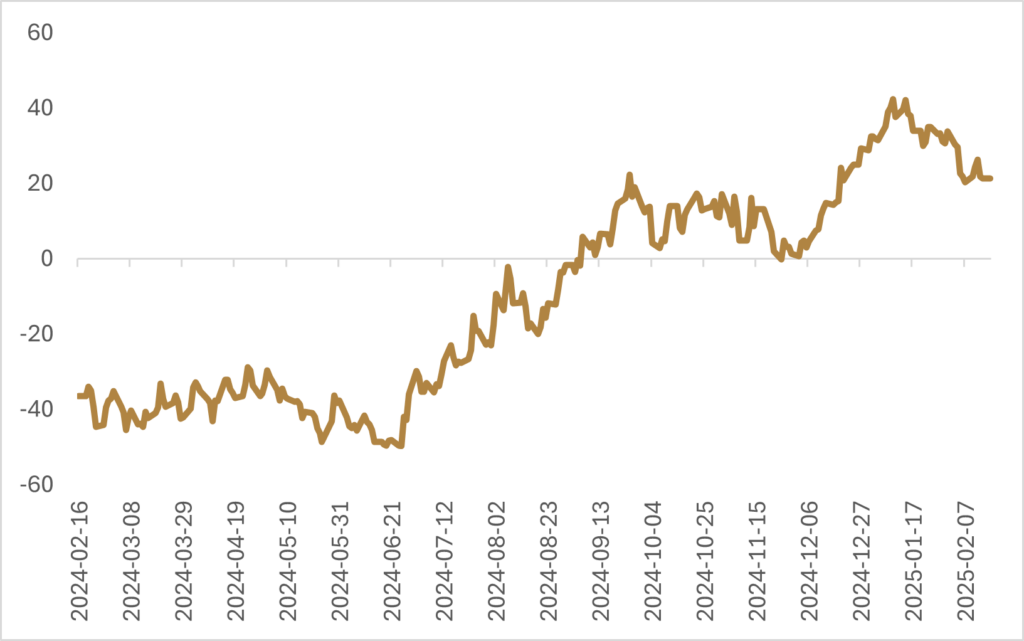

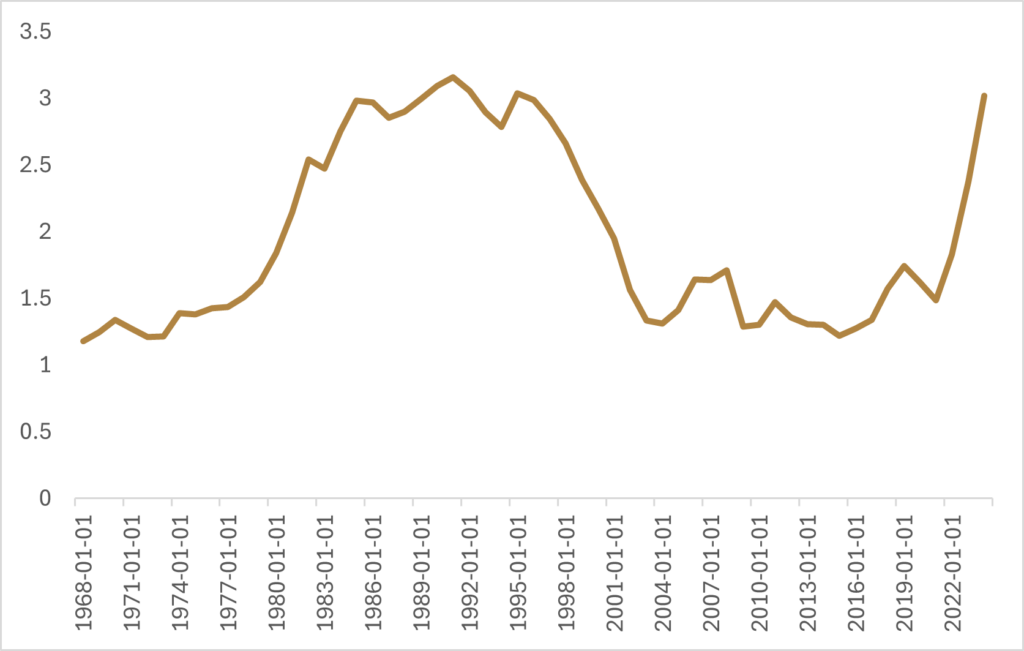

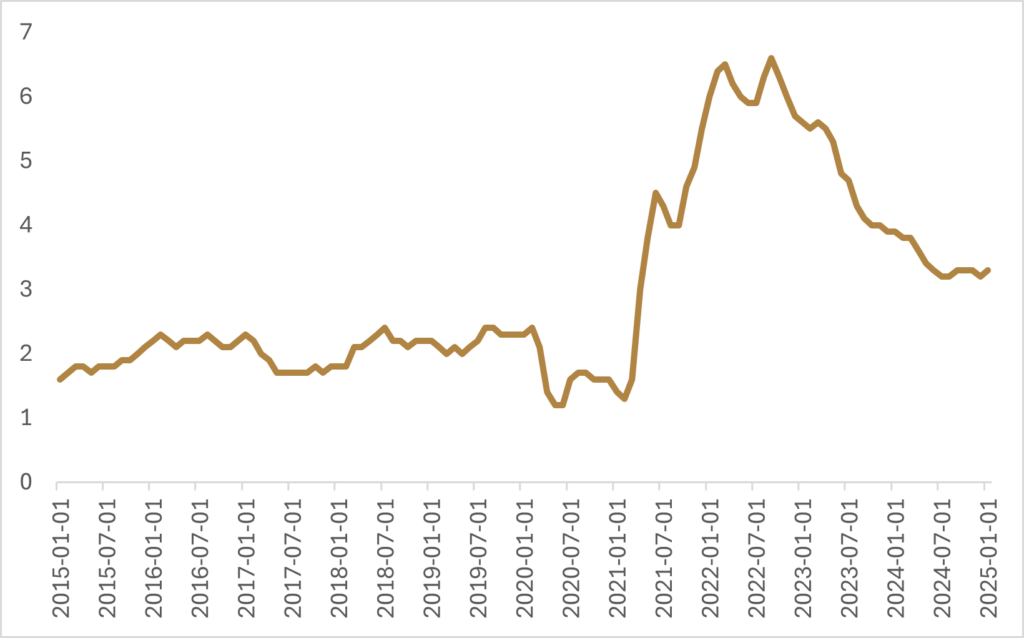

The 10-year U.S. Treasury yield might seem like just another data point in the vast sea of financial indicators, but in reality, it’s one of the most influential numbers in the global economy. It dictates everything from mortgage rates to corporate borrowing costs, influences stock market valuations, and even foreshadows the prospects for economic growth. The U.S. 10-year Treasury yield has been on the rise since the fourth quarter of 2024, driven higher by expectations that stimulative fiscal policy from the new U.S. administration could cause a resurgence in inflation. The combination of an extraordinarily wide fiscal deficit and messaging from new Treasury Secretary Scott Bessent that the Treasury would lengthen out the term of its debt issuance left us at Viewpoint with a bearish stance towards long duration fixed income. The “easy” trade in the U.S. fixed income market since the re-election of Donald Trump has been to bet on the continuation of rising yields; however, since early January, the 10-year Treasury yield has reversed course and declined from a high of 4.8% back to 4.5%.

The first catalyst that has provided some support to long-term U.S. government bonds has been a reversal from Bessent’s earlier comments around longer-term debt issuance. Bessent had been critical of the debt issuance policies of his predecessor, Janet Yellen, opining that her decision to favour the issuance of shorter-dated debt amounted to stealth quantitative easing that kept a ceiling on longer-term Treasury yields in hopes of spurring economic growth. Market participants had been preparing for an increase in longer-date Treasury supply under a Bessent-led Treasury, causing the U.S. yield curve to steepen as markets demanded additional premium to hold longer-dated government debt. A little over a week ago, Bessent calmed the U.S. bond market by stating that he has no imminent plans to alter the current trajectory of debt-issuance plans and noted that the direction of federal borrowing was one positive holdover from Yellen and the previous Treasury administration. Those comments from Bessent have helped to ease longer-term bond yields, partially reversing the yield curve steepening we’ve seen over the last few months. Bessent also noted that he and President Trump are focused on the 10-year Treasury yield, understanding that a continued steepening of the yield curve would be a headwind for economic growth as financial conditions tighten.

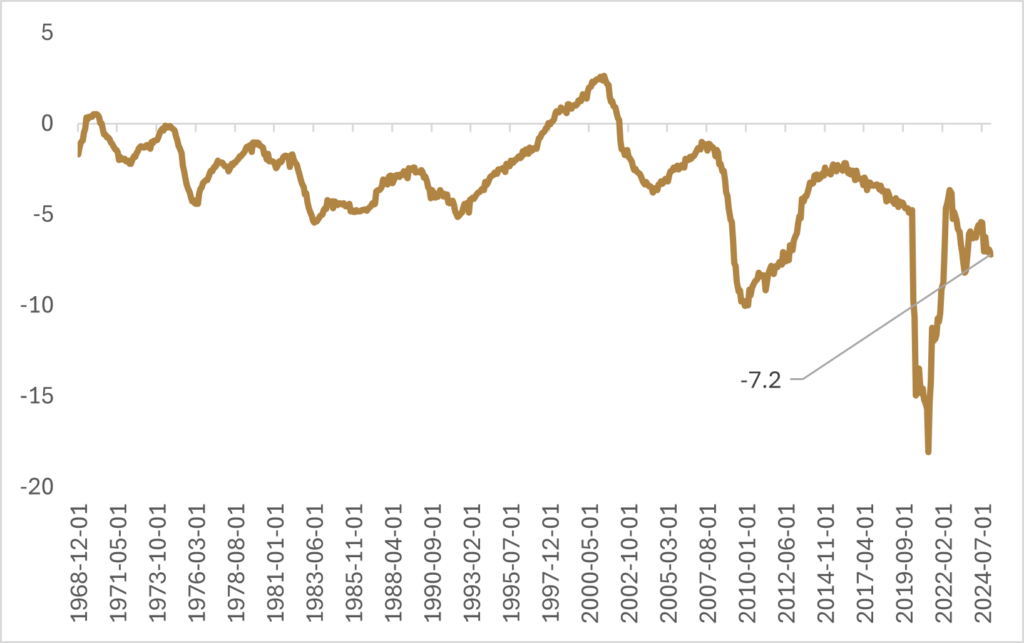

The second catalyst has been a more intense focus on cutting government spending and narrowing the fiscal deficit in recent weeks. Elon Musk’s Department of Government Efficiency (DOGE) has been in the headlines by taking a “slash and burn” approach to perceived areas of government bloat, while Bessent also reiterated his commitment to getting the federal deficit to 3% of GDP. “We cut the spending, we cut the size of government we get more efficiency in the government. And we’re going to go into a good interest-rate cycle.” Reducing the headcount of federal employees will likely continue as the 75,000 who signed up for the voluntary resignation program—amounting to 3% of the federal workforce—fell short of the White House’s target of a reduction in federal employees of 5-10%.

While the new administration is aiming for private sector led growth fueled by capital spending and more domestic manufacturing jobs, the widening of the deficit in the first quarter of the new fiscal year highlights the tall task that Bessent and the administration have in front of them. For the four months from October to January, the U.S. federal budget gap widened to a record $840bn, with federal spending increasing by $319bn relative to the same period the year prior. It is unlikely that DOGE will be able to materially move the needle on narrowing the federal deficit due to the “stickiness” of large government outlays like Social Security, Medicare, and interest payments on outstanding government debt. Therefore, the concrete measures on getting government spending under control will need to come in conjunction with the legislative package that will encompass the extension of the tax cuts Trump passed in his last presidential term.

Last week the Republican-controlled House Budget Committee voted along party lines to continue advancing the budget resolution into the writing stage of the bill, with the resolution allowing for a reduction in federal revenue of $4.5 trillion to incorporate the extension of Trump’s expiring 2017 tax cuts. The resolution also includes $2 trillion in cuts to federal spending from mandatory programs like Medicare and Medicaid, with the provision that if $2 trillion in spending cuts can’t be found, then the $4.5 trillion in tax breaks must be reduced by a commensurate amount. The $4.5 trillion of new deficits from tax breaks is on the lower end of what analysts were expecting from Trump’s wish list, with the Committee for a Responsible Federal Budget estimating the full tax cut priorities would run the government anywhere from $5 trillion to $11.2 trillion in lost revenue. The current budget blueprint is looking more optimistic as it relates to the size of government deficits, but we’ll have to see how the negotiation process proceeds and where the final numbers settle.

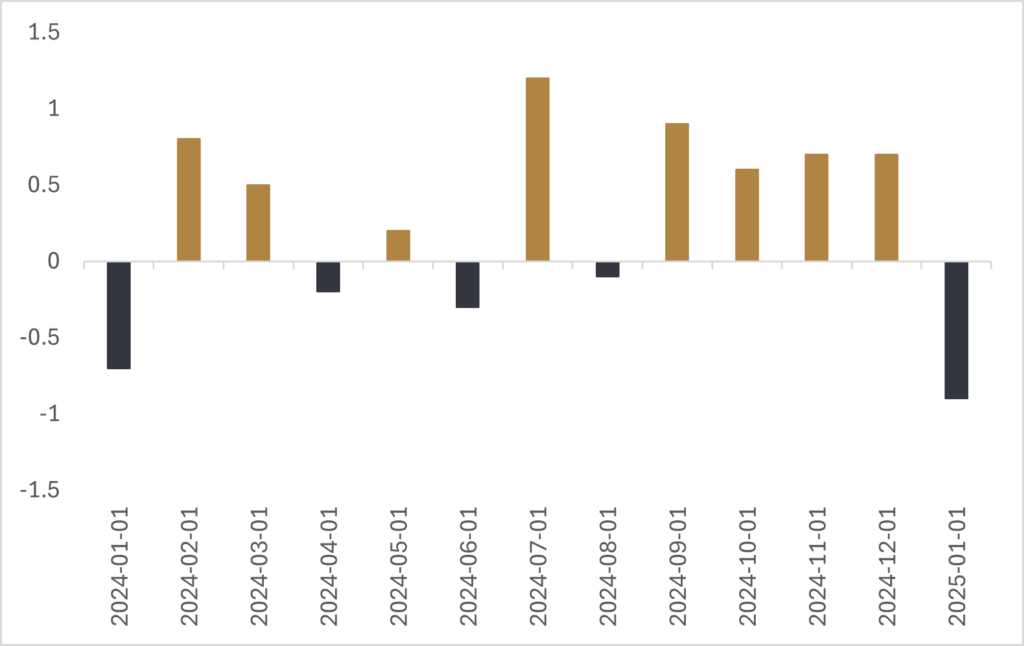

The combination of status-quo debt issuance plans and a commitment to reducing government spending is a breath of fresh air for U.S. bond markets. While I’d be cautious on turning outright bullish on U.S. bonds until there is more concrete evidence on progression towards narrowing the fiscal deficit, the events of the last two weeks do reduce some of the overall bearish sentiment that has permeated through the market over the last five months. Price action in the Treasury market last week was also telling, with 10-year Treasury yield finishing the week lower than where it started, despite a hotter-than-anticipated inflation reading on Wednesday. Core inflation in January rose by +3.3% on a year-over-year basis, up from the +3.2% pace registered in December and higher than the +3.1% estimated by economists. The 10-year Treasury yield received a reprieve from the hotter-than-anticipated CPI report after U.S. consumer spending unexpectedly slumped during the month of January. Retail sales dropped by -0.9% on a month-over-month basis, much worse than the -0.2% economists had expected, though December’s figure was revised up from +0.4% to +0.7%.

While these respective reports are both just singular data points that followed strong consumer spending into the end of 2024, they will be important to keep an eye on. Overall sentiment in the fixed income market will continue to be driven by economic data and the associated impact that this will have on short-term monetary policy, but the last few weeks have been positive for placing a lid on the bear steepening of the yield curve. Though we’re not yet outright bullish on bonds, the bearish sentiment that has been hanging over bond markets has been somewhat alleviated.

Happy investing!

Scott Smith

Chief Investment Officer

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.