Canadians headed to the polls on Monday and handed the Liberal Party a fourth consecutive election victory. While the comeback seemed unthinkable earlier this year, the narrow margin of victory leaves the Liberals with a weaker mandate than pre-election polling had forecasted. Heading into election night, aggregated polling data gave the Liberals a 65% chance of forming a majority government, but the Conservative Party was able to outperform expectations in Ontario, specifically in the Toronto area, helping to close some of the anticipated gap with the Liberals. For the Conservatives, outperformance on election night is a hollow victory given their 20-point lead in late 2024, but outperformance in Ontario, gaining seats (144 vs. 119 in 2021), and securing 41.3% of the popular vote (up from 33.7% in 2021) provides a foundation for optimism within the party.

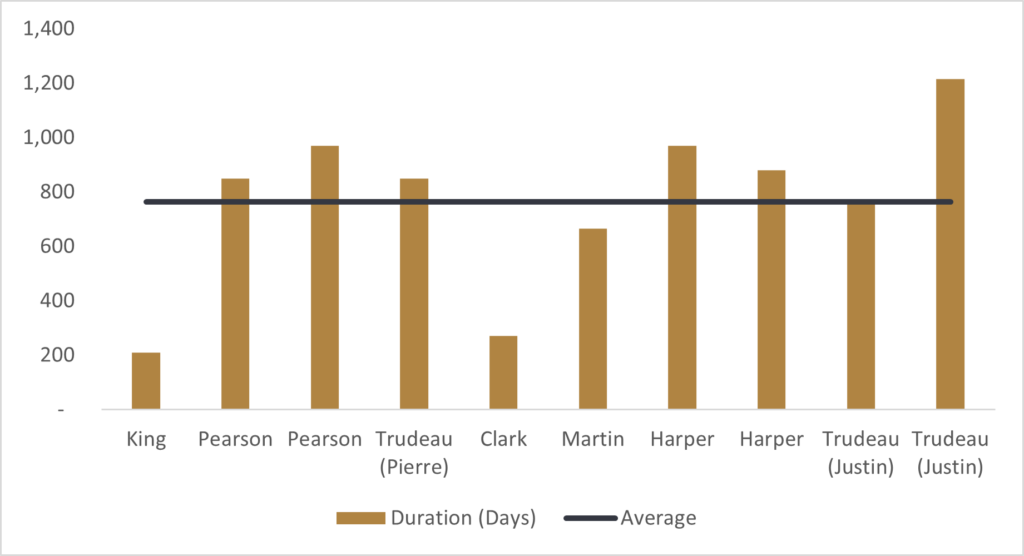

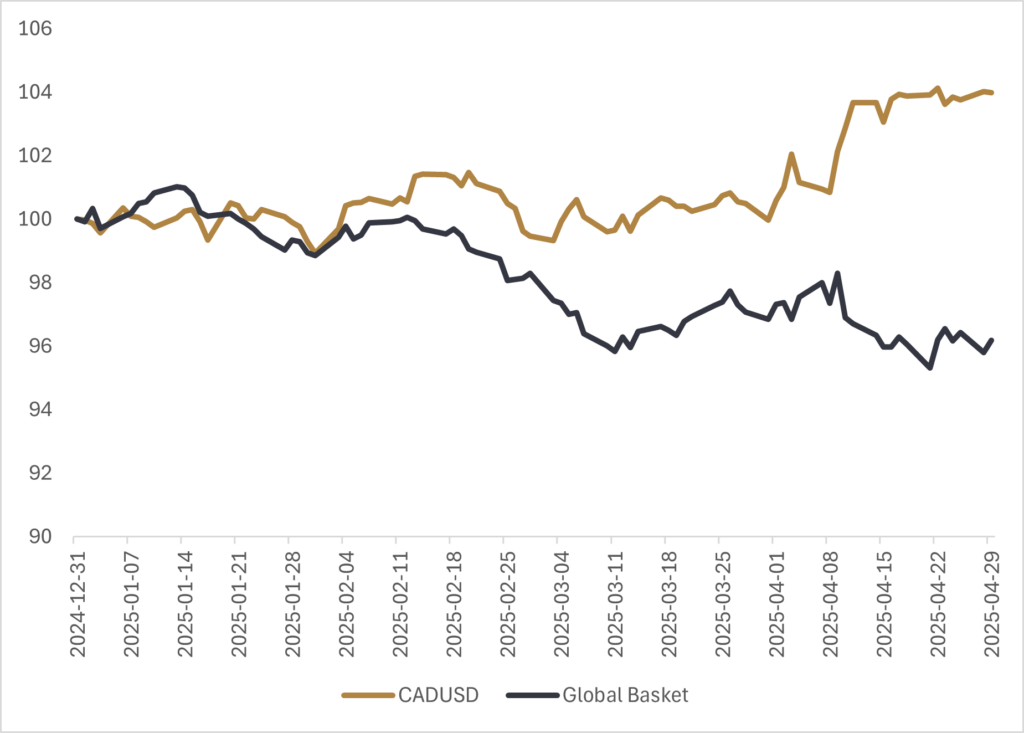

The final seat count puts the Liberals at 169, Conservatives at 144, Bloc Québécois at 22, the NDP at 7, and the Greens at 1. Markets reacted to the early signs of a potential Liberal majority with brief Canadian dollar strength but started to fade as it became more likely the Liberals would form a minority government and need to lean on support from other parties. The loonie traded within a narrow range for most of Tuesday, ultimately finishing slightly higher against a global basket of foreign currencies. Despite the slight Canadian dollar strength, uncertainty around the Liberals’ ability to execute on their policy platform—whether via a renewed confidence and supply from the NDP or vote-by-vote negotiation with other parties—will likely do little to calm the nerves of market participants. Minority governments in Canada typically last a little over two years, and the lack of clarity around coalition dynamics is not a bullish backdrop for capital flows into Canadian assets. While the Liberals will likely be able to count on the support of the NDP given their support for the last minority government, the reduction in NDP seats (25 in 2021 to now only 7) doesn’t give much room for error.

Relying on an informal issue-by-issue coalition increases the policy uncertainty around trade negotiations with the United States and domestic infrastructure spending, so Prime Minister Mark Carney now faces an uphill task in navigating economic headwinds while managing a fragile mandate. GDP growth is projected at just +1.2% in 2025 and +1.0% in 2026, with recession odds near 45%. Neither major party campaigned on fiscal austerity—understandable in an environment where a trade war threatens a global growth slowdown—but if the Liberals need to rely on Bloc or NDP support, projected deficits could exceed baseline expectations given both these parties also ran on expansive fiscal platforms.

In a status quo scenario, where the Liberal government relies on the support of the NDP or Bloc, there is the potential for federal-led domestic investment to bolster private capital investment. However, the risk with a status quo scenario is that sentiment in Western Canada continues to erode and it’s harder to work in unison to lower interprovincial trade barriers. Reducing interprovincial trade barriers should be low-hanging fruit for increased economic growth, but the relationship between Western Canada and Ottawa will likely need to improve. Another scenario, which admittedly is a lower probability but one that is underappreciated by financial markets, is that both the Liberals and Conservatives work together to expedite a rebound in economic growth. It’s clear there has been a movement away from the multi-party fragmentation that has been seen in previous elections, with this being the first time since 1930 that two parties have each won more than 40% of the popular vote. The consolidation in power signals the importance of this election and that the public’s appetite for political gridlock in this challenging geopolitical environment may be thin. The two economic platforms weren’t dramatically different, both highlighting the importance of increasing domestic investment and reducing provincial trade barriers. The Liberal economic platform was more focused on government-directed investment to leverage a return of private capital, while the Conservative platform focused on reducing taxes and regulation to unleash stronger private investment and economic activity. While this may seem like a long shot and a movement away from traditional Canadian politics, the recent experience of Germany could be a roadmap for Canada. Faced with the threat of the U.S. stepping back from being the global security watchdog, the newly formed German government hastily passed a historic package of constitutional reforms, which required a two-thirds majority. Friedrich Merz, the incoming Chancellor from the center-right CDU, needed to work with the outgoing center-left SPD and the Greens to secure the necessary votes to approve the historic fiscal spending package, which by some analyst estimates could end up being larger than the fiscal stimulus implemented following the fall of the Berlin Wall and the reunification of Germany. The consensus from German policymakers on a commitment to increase domestic investment has led to optimism for a turnaround in both productivity and economic growth in Germany, which has helped to underpin a recent rally in the Euro.

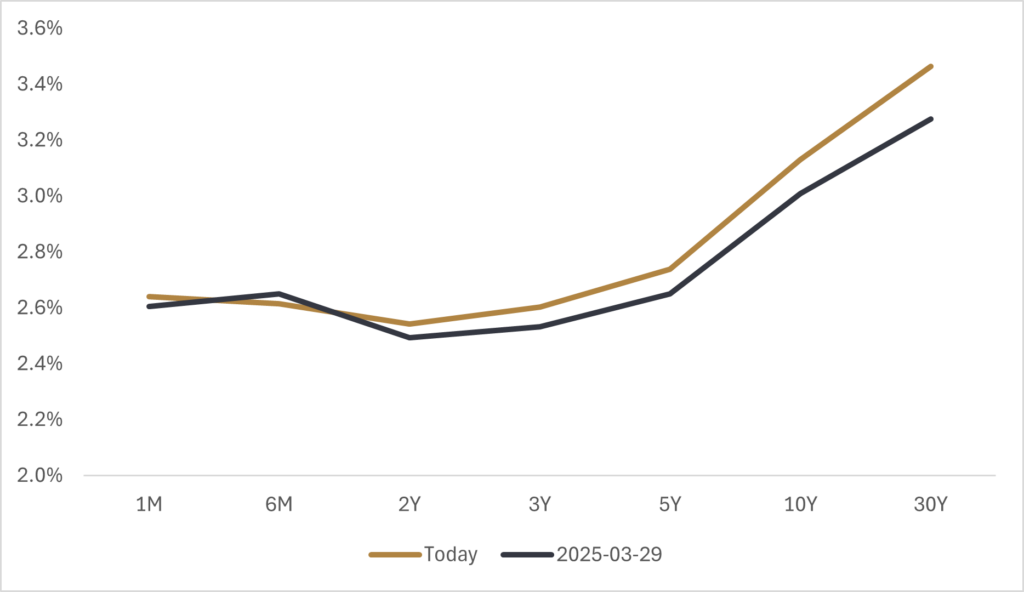

If the Liberals can reach across the aisle and secure Conservative support by compromising on deregulation initiatives, then there is the potential that we could see a faster rebound in economic activity as opposed to having to cobble together support from the Bloc and NDP. In this scenario, we’d likely see a strong rally in the Canadian dollar, with additional upside in resource equities. This is not my base case, but I think it’s an upside risk that is underrepresented in market pricing. However, given the uncertainties around minority governing and the margin of error for important policy decisions, in my view, it still makes sense to have a defensive stance when assessing Canadian assets. With increased fiscal spending, widening deficits, and rising interest costs, we would expect that the yield curve is vulnerable to continue its recent steepening. If a recession materializes and the Bank of Canada eases short-term interest rates, the shift lower in the yield curve will likely lead to an outperformance in duration. However, there is risk that a yield curve steepening eats into those gains, and we don’t mind being underweight duration in Canada due to the potential impact of inflation risk on longer-dated bonds.

On the outlook for the loonie, my view is that peak weakness against the U.S. dollar is behind us, but this has more to do with the intricacies of what the U.S. administration is trying to achieve as opposed to outright optimism for the Canadian economy. This would be a continuation of the trend we’ve seen so far in 2025, where the loonie has gained against the greenback but lost ground against a basket of global foreign currencies.

Until there are positive signals that the new government will be able to spark a rebound in sluggish business investment and productivity, we’re comfortable being overweight foreign currencies relative to the loonie (except for the U.S. dollar). The first piece of the puzzle to provide further direction will be how Carney’s new cabinet selection process goes, and we should be expecting the decision within the next two weeks.

Happy investing!

Scott Smith

Chief Investment Officer

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.