Escalating geopolitical tensions in the Middle East and an ongoing war in Ukraine have yet to jolt oil price materially higher, with crude benchmarks continuing to trade below the recent highs seen at the end of Q3 2023. Oil prices did find some support to start 2024 as extreme weather conditions in North America shuttered some production and OPEC (the Organization of the Petroleum Exporting Countries) went ahead with another round of cuts, both contributing to tighter short-term supply. Both West Texas Intermediate (WTI) and Brent have gained roughly 8% YTD, with their futures curves getting steeper in their backwardation.

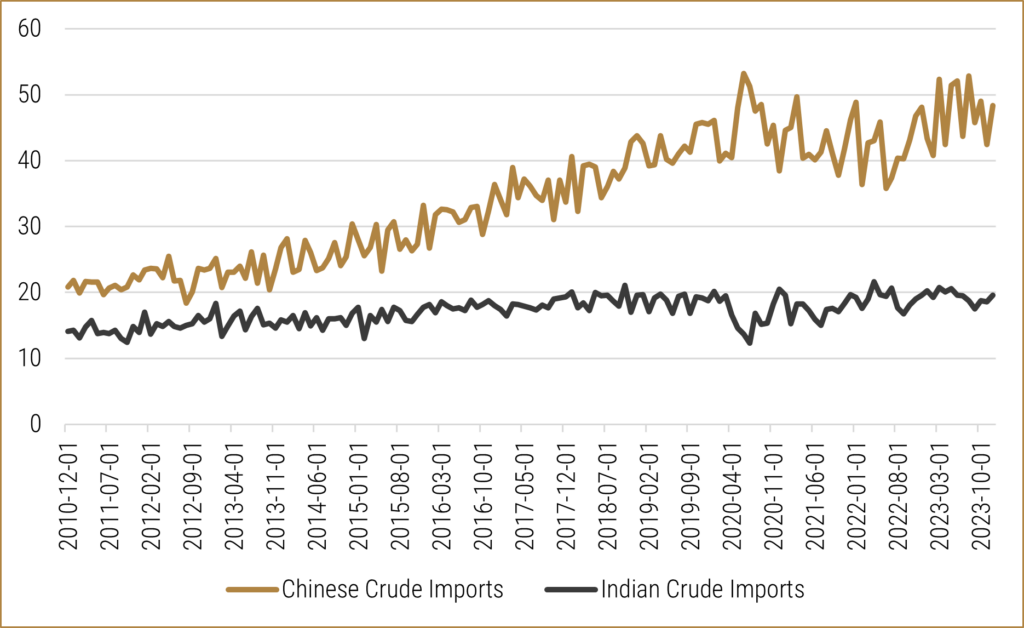

Despite the sluggish start to the year for production volumes and barring any further geopolitical turmoil or more extreme weather conditions, the International Energy Agency (IEA) expects that we should see oil inventories build over the course of 2024. Expectations are that oil demand continues to ease from the post-COVID spike, with a notable slowdown in demand from China. The reduction in demand from China squares with our view that China is abandoning a “growth-at-all-costs” mindset and will stimulate economic growth in a more strategic fashion. However, the question going forward will be if economic growth in India can help to replace some of the tempered demand from China, as crude oil imports into India have been relatively stagnant over the last decade. The IEA is forecasting oil demand to grow by 1.2 million barrels per day, short of the 1.7 million barrels per day growth that is expected in supply. Forecasts generally don’t come to fruition quite as expected (including mine), but assuming no material shocks, the surplus supply should help to buffer market volatility.

Depending on your interaction with the oil market, your reaction to the IEA’s 2024 forecasts will vary. As a consumer of oil and oil-related products, a surplus in supply should help keep global prices capped, keeping prices for end users relatively stable. On the other hand, OPEC might not be as happy as they continue to cut production to try and shore up prices. OPEC’s strategy of trying to stabilize the global oil market has left a gap that is being filled by non-OPEC producers who have ratcheted up output, benefiting from the cartel’s “altruism.” U.S. shale has roared back to life after getting more cost efficient to respond to the severe price declines of 2018 and 2020 and is taking advantage of WTI prices north of $70 per barrel. Canada’s Trans Mountain Expansion (TMX) is finally going to be moving oil by early summer, and with more pipeline capacity, this should help to narrow the discount between Canadian and U.S. crude, incentivizing Canadian companies to produce more oil. After little in the way of growth last year, Canada is set to increase oil production by 200k barrels per day, which is roughly 15% of the incremental growth in demand from the IEA’s forecast. When you combine this increase in Canadian output with growth from U.S. shale, Canada and the U.S. will be producing one-in-four barrels of worldwide oil production during 2024.

TMX coming online will be a welcome boon to both Canadian oil producers and social activists. Adding 600k barrels per day of transportation capacity to the west coast will allow Canadian oil to flow via tanker to Asian energy markets, as well as reduce the reliance on more expensive and dangerous railway routes down to the U.S. Barring any material setbacks, the increase in pipeline capacity should boost profitability for Canadian companies as Canadian oil becomes less expensive to transport.

Furthermore, the expected increase in Canadian and U.S. oil production continues to take market share from OPEC as they cut production to try and balance excess supply, which should be a welcome development for the western world and those focused on the social and governance aspects of energy production. For anyone interested in a further exploration of Saudi Arabia’s social track records, Blood and Oil by Bradley Hope and Justin Scheck is a great book. The challenge moving forward will be that, as the Bloomberg article from Javier Blas states, the “pipeline” of pipelines in Canada is dry. Politically, it appears as if TMX will be the last big Canadian pipeline project, and after growth in Canadian oil production this year and next, pipelines will likely be back to full capacity. Unless we see a massive decline in global consumption, Canada will again become limited in how much oil it can supply to the global market to displace the less socially acceptable OPEC production.

Although we are constructive on broad commodity markets and the underinvestment in supply needed to respond to sharp demand spikes, the outlook for global oil markets in the short term appears well balanced. However, with an increasing focus on fortifying energy security and rising geopolitical tensions, being long oil still makes sense, just at weights lower than energy-heavy commodity benchmarks, such as the S&P GSCI Index. With both Brent and WTI curves in backwardation, being long the front-month is also attractive. The wildcard will continue to be OPEC and how the cartel responds to increasing global oil supply from North America, and if they would be incentivized to try and break the back of U.S. shale producers once again. In our books, we view the narrowing of the discount for Canadian crude relative to WTI as the trade with higher conviction, and we maintain a constructive stance on local fundamentals as TMX begins to move barrels.

Happy investing,

Scott Smith, Chief Investment Officer

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.