A couple of weeks ago, I wrote a note explaining that even though the Federal Reserve had recently reduced the overnight interest rate by 50 basis points, long-term bond yields have since moved higher, which could be counterintuitive for casual market watchers. Stronger-than-expected economic data was one of the catalysts that has put upward pressure on bond yields, as worries of a recession in the U.S. start to fade. The upcoming U.S. election has also caused consternation for U.S. bond holders as the odds of a Republican sweep have increased. The combination of a Trump presidency with Republicans controlling both the House and Senate would clear the way for additional fiscal stimulus through additional tax cuts, leading to a higher supply of bonds in the future. Although rising yields generally act as a headwind for precious metals, gold and silver prices have continued their strong run in 2024, with investor demand for store-of-value assets increasing as a hedge against a resurgence in inflation. Gold futures prices are up just under 33% year to date, while silver futures prices are up a whopping 40% year to date.

In July, I wrote a note on our bullish thesis for precious metals, which was based on two main themes. Firstly, we anticipate increased demand from emerging market central banks as they look to diversify their foreign reserve holdings away from the U.S. dollar. Less reliance on U.S. dollars can provide additional flexibility to these central banks as U.S. economic sanctions become a favoured foreign policy measure by U.S. administrations. In an increasingly multi-polar world, reducing one’s reliance on the U.S. dollar and the SWIFT network makes sense from a risk management perspective. Secondly, peak globalization and the movement towards more populist governments will make it challenging to reign in global fiscal deficits. Investors will look to increase their exposure to asset classes that can protect against periodic resurgences in inflation, making precious metals attractive as part of a broad commodity portfolio.

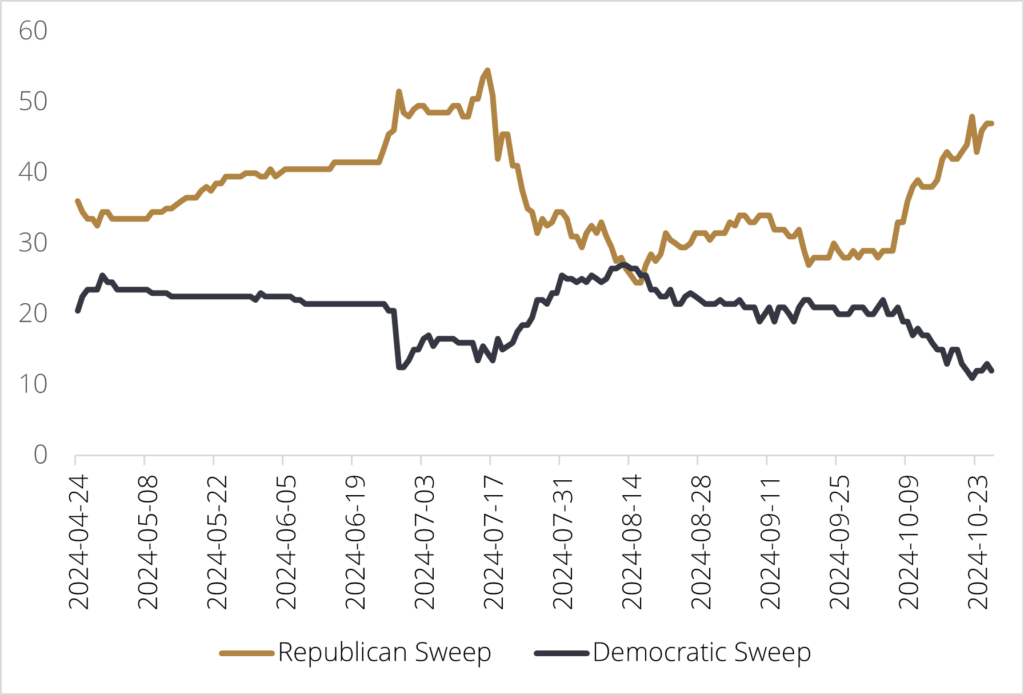

While I continue to believe in the long-term thesis for precious metals and their place within investment portfolios, the current rally has led to stretched prices and relatively crowded positioning. The potential for a Republican sweep has increased rapidly over the past month, as referenced by the Polymarket betting site (Figure 1), though this comes with the risk of disappointment for gold (and equities) should Trump win the election but find himself with a divided government. With a divided government, Trump would still be able to push forward with his tariff agenda, though the ability to pass new tax legislation over and above the extension of the 2017 tax cuts will be more challenging. As we’ve said before, neither candidate’s policy proposals are aimed at reducing the U.S. government deficit, but the current policy proposals do differ with respect to the magnitude of fiscal policy that the candidates have put forth. J.P. Morgan Asset Management released a note a few weeks ago highlighting that the Committee for a Responsible Federal Budget estimates that Trump’s policy proposals will increase the federal debt by $7.5 trillion over the next ten years, relative to that of Harris’ policy proposals that are estimated to add $3.5 trillion over the same horizon. As financial markets continue to price in the outcome of a Republican sweep, stretched prices combined with relatively crowded positioning increases the risk of a pullback over the next couple of weeks, especially if a divided government is the outcome of the election.

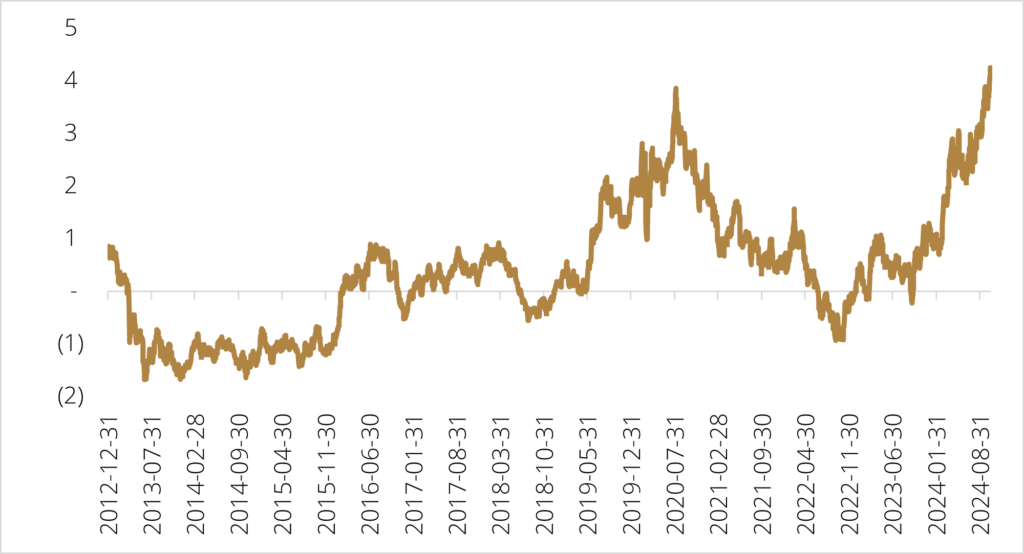

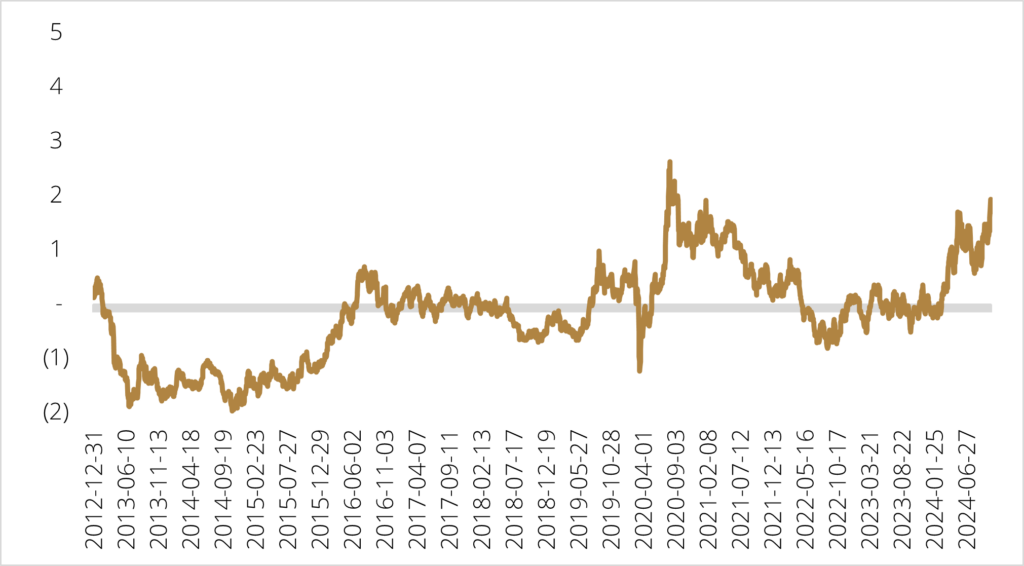

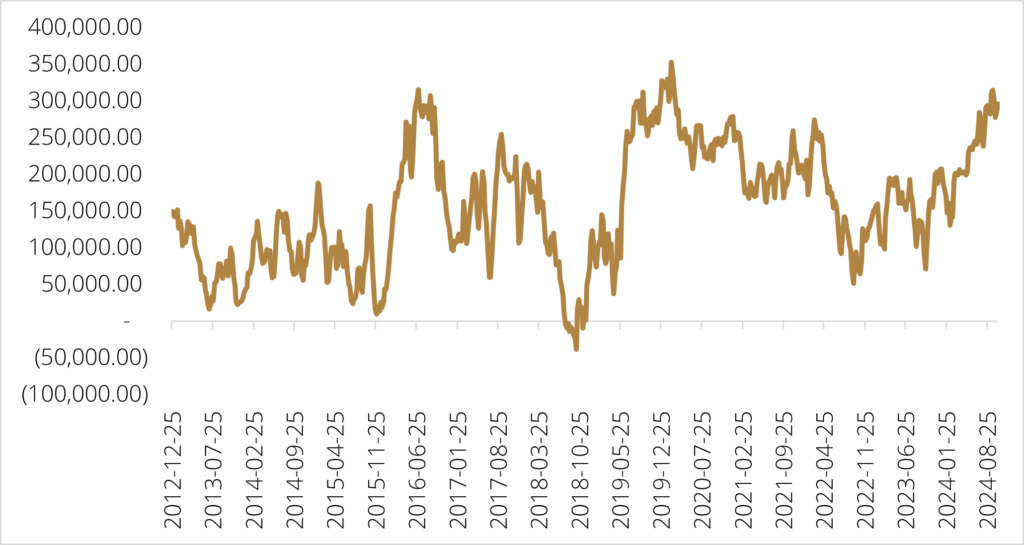

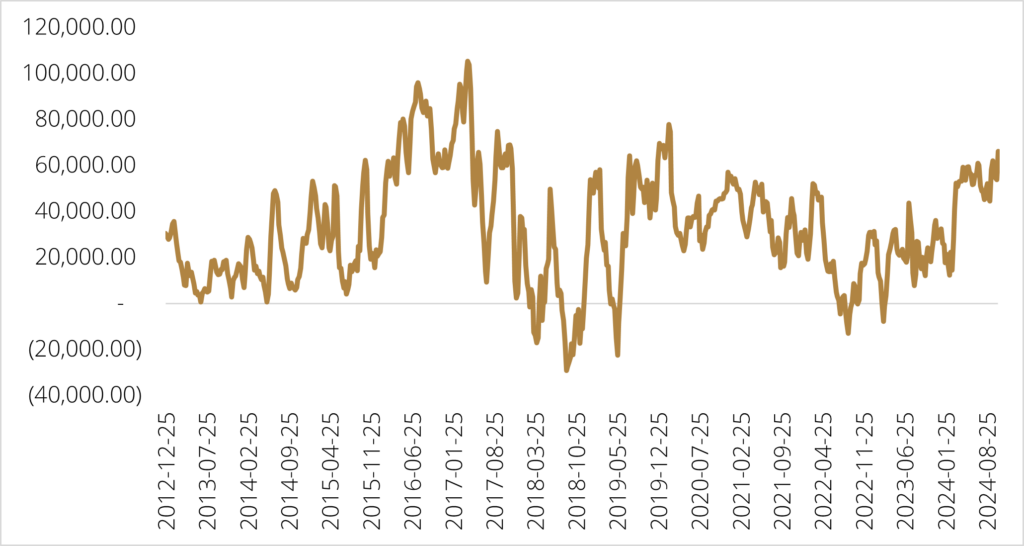

Looking at price action for both gold and silver, I’ve calculated a modified z-score that utilizes a rolling three-year moving average to look at how stretched current prices are. You can see from the below charts that even though silver has been the better performing of the precious metals this year, it is less stretched than gold from a historical perspective. Gold is the most stretched from its three-year moving average over the last decade, surpassing the levels witnessed in August of 2020, before it (and silver) began a decline that didn’t bottom until late 2022. Speculative positioning in the futures market also illustrates the crowded nature of the gold trade, with speculative positioning in gold futures encroaching on the high watermarks seen over the last ten years. Silver, on the other hand, doesn’t look nearly as crowded as gold positioning, potentially signaling less downside in the event of any profit-taking or disappointment with the election outcome.

While these positioning metrics don’t necessarily signal that a pullback is imminent, it does highlight the increased risk of short-term profit taking should the outcome of the U.S. election end up with a divided government. At Viewpoint, we continue to believe in the long-term thesis for precious metals and broad commodity markets, preferring a risk-balanced framework for the construction of a commodity portfolio. A portfolio construction methodology that utilizes volatility and correlation to allocate capital would have been reducing capital allocation towards precious metals during 2024, as the rapid price increases have also corresponded with higher volatility. To keep the risk contribution of precious metals stable within a broad portfolio of commodities, this type of framework manages risk by taking profits on the move higher in precious metals, as both price and volatility expand.

Happy investing!

Scott Smith

Chief Investment Officer

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.