Financial markets hit another speed bump this morning, with U.S. inflation coming in warmer than anticipated. Both headline and core consumer prices surprised to the upside, with headline CPI increasing by +3.5% relative to one year ago, missing expectations of a +3.4% increase and up from February’s +3.2% reading. Housing and gasoline costs contributed more than half of the increase in CPI, which isn’t necessarily surprising, given the uptick in gasoline prices we’ve seen so far in 2024. Stocks and bonds both hit an air pocket after the economic data hit the wires, as stickier consumer prices reduced the probability that the Federal Reserve (Fed) will be able to ease rates as much as they had forecasted. Expectations for a June rate cut have now fallen to 15% with only two rate cuts priced in for 2024. U.S. stocks finished the day down -1.0%, while U.S. bonds were off -1.2%. Both Brent and WTI were up around +1.3%, while broad commodity markets, as proxied by the Bloomberg Commodities Total Return Index, were flat on the day.

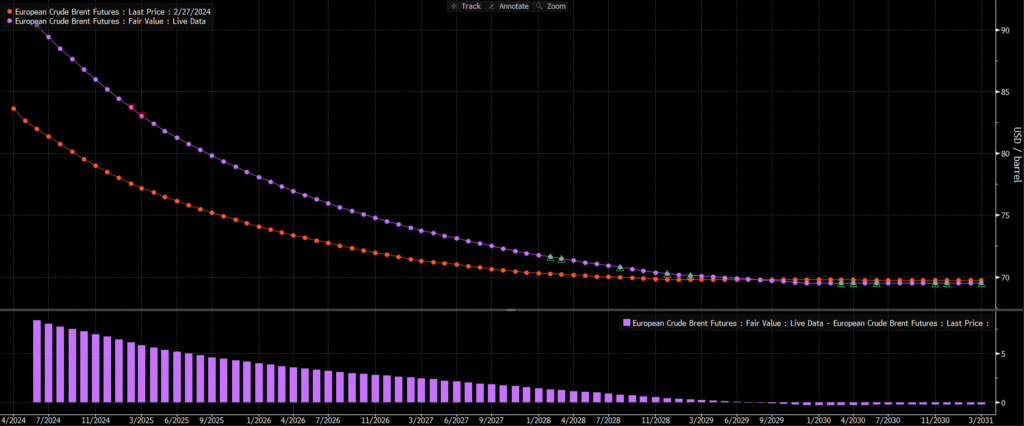

A little over a month ago, I wrote a note about the outlook for the oil market in 2024 and how, barring any additional geopolitical turmoil, supply and demand in the oil market appears well balanced. I was constructive on being long oil given the geopolitical landscape, but at weights lower than oil-heavy commodity benchmarks like S&P GSCI. Since that note was released, WTI and Brent oil are both up around +10%, with Brent currently pivoting around the $90/barrel mark and closing in on the all-important psychological level of $100. The backwardation in the Brent futures curve has gotten steeper, meaning that front month prices are rising at a slightly faster clip than further out on the curve, highlighting that participants are willing to pay a premium to secure supplies today.

Tensions have ratcheted higher after Israel’s strike on the Iranian consulate in Damascus added a geopolitical risk premium to oil prices, but just like in agricultural commodity markets, oil markets are also contending with their own supply disruptions. The OPEC+ cartel has been reducing their production to try and “balance” the market in response to increasing production from Canada and the U.S., Houthi attacks in the Red Sea have diverted and delayed crude shipments, and now Mexico is reducing its crude exports. As reported by Bloomberg, Mexico’s state-controlled oil company has suspended some of its exports in a pivot to refining more of its crude domestically, a promise made by Mexican president Andres Manuel Lopez Obrador to not rely as heavily on importing more costly refined products such as gasoline and diesel. The halting of Mexican exports is exacerbating an already tight market environment, which is bad timing, given that refinery demand is starting to ramp up ahead of the summer driving season.

One of the beneficiaries of continued tightness in global supply has been Canadian crude, which we have been particularly bullish on. The Western Canadian Select benchmark continues to see its discount to WTI narrow and is now at levels we haven’t seen in about a year. My bullish thesis for Canadian crude was based on the Trans Mountain Expansion (TMX) allowing for greater access to global markets, and the ability of Canada to be able to supply oil in a tight market will continue to be a boon for domestic producers. There is no doubt that the fundamentals in the oil market remain strong, as there doesn’t appear to be a thawing of geopolitical tensions on the horizon, especially given speculation over the re-imposition of sanctions against Venezuela. However, just like in the last note, the wildcard for oil markets continues to be OPEC+ and whether the cartel will take this opportunity to allow their members to start flowing more barrels and take advantage of higher prices, which would put somewhat of a cap on prices as more supply comes online.

At Viewpoint, the one thing of which we continue to be mindful is that we don’t foresee a change in our view that the “fight” for central banks in the coming years will continue to be reigning in inflation, as opposed to supporting growth. Until we see financial market conditions tighten enough to where aggregate demand falters and the labour market materially eases, we believe we’re in a continuation of a “bumpy landing” scenario where interest rate volatility (and general risk sentiment) remains heightened. I’ll also reiterate that days like today are good reminders for the diversification benefits that commodity exposure can provide to investment portfolios, especially when stocks and bonds fall in tandem due to changing interest rate expectations.

Happy investing!

Scott Smith

Chief Investment Officer

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.