As financial markets digest the implications of another presidential term for Donald Trump—this time with a more definite mandate as the Republicans control both legislative branches of Congress—one of the outcomes has been a rising U.S. dollar. The U.S. dollar has gained +3% against a basket of global currencies since the election, due to expectations of faster economic growth in the U.S. relative to the rest of the world. While I’ve mentioned that there could be risks to an optimistic view on U.S. economic growth with stricter immigration policy and the potential for mass deportations, markets are currently more focused on tariff policy and how that will negatively affect economic growth in Europe and China, boosting the value of the U.S. dollar.

The rising U.S. dollar has acted as a headwind for broad commodity markets, with crude oil exhibiting notable weakness. Since the presidential election, West Texas (WTI) front-month futures contracts are down -4.0%. Heading into the election, the prevailing narrative was that with Trump returning to the White House, there would be a de-escalation in the Ukraine-Russia war, though hawkish foreign policy toward Iran would act as a counterbalance on the geopolitical risk premium embedded in oil prices. Since the election, not only have we seen positive headlines around an end to the war in Ukraine, but there are increasing rumors around the potential for a ceasefire deal in the Middle East.

In addition to the de-escalation of geopolitical conflicts deflating the geopolitical risk premia from crude oil prices, market participants are also trying to gauge how much U.S. tariff policy will affect Chinese crude oil consumption. Oil demand has already been struggling to keep pace with estimates from earlier this year, and the International Energy Agency (IEA) is now forecasting oil demand to come in at just under one million barrels per day, slower than the two million barrels per day of growth seen in 2023, and less than the one point two million barrels per day average growth over the 2000-2019 period. The slowdown in Chinese growth has been the main drag on global crude demand, with the Head of Oil Industry for the IEA saying on Bloomberg TV that “it’s possible that China’s oil demand has peaked.” While forecasting peak oil demand is rife with uncertainty, it does highlight that in addition to China’s movement towards greater utilization of electricity (which doesn’t always mean cleaner emissions given their use of coal for electricity generation), the threat of increased tariffs hampering Chinese growth isn’t a welcome development for global oil demand in the near term. The challenges for crude demand due to slowing global growth are further compounded by the fact that OPEC+ has voluntarily cut production to help shore up prices, delaying the unwind of these cuts until January 2025 at the earliest. The potential for an increase in OPEC+ production represents downside risk to the global crude benchmarks, and even if those voluntary production cuts remain in place, the IEA is still forecasting a one million barrel per day surplus for 2025.

While the fundamental picture seems bearish, there are several upside risks to the current market environment for crude oil. Not only could a ceasefire in the Middle East fall through, but tensions could once again escalate in the region. Hawkish trade policy from the incoming Trump administration could be used as a bargaining tool for better trade deals, resulting in upside surprises to Chinese economic growth. However, the bigger question mark is how long OPEC+ will be comfortable ceding market share to non-OPEC producers. The Trump administration over the years has had a much more friendly relationship with Saudi Arabia than the Biden administration, and more OPEC+ supply coming online would have the added benefit for U.S. consumers that gasoline prices—and inflation—would remain low, an important pillar of Trump’s economic platform.

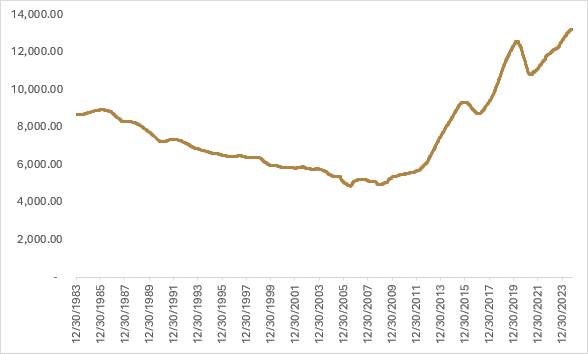

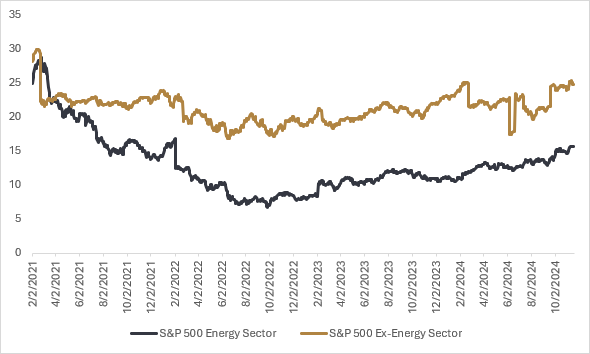

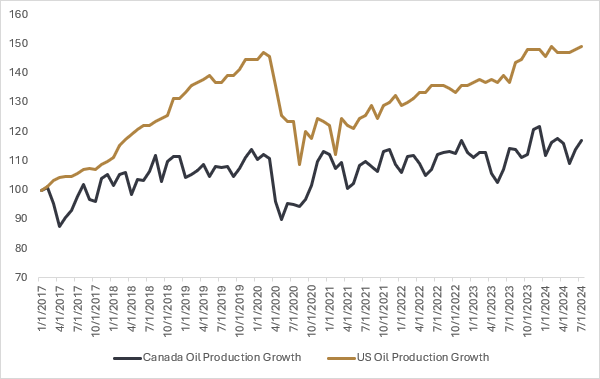

While we would opine that risks to crude prices are skewed to the downside, the environment for oil production in the U.S. continues to be favourable. The incoming Trump administration is going to nominate Doug Burgum from North Dakota as Interior Secretary. During his short stint running for the Republican nomination, Burgum campaigned on promises to bolster American energy production. Continuing to round out the Trump administration, reports over the weekend suggest that Trump will also nominate Chris Wright, CEO of Liberty Energy, as Energy Secretary. Wright is a vocal proponent of the oil and gas industry, advocating that fossil fuels are crucial for spreading prosperity and that the threat of global warming is exaggerated. U.S. oil production is already at record levels, though the incoming administration is likely to ramp up the sale of oil and gas leases to make sure the pipeline (pun intended) for oil production remains full. In addition to the pro-growth stance towards domestic oil production, productivity gains are also helping to bolster the outlook for the industry. Higher well productivity is propelling growth in the industry, with estimations that oil production in the U.S. will grow by 600k barrels per day next year, which is 50% higher than in 2024. Ten years ago, the break-even for producers in the Permian Basin was around $70/barrel, but according to S&P Global Commodity insights, increased productivity has made it such that producers are now profitable in the $40/barrel range, which is likely to help insulate the U.S. energy industry from any downward pressure on prices that could result from an increase in OPEC+ supply. Efficiency gains will likely continue to drive cash-flow yields, and valuations are extremely attractive relative to other sectors of the S&P 500.

The pro-growth deregulation policies of the incoming U.S. administration continue to highlight an ever-growing gap in alignment between U.S. and Canadian energy policy. The recent regulations from the Canadian government on capping oil and gas emissions run counter to U.S. energy policy, and if Canada doesn’t want productivity to fall further behind our neighbour to the south, the regulatory burden in Canada will have to ease. The outlook for Canadian producers under a Trump administration is more optimistic than it has been in that it is unlikely tariffs would be applied to U.S. oil imports from Canada. Also, a more favourable regulatory environment will put pressure on Canada to take a hard look at the divergence in energy policy with that of its neighbour. Even if you are of the belief that the world is moving towards cleaner sources of energy and there is limited shelf life for hydrocarbon demand (something we don’t foresee given energy needs in Asia and other developing countries), more favourable energy policy in North America that allows the continued displacement of OPEC+ supply is a net benefit for ethical energy production.

Happy investing!

Scott Smith

Chief Investment Officer

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.