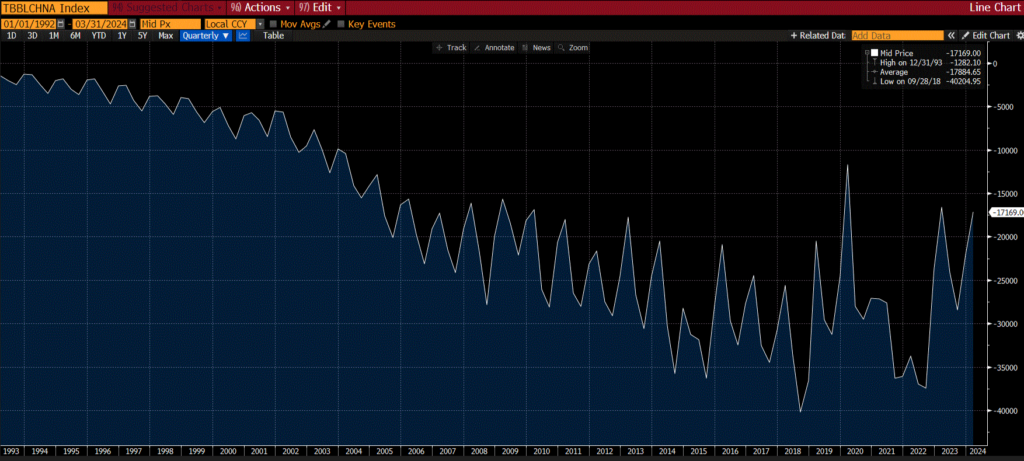

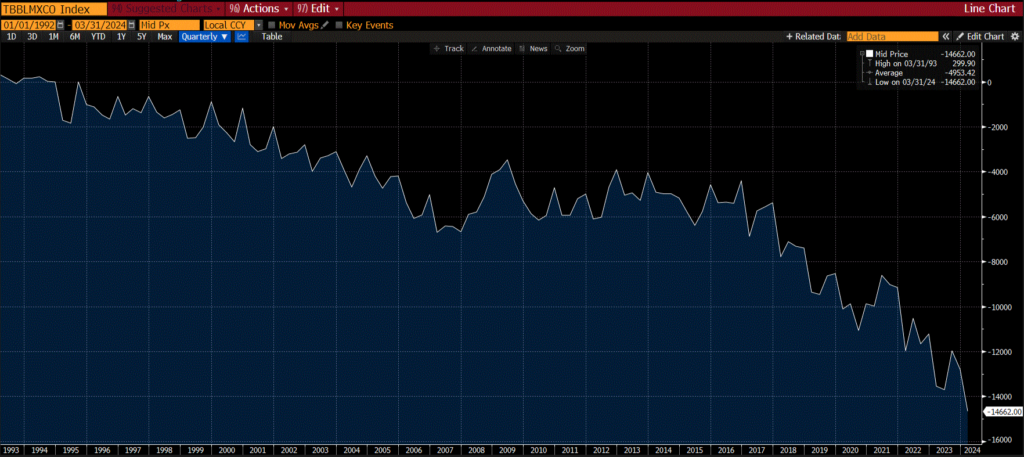

One of the key themes on which we’ve been focusing this year in the run-up to the U.S. election has been foreign trade policy and how this could impact everything from growth and inflation, to the U.S. dollar. While both political parties in the U.S. can’t seem to agree on much, one thing they have been able to agree on is hawkish trade policy towards China. Former President Trump campaigning on increasing tariffs on Chinese imports to 60%, while aggressive, is not that surprising, given his actions during his last presidential term. What has been somewhat surprising is the Biden administration’s decision to not rollback the tariffs on Chinese imports that were put in place during Trump’s previous administration, given the Democrats general platform of championing free trade. The working paper by Corte and Fu that I mentioned in my note on “Trump, Trade, and the Greenback” has some good data around generalized trade policy under various administrations over the last 40 years. The hawkish trade policy towards China has been having its intended effect, as we’ve seen the trade balance between China and the U.S. start to arrest its downward trendline. While many of these Chinese goods are likely getting rerouted to the U.S. through places like Vietnam and Mexico, this will likely be the next focus for the U.S. administration as it relates to reducing Chinese imports.

On Tuesday, the Biden administration upped the ante on hawkish Chinese trade policy, increasing tariffs on several import categories, mainly relating to the renewable energy industry. Tariffs on electric vehicles imported from China will be rising from 25% to 100%, electric vehicle batteries from 7.5% to 25%, solar cells from 25% to 50%, and steel and aluminum from 7.5% to 25%. There are a few notable takeaways from this policy action, with the first being a confirmation that there is little political incentive on both sides of the aisle to ratchet down the heat on China. There is a possibility that under a Trump presidency the hawkish trade policy is used as a bartering tool for a larger deal at some stage, whereas it seems increasingly likely that the Democrats continue to be focused on the protection of certain industries that they see as the future of manufacturing and industrialization in the U.S. What will be interesting to square for Democrats will be the increased cost to consumers for sustainable energy and how that will impact emission targets in the short term.

Regardless of where you stand on the renewable energy industry and if they will be the manufacturing jobs of the future, the policy action from the Biden administration continues to suggest that we are moving into a period of “reindustrialization” in Western economies, rebuilding supply chains to be more robust to both geopolitical and macroeconomic supply shocks. The movement away from globalization and towards more protectionist trade policies is something we expect to see in an increasingly multi-polar world. The implications of this will be increased deficit spending by governments as they rebuild their supply chains to be more domestically focused, putting upward pressure on prices, and a higher neutral interest rate for capital. The balancing feedback loop mechanism here is that protectionist trade policies are generally negative for global growth, and lower demand puts downward pressure on prices. However, in our opinion, this will have more of a negative impact to the services sector as demand for goods and commodities will be well supported through government spending and infrastructure bills like CHIPS and IRA that we’ve already seen from the Biden administration. We continue to believe that commodities are positioned to do well in a secular shift away from globalization and will be accretive to diversification in multi-asset portfolios. Furthermore, strategies that harvest efficiency through using dynamic gross exposure on highly diversified portfolios are positioned to do well in an environment where the neutral rate of interest settles higher than it has in the past twenty years, and various multi-asset risk premiums are more efficiently compensated.

Speaking of consumer prices and the quest of central banks to tame inflation, we got some additional data points this week for the Federal Reserve (Fed) to add into their data dependent calculations. Yesterday, producer prices for April hit the tape, and they came in slightly warmer than anticipated. There were some revisions to the March numbers that muted the impact of the much hotter April figures, but on a year-over-year basis, core PPI came in at +2.4%, up from the downwardly revised +2.1% in March and above the +2.3% pace economists had expected. Today, consumer prices for April were released and there was a collective sigh of relief from markets that there was not another hotter-than-anticipated reading. Headline inflation for April came in at +3.4% on a year-over-year basis, which was as expected, and down from the +3.5% pace in March. The core CPI reading registered at +3.6% on a year-over-year basis, again as economists had expected, and an easing from the +3.8 % pace from March. One notable area of the headline CPI figure is that energy costs were a positive contributor to headline CPI this month and appear to be gaining some momentum after being a negative contributor to headline CPI since March of last year. Within the core reading, shelter costs are probably not moderating as fast as the Fed would like, increasing at a stable pace relative to March. This will continue to be a key area the Fed is focused on taming. To wit, the ‘supercore’ CPI reading accelerated in April to +4.9% on a year-over-year basis, up from the +4.8% reading in March, with transportation services continuing to show momentum in price increases.

Although consumer prices were in-line with what economists had expected, retail sales for the month of April came in softer than anticipated. For headline retail sales, there was no growth on a month-over-month basis from March, well short of the +0.4% forecast from economists. There was a similar miss to the retail sales control group, which declined -0.3% on a month-over-month basis, missing the +0.1% pace that had been expected. The combination of an in-line reading for consumer prices with softer-than-expected retail sales data have kick-started a rally in financial assets today. The combination of an in-line reading for consumer prices with softer-than-expected retail sales data led to a rally in financial markets today. The S&P 500 finished the day up +1.2%, while U.S. 10-year bonds also rose by +0.6%. With the increase in risk appetite based on the potential for the Fed to cut interest rates this year, the U.S. dollar fell against a basket of global currencies by -0.7%, and gold got a boost on the prospects for easier monetary policy, increasing by +1.4%. Market expectations for the magnitude of interest cuts from the Fed this year have now been increased back to two, with one in November and one in December. We’ll have to see how financial conditions evolve over the next few weeks, as the next major economic data point for the Fed will be the May employment report and the state of the U.S. labour market.

Happy investing!

Scott Smith

Chief Investment Officer

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.