In what continues to be a challenging growing season for certain agricultural commodities, orange juice prices have resumed their upward trend as a combination of disease and extreme weather continue to wreak havoc on orange crops in Brazil. Frozen orange juice prices are up +32% so far this year, as excessive heat during the key flowering period for oranges has caused disproportionate stress on crops leading to worse-than-expected harvests. This comes at a time when orange trees in Brazil have already been struggling with an incurable disease called “citrus greening,” which is spread by a tiny insect called the Asian citrus psyllid. Once infected, most trees die within a few years. The combination of adverse weather and disease has resulted in what is likely to be Brazil’s worst harvest in 36 years, with orange production down -24% from a year earlier. The run-up in prices so far this year is astonishing all on its own, but to add insult to injury for orange juice lovers, what is even more shocking is that orange juice prices had already risen by +55% in 2023.

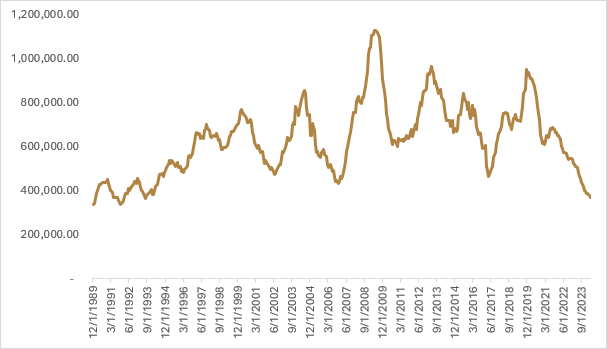

Much like what has been transpiring in the cocoa market, the orange shortage is not something that can instantly be cured. Higher prices for oranges are representative of the supply shortage and will provide a cash infusion to farmers that are struggling with declining yields, but replacing dying trees from citrus greening disease can take time, with most newly planted trees taking between three to six years to bear fruit. With this being the third difficult harvest for Brazil in a row, orange juice inventories are at the lowest level seen in decades, causing many drink makers to look at either using lower quality juice or mixing orange juice with other fruit that may be in higher abundance, like apples or mangos. While consumer demand for orange juice has fallen by about 20% according to Rabobank, that has not been enough to derail the lack of supply from poor harvests, and orange juice inventories continue to decline.

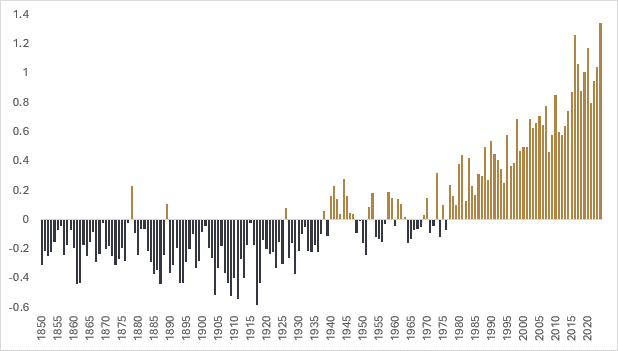

With Brazil accounting for roughly 70% of global orange juice production and already dealing with groves plagued by disease, weather patterns now become that much more important for marginal production. Further complicating the ability to diversify global production is the fact that the orange industry in Florida has been struggling to contend with rising labour costs and a series of hurricanes, which have hampered U.S. production. One of our high-level themes for our bullishness on agricultural commodities is the increase in erratic global weather patterns, which don’t appear to be abating. January to April of 2024 was the warmest four-month stretch for global land and ocean temperature in 175 years since data from the National Oceanic and Atmospheric Administration (NOAA) has been collected, 1.3 degrees Celsius above the 1901-2000 average of 12.6 degrees Celsius. After the record heat wave to begin the year, NOAA is forecasting that there is a 61% chance that 2024 will be the warmest year on record.

While underlying supply shocks that lead to cost-push inflation are obviously different than demand-driven commodity rallies, this doesn’t diminish the role these commodities can play in a well-diversified portfolio. In fact, we would advocate that in order to provide true diversification to traditional investment portfolios, a purposefully built commodities strategy should have a wide range of commodities where there is a balance between various supply and demand factors. It just so happens that many bullish demand catalysts for certain commodities are also aligning with increasing erratic weather patterns, which are putting upward pressure on agricultural commodities that have geographical concentration risk. This provides a favourable environment for a well-diversified commodities portfolio.

Happy investing!

Scott Smith

Chief Investment Officer

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.