Friday’s blockbuster U.S. employment report may have upended the bond market’s optimism that monetary policy easing will begin in June as the labour market in the U.S. refuses to soften. The U.S. labour market added 303k new jobs in March, close to 100k more than had been expected. The unemployment rate fell to +3.8% from +3.9% in February, while labour force participation rose more than expected to +62.7% as more people are looking for work. The rise in labour force participation may have helped keep wages somewhat in check, with average hourly earnings falling to +4.1%, down from +4.3% in February. While wage pressures have been easing, the hot jobs report is another in a line of stronger-than-anticipated U.S. economic data to begin 2024. The Atlanta Fed’s GDPNow is currently estimating Q1 GDP for the U.S. to come in at +2.5%.

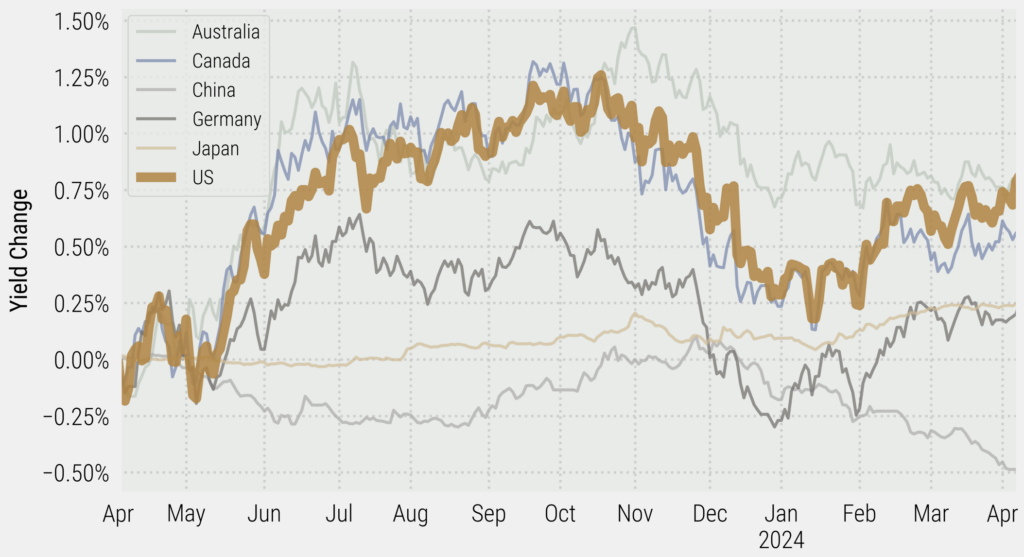

The Federal Reserve (Fed) will get more information on Wednesday of this week when March inflation figures hit the wires, but as of right now the probability for a June rate cut has been pared back to below 50%, with an aggregate of only 2.5 cuts now expected for 2024. This is a continuation of the theme we have seen to start 2024, with the magnitude of interest cuts expected by the market being reigned in, which has put upward pressure on short-term interest rates in the U.S. However, a hot domestic economy pushing back the expectation for central bank rate cuts is not a global phenomenon, and interest rate differentials have broadly moved in favour of the U.S. dollar (USD). The USD has done exceptionally well against a basket of global currencies so far in 2024, rising by +2.3% in Q1.

A strong USD should help keep inflation in check, though it wouldn’t be surprising to see volatility in the dollar rise as the political news cycle begins to heat up as we get closer to November. Instead of Fed-forward guidance providing the main direction for short-term interest rates and the direction of the USD, trade policy is also likely to enter the fray as the election starts to take centre stage. The latest YouGov polling has Biden and Trump tied at 43%, and betting sites are effectively a coin flip, with bet365 giving a slight edge to Trump, while Predict-It is giving a slight advantage to Biden.

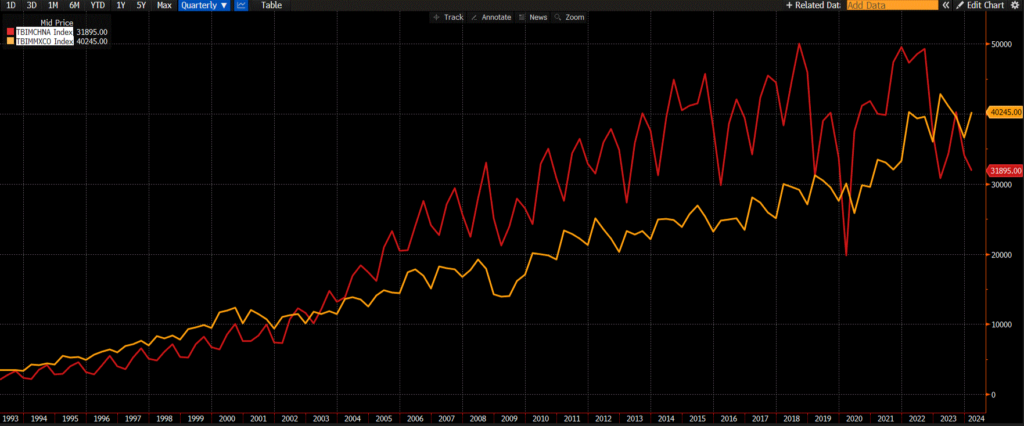

I wrote in another note about how Trump has vowed to be increasingly punitive towards trade with China if elected, though even if Biden retains the presidency, it is unlikely that foreign relations with China will get any less hawkish than they already are. That note focused on what this means for the Chinese stock market, while in this note, I will discuss what another trade war with China could mean for the USD. While the massive 60% tariff on all Chinese imports that Trump has floated would effectively grind trade between the U.S. and China to a halt, the more surprising of the proposals is a flat 10% tariff on any imported goods into the U.S. While this is speculation, I would imagine that if Trump were elected, the heat on China is likely to ratchet up, while the 10% tariff on all imported goods gets walked back, at least for existing trade partners. As Bloomberg Business has noted, the recent emphasis on “friend-shoring” has resulted in Mexico overtaking China as the number one source of imports into the U.S., and I don’t think we’re near the end of this trend. Although, one area on which we could see a crackdown is the routing of Chinese goods through Mexico, with the destination being the U.S.

Analyzing how the upcoming presidential election could influence the value of the USD, there was a recent working paper that was released by Corte and Fu, exploring the effects that tariffs have on the USD. The main finding of the paper was that the USD tends to depreciate (-1.25%) under Republican presidential terms and appreciate (+4.31%) during Democratic presidential terms. The paper posited that the 5.56% delta was both economically and statistically significant, and it cannot be explained by interest rate differentials, inflation differentials, or the variation of the U.S. business cycle. Corte and Fu chalk up the change in value of the dollar under different parties as trade policies and tariff uncertainties. The authors put forward the working theory that Republican presidents generally favour higher tariffs that restrict trade volume, which incite retaliation that leads to lower global trade and reduction in the demand for USD. The negative correlation between tariffs and the value of the USD is an interesting conclusion, given economic theory would suggest that, in a vacuum, tariffs and the value of the local currency should be positively correlated. In theory, an increase in tariffs would put upward pressure on the domestic currency, as the increase in consumer prices necessitates an increase in interest rates to head off inflationary pressures, supporting the local currency.

While the Corte and Fu paper analyzes over 40 years of data to look at the average move in the USD during presidential terms, we also have recent history of Trump’s previous presidential term to study, where Trump’s trade war with China was one of the factors that caused the USD to appreciate significantly. While there were additional macroeconomic factors unfolding at the same time, including monetary policy tightening, this paper from Jeanne and Son that was published in 2023 found that approximately 22% of the USD appreciation and 65% of the renminbi depreciation from 2018 to 2019 can be ascribed to the tariffs implemented by the U.S.

In conclusion, U.S. trade policy will likely be a source of volatility for the USD heading into this year’s election cycle. The risk of a rising USD could be a potential headwind for equities and broad commodity markets if it tightens financial conditions enough to tamper global growth, though we have yet to see this be a material issue for either asset class in 2024. What has been interesting is that commodities that generally tend to be negatively correlated to the USD and interest rates, like gold and silver, are up double digits year to date. The demand for ‘value stores’ or ‘fiat hedges’ has been getting a lift from foreign central banks increasing their reserves, as well as reports of retail buying as global monetary policy looks set to ease at a much faster pace than in the U.S. On the other hand, this demand for safe-haven commodities could be a warning sign. The yield between spot gold and three-month forwards (essentially financing and storage costs) has dipped below the Fed’s target overnight rate. The furious buying of spot gold (relative to longer-term futures) could be a signal that investors are either extremely worried about geopolitics, or the probability of a hard landing has increased. Regardless, it is a telling sign that commodities continue to rally in the face of a stronger USD, signaling aggregate demand has yet to be phased.

Good luck out there!

Scott Smith

Chief Investment Officer

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.