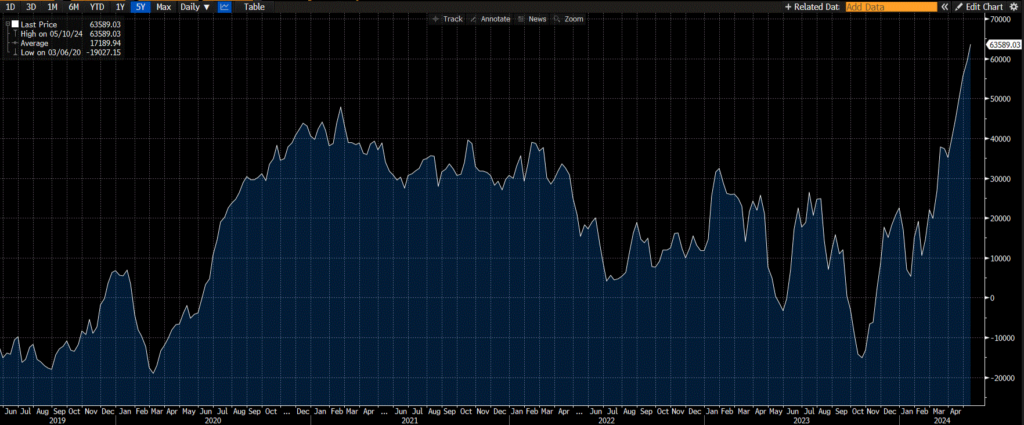

Copper continued its upward climb on Monday, with front-month futures on the London Metal Exchange (LME) hitting a new record of $11k/ton before pulling back prior to the close. Copper prices have risen +30% year to date and the industrial metal is one of the top performing commodities in 2024. As such, copper has been getting a lot of attention over the last few weeks, and market consensus is quite bullish with notable asset managers and hedge funds jumping on the bandwagon. The LME’s Commitment of Trader’s Report (COT) illustrates the bullish market consensus, with net positioning of investment funds rising to the highest levels seen in the last five years.

Jeff Currie, Chief Strategy Officer of Carlyle Group and former Global Head of Commodities Research at Goldman Sachs, recently said on a Bloomberg Odd Lots podcast that copper is “the most compelling trade I have ever seen in my 30-plus years of doing this.” Currie’s thesis for being long copper is similar to our view at Viewpoint in that both environmental policy and deglobalization will continue to underpin demand for the metal. Governments are focused on infrastructure spending to support electrification and as the world takes a step back from globalization, defense spending is becoming a higher priority. This comes on the heels of notable hedge fund manager Pierre Andurand forecasting copper prices will reach $15k/ton this year and will be up to $40k/ton over the next five years. Andurand’s reasoning for significant upside in copper is similar to what transpired in the cocoa market. A lack of investment in new supply will eventually lead to a shortage in copper stocks as demand continues to increase from electrification and data center demand. Because copper is a small percentage of the cost for the end products for which it’s used, its price is relatively inelastic like cocoa, making the potential for large price moves much greater.

The International Energy Association (IEA) is forecasting that primary copper supply will need to increase by almost 20% by 2030 under announced pledge assumptions (more conservative than net-zero assumptions by 2050), while copper supply is expected to fall over the next five years based on announced projects. As we’ve spoken about previously, copper prices will likely have to move higher – and remain high – in order to entice miners to bring new supply on-line. Currie, like Viewpoint, believes that we’re in the early stages of a commodity supercycle where it is cheaper for major players in the space to consolidate through mergers and acquisitions (e.g., BHP and Anglo American) and prices will have to go higher before the majors will be interested in investing in greenfield mining projects. And even if prices get to a point where miners are comfortable investing in greenfield projects, the average lead time of a new mine from discovery to production is just under 16 years. Even if you were optimistic that the discovery and exploration phases had already been completed on potential project sites, the construction-to-startup phase of base metal mines still averages about four years.

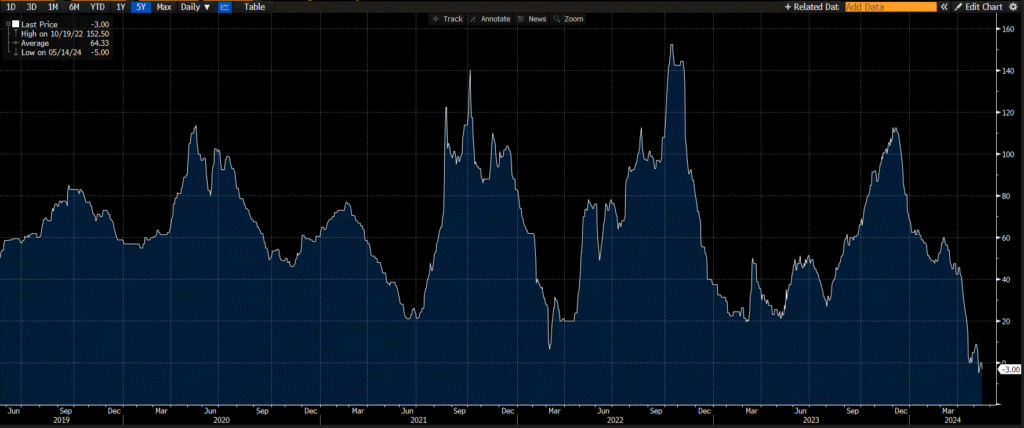

While the fundamental picture remains bullish in the long term, the short-term view is more mixed with respect to recent price action. The copper concentrate market remains extremely tight for smelters, with mining closures and decreases in ore quality acting as the main culprits for the shortage in concentrate. The tightness in the concentrate market has led to treatment and refining charges (i.e., charges that miners pay to smelters in order to process the concentrate into refined metal) going into negative territory at -$2.4/ton. While treatment and refining charges trading at a discount doesn’t seem like a great business model for smelters and would suggest that we should see production cuts, the prospect of tighter refined supply is being offset with softer physical copper demand in China. Premiums paid on importing refined copper into China have sunk to where they are trading at a discount to futures prices, the lowest in five years. The discount for refined copper products is suggesting that there might not be the physical demand to support the bullishness witnessed in both New York and London futures markets. Given that China accounts for about 50% of copper demand, in the short term, it is hard to square the bullishness on futures markets while physical demand is not keeping pace.

Javier Blas wrote an opinion article for Bloomberg on Sunday, warning that the copper uber-bulls may be getting ahead of themselves. Along with citing softer physical demand from China, Blas also discusses the potential for higher prices to incentivize switching from copper to cheaper electricity conductors like aluminum. Furthermore, while Blas mentions that the easiest copper deposits have already been tapped, new technologies such as sulphide leaching could help to increase copper ore yields.

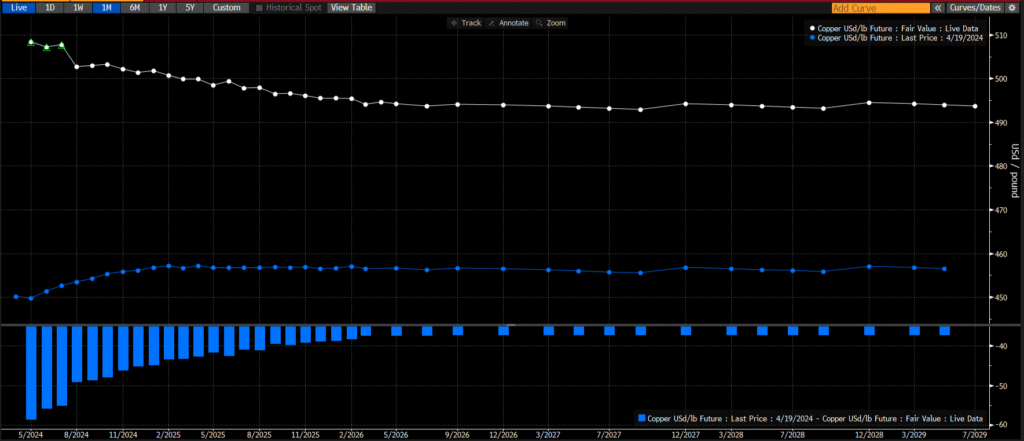

At Viewpoint, we are still bullish on the long-term outlook for copper, though we acknowledge that the recent run might be getting long in the tooth unless we see a turn in physical demand to help underpin financial price action. The reindustrialization of Western supply chains and the continued focus on electrification and artificial intelligence data centers will drive continued demand, and we’ve yet to see a sufficient supply response outside of the potential for industry consolidation. Holding long copper positions has also gotten cheaper recently, as a short-squeeze in New York has led to the futures curve moving into backwardation, while futures traded on the LME remain in contango. News outlets are reporting that the price spike in the front-month copper contract in New York was driven by short covering as opposed to any physical shortage, which has led to traders and miners diverting shipments to try and take advantage of higher prices in New York. The increase in convenience yield for holding front-month copper in New York has resulted in positive roll costs, though it’s unlikely this will continue unless we see an increase in physical demand or a dramatic reduction in refined supply.

Happy investing!

Scott Smith

Chief Investment Officer

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.