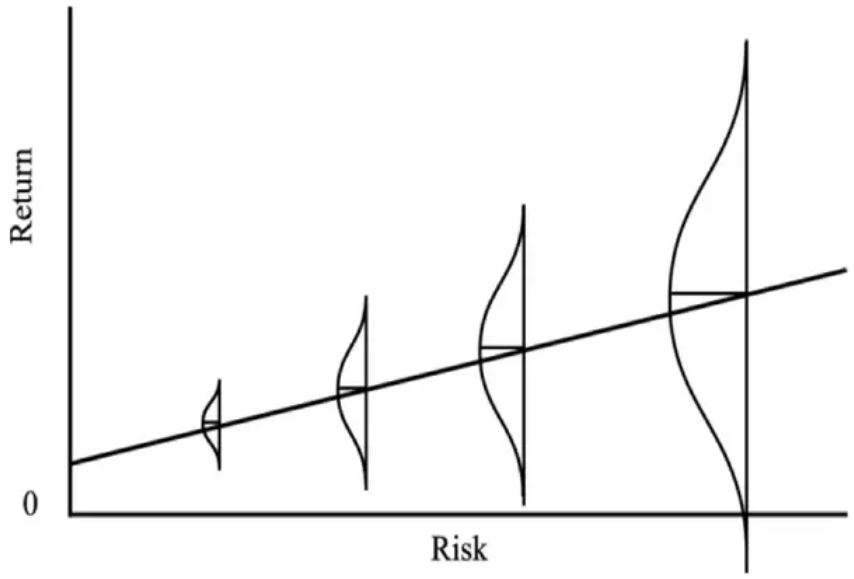

A well-known adage is that risk and reward go hand in hand. To increase your potential upside, you must be willing to withstand increasing levels of uncertainty as to whether that upside will be achieved. The prospect of becoming a famous actor in Hollywood sounds enticing, until you realize that there are very few leading actors who make extraordinary amounts of money, and many more actors who failed to catch their break and were forced to work lower income jobs that don’t quite meet their needs. The distribution of potential income levels for aspiring actors is much wider than a factory worker who is part of a union. The concepts of risk and reward are synonymous with investing and are unique from the perspective that they can be more easily quantified than big life decisions. Rewards are easy to wrap our heads around and are measured by calculating the return an investor receives on their investment. The concept of risk, however, can be a bit more nuanced. The most common way to define risk ex-post (after the fact) is known as volatility, which is measured by the standard deviation of returns. The volatility of an investment tells us how variable the returns of an investment have been, and the magnitude of the variability gives us a sense of the uncertainty an investor will experience as to whether or not their investment will realize the return that was expected ex-ante (before the investment). With the same return expectations, a highly volatile investment has more likelihood of very high or very low outcome. Figure 1 shows how this volatility increases the expected range of realized returns. We also know that as humans we experience risk asymmetrically, assigning greater value to losses relative to gains of the same size. The asymmetric assignment of risk is not just a psychological phenomenon, but it also has mathematical implications. And so, it makes sense that investors should be cognizant of how much extra uncertainty they are willing to endure to increase their potential returns. The concept of risk becomes nuanced because of the different drivers of return variability and the various actions investors can take to manipulate, transform, and scale their risk.

Source: Oaktree Capital Management, L.P.

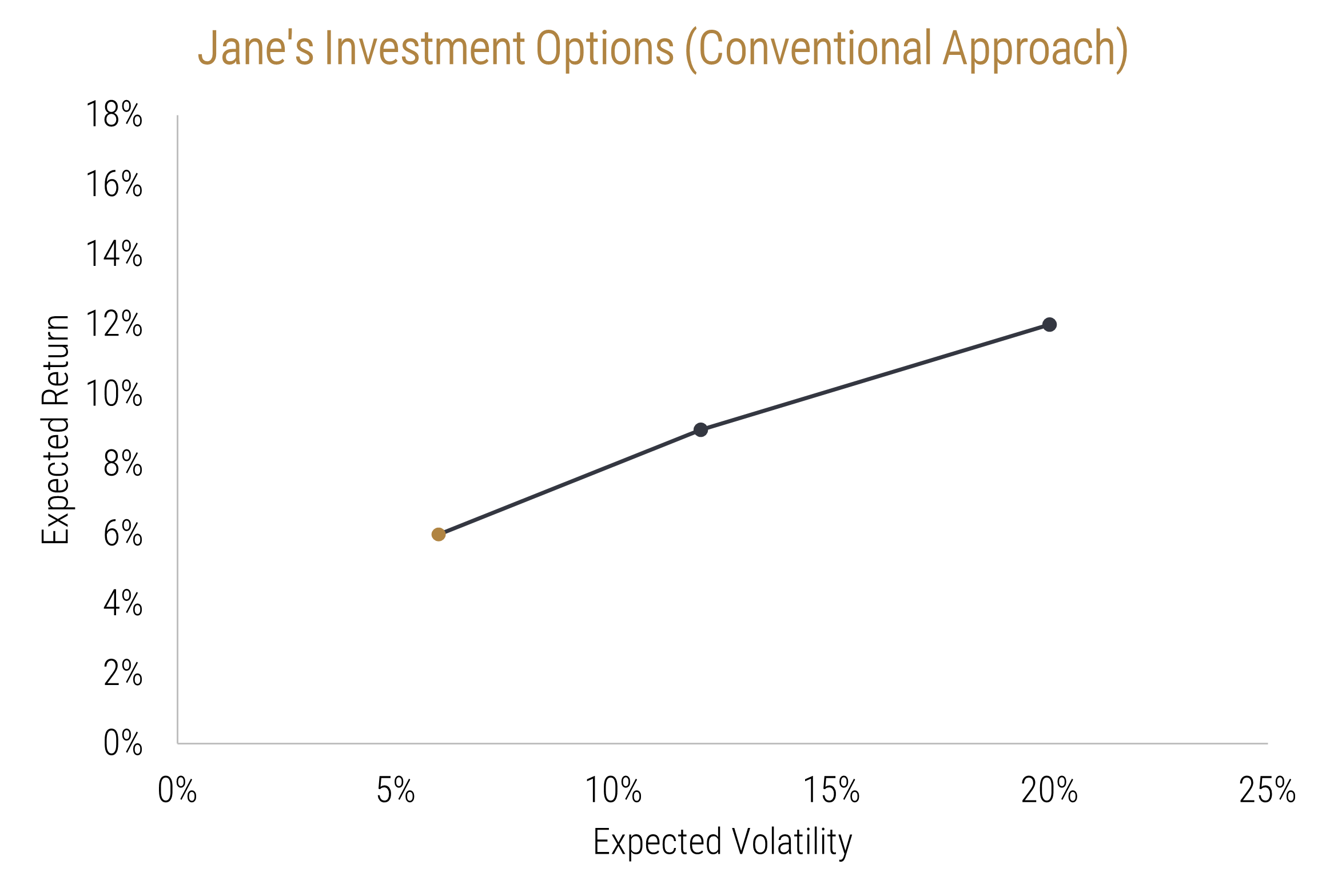

Conventionally, investors tend to let return objectives drive asset allocation decisions. As return objectives increase, allocations to asset classes with higher expected returns will increase as a proportion of the investor’s total portfolio. Diversification across asset classes becomes somewhat of an afterthought and takes a backseat to the potential for higher returns. At its surface, this makes sense. If we want more return, we should weight more towards asset classes, such as equities, which offer more return potential than lower return assets, such as fixed income. However, this gives rise to an insidious type of risk known as concentration risk.Let’s offer a simplified example of an investor, Jane, who wants to earn an expected 6% return over the next 10 years, but her risk tolerance is such that she is only willing to accept 8% volatility on her returns. Her portfolio manager is able to build out a diversified portfolio that equally weights equities, fixed income, and commodities, which fits her return requirement with a lower expected volatility of only 6% (see the gold dot in Figure 2). A few months later, Jane’s husband loses his job and with it, his pension. With the help of her portfolio manager, Jane realizes that she will require a 12% rate of return going forward to reach her financial goals and is now willing to take moderately more risk at a level of 12% volatility. Knowing that there is some wiggle room on the risk side, the portfolio manager changes her asset allocation to increase the weight in the highest expected return asset class (equities) such that her return objective is met. This results in a portfolio with a 12% expected return, but a 20% expected volatility (blue dot). Alternatively, to stay within her risk tolerance, a portfolio somewhat less concentrated in equity offers a 9% return with a 12% volatility. Now, Jane is faced with a conundrum. Does she accept a level of risk that she can’t tolerate, or does she risk a shortfall on her financial goals because her portfolio’s expected returns aren’t high enough.

Source: Viewpoint Internal

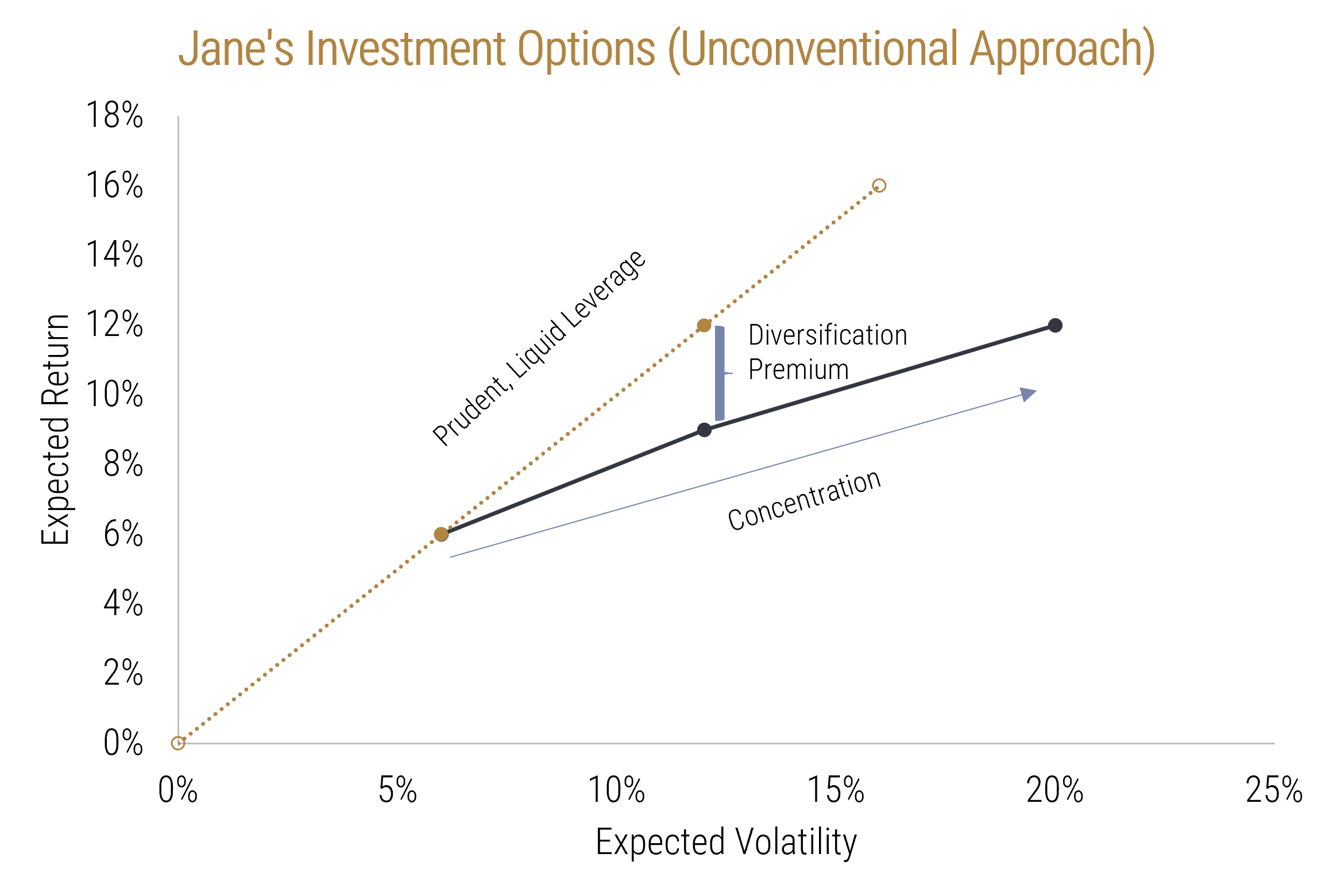

Fortunately for Jane, there is an alternative portfolio construction method that will allow her to meet both her risk and return objectives. We can see that while the initial diversified portfolio has a one-to-one relationship between return and risk, offering 6% return at a volatility of 6%, the higher return portfolio that is more concentrated in equities offers less return per unit of risk. This is the manifestation of concentration risk. As concentration risk increases in a portfolio, the portfolio becomes less efficient, and the excess risk offers diminishing marginal returns. This is because any risk that is diversifiable (i.e., concentration risk) is a source of uncompensated risk and will lower excess return per unit of excess risk. Instead of utilizing conventional portfolio construction techniques, Jane’s portfolio manager could instead build portfolios where diversification is the primary objective, and risk and return targets are realized through the use of liquid, prudent leverage. (Figure 3) By utilizing liquid, prudent leverage, we can amplify Jane’s initial portfolio such that the return per unit of risk is stable, increasing her expected return without taking risk outside of Jane’s tolerance. The result of utilizing liquid, prudent leverage on a maximally diversified portfolio is that Jane can capture a premium above and beyond the more concentrated portfolio at the same risk level. This allows Jane to stay within her risk limits, while maintaining her expected return requirements.

Source: Viewpoint Internal

This idea itself isn’t new and is in fact the basis of Modern Portfolio Theory, which was the framework for portfolio construction that won Harry Markowitz a Nobel Prize over 70 years ago. What is novel is Viewpoint’s use of this concept as a source of structural alpha (excess returns) that can be applied through virtually every facet of the portfolio construction process, thus allowing us to elevate beyond the convention of just adjusting asset allocation to meet objectives and build more robust portfolio solutions.

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.