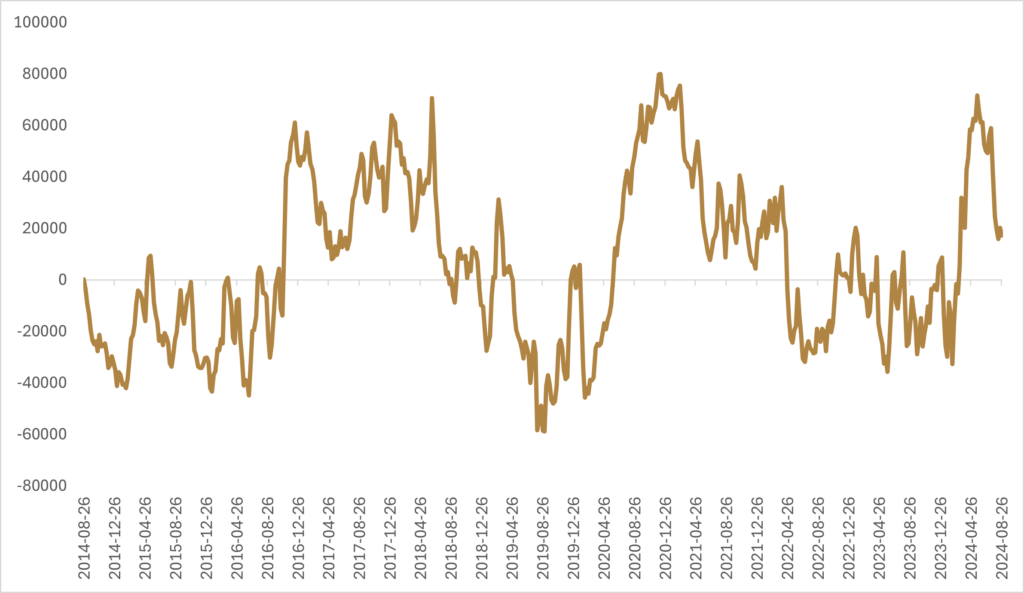

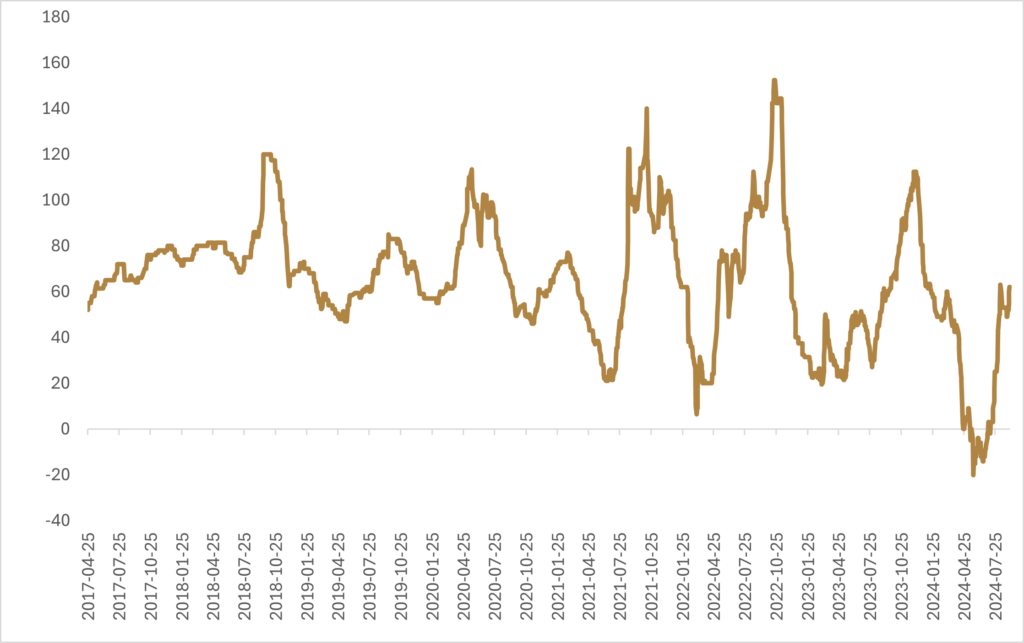

Over the last three months, broad commodity markets have experienced a notable pullback. Outside of the softs sector, which encompasses commodities like cocoa, sugar, coffee, and orange juice, there aren’t many commodities that are in the green over the last three months. Industrial metals have experienced some of the most prominent drops, with copper, aluminum, and platinum all posting double-digit declines. We wrote a note about the blistering copper rally to begin the year back in May, highlighting that while we were bullish on copper from a long-term fundamental perspective, the short-term technical picture was cloudier, and the rally might be long in the tooth. The rationale for tempering expectations on the copper rally was that speculative positioning in the futures market was quite long, while demand in the physical market from China was alluding to a much softer fundamental picture.

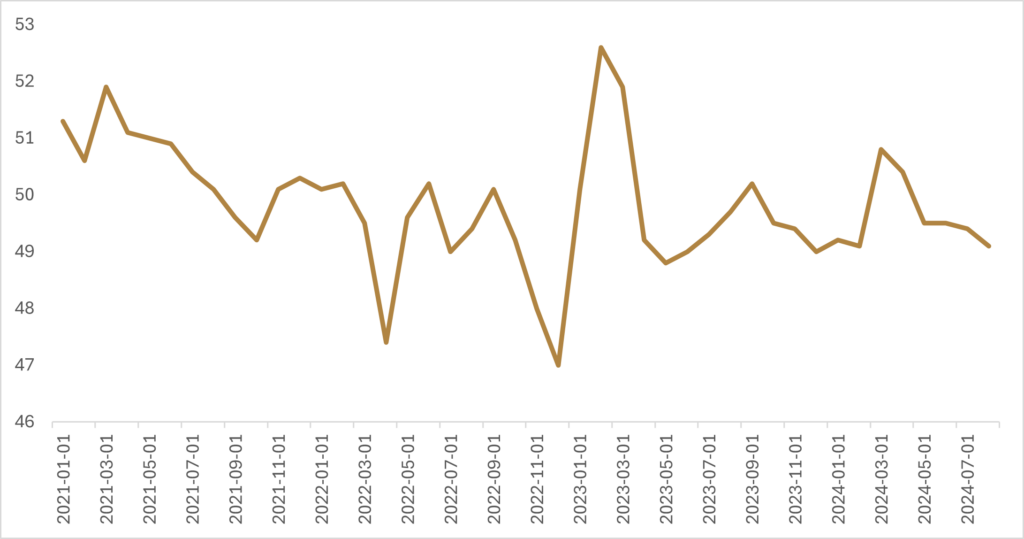

Since that note, the Chinese economic growth engine has continued to sputter. The sluggish property market continues to weigh on domestic demand, denting manufacturing sector activity that has contracted for four consecutive months and stoking worries about the impending creep of deflation as consumer prices hit a three-year low. Concerned about hitting the official economic growth target of +5%, Beijing is contemplating allowing homeowners to refinance up to $5.4 trillion of mortgages, hoping the lower borrowing costs will boost domestic consumption.

Pundits are wary that mortgage refinancing will be enough fiscal easing to stabilize economic growth, and that bolder stimulus measures will be required heading into the fourth quarter. The sour outlook for economic growth in China has prompted Goldman Sachs to slash its 2025 price target for copper from $15,000/ton to just over $10,000/ton, which is only slightly higher than current spot prices. The depressed risk appetite and consumer sentiment continues to reverberate through equity markets, with the Shanghai Composite (in USD terms) underperforming the S&P 500 by over 20% year to date to the end of August.

While we have yet to see signs of a turn in Chinese economic data, the next few months could be crucial for the direction of industrial metal prices. Two macro headwinds are currently hanging over the Chinese economy and growth-sensitive commodity sectors like industrials metals.

The U.S. election in November is currently weighing on risk appetite, given the uncertainty surrounding the potential for an escalation in tariffs that could affect both Chinese exports and global trade volumes. While neither political party is outright accommodative towards Chinese economic interests, the Trump campaign has been the more hawkish of the two with respect to trade policy, and therefore we would expect any advancement of polling odds for Trump to continue to act as a headwind.

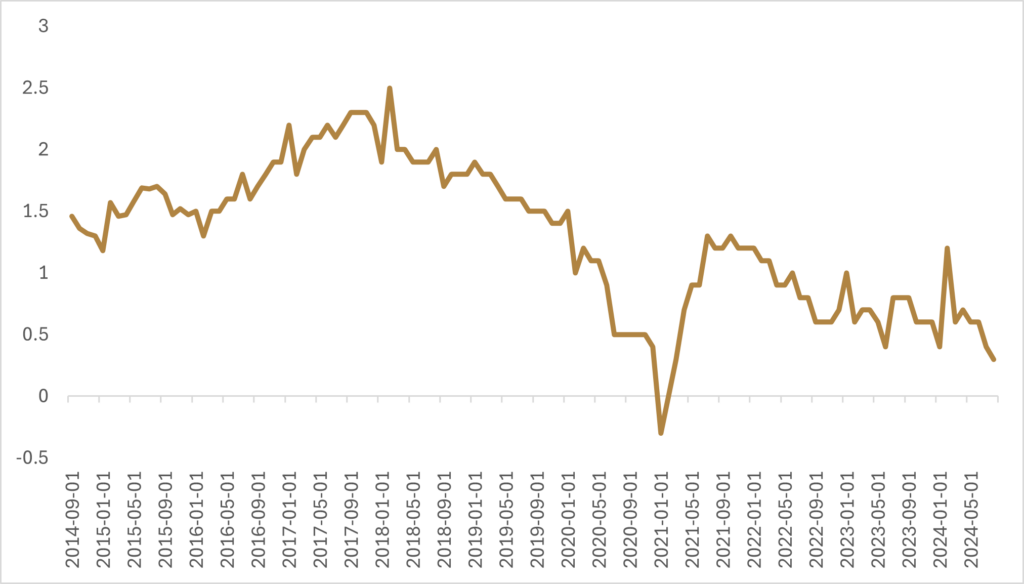

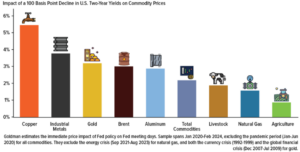

The other macro event is the potential for a ‘soft-landing’ in the U.S., where the Federal Reserve can embark on a rate cutting cycle to bolster a flagging employment market and underpin U.S. consumer demand. While a ‘hard-landing’ recession in the U.S. would undoubtedly be trouble for growth-sensitive commodity sectors, a rate cut cycle in non-recessionary periods typically leads to a boost in commodity prices, with copper and gold being the largest beneficiaries.

Although we at Viewpoint did increase the probability of a recession in the U.S. from 20% to 25% as the labour market has continued to weaken, the balance of probabilities continues to lie in the camp that the Fed will be able to gradually start reducing rates in Q4 of this year, helping to underpin U.S. economic activity. While job creation in the U.S. labour market has lost some steam and JOLTS data is showing that less employees are voluntarily leaving their jobs for new opportunities, this isn’t at a dire enough rate that we are confident a recession is on the horizon.

The August jobs report certainly wasn’t strong, but it also doesn’t scream the U.S. labour market is on the precipice. If the U.S. economy can skirt a recession but still embark on a rate cut cycle, the narrowing of interest rate differentials between the U.S. and developed markets would reduce the attractiveness of currency carry trades, putting downward pressure on the U.S. dollar (as incoming flows are reduced), which would increase the attractiveness of commodities prices in U.S. dollars.

Bloomberg wrote a piece on how narrowing interest rate differentials could spark an exodus of capital from U.S. dollar assets to the Chinese yuan because of U.S. interest rate cuts, and while a weakening U.S. dollar is beneficial for global growth, the People’s Bank of China will have to be mindful that a strengthening yuan doesn’t sap any additional strength from an already flagging export industry.

Looking specifically at the copper market, the price action over the last three months has shaken out a lot of the weaker speculative positions, and net long positioning in the futures market has eased from the highs seen in May. While copper stocks on the Shanghai futures exchange are still elevated, they are also starting to get whittled down, and the premiums paid on importing refined copper have started to rise, signaling a better balance of market dynamics. While it is still likely that the macro picture over the next few months will be a greater influence on industrial metal prices, the fundamentals appear healthier than they were back in May of this year.

At Viewpoint, we continue to be bullish on the overall outlook for copper based on longer-term supply and demand, and while the rally may have stalled out given the macroeconomic climate, assuming the global economy doesn’t slip into an outright recession we should be close to a turning point for the recent rout.

Happy investing!

Scott Smith

Chief Investment Officer

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.