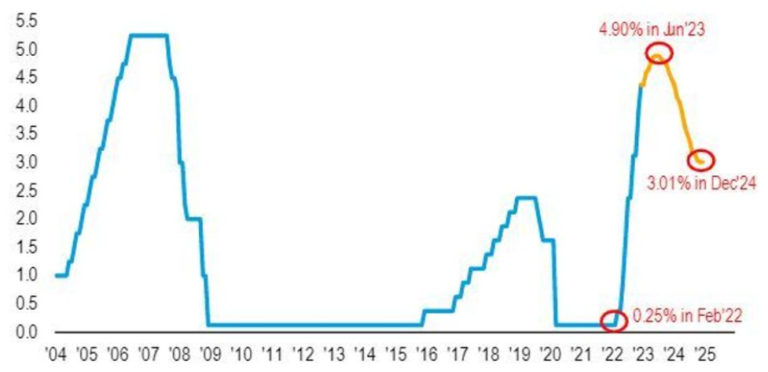

I’ve been writing for some time about how the constraints that the Federal Reserve (Fed) is operating under make it such that it’s likely they will overreact to inflation, thus causing a recession. Despite the gravity of the ‘R’ word, the recession that is likely to materialize should be mild given we’re coming off a post-COVID growth bonanza fueled by a firehose of fiscal stimulus. Although the fiscal impulse has waned and inflation is showing signs of slowing, the Fed continues to remain resolute in its fight against inflation becoming entrenched.

As evidenced by Jerome Powell’s (Chairman of the Federal Reserve) comments around his desire to emulate Paul Volcker’s monetary policy actions from the 1980s, along with his statements around bracing for economic pain in the fight against inflation (i.e., prepare for a recession), the Fed has telegraphed that in a decision between battling inflation and avoiding a recession, inflation is the more important of the two. The idea that monetary policy is now restrictive enough to cause a recession is consensus view from a macro pundit perspective, which is reinforced by asset pricing observed in financial markets. Market participants are expecting that after two rate hikes early this year, the Fed is going to have to reverse course near the end of the year and ultimately end up cutting rates to relieve some pressure.

Data as of January 12, 2023. Fed funds rate expected in 12 months minus effective fed funds rate.

Source: Bloomberg; BofA Global Research

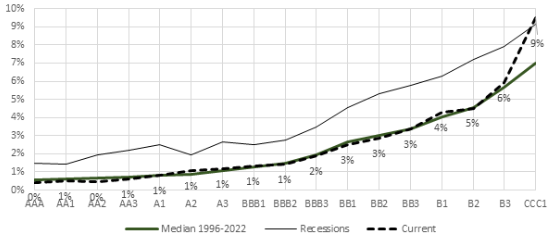

Additionally, the yield curve is the most inverted it’s been since the 1980s, which is typically a leading indicator that a slowdown in growth, or a full-blown recession, will cause interest rates to fall in the future. Although the yield curve may be sending ominous warning signs of an impending recession, high-yield interest rate spreads aren’t yet ringing any recessionary alarm bells. High-yield spreads are currently right around the historical median, suggesting that default risk is about normal. As the article from Verdad points out, while we’re seeing some spread widening in the higher-risk categories of high-yield (triple-C), spreads are far from confirming a recession is imminent.

Current Ratings Curve vs. Median and Recession Ratings Curves

Data as of December 31, 2022.

Source: Verdad Bond Database

This doesn’t necessarily mean the signal from the yield curve is wrong, just that the pain witnessed in credit markets in 2022 (as well as other asset classes) was a result of the discount rate rising versus credit risk increasing through spread widening. As we move forward into 2023, credit spreads (as well as corporate earnings) are the areas where we see the potential for increased risk, as opposed to further compression in asset class valuations stemming from a sustained rise in the discount rate. Circling back to market participants expecting the Fed to begin easing monetary policy at the back half of 2023, not only has Powell expressed his hawkish outlook many times, but historically dovish Neel Kashkari (a voting member on the Federal Open Market Committee this year) has turned more hawkish, warning that Wall Street is going to lose the game of chicken that it’s playing with the Fed. If expectations of inflation in one year (extracted from inflation index swaps) are still hovering above 2%, it seems unlikely the Fed would be quick to reverse course without seeing a risk that inflation is beginning to undershoot their target. This should give investors pause that a rally fueled by discount rate changes is right around the corner.

While higher interest rates for longer than the market anticipates might seem like a negative development, the optimistic angle is that active investment strategies are poised to do well in an environment where a lower supply of money leads to a normalization of spreads where risk is adequately compensated. In an environment where interest rates are depressed as a result of monetary policy, investors are forced further out on the risk spectrum in order to generate the same amount of return, thereby compressing spread risk. For active investment strategies that appropriately size risk premiums and then utilize leverage to harvest a diversification premium, the investment landscape gets more attractive as interest rates normalize. While the economy might not be out of the woods yet, it may be time to start getting optimistic about asset prices (government bonds in particular), as well as factor premiums like momentum and carry, as the investment landscape shifts from a predominate focus on the discount rate to asset class fundamentals.

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.