2024 has been an interesting year in commodity markets. As we’ve written about previously, we believe de-globalization and supply chain diversification have kicked off a confluence of supply and demand factors that has initiated a new commodity supercycle. However, this commodity supercycle is likely to be different than the last cycle, which began in the early 2000s and was initiated primarily from China’s rapid economic growth and the accompanied increase in commodity consumption. The forces affecting broad commodity markets are likely to be more differentiated in this new cycle, with the potential for dramatic price rises occurring in certain commodities at various points in time. One of the big stories of 2024 has revolved around what we have called “origin concentration risk” in the Softs commodity subsector, whereby economies of scale have led to the concentration of production in certain regions making commodities—like cocoa, coffee, sugar, and orange juice—more susceptible to supply shocks due to erratic weather patterns and disease. The other major narrative within the commodity landscape has been in the Value Stores commodity subsector, with fiscal deficits and government spending driving increased demand for gold and other stores of value as a way for investors to protect their purchasing power. We’ve previously talked about how gold has been a major benefactor of investment flows due to worries about a resurgence in inflation, but another commodity in the same subsector that has also experienced a rapid price increase this year has been bitcoin.

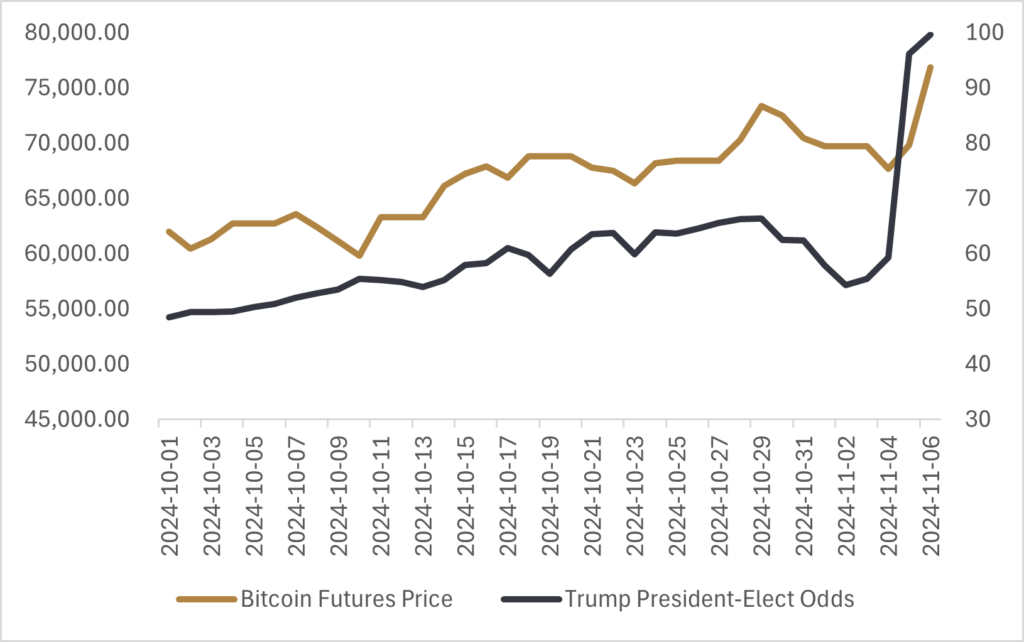

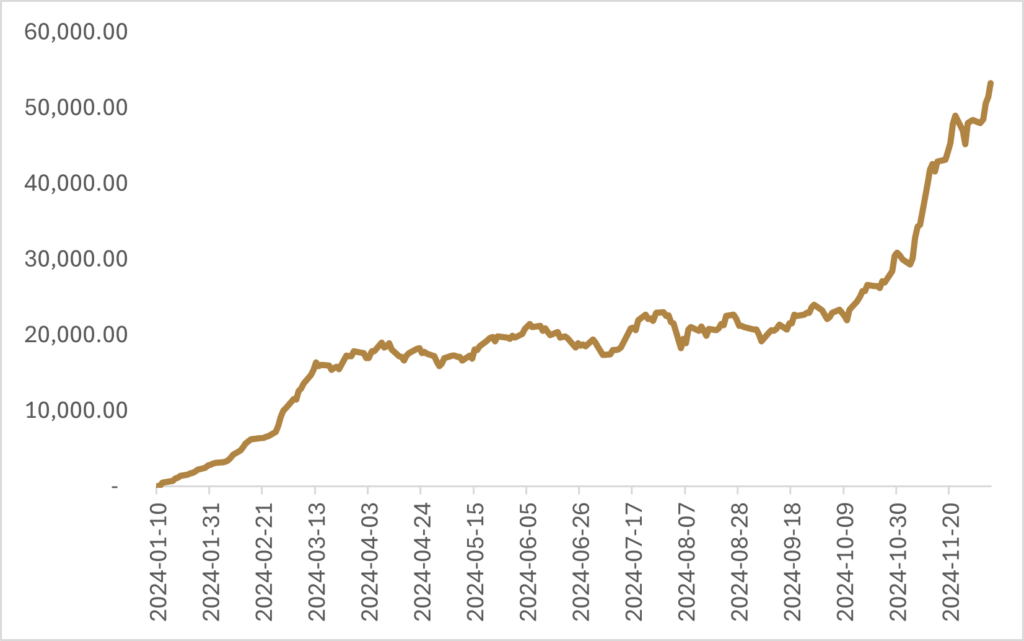

Bitcoin futures have soared by over 100% this year, with the digital value store breaking through the $100,000-mark last week. Bitcoin’s price appreciation had been modest for most of the year, but it really started to accelerate in the fall as Trump’s chances of winning the White House picked up steam and his stump speeches began to feature crypto-friendly talking points. As part of his pro-digital asset messaging, Trump promised to replace Garry Gensler as the chair of the U.S. Securities and Exchange Commission (SEC) with someone more friendly to the crypto industry, given Gensler had been leading a regulatory crackdown on the industry since the FTX blow up in 2022. Trump made good on this promise last Wednesday with his nomination of Paul Atkins as SEC chair, noting in his announcement that Atkins “also recognizes that digital assets & other innovations are crucial to Making America Greater than Ever Before [sic],” confirming we are entering a much different regulatory environment. The launch of U.S.-listed bitcoin ETFs this year has also helped drive increased adoption of the digital asset from both retail and institutional investors, with inflows into bitcoin ETFs surging during 2024. One of the bitcoin ETFs launched early this year by Blackrock already has total fund assets of $53bn in AUM, raking in over $23bn of assets since November 5th.

In addition to the Trump administration ushering in a more favourable regulatory environment for digital assets, bitcoin prices have also received a lift on concerns around increasing government deficits and the potential for a resurgence in inflation, similar factors that have been driving flows into other stores of value like gold and silver. Without getting into the weeds on the perceived utility of bitcoin, it’s hard to argue that it doesn’t have many of the same properties that make gold a good hedge for the debasement of fiat currency. Gold is hard to mine and there is limited new supply that is brought on-line each year, so the existing stock of gold acts as a value store when priced against U.S. dollars. The utility of holding an asset with limited supply in circulation increases in an environment where the fiat money supply is expanding, which is the argument why both gold and bitcoin can act as value stores and preserve purchasing power against the U.S. dollar and other fiat currencies. While gold has a much longer history of established trust in its utility as a store of value, the limited supply of bitcoin to be mined via computer code allows the digital asset to also act as a hedge against monetary expansion; it just lacks the physical chemical element that you can see and touch. Last week, Federal Reserve Chairman Jerome Powell was asked about bitcoin at an investment conference and had similar comments. Powell noted that he doesn’t see bitcoin as a challenger to traditional currencies like the U.S. dollar, but he did say “it’s just like gold, only it’s digital…It’s not a competitor for the dollar, it’s really a competitor for gold.”

The alignment of a more favourable regulatory environment combined with the potential for government deficits to increase gives the impression that the path of least resistance for bitcoin is higher. However, we would opine that even with increased adoption in investment portfolios, those looking to get exposure to bitcoin will likely have to contend with heightened volatility, if not outright downward pressure should the current tailwinds turn into headwinds. Trump’s pick for Treasury Secretary and the soon to be created Department of Government Efficiency are both keen on reining in the U.S. federal deficit, so assets that act as a hedge against monetary debasement could become less attractive if we start to see constructive progress towards less government spending. While the regulatory environment currently seems like it will be favourable, President-elect Trump recently threatened the BRICS group of nations (Brazil, Russia, India, China, and South Africa) with tariffs of up to 100% if they continue discussions around creating a joint currency outside of the U.S. dollar as a means to facilitate trade between the BRICS nations. On the surface this may not seem related to the regulatory environment for bitcoin, but it does highlight that if bitcoin usage increases to the point where the administration felt threatened that it—and other mediums of exchange—was facilitating trade outside of the U.S. dollar, there is the potential this could draw the ire of the U.S. administration. At the very least, there’s a bit of cognitive dissonance at play with Trump outwardly defending the U.S. dollar as the world’s reserve currency but at the same time being pro-digital assets, where one of the use cases for those digital assets is de-centralization outside of the established monetary system where the U.S. dollar is a global reserve currency.

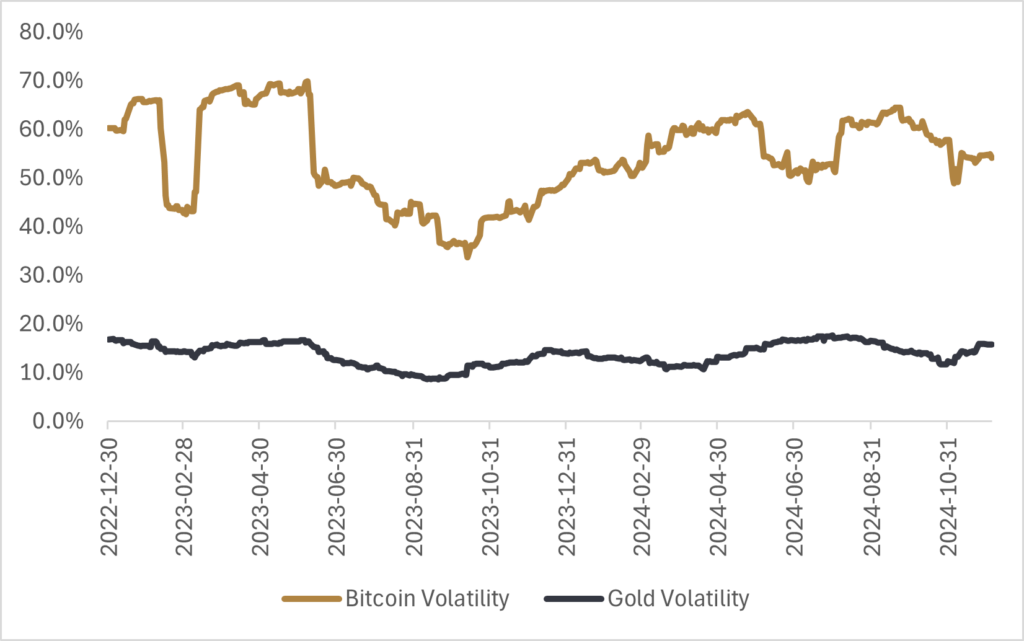

At Viewpoint, we see the utility in holding bitcoin and ethereum as part of our Value Stores commodity subsector, with digital assets providing additional diversification to the assets we hold as hedges against fiat debasement. Digital assets provide a differentiated exposure than traditional value stores, with the correlation of bitcoin and ethereum to gold being 0.18 and 0.06 respectively, whereas the correlation of gold to silver is 0.81. As I mentioned earlier, the launch of U.S.-listed bitcoin ETFs has helped to drive investor adoption this year, but it is also important to highlight that bitcoin futures have been listed on the CME since late 2017 (ethereum futures were listed in early 2021), and the centrally-cleared, cash-settled futures markets also gives investors an easy way to access the underlying return stream without having to worry about custody of the underlying digital asset. While the market for digital assets continues to mature and ease of access for investors increases, it is worth highlighting that the market is still much younger than that of traditional value stores, and therefore there is greater “tail risk” associated with exposure to digital assets. Our ethos for our investment strategies is to manage risk by adjusting capital allocations based on underlying volatility and correlations, which is especially important when gaining exposure to a highly volatile assets like bitcoin and ethereum. Rolling three-month annualized volatility for bitcoin is 54%, much higher than the volatility profile of gold, which is currently at 16%. The higher volatility profile dictates a much lower capital allocation to bitcoin relative to traditional value stores like gold and silver. However, if the adoption of digital assets in investment portfolios continues to increase and a maturing marketplace leads to a decline in volatility, this would allow for a greater capital allocation to digital assets in our strategies over time.

Happy investing!

Scott Smith

Chief Investment Officer

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.