and lumber prices have seen a recent rally, likely a result of both easier monetary policy on the horizon combined with the potential for pro-growth housing policy.

The last major pillar of the Harris economic platform is perhaps the most straightforward. While Trump is campaigning on extending his 2016 tax cuts which the Congressional Budget Office is projecting will cost $330 billion per year over the next ten years, Harris is proposing an increase in the corporate tax rate from 21% to 28%, which is forecast to reduce the budget deficit by $100 billion per year over the next 10 years.

While this is being billed as “corporations paying their fair share”, this proposal is the most significant with regards to tackling the federal deficit, eating into corporate profits, slowing economic growth, and ultimately flowing through to consumer prices. Goldman Sachs has forecast that every percentage point increase in the corporate tax rate will result in reduced corporate profits by a similar magnitude, translating to a roughly 7% hit to corporate profits. The potential for the U.S. government to start to reign in the fiscal deficit at a time where the Fed is starting to decrease interest rates should help to increase the attractiveness of long-term government debt and ease the pressure of how to deal with an increasing supply of treasuries.

On the flip side, the bull case for precious metals and other value stores becomes less attractive on the prospect of reining in the federal budget deficit.

Happy investing!

Scott Smith

Chief Investment Officer

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.