If you managed to disconnect from news headlines for the month of April and avoided checking any financial charts, you’d have no idea that equity markets had just endured a full-blown anxiety attack. As quickly as market sentiment soured from the reciprocal tariff announcements on Liberation Day, equity markets staged a relief rally after a 90-day pause and communication that the White House was motivated to strike deals with affected countries to lower the aggressive import tariffs. Despite the notable deterioration in U.S. soft economic indicators, significant drops in shipping volumes, and emerging signs of a reduction in consumer spending, equity investors have taken a more sanguine view and have been rallying on positive developments around tariff relief. The S&P 500 is now back to flat in local terms since the Liberation Day sell-off, but we would suggest that sentiment in equity markets remains vulnerable to either a deterioration in hard data, or lack of meaningful progression on trade policy.

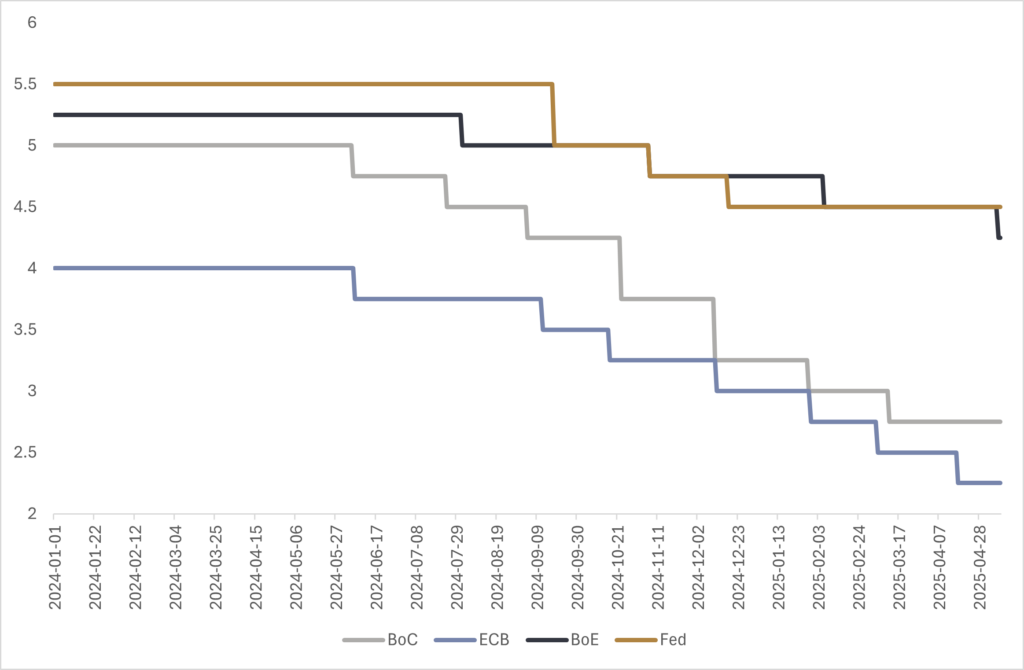

While equity markets are taking an optimistic view on global trade policy, the Federal Open Market Committee (FOMC) struck a cautious tone at their meeting this week. The FOMC noted that recent economic activity and the labour market have been solid, but “the risks of higher unemployment and higher inflation have risen.” Federal Reserve (Fed) chair Jerome Powell again reiterated that it’s prudent at this juncture to be patient, noting that if the tariffs are sustained at the announced levels, “they’re likely to generate a rise in inflation, a slowdown in economic growth, and an increase in unemployment.” The stagflationary threat puts the Fed in a tricky position relative to other developed central banks. Central banks like the Bank of Canada (BoC) and the European Central Bank (ECB) can direct monetary policy with a greater emphasis on smoothing out a negative growth shock, as retaliatory tariffs and the potential for rising price levels aren’t as much of a threat as slower economic growth. As such, both the BoC and ECB continue to reduce short-term rates to help cushion against an economic slowdown, while the Fed has been forced to hold rates steady until it sees additional economic data on growth and inflation. Despite this monetary policy divergence that would traditionally lend itself to a strengthening U.S. dollar, the U.S. dollar has continued to weaken. While the S&P 500 is effectively back to flat in local terms since the Liberation Day sell-off, the continued weakness of the U.S. dollar has been a drag on returns and made it a laggard for Canadian investors. The S&P 500 is down -6.4% year-to-date in CAD, trailing the TSX (+3.5%), Emerging Markets (+3.5%), FTSE 100 (+9.4%), and Euro Stoxx 50 (+16.3%).

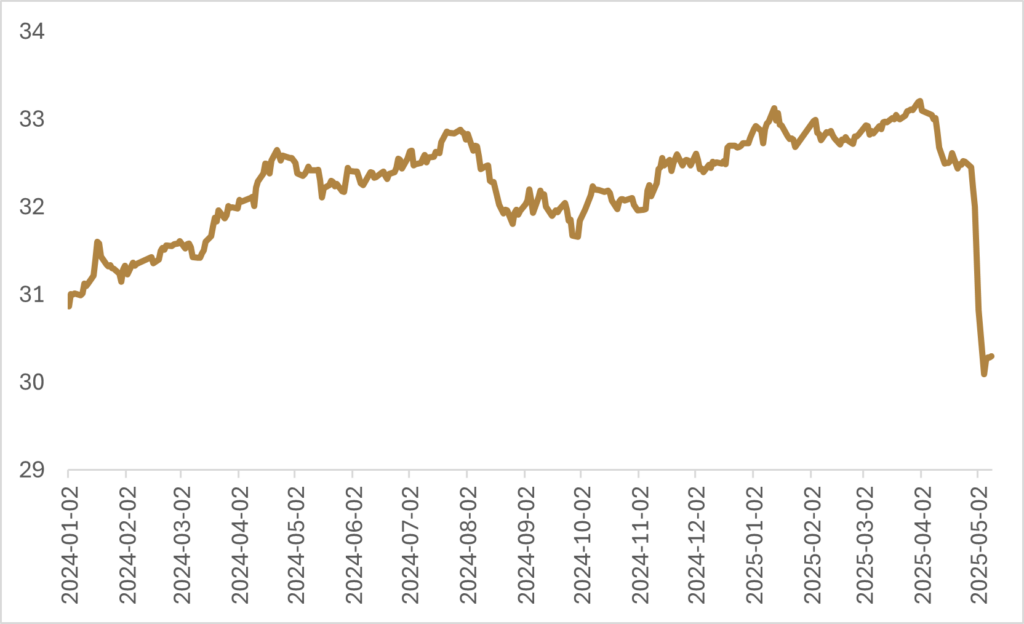

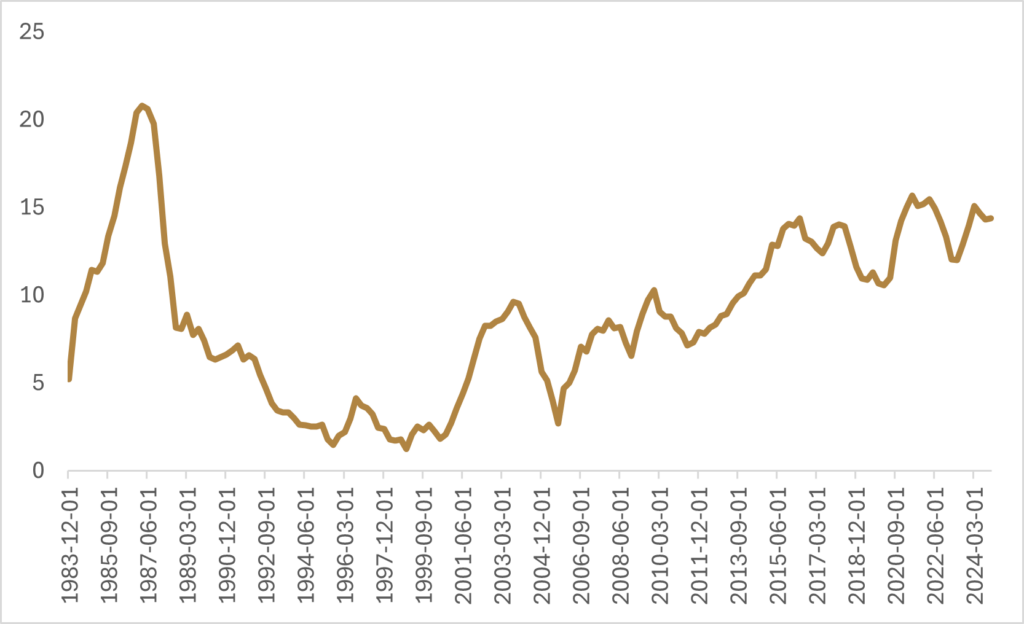

The 7.5% drop in the value of the U.S. dollar year-to-date suggests that policy uncertainty for global asset allocators has not been fully resolved. The trend of a lower U.S. dollar may continue, especially given the U.S. administration’s goal of shrinking its current account deficit. A narrower current account deficit would mean reduced foreign demand for U.S. assets, as countries that run a current account surplus would have less U.S. dollars to recycle back into the system. At the same time, if U.S. equities continue to underperform international peers, global capital flows could rotate out of U.S. markets. The last decade of U.S. exceptionalism and strong asset returns have led to a growing allocation to U.S. assets from foreign investors, which could reverse if ongoing policy uncertainty leads to an underperformance of U.S. economic growth. There have already been some flow-based anomalies occurring in foreign exchange markets, with the Taiwanese dollar appreciating by 5% against the U.S. dollar last Monday, the biggest surge since 1988. Taiwan runs a large current account surplus with the world at roughly 14% of nominal GDP, of which approximately 9% is with the U.S., and thus has a need to recycle those U.S. dollars into U.S.-denominated assets both at the central bank and domestic savings level. The outperformance of U.S. assets over the last decade combined with an increased cost of hedging has resulted in life insurance companies (domestic savings vehicles) letting their internal hedge ratios decline, leaving them particularly exposed to a weakening of the U.S. dollar. This sort of behaviour has the potential to cause a cascading effect where market participants then look to increase hedge ratios in a falling market, putting further downward pressure on the U.S. dollar.

While there have been conflicting reports around how prominently the U.S. administration will push countries to strengthen their currencies as part of trade negotiations, countries that run a current account surplus with the U.S. and have built up large USD holdings may be more inclined to look at repatriating these assets or increasing hedge ratios as a way to protect against a further weakening of the U.S. dollar. Stephen Jen, famous for his work on the “dollar smile” theory, has warned that Asian exporters and private investors have built up large U.S.-denominated positions that could be as large as $2.5 trillion, which poses further downside risks for the U.S dollar. Jen’s well-known “dollar smile” theory holds that the USD appreciates during global stress and periods of strong U.S. outperformance. But we may be seeing that pattern flip. With U.S. policy increasingly unpredictable and debt concerns rising, the dollar may weaken, even in recession or high-rate environments. The dollar smile could turn into a dollar frown. Goldman Sachs recently released a research note suggesting the U.S. dollar is currently overvalued by approximately 16% and that an adjustment of that magnitude would align with the U.S. current account deficit returning from its elevated levels to its longer-run average. While valuations are not enough of a catalyst by themselves to force currencies to mean revert, the combination of the U.S. administration wanting to reduce its current account deficit and the potential for a shift in marginal demand for international assets suggest the trend of a declining U.S. dollar could have further room to run.

Further evidence of declining demand for U.S. dollars comes from China, where the People’s Bank of China (PBOC) increased its gold reserves for a sixth straight month in April. As we’ve previously discussed, the freezing of Russian reserves after the Ukraine invasion appears to have triggered a structural shift in reserve management, especially among emerging market central banks navigating a more protectionist, multi-polar world. Goldman Sachs estimates the PBOC holds just 8% of its reserves in gold and if they were to endeavour to reach the global average of 20%, it would take about three years at their current buying pace of 40 tons per month.

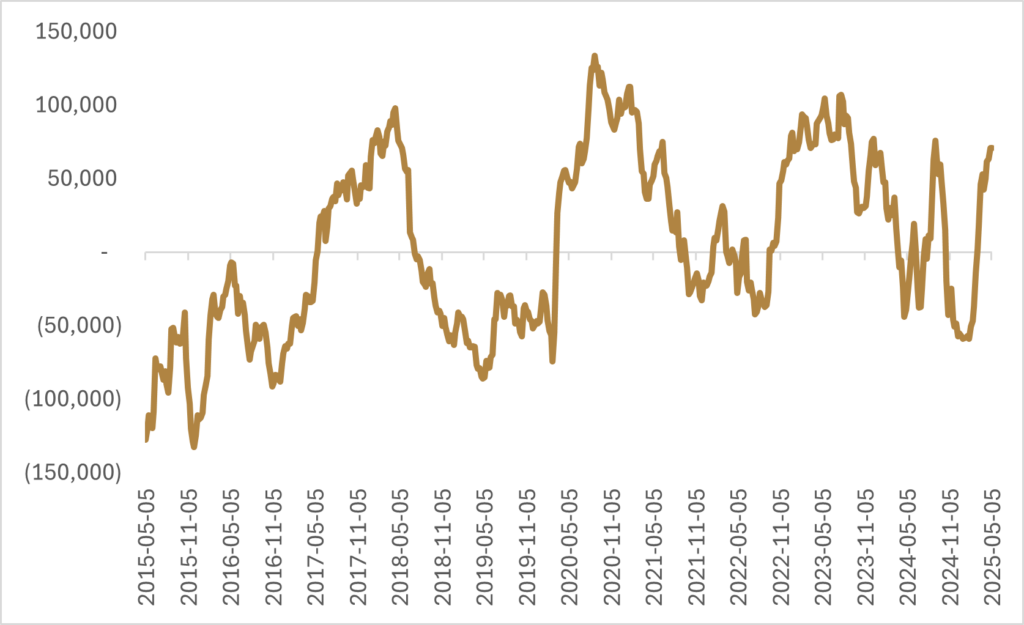

From a balance of probabilities perspective, we’re comfortable continuing with a cautious approach to risk appetite for portfolio construction, with international diversification and increased foreign currency exposure as prominent features of multi-asset portfolios. In the near term, the bullish USD positioning from speculators in the futures market in late 2024 and early 2025 has been unwound in favour of being long predominately Euro and Yen; though the bearish U.S. dollar position is by no means stretched. The framework of the trade deal struck between the U.S. and the U.K. this week suggests that a 10% tariff level is going to be the floor for all countries, so it’s unlikely we will see a material shift in U.S. protectionism. We’re likely to see more positive trade headlines this weekend, as delegations from the U.S. and China are meeting with the goal of trade war de-escalation. Bloomberg has reported that container traffic out of China picked up in late-April after a closed-door meeting between executives of Walmart, Target, and Home Depot with the U.S. administration. Accounting for travel time, the Port of L.A. is now expecting an uptick in shipping volume over the back-half of May, which would suggest that U.S. retailers are expecting a material decline in tariffs by the time the ships land. However, even if the U.S. slashes tariffs on China move from current “embargo” levels to 54% (20% from Fentanyl and 34% from Liberation Day), the average tariff rate on U.S. imports will still be the largest hike the U.S. has imposed since the 1930s, and Bloomberg Economics expects U.S. imports from China will fall by 80% over the medium term. In a world where the U.S. dollar’s safe-haven status is no longer assured, investment portfolio resilience will come from broader market exposures and currency-aware positioning.

Happy investing!

Scott Smith

Chief Investment Officer

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.