There has been a lot of talk over the past few years about how passive investing and the rise of exchange traded funds (ETFs) would be the next financial market bubble that would wreak havoc for investors. Since the Global Financial Crisis of 2008 and the ensuing period where index investing started to gain in popularity, there have only been a few episodes where financial market sentiment has soured materially (i.e., Chinese renminbi devaluation of 2015, trade war concerns of Q4 2018). While the aforementioned periods did represent serious declines in equity investor wealth, markets generally rebounded fairly quickly. As such, there hasn’t been a period of panic in financial markets similar to what occurred in 2008 to test the mettle of ETF products – that is, until the COVID-19 pandemic of 2020.

As the uncertainty around the economic impact of COVID-19 ratcheted higher in late February, financial markets seemed to be in free-fall and investors were looking to unload risk at almost any price. What transpired was one of the fastest and sharpest drawdowns for global equity markets in modern history. While the cause of the deterioration in risk appetite was by no means sparked by a passive investing bubble, it is nonetheless a great time to assess how ETFs held up during the pandemic panic and whether they were able to deliver as promised.

The main argument cited by critics of ETFs was that the rise in passive investing would result in less ‘price discovery’ being conducted by ‘active investors’ and this would create a bubble in financial assets. As of the end of 2018, ETFs domiciled in the United States that owned domestic equities accounted for roughly 6.0% of the total U.S. equity market capitalization. The $3.4 trillion U.S. ETF market represents 71% of the global ETF market, so even if we conservatively grossed up net ETF assets to account for international ETFs holding U.S. equities, it would still only be roughly 8.4% of the total U.S. equity market capitalization (Bloomberg, VIP internal). While that number is large and growing, we can conclude it is not yet large enough to deem that price discovery is being impaired by the popularity of ETFs.

The other argument from ETF cynics is that the products would exacerbate a liquidity crunch in times of financial stress given that ‘everybody would be on the same side of the trade’ and investors wouldn’t be able to get out at a fair price when they needed the liquidity. This is perhaps the timeliest claim to study given the severity of the recent drawdown. Could ETFs withstand a barrage of higher than normal trading volume and still operate efficiently, or would they exacerbate a liquidity crunch?

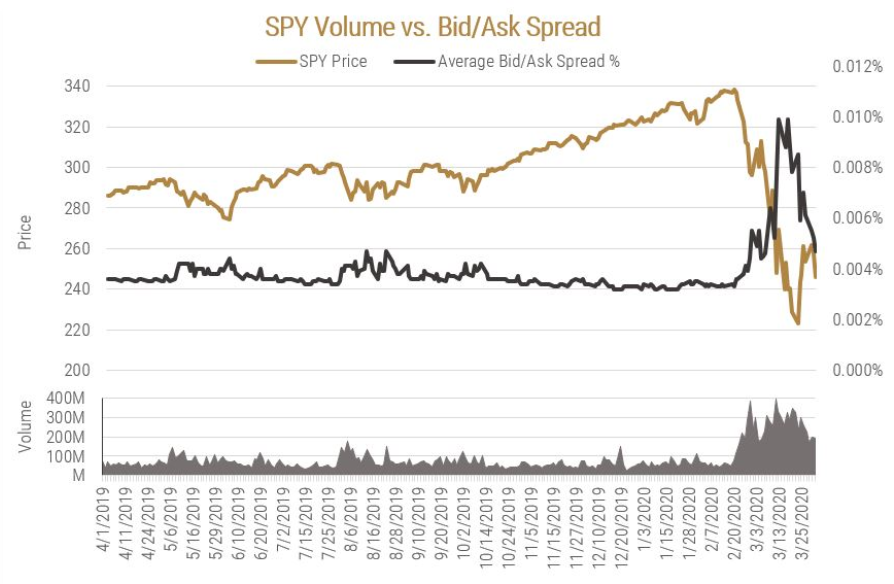

If we take a look at the largest and most liquid ETF, SPDR S&P 500 (Ticker: SPY), we can see that volume and bid/ask spreads ratcheted up materially in late February and early March as the sell-off in equity markets intensified.

This is no surprise. It is quite often that when we see volatility increase in financial markets, ETF volume traded as a percentage of total equity volume traded also increases. Given that ETFs allow investment managers to quickly and efficiently adjust their asset allocations, it makes sense that we see ETF volume rise along with volatility. Typically, ETF volume as a percentage of total volume hovers in the 20-35% range, moving higher when volatility increases. Although ETF trading has increased dramatically during the COVID-inspired drawdown in equity markets, are we seeing a malfunction in pricing? Effectively, while everyone is running for the exits, are we seeing underlying liquidity in ETFs disintegrate relative to the underlying assets, thus exacerbating a liquidity crunch?

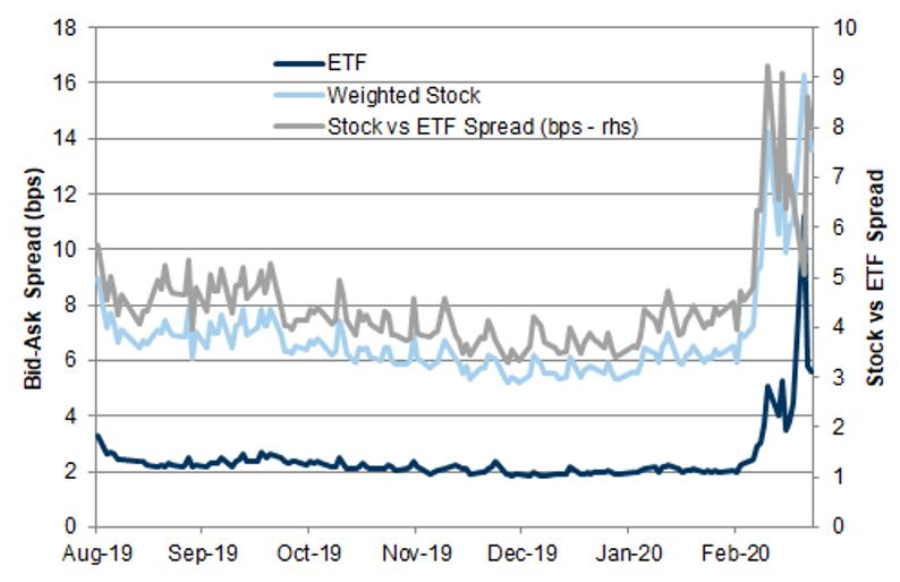

With the most recent surge in volume of ETF trading, we haven’t seen a deterioration in liquidity (bid/ask spreads) relative to the underlying assets as skeptics have suggested would occur. In the chart below, you can see that while ETF bid/ask spreads increased during the recent sell-off, the underlying individual equity bid/ask spreads have also increased, and ETFs continue to trade tighter than the underlying assets.

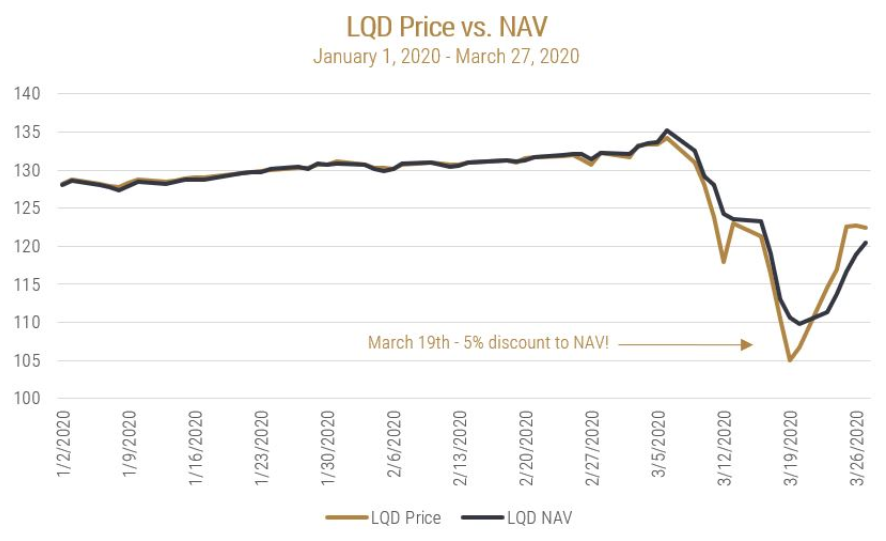

So, you might say that’s all fine and dandy; the equity market and the ETFs tracking stocks are functioning normally. But, what about all the headlines we’ve been reading about the dislocation between the price of ETFs that track bonds and the underlying net asset values (NAV)? Doesn’t that displacement of prices from NAVs mean that ETFs have not passed the stress test and they are inherently broken?

While it is easy to assume that seeing ETFs like the iShares iBoxx Investment Grade Corporate Bond ETF (Ticker: LQD) trade at a substantial discount to NAV is akin to ETFs failing the stress test, we would opine the opposite is actually true.

What is actually happening under the hood is that the heightened volatility in financial markets has caused market making activity in the corporate bond space to effectively seize up. With dealers unwilling to warehouse any unnecessary risk, little actual trading in the underlying corporate bonds has been occurring. Given turnover in the underlying bonds that make up the basket of securities the ETF tracks is greatly reduced, quotes on the underlying bonds are effectively stale and not indicative of the ‘true’ level at which you could unload those bonds if absolutely required. Dave Nadig from ETF Trends had a great blog post on how the NAV estimation process for bonds works and why published prices can deviate substantially from where the ‘true’ fair value lies.

In the example of LQD and other bond ETFs that have dislocated from underlying NAV, what is happening is that the ETFs are providing investors with liquidity when there may be none (or severely impaired) in the underlying bonds. Effectively, not only are ETFs not exacerbating the underlying liquidity crunch, the vehicle is creating a more accurate representation of where fair value actually is, along with allowing secondary market liquidity of the ETF to reduce the liquidity burden in the underlying. Whether the ability to access liquidity when it might not be available in the underlying is in the best interest of long-term investors is a separate question and out of the scope of this piece, but we can conclude that the ETF vehicle has safely passed its stress test.

What should be concerning for investors are those who are invested in fixed income mutual funds. In an ETF structure, when an investor wants to exit the vehicle, they must depart through either a sale of their units on an exchange or to a market maker who then in turn can facilitate an in-kind redemption. When a trade is large enough and there isn’t enough volume listed on an exchange to execute the fill at a reasonable price, the trade will typically occur off-exchange through a market maker. The market maker acts as a principal in the transaction and would make the investor a price that accurately reflects the true level of NAV. As in the above example, this price would be at a discount to NAV. The in-kind redemption process allows the ETF issuer to buy the units the investor sold to the market maker in exchange for delivering the underlying bonds to the market maker. This process leaves the ETF with the same NAV as had the redemption not occurred. The only party that is affected by the redemption is the investor that exits and, in this case, has received a lower price for their ETF shares than the published NAV.

This is not the same process as what happens in mutual funds when an investor would like to exit. Traditional mutual fund structures have a daily NAV – which like ETFs may be stale based on trading in the underlying – allowing investors to redeem at the published NAV and receive cash. Unlike an investor wanting to exit an ETF and having to go through a market maker, the portfolio manager of the mutual fund must raise cash to fund the redemption. Therefore, the portfolio manager must go into the market to sell the underlying bonds that may have been providing stale NAVs into the fund, thereby marking down the holdings when the trades go through. Not only does this process revalue the NAV for the mutual fund lower, but the redeeming unitholder that was able to exit at the stale NAV is better off at the expense of the remaining unitholders than if the exit was done in an ETF structure.

In our opinion, the ability of ETFs to protect other investors in the vehicle by passing on market impact costs to those participants causing the impact in the first place is not celebrated enough. In addition, the ability of these vehicles to provide a more accurate representation of current value because of the creation/redemption process and trading in the secondary market actually helps to provide liquidity when it is otherwise scarce.

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.