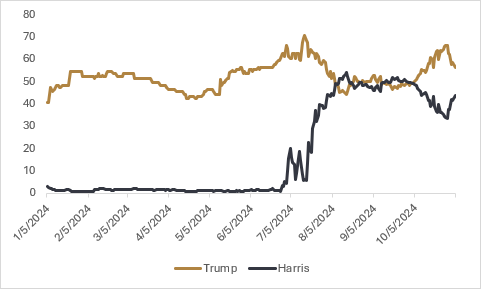

Investors are bracing for an eventful week in financial markets, with the U.S. election on Tuesday followed by the Federal Reserve (Fed) interest rate policy meeting that culminates on Thursday. As to be expected, volatility markets are placing a premium on near-term crash protection, though we’ve also seen the whole volatility futures curve move higher over the last week. Polling numbers continue to suggest that the race for the White House and the legislative branches will be tight, but over the last week, we’ve seen betting markets pull back expectations for a Trump victory and Republican sweep of Congress. Ann Selzer, a renowned pollster out of Iowa, published a new presidential poll of state voters over the weekend that showed Harris had jumped into a three-point lead in the Hawkeye state. While the sample size of the poll is relatively small and comes with a six-point-six margin of error, the mere thought that Iowa, which Trump won by eight points in 2020, could go back to the Democrats was a headline-grabber over the weekend. Not only did it shock some into thinking there is a real possibility that Iowa could swing back to the Democrats, Selzer’s new poll also raised the question on whether the more mainstream pollsters have been guilty of “herding” and that they may have overestimated Trump’s support this cycle after adjusting for Trump’s outperformance relative to the polls in 2016 and 2020.

There should be plenty of fireworks on Tuesday, and we would caution that market participants should expect heightened volatility should there be delays in the announcement for the winner of either the White House or the legislative branches on Tuesday. In 2020, it took until the Saturday after election day for Joe Biden to be projected as the winner, and there was a similar delay in announcing control of the House and Senate in the 2022 midterms. We’ve previously written about the importance of control of the legislative branches for the presidential candidates in passing their proposed policy platforms, so we would expect lingering volatility even after the President has been projected, depending on how control of the legislature shakes out.

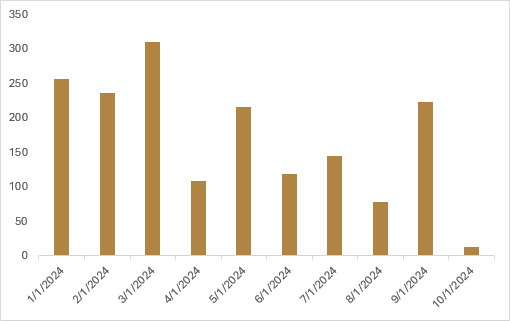

Of the two major events on the economic calendar this week, the Fed interest rate policy decision is likely to produce relatively fewer fireworks than the election. Market participants have fully priced in a 25bps decrease in the overnight rate, and we don’t anticipate the fate of the election to sway the Fed away from that short-term policy path. U.S. employment data for October was released last Friday and this showed the U.S. economy added 12k new jobs over the month, well short of expectations for the creation of 100k new jobs. We knew heading into the release that the hurricanes earlier in the month would affect payroll reporting, and so the miss in payroll growth can be somewhat chalked up to weather-related disruptions. Payroll reporting disruptions for October notwithstanding, revisions on payroll growth for the last two months showed a decline of -112k jobs, which was arguably the most disappointing part of the October payrolls report. On the household survey side, the unemployment rate remained at +4.1%, though it was close to being rounded up to +4.2%. The slight increase in the unrounded unemployment rate also came in the face of a drop in labour force participation, making the number more attractive than it would have been otherwise. Average hourly earnings for the month came in slightly higher than anticipated, up 0.4% on a month-over-month basis, keeping the year-over-year figure at +4.0%. On balance, this was a slightly disappointing payroll report that will likely allow the Fed to continue forward with a gradual reduction in interest rates, cutting by another 25bps this week.

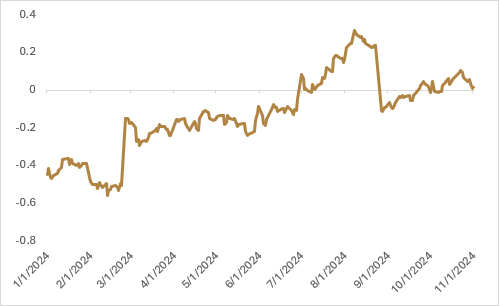

We have talked quite a bit about interest rates over the last few months, and how despite the Fed beginning to lower short-term interest rates, long-term interest rates have remained elevated. This has partially been due to robust U.S. economic data, along with both political parties putting forth economic agendas that are expected to increase the fiscal deficit. It’s too early to suggest that bond vigilantes have homed in on the U.S. treasury market, but in what could be a foreshadowing of things to come, bond vigilantes have set their sights on the U.K. gilt market. Chancellor of the Exchequer Rachel Reeves released the Labour Party’s first budget of the new government, promising to “rebuild Britain” by ending austerity and breaking economic stagnation. The budget calls for tax hikes intended to raise £40bn a year, only partially offsetting the £70bn in annual public spending. The net result of the plan is an increase in public borrowing of £142bn over the next five years, with spending as a share of GDP being two percentage points higher than forecast in March of this year. As part of the plan to rebuild Britain, Reeves is pledging £100bn to capital projects over the next year, with net investment projected to average 2.6% of GDP, up from the 2% rate under the Conservatives.

While nowhere near the scale of panic witnessed after the Lizz Truss unfunded tax cuts in 2022, bond markets are on edge about how this increase in fiscal spending will affect inflation expectations. The reaction from the bond market highlights how the “mood” towards fiscal policy is one of sell-first and ask questions later, with bond vigilantes not shy about voicing concern over what might be considered excessively easy fiscal policy. Yields on two-year gilts have increased by 28bps since the release of the Reeves budget, with a bear flattening of the yield curve as 10-year gilt rates increased by 25bps. We continue to feel that the movement towards more populist governments who are reliant on fiscal policy spending and increased borrowing will act as a drag on global fixed income, and that there is a need to look outside of traditional balanced portfolios to create more robustness in an environment where inflation uncertainty remains high.

Happy investing!

Scott Smith

Chief Investment Officer

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.