About a month ago, I wrote a brief note pondering if it was time to start getting back to benchmark duration weights in U.S. fixed income portfolios. The rationale for why it is too early to be extending duration is due to U.S. monetary policy being in a balancing feedback loop, which is the basis for my view that we are still in a “no-landing” type scenario. The balancing feedback loop can be described as the following: the Federal Reserve (Fed) provides guidance to market participants that they would like to lower interest rates, bonds rally on this news as yields drop, lower interest rates support consumer demand, economic activity improves reinforcing sticky inflation, the Fed warns market participants that interest rates may have to stay higher for longer as a result of warmer inflation, interest rates rise resulting in tighter financial conditions…rinse and repeat.

On Friday, we received additional inflation data in the U.S., with personal consumption expenditures (PCE) for the month of April being released. The Fed’s preferred measure of inflation rose by +2.8% on a year-over-year basis (in-line with economist’s estimates), which was also the same pace as the March readings. Although there wasn’t any positive progression for inflation for the month of April, financial markets will take this as a win on the basis that inflation didn’t surprise to the upside. The in-line inflation reading was a bit of relief for U.S. bond markets, which had hit a rough patch over the last week after hawkish comments from Fed members took some wind out of the bond market’s sails.

While I still think it’s too early to be extending duration of U.S. fixed income portfolios, we’ll get employment data out of the U.S. next Friday that could make the case to start increasing duration exposure. While the U.S. labour market has not yet frozen over, a weaker-than-anticipated employment report for the second month in a row would start to raise questions if the current cracks may be turning into fissures. A weakening labour market would provide the Fed with some ammo to cut rates in the fall, though this is still a big ‘if,’ and we’ll have to wait until next Friday’s employment report to give us further clues on how it could influence monetary policy into the end of the year. Duration clawed back some of its year-to-date relative underperformance in May, with U.S. 10-year bonds rising +1.1% relative to two-year bonds rising only +0.2%. Year to date, U.S. 10-year bonds are down -4.7%, with two-year bonds down -1.6%.

Where I would be more comfortable taking duration risk at this juncture would be in the Canadian fixed income market, where notable softness in both the labour market and consumer prices will likely spur the Bank of Canada (BoC) to cut interest rates before the summer is over. In fact, on Friday, we received GDP data for the first quarter of 2024 that showed the Canadian economy expanded by +1.7% on an annualized basis over Q1, missing the +2.2% pace that economists had been forecasting. Almost as challenging at the Q1 2024 print was that the Q4 2023 numbers were revised down from an annualized quarterly expansion of +1.0% to +0.1%, highlighting that the softness in the Canadian economy has been more pronounced than expected.

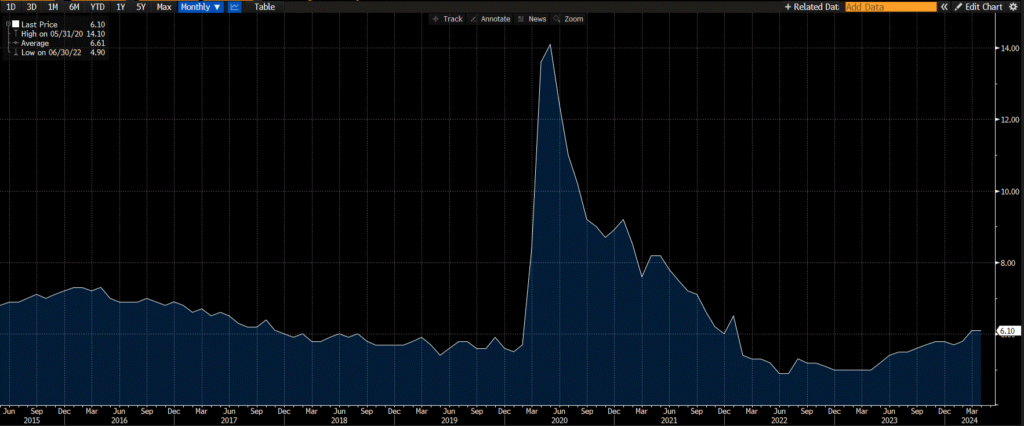

Last Friday’s GDP figures corroborate signs of a cooling Canadian economy, as the labour market has been softening since June of 2022 with job vacancies on a downward trend and the unemployment rate rising from a low of 4.9% to its current level of 6.1%. While the Canadian economy has been creating new jobs, the gains in the labour market have not been able to keep up with the increased supply of labour, and bargaining power is shifting from employees back to employers.

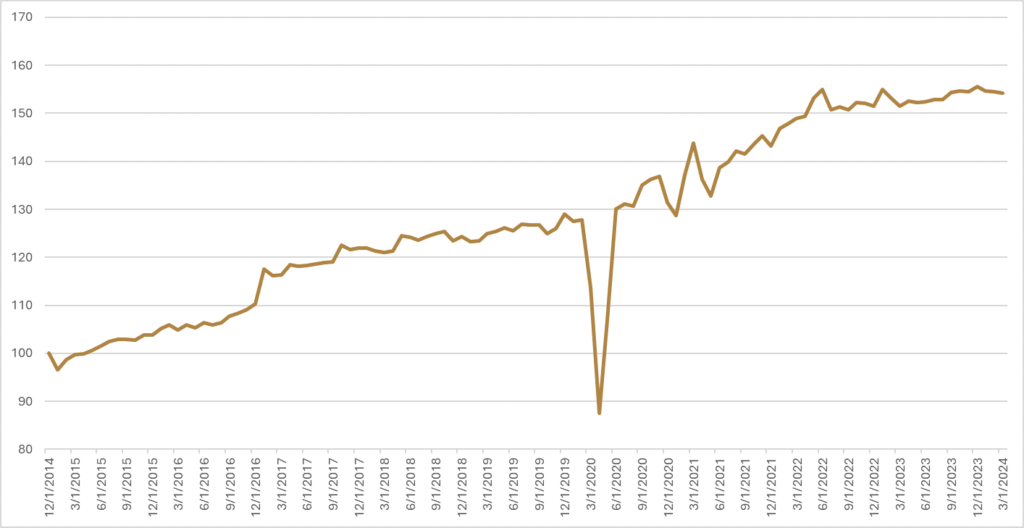

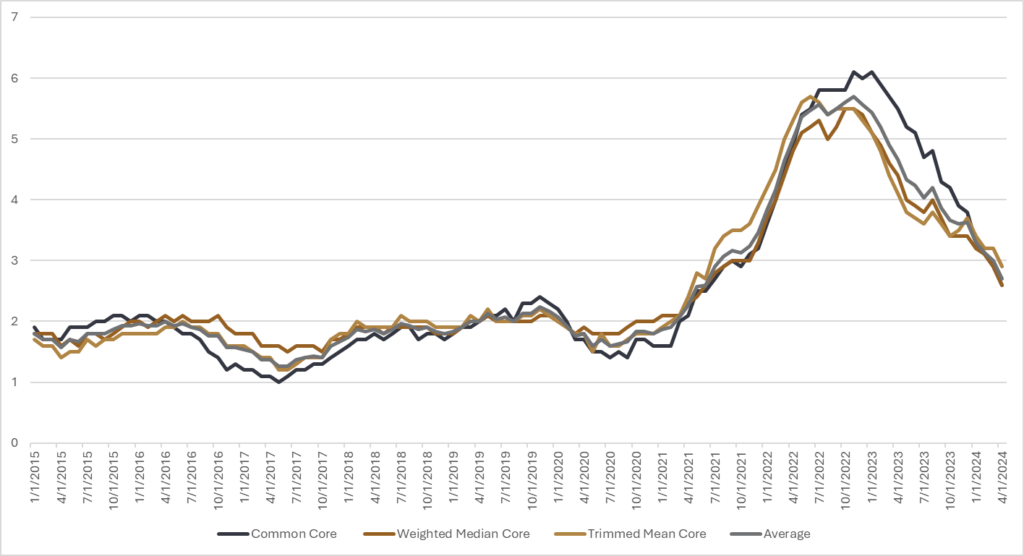

Headwinds for the labour market have resulted in a hit to consumer spending, with retail sales stagnating for much of the past six months. As consumers start to pare back their discretionary expenditures in a high interest rate environment, this is relieving some of the pressure on consumer prices, with the BoC’s three preferred measures for core CPI falling below the 3% handle and closing in on the BoC’s target of 2%.

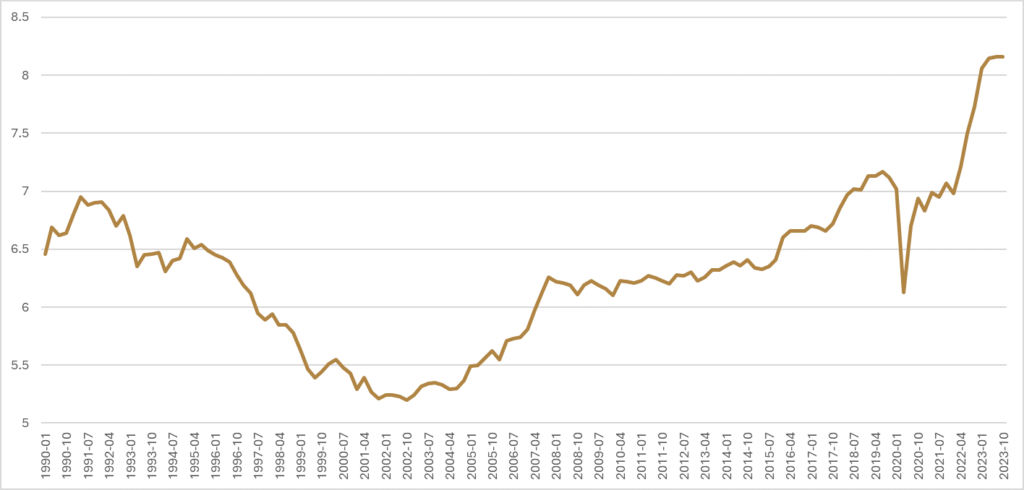

With Canada’s relatively heavy debt burden compared to other developed countries (both private and public balance sheets), we don’t foresee a resurgence in consumer demand unless interest rates ease from these levels. Housing affordability across Canada continues to be an area of consternation, with record immigration and a lack of housing supply becoming a disastrous combination. Mortgage debt service levels are at the highest levels in the last 30 years and are likely to continue to weigh on demand as refinancing from extremely low rates continues to occur.

Putting it all together, a softening labour market along with consumer prices homing in on the BoC’s target make it such that there is a good chance the BoC will cut interest rates sooner and deeper than the Fed. Generally, the BoC will wait until the Fed embarks on their easing cycle before following suit, but this time there is a good case to be made that the BoC will cut interest rates first and have more room to cut more aggressively to shore up the economy and the Canadian consumer.

This Wednesday is the BoC’s June interest rate announcement, and markets are currently pricing in about an 80% chance of a rate cut, with a little over two cuts priced in for 2024. At this juncture, I think the BoC has enough data to support lowering interest rates, but we’ll have to see if Tiff Macklem is interpreting the data in the same way. South of the border, financial market participants are only pricing in a little over one cut for the Fed in 2024, and this monetary policy divergence between Canada and the U.S. has put downward pressure on the loonie against the USD so far in 2024. The USD has appreciated just under 3% against the loonie this year, and we expect the loonie will continue to tread water as the divergence between bond yields continues. While the probability of a global recession is still lower (in my opinion) than a continuation of the current ‘no-landing’ state for the next few quarters, moving back to benchmark duration in Canadian fixed income portfolios is attractive from a risk and reward perspective. Outside of fixed income markets, we also anticipate that a continued weakening of the Canadian dollar will be a tailwind for foreign equity market exposure, and we recommend diversifying internationally in response to the Canadian economy’s further slowdown compared to other G7 economies. Outside of resource extraction and housing construction, the outlook for the Canadian economy does not seem awe inspiring. While we always recommend that investors prioritize portfolio diversification to include foreign financial markets, predominately as a way to gain exposure to foreign currency and other monetary policy regimes, at this juncture, the recommendation for international diversification seems all that more important.

Happy investing!

Scott Smith

Chief Investment Officer

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.