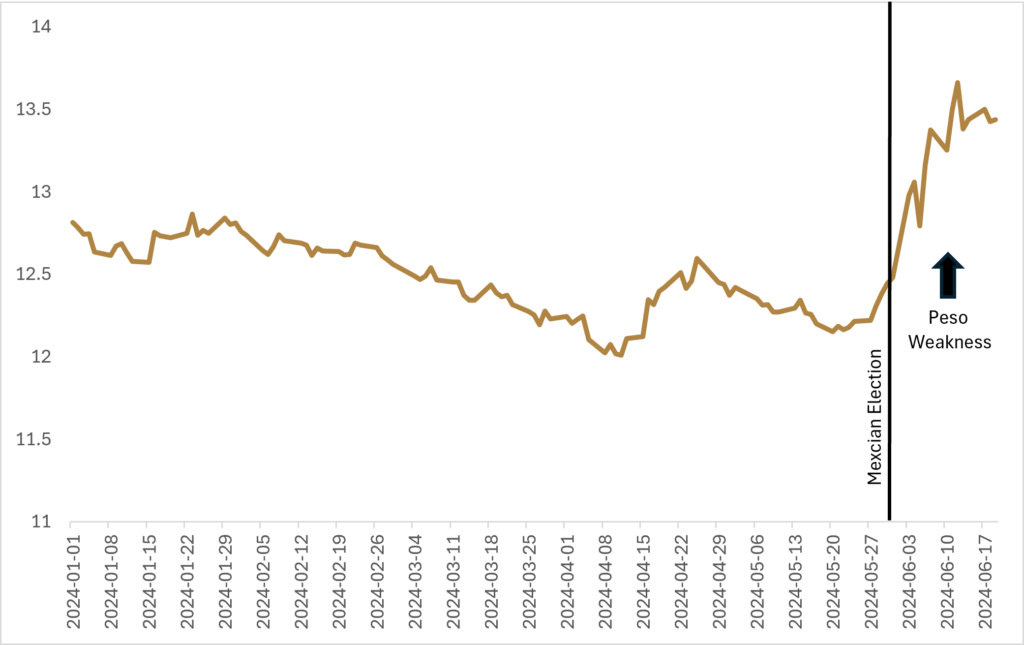

Global equity markets have powered higher for the first half of 2024, gaining ground on strong margin growth and the prospect of declining inflationary pressures. The U.S. equity market has been a stand-out, increasing by +19.8% in CAD terms, brushing off geopolitical concerns and any uncertainty around the upcoming U.S. election in November. While election concerns have yet to inject any volatility into U.S. stock prices, other foreign equity markets have not been so lucky, with unexpected outcomes sending shockwaves through corresponding domestic equity markets. In Mexico, a larger-than-expected majority for Claudia Sheinbaum and the Morena party has caused Mexican equities to fall -10.4% in CAD terms – most of which has been a weakening in the peso – since the election on June 2nd, as investors worry about the ability of the left-wing Morena party to enact greater constitutional reforms. Indian equities also experienced a sharp fall after Narendra Modi and the BJP party failed to gain as many seats as had been expected in the Indian general election that culminated on June 1st, potentially thwarting Modi’s ability to continue his reforms to power the economy forward. Since the initial decline in Indian share prices after the upset, Modi has secured crucial backing from two key allies in his coalition and the Nifty 50 has rallied, increasing by +5.2% in CAD terms for the month of June.

The latest bout of anxiety has been in France, after the European parliamentary elections held on June 8th injected additional volatility into France’s domestic political situation. The outcome of the parliamentary elections was a distinctly rightward shift in representatives to the E.U. parliament, with the current governments of France and Germany suffering greater-than-expected losses, and therefore leading to questions surrounding their respective domestic agendas. The biggest issues facing voters in the E.U. were immigration and the economy, though green and left-leaning parties also suffered challenging showings as increasing costs of decarbonization are weighing on voter sentiment.

In France, President Emmanuel Macron’s centrist Renaissance party only received 15% of the vote for the E.U. parliament, while Marie Le Pen’s right-wing National Rally party received 31% of the vote, the best showing for the National Rally over the last three elections. In response to his crushing defeat for E.U. parliamentary representation, Macron surprised political pundits by calling a snap election, a risky maneuver aimed at calling the “bluff” of his constituents. While one cannot know Macron’s exact strategy, the thinking is likely that voters may be less willing to take the risk of voting for Le Pen in a national election (as opposed to the E.U. parliamentary elections). Some see the E.U. parliamentary elections as a “protest” vote, with constituents potentially less likely to take a gamble on dramatic change when it comes to domestic politics. With Le Pen and the National Rally having improved their percentage of the vote at every election since Macron came to power, Macron is hoping to staunch his party’s bleeding ahead of the next presidential election in 2027, when Macron cannot run because of term limits.

Although it’s only been a week since France’s National Assembly was dissolved in preparation for the upcoming elections, which will be held over a two-round ballot scheduled for June 30th and July 7th, Macron’s gamble already seems like it’s unravelling. With Macron already dealing with trying to fend off the rising popularity of the National Rally, an alliance of left-wing parties, called the “New Popular Front,” has emerged as a contender and has leapfrogged Macron’s party in the polls. According to the most recent polls, the New Popular Front would garner 28% of the vote, solidly in second place behind the National Rally at 33% and ahead of Macron’s Renaissance party at 18%. Although the left-wing alliance of the New Popular Front could be characterized as a fragile coalition given their diversity of platforms within the coalition, the prospect of the second-round runoff being between the National Rally and the New Popular Front has sparked worry in French financial markets. At a very high level, the assumptive clash would be between a left-wing coalition with a platform of pushing back against the E.U.’s fiscal pact governing debt and deficits, or the right-wing National Rally who has a history of euro-skepticism and who has also pledged to take back control of energy policy from the E.U.

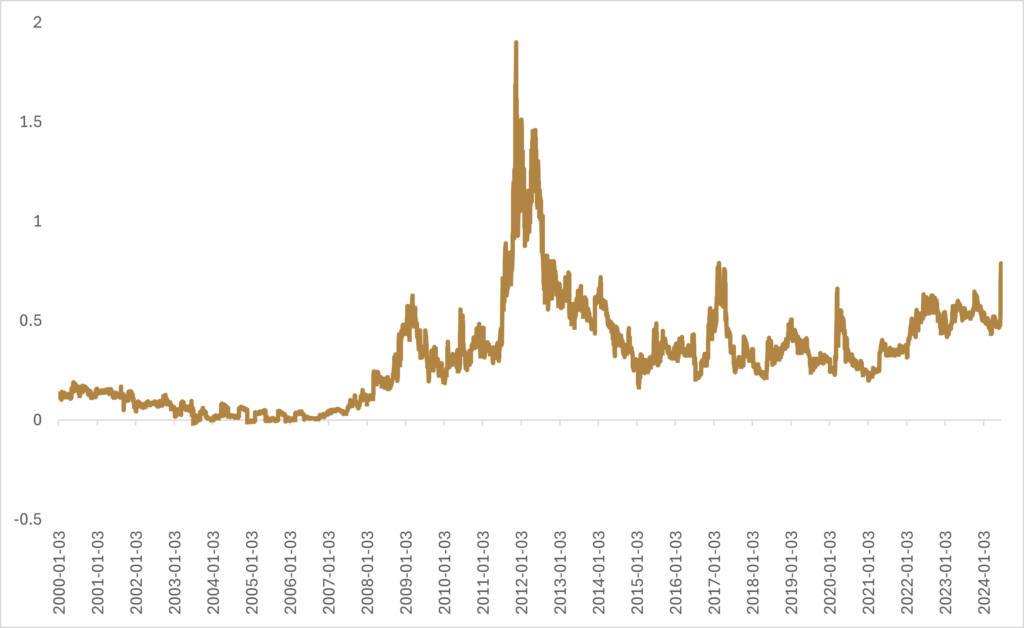

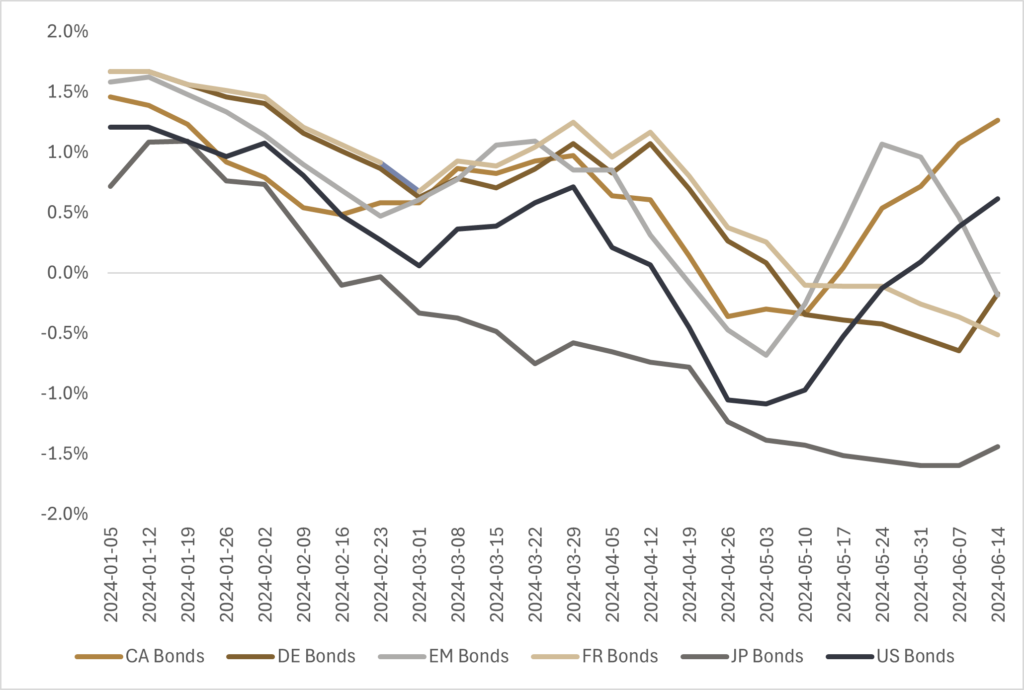

Both the New Popular Front and the National Rally parties would represent a departure from Macron’s focus on greater French integration into the E.U. that, if it transpires, would raise questions about whether ‘Frexit’ could be a reality. Any breath of a potential clash with the E.U. over fiscal policy has financial markets on edge, and since France’s National Assembly has been dissolved, French equities have declined by -5.4% in CAD terms, relative to a decline of -3.1% for German equities and a rise of +2.5% for U.S. equities. The bond market has also been sent into a tailspin, with spreads between French and German 10-year bonds blowing out to 0.8%, harkening back to 2017 when markets where on edge for a very similar reason: the popularity of Marie Le Pen and the National Rally party was rising ahead of the French presidential election.

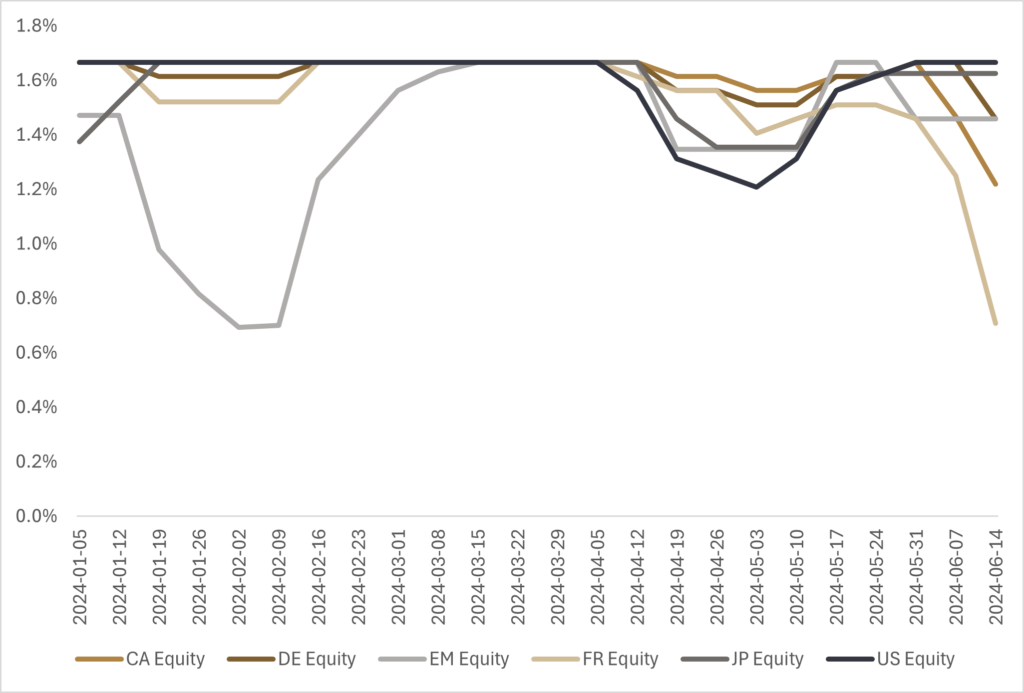

Trend indicators have been underweight French sovereign bond markets since early May, and that trend remains decisively downhill for French government debt as election anxiety dominates headlines. A similar situation has transpired in global equity markets, and while trend indicators are still overweight, they are shedding exposure to French equities at a faster clip than other markets. It is likely that French financial assets will continue to price in an election uncertainty premium heading into the first round of the French elections on June 30th. If, like the polls are suggesting, Macron and the Renaissance party do not make it to the second-round runoff, I could see further downside for both equities and bonds as friction between France and the E.U. becomes a greater concern. However, should the diverse platforms of the New Popular Front fail to coalesce left-wing voters and the runoff comes down to Renaissance and Le Pen’s National Rally, it is likely there will be somewhat of a relief rally. Regardless of the eventual outcome, there does appear to be an undercurrent of deglobalization that is filtering through to the voting booths, which is in-line with our view at Viewpoint that there is a shift underway towards a more multi-polar world that is less interconnected and more focused on domestic outcomes.

Happy investing!

Scott Smith

Chief Investment Officer

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.