It’s probably best to start this note right up front and say the stock market is not the real economy, lest we get into a debate about whether it’s rational for bad news to be good for stocks and vice versa. On Friday, employment numbers for the U.S. economy were released, and there was a general chill that permeated through the labour market that has otherwise been running at a blistering pace throughout 2024. The U.S. economy added +175k new jobs during the month of April, much less than the +240k that had been expected, with the unemployment rate rising from +3.8% to +3.9%. Average earnings also fell short of economists’ expectations, rising by +3.9% on a year-over-year basis to April, down from the +4.1% pace in March. Despite the weaker-than-expected employment figures, the S&P 500 rallied strongly to finish the day up +1.2%, while 10-year U.S. government bonds rose +0.5%. The jubilation in financial markets at the expense of the real economy can be chalked up to the fact that a softer employment market increases the likelihood the Federal Reserve (Fed) will be able to cut interest rates this year, with market expectations on the magnitude of cuts in 2024 increasing from one to (almost) two. The guidance from the Fed has been that they believe monetary policy is sufficiently restrictive, and their current view is that the next adjustment will be to ease monetary policy, which Friday’s labour market data supports. I’ve previously said that we’re likely in a “no-landing” monetary policy environment unless the labour market materially weakens and the potential for a recession increases, at which time investors should think about increasing their duration exposure in their fixed income portfolios.

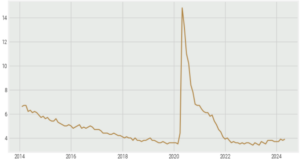

While the unemployment rate in the U.S. has ticked up recently, the rise is still short of triggering the Sahm Rule recession indicator, though it’s closing in on the critical threshold. The Sahm Rule signals the start of a recession should the three-month moving average of the unemployment rate rise by 0.50% or more relative to the minimum of the three-month averages from the previous 12 months. The theory here is that once unemployment picks up steam, real economic activity and consumer spending decrease, leading to further layoffs and a further slowdown in economic activity. The Sahm Rule currently stands at 0.37% and is closing in on that integral 0.50% level.

Further signs of softening outside of just the unemployment rate are also occurring, with average hourly earnings on a year-over-year basis decelerating. On a year-over-year basis, average hourly earnings are down to +3.8%, though still above pre-COVID levels.

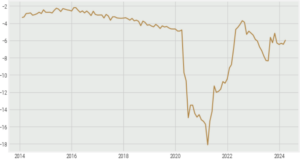

One of the reasons we’ve seen less upward pressure on wages is because there has been a softening demand for labour, which probably seems obvious but can be illustrated in the U.S. Job Openings and Labour Turnover Survey known as JOLTS. Last Wednesday, the latest JOLTS reading was released and showed that job openings are continuing to ebb lower as people are less willing to quit their current jobs in hopes of finding a higher paying alternative. While job openings are still elevated above the pre-COVID levels, the “quits” rate fell to +2.1%, which is the lowest reading since August 2020. The ratio of openings to unemployed people dropped to 1.3, which is the kind of softening the Fed has been hoping for, as it puts less pressure on wage prices.

In conclusion, the labour market is indeed cooling, though not yet frozen, which is broadly supportive of the Fed’s view they will be able to lower interest rates this year. Where we get into the nuances is whether this will allow the Fed to thread the needle and achieve a soft landing where inflation continues to fall while interest rates are being lowered, or if monetary policy is too restrictive and labour market weakness compounds into additional problems for the real economy. The latter scenario where a recession materializes would bode well for duration and be challenging for both equities and commodities. My takeaway here is that while headline and core inflation readings will be impactful on how the Fed aims to administer short-term monetary policy, employment figures will give us a better underlying view of the real economy, and the importance of the May report has just increased significantly. On the side of the “no-recession” camp is the fact that the U.S. government is running a relatively large fiscal deficit, which should be supportive of the labour market. On the other hand, the Hutchins Center expects that, barring any major changes in tax or spending legislation, the fiscal thrust through the end of 2025 will be a slightly negative contribution to GDP, though this could certainly change as we move through the summer and into fall and the election cycle begins to heat up.

Happy investing!

Scott Smith

Chief Investment Officer

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.