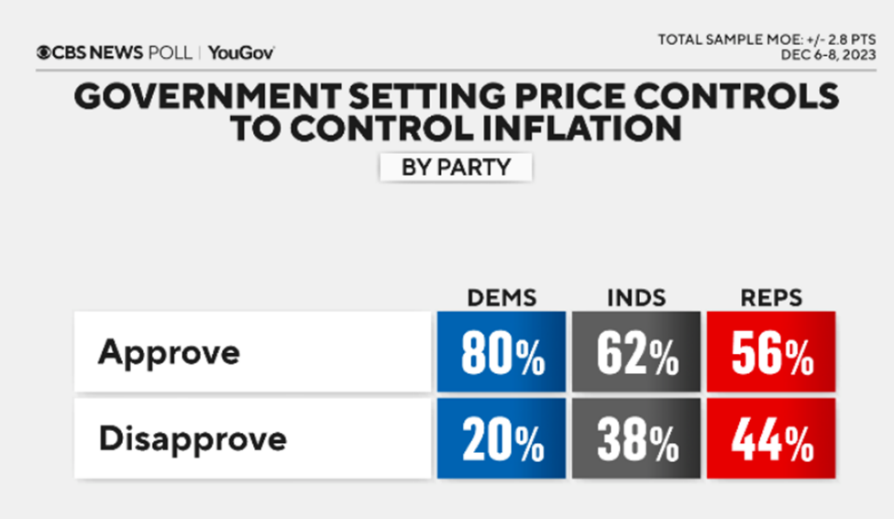

While listening to a Palisades Gold Radio podcast on government spending, debt loads and inflation, the ever-dour John Rubino made note of a recent survey which revealed that 62% of Americans were supportive of government set price controls to control inflation. Although much of the content of the podcast covered some overtly bearish topics like the significant increase in government debt and increased credit card use by consumers, I was particularly surprised by the support of government-administered price controls. This same sample showed that 60% do not approve of raising interest rates to combat inflation. Shockingly, a majority of self-proclaimed Republicans – the supporters of small government and free markets – agreed with the idea of government setting price controls to control inflation.

Assuming that Winston Churchill was right and “Those that fail to learn from history are doomed to repeat it.”, maybe I should not have been surprised. In the end, populism is important to politicians. Unfortunately, the average American – and likely the average Canadian and the average citizen of other developed countries– don’t understand how economies work. A survey of history will show that price controls are valuable in only rare circumstances and are difficult to sustain over long periods of time.

Based on the popular support in the US and Canada’s imposition of price controls for grocers, we can likely assume that the current political class does not know their history. With the release of the Nixon Tapes, we know that President Richard Nixon was aware that the price controls he introduced would not work. On Aug. 15, 1971, in a nationally televised address, Nixon announced, “I am today ordering a freeze on all prices and wages throughout the United States.” After a 90‐day freeze, increases would have to be approved by a “Pay Board” and a “Price Commission”. The move hit its mark with the press swooning and pools showing that 75% of Americans backed the idea (Healy, 2011). However, the Nixon Tapes show that Nixon knew the move would not work and was for “cosmetic” reasons only:

“’Here’s my concern about the freeze…There is strong support for a wage board and wage-price controls and particularly from sources like Arthur Burns. … The difficulty with wage-price controls and a wage board as you well know is that the God-damned things will not work. They didn’t work even at the end of World War II. They will never work in peacetime.”

”I know the reasons, you do it [wage and price controls] for cosmetic reasons good God! But this is too early for cosmetic reasons.”

~ Richard Nixon July 1971 (Skarbek, 2016)

For millennia, societies have attempted to use price controls to control inflation. Interestingly, the imposition of price controls often followed periods of government overspending and indebtedness. (Rockoff et al., 2022) Unfortunately, price controls are problematic because they artificially distort the allocation of resources by discouraging supply without the requisite rationing of demand. The role of prices is at the foundation of the modern economy and setting price ceilings below the market price is the surest way to create shortages, provoke misallocations of capital, and reduce the availability of products. By discouraging new supply and supporting additional demand, the imposition of price controls will only make the current food inflation shock worse.

Price controls come with many known costs and other unknown impacts. A material increase in government and administrative costs is an important cost to consider. What one “saves” via price controls may be taxed away by government to fund the administration required to enforce the price controls. Other important problems to consider are supply shortages, the growth in black markets, and the cancellation of productive investments that foster competitive growth – and if invested – would help to moderate the higher prices through increased supply. Another distortion is that industry concentration increases as the scale advantages of incumbent large competitors are too strong to overcome.

Proponents of central planning are normally quick to agree that the historic imposition of price controls didn’t work, because they were imposed incorrectly. However, this time they have a better plan, more data, or a smarter team – the problem is that it is never the case. It is better to trust the free markets and the laws of supply and demand to deliver fair prices and the optimal allocation of resources.

Sources

Healy, G. (2011). Remembering Nixon’s Wage and Price Controls. Retrieved from https://www.cato.org/commentary/remembering-nixons-wage-price-controls

Rockoff, H., Munger, M., Moore, G., Heyne, P., & Anderson, L. (2022). Price controls. Retrieved from https://www.econlib.org/library/Enc/PriceControls.html

Skarbek, E. (2016). Nixon knew his price controls wouldn’t work: Emily Skarbek. Retrieved from https://fee.org/articles/nixon-knew-his-price-controls-wouldnt-work/

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.