The initial shock from the retaliatory attack on Israel by Iran over the weekend had been well absorbed by markets when trading opened this morning. But as the day progressed, the prospects of rising geopolitical tensions weighed on risk appetite. The communication from Iran was that the barrage of ballistic, drone, and cruise missiles was in response to Israel’s strike on the Iranian consulate in Damascus and that they now “consider this matter concluded.” Given how well this attack appears to have been telegraphed, it seems this was more of a face-saving exercise for Iran than a provocation for additional escalation. However, despite the market initially brushing off the Iranian attack, I wouldn’t be so quick to consider this matter concluded. This marks the first direct strike by Iran on Israeli territory from Iranian soil, and the current messaging from Israel is that they are likely to respond to Iran. The question now becomes: what does the response from Israel look like and will it incite further escalation from Iran, potentially drawing Russia into the fray?

U.S. stocks opened the day higher but ultimately finished their session off by -1.2%. U.S. government bonds weren’t able to catch a bid from any safe haven flows, as U.S. retail came in hotter than anticipated, which put pressure on bonds all day and they ultimately shed -0.6% by the closing bell. Gold rallied on the potential for further escalation from a response from Israel, with the precious metal ending its day in the green by +1.1%, while oil reversed its early morning sell off and made it back to flat. After being subdued for a long period of time, implied volatility is starting to rear its head, with front-month VIX futures spiking +21.8% over the last three days. Over the same period, U.S. equities have only sold off by -1.9%, which is a relatively outsized response for VIX futures given the rather subdued downward move in equity prices. Earlier this year, I wrote a note highlighting how it seemed odd that implied stock market volatility was so depressed given the large menu of macroeconomic risks on the horizon. The note referenced an Oddlots podcast featuring Kris Sidial, who offered the opinion that subdued volatility in markets has been a result of a dogmatic appetite to sell volatility on any spike, as investors look for alternative ways to enhance investment returns. This sentiment could very well be changing, and further escalation of geopolitical risk could flip volatility from being well supplied to being in high demand.

While risk appetite in financial markets for the short term will likely be driven by evolving headlines out of the Middle East, commodity markets continue to contend with supply disruptions. This time, disruptions are related to exchanges, as news dropped over the weekend that the London Metal Exchange (LME) would be adhering to U.S. and U.K. sanctions against Russia by banning deliveries of any Russian supplies produced after last Friday. Russia is an important player in the global metals game, with Bloomberg reporting that Russia produces 6% of global nickel supply, 5% of global aluminum supply, and 4% of global copper supply. Arguably the bigger concern here is whether the LME will continue to be able to be the global benchmark for metals pricing, now that their contracts will be referencing either old Russian metal or non-Russian metal, while “new” Russian metal will continue to be consumed in the physical market. Furthermore, another possible outcome is that there is a flood of old Russian metal to the LME, which would push spot prices down and drive the futures curve into steeper contango.

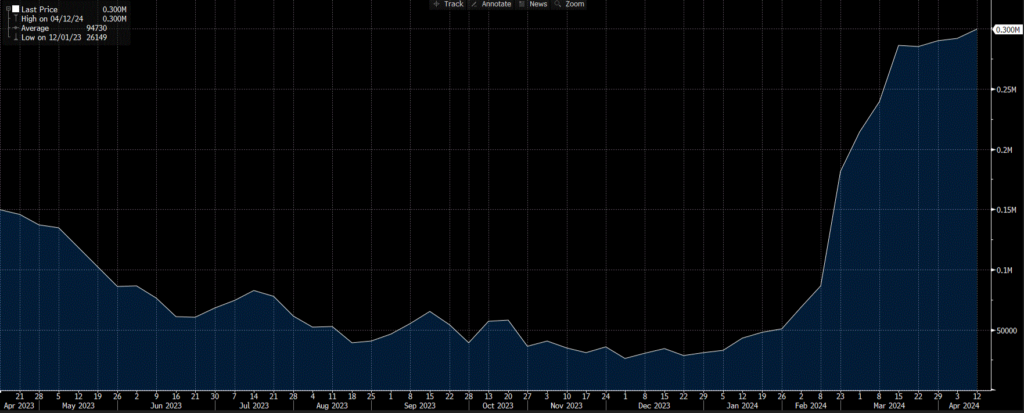

The latest sanction-related news is all transpiring in the wake of copper being up +9.3% month to date, while the futures curve remains in steep contango, a sign that would normally suggest supply is not currently an issue. However, as Bloomberg has reported, the discount for copper ore relative to the refined metal, known as treatment and refining charges, has evaporated. As the discount for copper ore has shrunk, market participants are increasingly worried there will be a curtailment of smelting production, which would then lead to a decrease in refined copper stocks. In a move that one might consider foreshadowing for an impending tight copper market, China has been feverishly restocking their inventories in 2024, which could mean they are looking to get ahead of any potential decreases in production.

Whether or not this could be the beginning of a new secular bull market for copper, we will have to wait and see. We are constructively bullish on copper given the likely supply gap that will materialize as demand for the metal increases as part of its role in energy transition. However, another emerging narrative that is also bullish for copper is the growth of artificial intelligence and the increase in energy demand from data centres that will be needed for the continued development of this technology. The International Energy Agency was already expecting almost a three-million ton deficit in copper supply by 2030, and Trafigura, a leading commodity trader, believes that artificial intelligence and data centres (like ChatGPT, who helped us to title this article) could add up to another one-million tons of demand that is unaccounted for, widening the anticipated supply deficits. The shape of the futures curve for copper (and other industrial metals) makes it a bit more challenging to be long because of the roll costs, but the short-term view that treatment and refining charges could reduce refined metal output in an already tight market, combined with the long-term positive fundamentals, continue to leave us bullish.

Happy investing!

Scott Smith

Chief Investment Officer

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.