Markets bounced back sharply last week, providing a much needed respite for equity investors. But, before we get too excited, we need to keep in mind that +20% rallies during bear markets are very common. In fact, the biggest up days in stock markets have historically occurred during major bear markets.

The Tech Bubble had three distinct rallies of +20% en route to a total drawdown of around -50%.

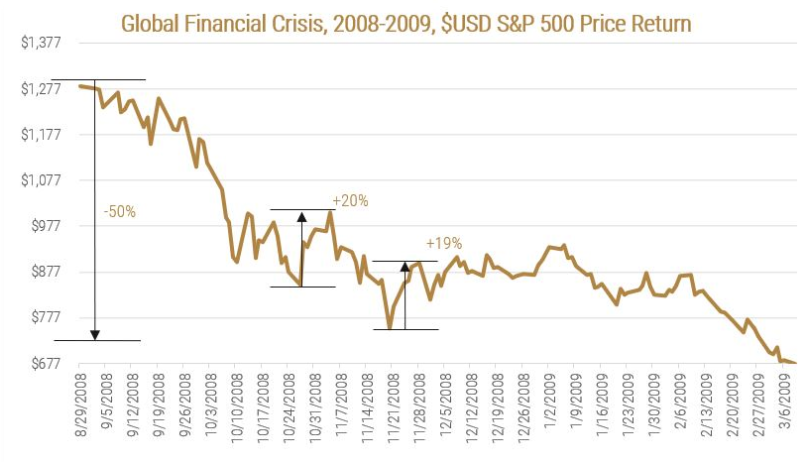

Similarly, the Global Financial Crisis (GFC) had two rallies of 20% in the midst of a -50% drawdown.

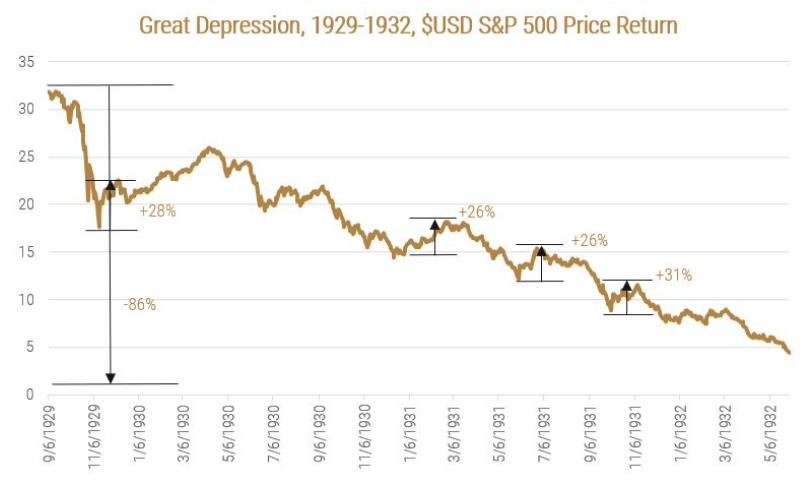

The Great Depression had four instances of a +25% rally en route to a decimation of -86%.

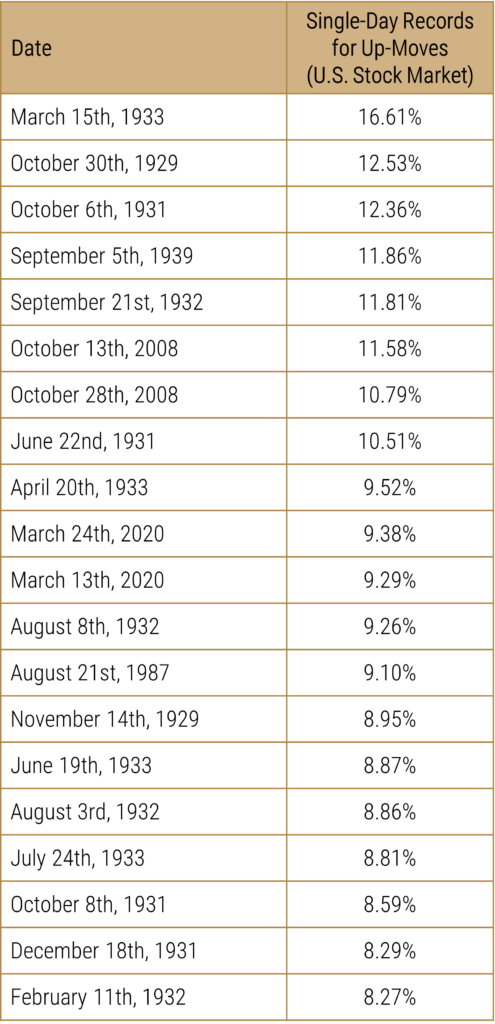

Looking at the top 20 single-day records for up-moves in the U.S. stock market, every single one of them came either during the Great Depression, the GFC, around Black Monday, or during the COVID-19 crisis:

This doesn’t exactly fill us with confidence in last week’s rally. Typically, bear markets do not bottom during periods of high volatility and high daily trading ranges.

The COVID-19 crisis is different than both the tech bubble collapse and the GFC, in that both of the aforementioned started in financial markets and bled into the real economy. Conversely, the COVID-19 crisis started in the real economy and is bleeding into financial markets. While there have certainly been pandemics throughout the existence of our species, there has never been one in an era like ours – an era in which information (and misinformation) flies at the speed of light, human life is valued at the highest it has ever been in history, unprecedented globalization and global travel are connecting us more than ever, and corporations increasingly rely on the entire globe for their revenues.

The biggest juxtaposition between the COVID-19 crisis and the GFC is the speed and depth of the monetary and fiscal response from governments and central banks this time around. This will act as an offsetting force to the severity of the economic shock, much of it from lessons learned the hard way in 2008-09.

There is no question that there will be a global contraction this year. But, how deep and for how long will it go? Since February, the market has been desperately trying to find the answer to these questions, causing the most violent bear market in history. Could this be a short-term, transient recession and earnings shock? Will it be longer-term, with viral flare-ups through the rest of 2020? Will it permanently affect our society’s norms around productivity, technology, and culture? What will be the impact of the continuing massive global deficits in the long term?

Almost all of the data that we’ve looked at, which is sparse at this point given the typical lag in economic data, is pointing to a significantly sharper contraction in the real economy than the GFC. How much will the market look through these numbers and price itself on a recovery through the end of the year, supported by a coordinated policy response?

On October 16th, 2008, Warren Buffett penned an op ed for the New York Times, alerting the world that he was aggressively buying the U.S. stock market. Stocks went on to decrease another -30% from that day to the bottom.

Are we saying there’s a lot more downside from here? No. Are we saying that we’ve bottomed? No. All we’re saying is that if you’re trying to bottom fish, be cautious. History may not agree with you.

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.