The Federal Open Market Committee (FOMC) concluded their March meeting today and, as expected, left interest rates unchanged at 5.25%-5.50%. Given that this was widely anticipated, market participants looked through the main interest rate announcement and took their cues from Jerome Powell’s press conference and updates to the FOMC “dot plot,” which on balance were all positive developments for risk assets with equities and bonds gaining on the day.

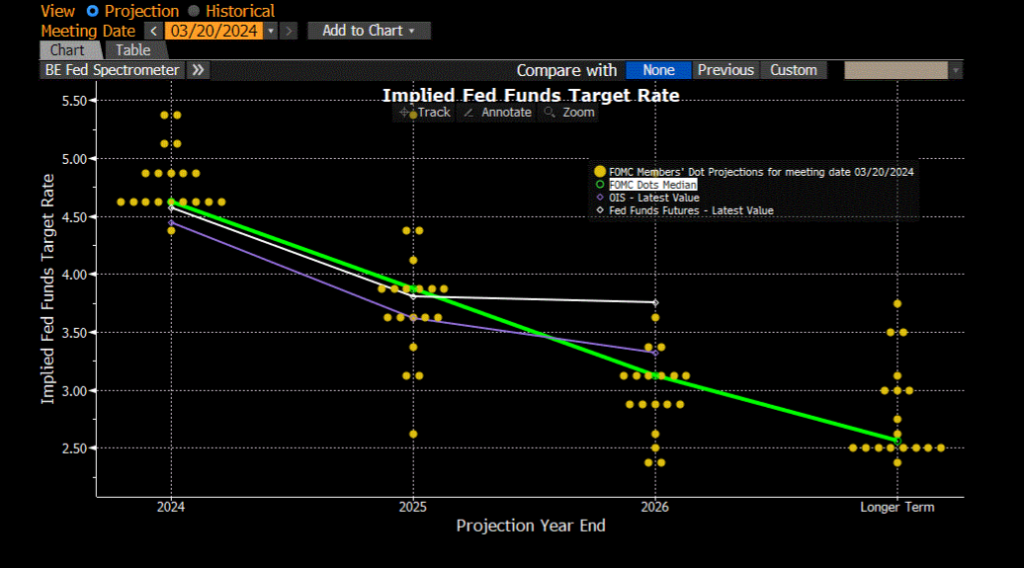

The dot plot is an aggregation of FOMC participants’ expectations for overnight interest rate levels in the future, and earlier this year there had been a large gap between what FOMC members anticipated occurring and what financial markets expected to occur based on federal funds futures markets. At the start of the year, market participants were pricing in roughly six interest rate cuts in 2024, while the FOMC was estimating only three. After some warmer-than-anticipated inflation readings over the last few months, market expectations had come back in-line with the last FOMC dot plot and the expectation for only three interest rate cuts this year.

There was a bit of a relief rally in financial markets, as the new FOMC dot plot was released and the median expectation for rate cuts this year held steady at 75bps (three cuts). Heading into yesterday’s meeting, there was some risk that the median expectations from the FOMC could decrease from three cuts to two given the recent inflation data. While there now seems to be alignment between the FOMC and market participants on how much monetary policy will ease this year, the median long-term interest rate forecast rose from +2.5% to +2.6%, giving the updated dot plot a slightly hawkish tilt. Despite expectations around the terminal rate increasing slightly – which we wouldn’t put too much stock in, given the folly of long-term forecasts – market expectations for a June rate cut have strengthened from 60% to 70%.

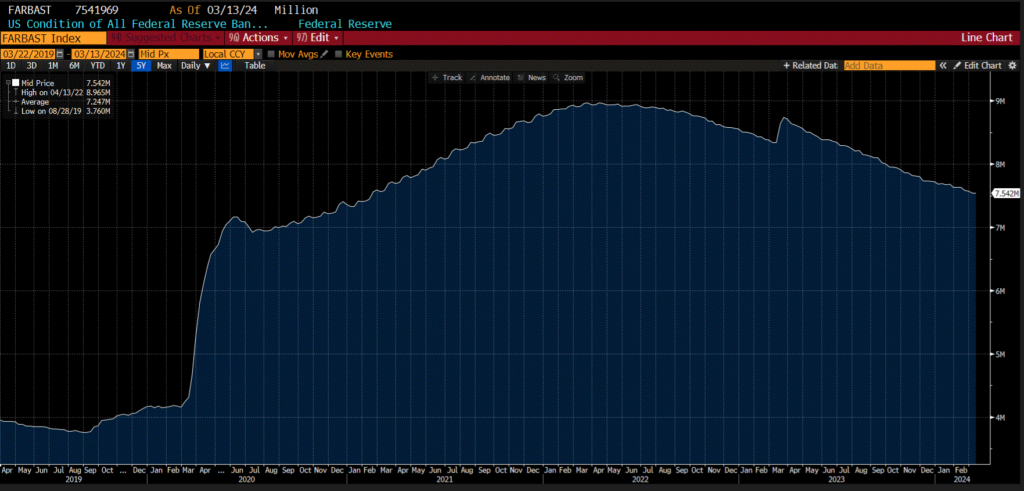

The big takeaway from my perspective is that the FOMC is getting increasingly confident that they are about to stick a soft landing. At the press conference, Jerome Powell signaled that he and the FOMC are increasingly confident that interest rates are at their peak and they will be begin dialing back the restrictive nature of monetary policy this year. At the same time, the FOMC increased their forecasts for GDP growth in 2024 from +1.4% to +2.1%, as well as median core PCE inflation in 2024 from +2.4% to +2.6%. Further to this “goldilocks” forward guidance, with interest rates easing while growth remains strong and inflation is stickier than originally anticipated, the FOMC also discussed the Federal Reserve’s balance sheet and the pace of its runoff. During the press conference, Powell commented that while there were no discussions around the immediate abatement of quantitative tightening, he thought it would be appropriate to slow the pace of balance sheet runoff soon so that there would be a smooth transition and reduce the probability of stress in money markets. Since the start of quantitative tightening, the Fed’s balance sheet has shrunk by $1.5 trillion, which may seem like a lot, but with context below, it is still well above pre-COVID levels. We’ve heard comments earlier in the year from individuals at the New York Fed that they don’t believe the balance sheet will get back to pre-COVID levels, and so these comments today around the slowing of balance sheet runoff are in-line with our expectations.

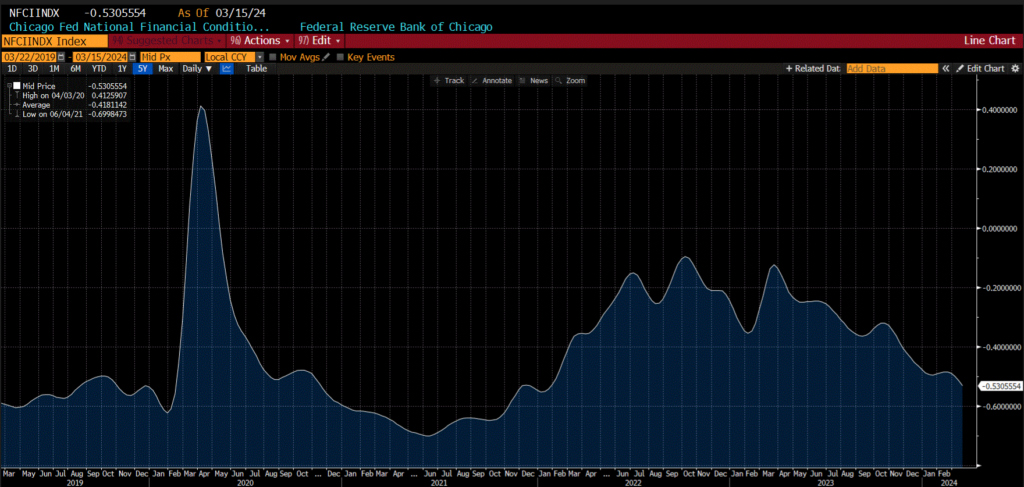

Financial conditions have continued to ease in 2024 as asset prices rise, and today’s announcement has done little to dissuade the rising tide lifting all boats. U.S. equities rallied and finished the day up +0.9%, and the U.S. 10-year bond future edged higher by +0.2%. We saw a bull-steepening in the yield curve with short-term yields falling by more than long-term yields, which should give some relief to the steepener trade that has faltered for much of this year. The U.S. dollar fell -0.7% from its daily high against a basket of global currencies, while gold popped higher and increased by +1.2% on its session.

While the Fed’s confidence on being able to navigate a soft landing (i.e., cutting rates without a recession) has increased, it will be interesting to see how things develop over the next few months. The transmission mechanism of monetary policy through easier financial conditions as short-term rates fall, combined with a falling U.S. dollar and commodity prices seeing some upward momentum, may continue to keep a floor under inflationary pressures throughout 2024. At Viewpoint, we’ll be keenly focused on the evolution of goods inflation through commodity prices, along with labour market indicators like wage prices and job openings, though Powell did say that a strong labour market by itself wouldn’t be a reason to not cut. The worst case for the Fed would be to reduce interest rates this year and then have to reverse course if inflation flares up again.

In conclusion, while today’s announcement was a rosy assessment of the economy and a positive for risk assets, we continue to advocate for commodity exposure as a part of a robust investment portfolio, especially in an environment where evolving expectations for the direction of future overnight interest rates directionally impact stocks and bonds in a similar fashion, leading to a positive correlation between the two assets.

Happy investing,

Scott Smith, Chief Investment Officer

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.