The prevailing narrative in markets heading into the new year was that U.S. economic activity was rebounding after a bit of a soft patch and set to accelerate with the incoming Trump administration. The economic policy platform of the new administration was viewed as pro-growth and fiscally stimulative, with tax cuts likely to further add to the already ballooning government deficit, which has been running at around 7% of GDP. The potential for an increase in fiscal stimulus combined with an already strong economy pushed bond yields higher in anticipation of a resurgence in inflation.

A few weeks ago, I wrote a note about how the perceived narrative in markets may be shifting, with recent actions from the Trump administration being a positive driver for lower bond yields and alleviating some of the bearish sentiment that had been hanging over the bond market for the last six months. The reason bond market jitters have calmed somewhat has been a renewed focus on government spending cuts as the administration has continued to signal a shift away from expansive fiscal policy. In addition to a more conservative budget resolution that is currently making its way through Congress, recent actions continue to highlight the administration’s desire to shift U.S. military spending to countries that haven’t been hitting their NATO targets.

A reduction in government spending to prioritize balancing the budget and getting the fiscal deficit closer to Treasury Secretary Scott Bessent’s target of 3% of GDP is helping to calm bond markets and drive down borrowing costs. This fiscal tightening reflects a broader strategy: prioritizing fiscal responsibility over short-term economic boosts. While such measures can help stabilize government finances in the long term, the immediate consequence may be a slowdown in economic momentum. The reduction in stimulus funding means fewer resources circulating in the economy, potentially leading to slower growth rates. While lower yields are suggesting increased confidence from the bond market in the government’s ability to control inflation, the other side of this coin is that the U.S. growth engine fueled by government spending might be cooling off.

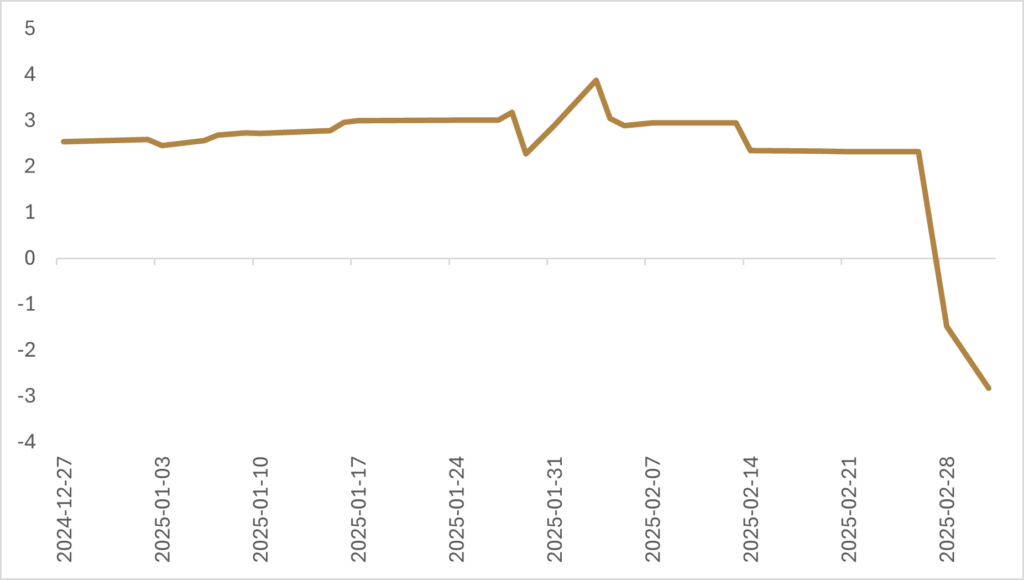

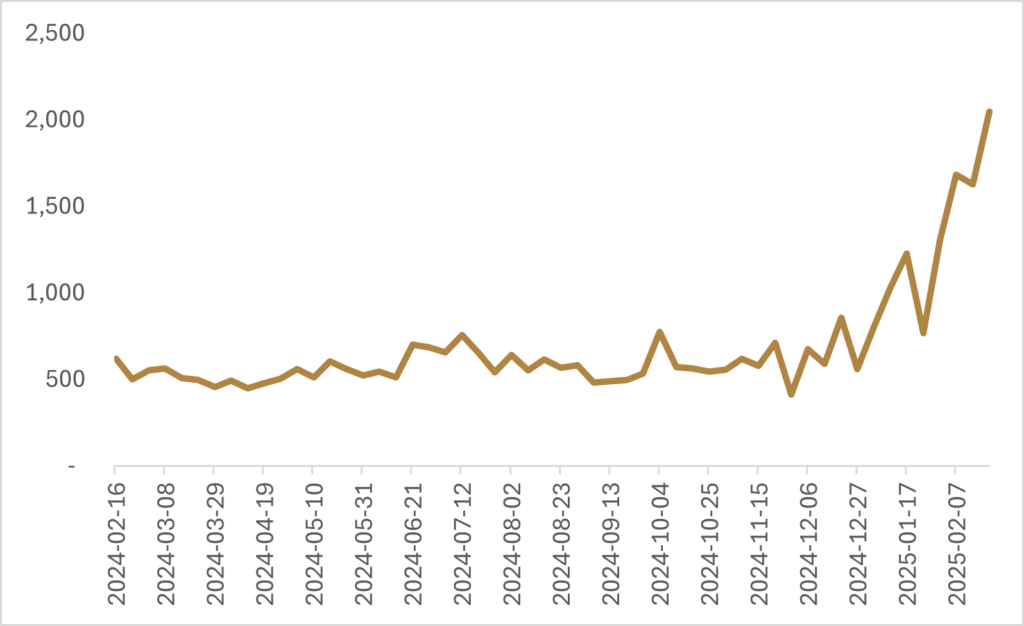

Over the last few weeks we’ve seen several key economic indicators suggest that the U.S. economy is beginning to cool. Among the most telling signs are the revisions to the Atlanta Fed’s GDPNow for the first quarter of 2025, and increases in initial jobless claims. The Atlanta Fed GDPNow, which offers a real-time estimation of economic growth, has recently been revised downward from +2.3% to -2.8%. The dramatic slowing in economic activity is a result of net exports and consumer spending both weighing on estimates for first quarter economic activity. While much of this estimated decline in economic activity can be attributed to an increase in imports to front-run any potential tariff implementation, a decline in consumer spending and business investment levels could be signaling potential vulnerabilities in overall economic activity.

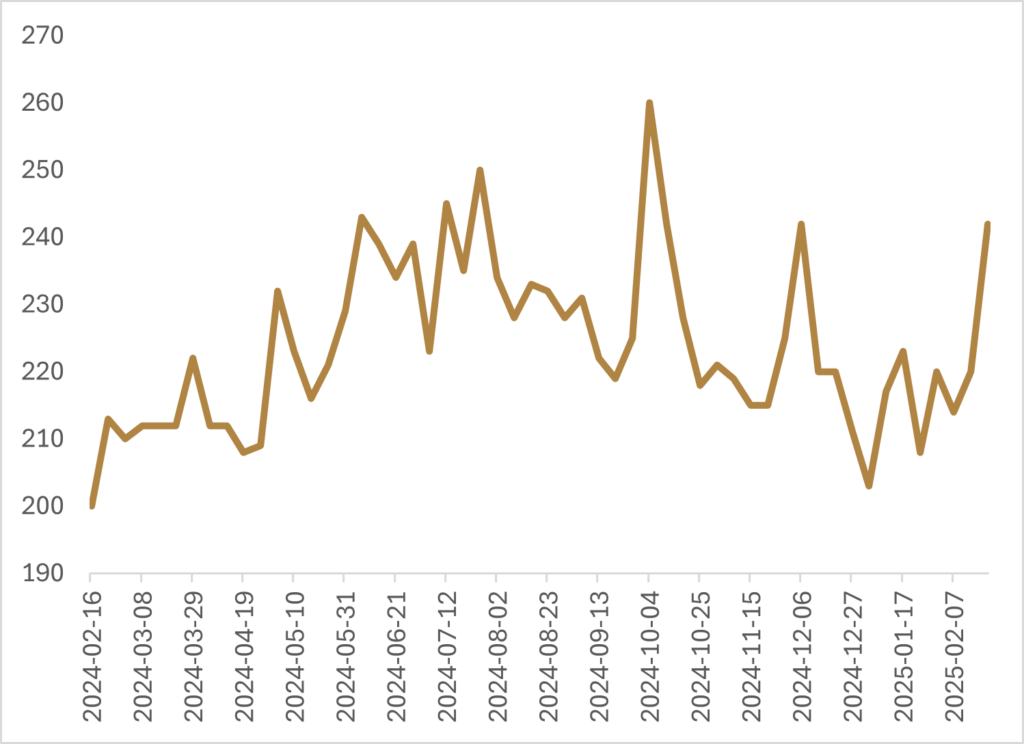

At the same time as the downturn in economic activity, initial jobless claims have also begun to show signs of stress. Traditionally a reliable indicator of labor market health, jobless claims are a crucial barometer for gauging the confidence of employers in sustaining or expanding their workforce.

Last week U.S. unemployment claims increased by 22k to 242k, above the median economist estimate of 221k and the highest level since October of 2024, which was right after the Federal Reserve began their rate cutting cycle. The rise in new jobless claims reflects several reductions from high-profile corporations like Starbucks, but also a dramatic rise in jobless claims out of Washington in response to the government’s crackdown on perceived waste and bloat.

The U.S. labor market has been on relatively strong footing, and while this uptick in jobless claims is something to keep an eye on, this Friday’s employment report will provide a better indication on if there is a more meaningful softening in employment underway. The combination of a lower Atlanta Fed GDP nowcast and rising initial jobless claims paints a picture of an economy that is starting to lose some of its earlier vigor.

While it is too early to determine the full impact of these economic reports, the data indicate that growth is decelerating, and a continued reduction in government spending could have further implications for consumer confidence, business investment, and overall economic stability.

Another intriguing development with respect to a potential growth scare in the U.S. is the so-called “Mar-a-Lago accord”, which points to a reordering of economic priorities under the Trump administration. Although still emerging as a theoretical concept floated by Jim Bianco and based on the work of Stephen Miran, the new leader of Trump’s Council of Economic Advisers, the theory advocates for a strategic pivot away from aggressive fiscal stimulus with a focus on deregulation and lower taxes. The long-term vision for the shift away from government spending is to stabilize public finances and encourage private sector-led capital, and by lowering bond yields through a reduction in government debt, this in turn will lower the value of the U.S. dollar creating a more beneficial environment for the manufacturing industry in the U.S.

Miran’s essay on the restructuring of the global trading system also argues that tariffs “present minimal inflationary or otherwise adverse side effects” and that “tariffs are ultimately financed by the tariffed nations, whose real purchasing power and wealth decline.” I’ve highlighted in the past that the Trump administration’s economic platform has elements that are both growth positive and negative, and that price action in financial markets will largely be path dependent on what parts of the agenda are emphasized at what time.

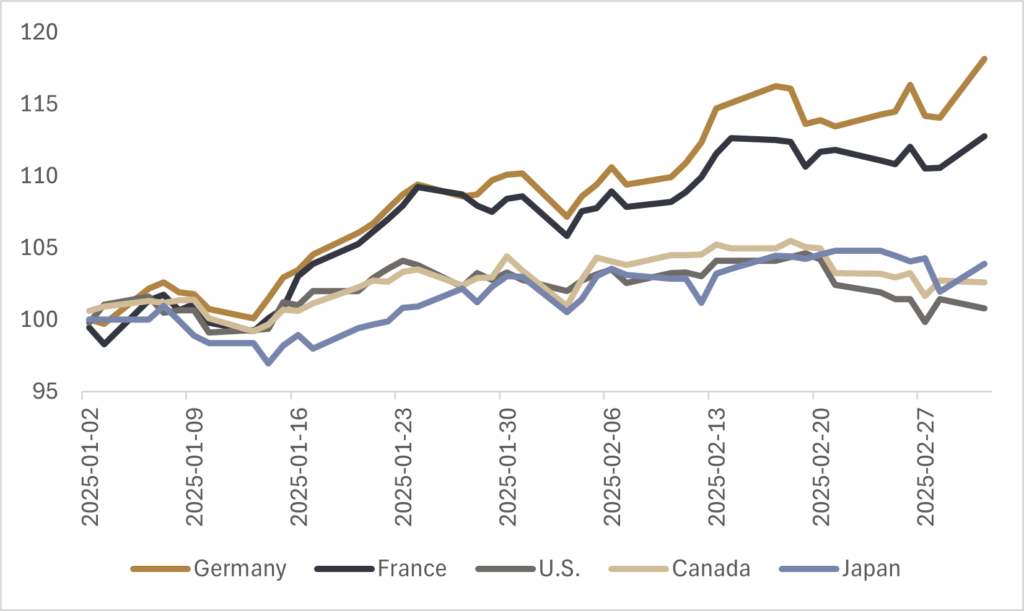

The current decline in U.S. bond yields and the outperformance of international equities relative to the S&P 500 is staring to reflect the market’s recalibration of expectations. Bessent’s recent comments have also reinforced the potential for a short-term growth shock to U.S. economic activity, with Bessent suggesting that the economy could experience a temporary period of sluggish growth—a “hangover”—as it adjusts to the withdrawal of expansive fiscal policies from the previous administration. Bessent argues that the negative impact of reduced stimulus may temporarily outweigh the benefits of future deregulation and tax cuts. Thus, while the long-term vision is to foster a more robust, deregulated market, the immediate aftermath could see lower yields and a slowdown in growth as the transition unfolds.

What has transpired over the last few weeks has reinforced the notion that over the next 6-12 months the U.S. could very well hit a bumpy patch for economic growth, and it appears as if the Trump administration is comfortable embracing the narrative that the economic “hangover” to be experienced is due to the policies of the old administration.

The always important question will be if investors will look past the short-term economic pain and anchor their expectations around the pro-growth policies that will follow, or if the growth scare could result in a more meaningful rotation out of U.S. equities and into international markets. There is a good case to be made that elevated valuations in U.S. markets could necessitate a rotation into European and Asian equities, which have much more attractive valuations, especially if the unification of Europe leads to a relatively quick re-prioritization of government spending and the associated fiscal stimulus results in a boost to economic output.

While the U.S. may face headwinds in the near term, the long-term structural changes driven by deregulation and lower taxes could ultimately spur entrepreneurial growth and innovation. For fixed income portfolios, the potential for a near term growth shock makes U.S. bonds look more attractive as growth hedges in portfolios, especially longer-duration offerings. For international bond markets like Canada and Germany, it is likely that if this thesis plays out we should see a bull-steepening of the yield curve; the threat of tariffs on each country will likely keep the respective central banks with a dovish tilt and further cuts to short-term interest rates, while likely increases in defense spending and domestic investment will increase debt supply and put upward pressure on the long-end of the yield curve.

While a depreciation in the value of the U.S. dollar is generally beneficial for commodity markets, some growth-sensitive commodity markets could be at risk of a sharper than anticipated slowdown in aggregate demand. The possibility of a U.S. growth scare, driven by a deliberate shift away from fiscal stimulus and a reordering of economic priorities, poses significant navigational challenges in the coming months. The declining ten-year U.S. treasury yield reflects market expectations of slower growth, and the evolving narrative around the Mar-a-Lago accord suggest that the U.S. may be reorienting its economic strategy toward deregulation, lower taxes, and a weaker U.S. dollar.

For investors, these developments underscore the importance of a diversified approach to portfolio construction. We believe that utilizing strategies that embrace capital efficiency to gain market exposure, while also “stacking” alpha-seeking rules-based overlays to dynamically adjust market exposures, are well positioned to take advantage of an environment where economic policies and prioritizations are in a fluid state.

The coming months will require vigilance, flexibility, and a keen eye on evolving economic indicators as the U.S. navigates this complex transition. Ultimately, while the short-term outlook may be marred by uncertainty and potential shocks, the long-term benefits of a more deregulated and tax-friendly environment could pave the way for renewed growth and innovation.

Happy investing!

Scott Smith

Chief Investment Officer

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.