In an executive order posted on the White House website Saturday, Donald Trump invoked the International Emergency Economic Powers Act, citing the flow of illicit drugs across the United States’ northern border as the rationale for kicking off what The Wall Street Journal dubbed as “The Dumbest Trade War in History.” The executive order signed by Trump imposes 25% tariffs on Canadian imports, though energy and energy resources will have an initial tariff rate of 10% to minimize the rise in costs to American consumers. Mexican imports into the U.S. were also hit with across-the-board tariffs of 25%, without an exemption or lesser tariff for energy resources. Although well telegraphed, but nonetheless bewildering, America’s biggest adversary only got dinged with a 10% tariff increase. Given the declining portion of Chinese exports to the United States in recent years, a 10% increase in tariffs on Chinese imports is not material and is likely to be managed at this stage through a continued measured decline in the Chinese currency, which has depreciated about 5% since October of last year.

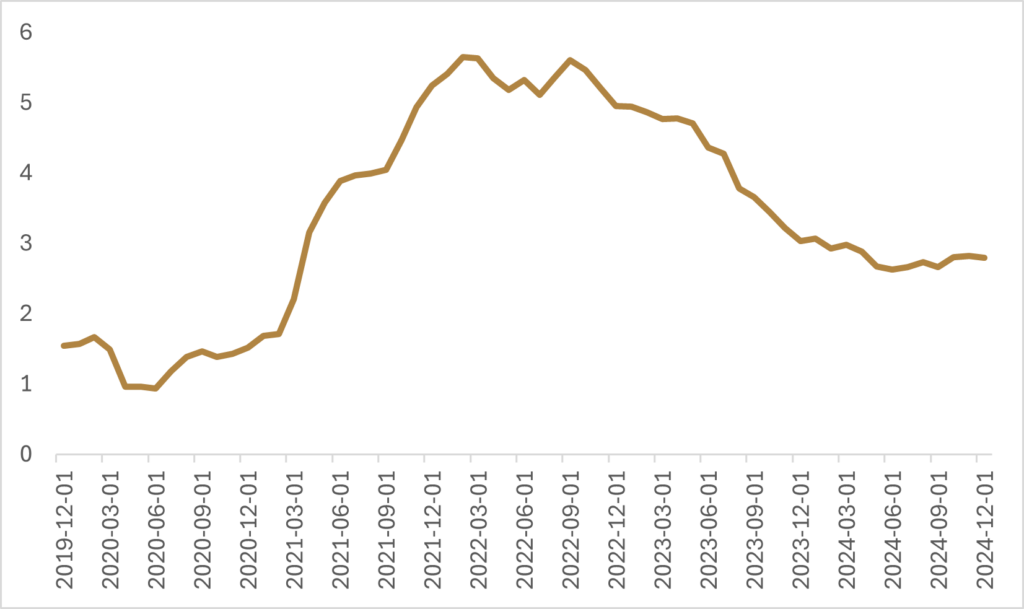

Bloomberg Economics has estimated that the trade war will increase the average U.S. tariff rate from 3% to 10.7%, reducing U.S. GDP by 1.2% and increasing core inflation by 0.7%. Last week, it was reported that U.S. Core Personal Consumption Expenditures (PCE), the Federal Reserve’s preferred inflation gauge, increased by 0.2% on a month-over-month basis, bringing the annual rate of change to 2.8%. While the first order effects of tariffs are generally seen as being one-time increases in the price level, the second order effects are less clear. Goldman Sachs commented over the weekend that during the 2018-2019 trade war experience, not only did U.S. companies pass through all the costs associated with tariffs, but some companies without tariff exposure saw competitors raising prices and took the opportunity to increase margins, effectively passing through more than 100% of the tariff increase. Trump has commented over the weekend that American consumers could potentially feel “some pain” and that he’s not concerned about market reaction around tariffs.

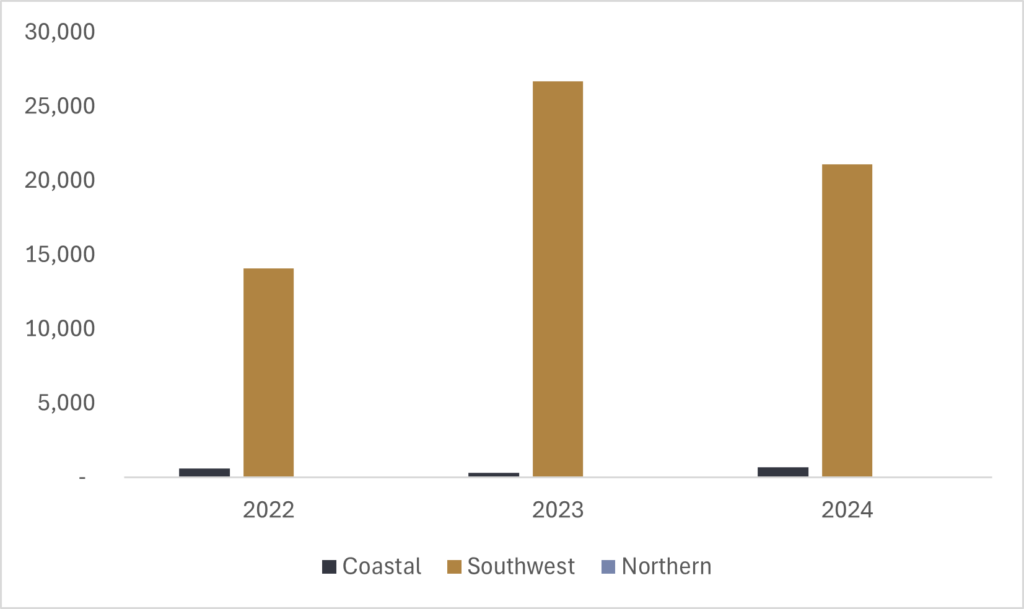

The argument for levying tariffs on Canada to stop the flow of illicit drugs continues to be nonsensical and not supported by data. Data from U.S. Customs and Board Protection (CBP) shows that drugs seized at the northern border account for only 2% of the total drug seizures in 2024. Drilling down further to look at the fentanyl epidemic that Trump has raised numerous times, for all of 2024 there have only been 43 pounds of fentanyl seized at the northern border, which is 0.2% of all fentanyl seizures in 2024. Despite the lack of data to back up the national security claims, Canada has already taken steps to appease Trump by implementing a $1.3bn package aimed at bolstering border security, making it increasingly unrealistic that diplomacy on the issue of border security is the true end game for this trade war.

As we anticipated and wrote about two weeks ago, Canada hit back at the U.S. and laid out its retaliation plan over the weekend. Canada will place 25% tariffs on $155bn worth of American products, starting with $30bn worth of goods that will go into effect on Tuesday, with the remaining $125bn taking effect later in February after a 21-day consultation period. The measured, but forceful, retaliation stopped short of export levies or export curtailment on oil and gas products, with Trudeau outlining that “no one region of the country or on industry carries a larger burden than anyone else.” A recent report from the Bank of Canada suggested that if the U.S. increased tariffs on imported Canadian goods to 25%, and Canada responded by increasing tariffs on imported goods from the U.S. by the same magnitude, Canadian GDP would fall by 2.5% in the first year and 1.5% in the second year, before leveling off at a lower absolute level in year three. Though not an identical scenario, given Canadian energy exports will only be tariffed at a rate of 10% (for now), it should serve as a decent illustration of the potential negative effects felt by both Canada and the U.S. if the trade war isn’t resolved in a timely fashion. Under the Bank of Canada’s model, the retaliatory tariffs are assumed to be gradually passed on to consumers over the course of three years, with total CPI increasing 0.1% in the first year, 0.5% in the second year and 1.0% in the third year. This is a similar finding to a report released by the Canadian Chamber of Commerce in late 2024, which estimated that under a retaliatory trade war scenario with the U.S., Canada’s GDP would shrink by 2.6% and would push Canada’s economy into a recession by the middle of 2025.

As we know in Trump-era politics, sentiment can quickly change, though at this juncture the end game for the “art of the deal” seems murky. Trump has already acknowledged that American consumers will feel some pain and that tariffs are going to increase prices, so the current rhetoric suggests that any negative stock market reactions may do little to dissuade Trump from continuing to work on reducing the U.S. trade deficits by any means necessary. Furthermore, unlike the last trade spat with Canada and Mexico that resulted in a rewriting of the North American Free Trade Agreement (NAFTA) during Trump’s first term, Trump himself was the one to negotiate the United States-Mexico-Canada Agreement (USMCA), so it seems unlikely that Trump is positioning for another version of NAFTA, given it would amount to him acknowledging he negotiated a bad deal with USMCA. We’ll have to see what the next few weeks bring and if Trump will follow through on his threats of doubling the tariffs and expanding their scope due to the retaliatory tariffs from Canada.

The pain that Trump telegraphed is being felt by the markets this morning, though we’re already seeing some of the negative sentiment being walked back after a reportedly “good” call between President Trump and Mexican President Claudia Sheinbaum where Sheinbaum has stated tariffs on Mexico will be delayed a month. We’ll have to see if that positive sentiment continues to echo through the markets after Trump’s call with Prime Minster Trudeau. At the time of writing, the S&P 500 and S&P TSX are both down around -1.0% after having been down close to -2.0% before the Sheinbaum headlines dropped. U.S. government bonds have pared back earlier gains but are still bid (+0.3%) on worries around the effects on global growth should the trade war persist. Agricultural commodities have seen a massive relief rally this morning on hopes the trade war will not come to fruition, and the positive headlines have dropped WTI futures back to flat on the day, while gasoline futures are still elevated up +1.5%. The Canadian dollar weakened to almost 1.48 against the USD overnight, but this morning had recouped some of its earlier losses before the Sheinbaum headlines and is now only slightly lower against the USD from where it closed Friday. Volatility is on full display this morning, and by the time you are reading this, it’s likely that all these numbers will have changed (either up or down).

In the absence of any de-escalation, we’re likely to see continued downward pressure on equity market valuations as well as the Canadian dollar. Given that a stronger U.S. dollar will eat into corporate profit margins and the tariff passthrough effect will hit headline revenue figures, there could be a price adjustment for equities in the -5% range; so, given price action this morning, the full effect of a prolonged trade war has yet to be felt. Similarly, the Canadian dollar will have yet to hit its weakest point if there is a prolonged trade war, as the Bank of Canada will continue with their interest rate cut cycle to bolster domestic demand. Additional rate cuts from the Bank of Canada will continue to drive a wedge between U.S. and Canadian short-term interest rates, reducing demand for the loonie in favour of U.S. dollars. Depending on how today’s call with Trump and Trudeau goes, we’ll be watching to see if Trudeau and the Liberals end prorogation and recall Parliament to enact emergency fiscal stimulus measures to help support Canadian workers and businesses. As I mentioned a few weeks ago, Canada should not let “a good crisis go to waste” and emergency fiscal measures, if enacted, should be directed at investing in an expansion of energy and trade infrastructure as a means to diversify Canada’s customer base.

Good luck out there!

Scott Smith

Chief Investment Officer

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.