The traditional 60/40 balanced portfolio is no stranger to coming under fire. Many pundits have decreed the death of the balanced portfolio, arguing that a low yield environment will prove insurmountable and bonds will no longer be able to provide necessary diversification for investor portfolios. This proclamation has yet to be proven correct, and in the investment management industry, being too early is the same thing as being wrong. That being said, is this time different?

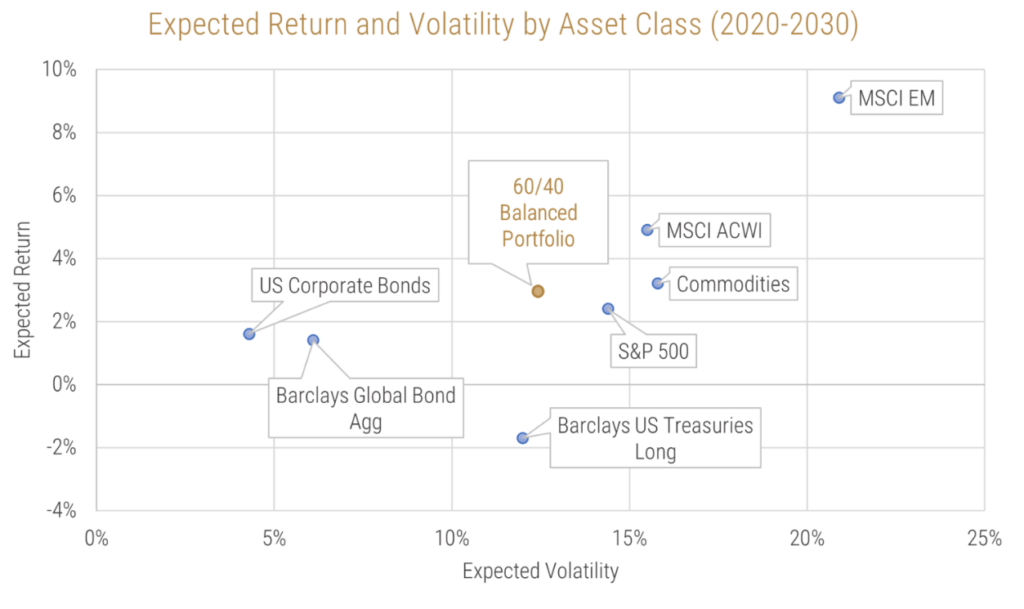

With interest rates continuing their march lower, both for structural reasons and in response to the COVID-19 pandemic, this has pushed equity and nominal bond valuations to historical highs. A falling discount rate has a dual effect of increasing both equity and bond valuations, because it increases the present value of cash flows produced by these securities. A global balanced portfolio (60% MSCI ACWI and 40% Bloomberg Barclays Global Treasuries) has returned 9.3% in Canadian dollars on an annualized basis over the last ten years (Source: VIP Internal); however, the next ten years are not expected to look as rosy. Based on current valuations, the 60/40 portfolio is expected to return 3.5% on an annualized basis, before inflation, taxes, and fees. The elevated valuations caused by a low discount rate are a major factor in why a traditional 60/40 portfolio is expected to produce such subdued returns over the next 10 years. We should also mention that just because a 60/40 portfolio is expected to produce nominal returns of 3.5% on an annualized basis, it does not mean that this will be the realized return in each year. Instead of a stable 3.5% return per year, what could potentially happen is a major reversion in both equity and nominal bond valuations (i.e., a sharp drop in prices), which then leads to a higher expected return profile on a go-forward basis.

What are investors to do in an environment where investment returns are expected to be so subdued? This question has been raised again and the answer is unfortunately far from conclusive. One potential solution is to shift additional assets into private markets, such as real estate and infrastructure. However, these asset classes are typically not accessible to all investors and generally come with liquidity restrictions where investors can’t access their capital for long periods of time. They are also typically more complex and are accompanied by higher fees.

The less radical answer being offered for traditional investment portfolios is to replace government bonds with corporate debt, moving higher on the risk spectrum to seek additional yield.

Moving a client’s portfolio from nominal government bonds to investment grade corporate credit might help to alleviate some of the yield challenges facing investors; however, there could be unintended consequences with making the shift. Increasing an investor’s allocation to corporate debt may boost the yield for the bond portion of the portfolio by 1% (the average yield on the Bloomberg Barclays Global Aggregate Credit Index is 1.5% versus just 0.5% for the Bloomberg Barclays Global Aggregate Treasuries Index), but investors may be overlooking how this adjustment could affect the overall risk of the portfolio.

Increasing exposure to corporate debt has the potential to increase the overall risk of the portfolio, as the historical correlation between corporate bonds and equity markets is higher than the correlation between equity markets and nominal bonds. By adding exposure to a more correlated asset class, investors may be unknowingly increasing the risk in the overall portfolio in the pursuit of a higher yield. The monthly correlation over the last ten years between global equities and global treasuries is 0.18 versus a correlation of 0.64 between global equites and global credit. (Source: Bloomberg) This means that in times of financial stress, the “bond” allocation of an investor’s portfolio may not provide the much-needed ballast to help offset a downturn in equity markets. For example, if you held a 60/40 portfolio comprised of global equities and global treasuries, you would have experienced a -14% drawdown during the heart of the COVID-19 bear market. If instead your fixed income portfolio contained solely global credit, your drawdown would have been closer to -18%. (Source: VIP Internal)

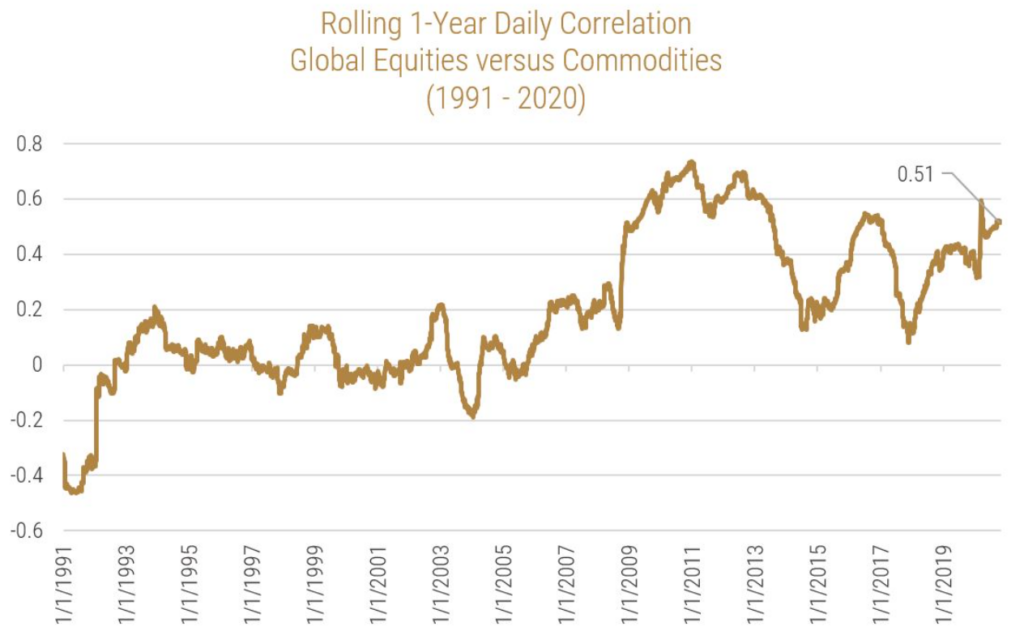

If inflation is the main risk for the future return prospects of a traditional 60/40 portfolio, then one could argue that financial pundits are focusing on the wrong remedies by recommending that investors should look for ways to enhance yield in their portfolios. An often-underutilized solution for enhancing a traditional 60/40 portfolio is to include alternative asset classes like inflation-linked bonds and commodities as a way to diversify the portfolio’s exposure and protect against the re-emergence of inflation.

LONG LIVE THE 60/40!

One way that investors could enhance their portfolio is to add exposure to inflation-linked bonds. The basic premise of inflation-linked bonds (also called real return bonds) is that the principle and coupon payments are indexed to inflation, therefore increasing along with inflation. At a very high level, government bond investors have two main sources of risk:

-

Term Risk: Locking up capital for a specific amount of time in return for interest payments

-

Inflation Risk: A dollar lent today is worth less than when it is returned in the future, assuming inflation is positive

By removing the effect of inflation, investors are then locking in a ‘real’ interest rate in exchange for their capital, leaving only term risk.

One misnomer about inflation-linked bonds is that they should be a good “hedge” against inflation. This is an interesting topic that will need more unpacking in a future post, but on the face of it, inflation-linked bonds do not have a high correlation to inflation as a coincident indicator. (Source: Ang, 2014) In theory, this makes sense given that the underlying mechanics of real return bonds neutralize the effects of inflation, so demand should be increasing when the market expects inflation to rise, not after there has already been an inflation shock. In an environment where inflation expectations increase unexpectedly and put upward pressure on nominal rates, real interest rates might remain stable. In this scenario, inflation-linked bonds may not increase in value and thus exhibit a positive correlation with inflation, but they do not lose value like nominal bonds in an environment where there is an upside inflation shock.

While it does seem like an attractive proposition to gain exposure to an asset class that can neutralize any upside inflation surprises, there are some challenges with investing in inflation-linked bonds without doing proper due diligence. For starters, the inflation-linked bond market is much less liquid than the sovereign government bond market, which makes gaining exposure to this asset class more difficult. Furthermore, governments do not all issue a uniform inflation-linked security, so investors need to understand the specifics of each issue to be aware of what events will impact their holdings (e.g., some bond issues have deflationary floor protection). In addition, real interest rates are all below the zero bound in advanced economies (with the exception of Japan, which is hovering around zero), so we would not suggest investors uniformly flip their entire fixed income portfolio into inflation-linked bonds, thereby locking in a negative real interest rate. We would propose that investors look at real return bonds not as an inflation hedge per se (i.e., something that increases in value as a result of an inflation shock), but as a competing asset class relative to nominal bonds that can help preserve the capital of your fixed income holdings if inflation unexpectedly increases.

Taking all of these factors into consideration, a holistic investment strategy that is uniquely positioned and suited for the current economic environment is a risk parity solution. Not only does this strategy have exposure to a more diversified set of asset classes like inflation-linked bonds and commodities, but the portfolio is constructed based on each asset class contributing the same amount of risk to the portfolio. Allocating asset weights based on risk, as opposed to dollars, results in a portfolio that is more efficient in terms of return per unit of risk, with a low correlation to equity markets. There are a number of different ways to implement a risk parity strategy, though we are partial to applying a prudent amount of leverage to the portfolio, so investors can target a similar risk and return profile to equity markets, while having a much more diversified opportunity set. The diversification benefit for investors is a key factor, as it reduces the dependency on a narrow set of asset classes to generate the required return that investors might struggle to achieve in the current investment environment.

The result is that adding a risk parity strategy to a global balanced or equity-centric portfolio should help increase overall portfolio robustness, while tackling some of the thorny expected return issues that investors are grappling with. We would suggest that investors would be better served to look at an investment strategy like risky parity versus what is being offered as potential answers in the Financial Times article. A risk parity strategy can be more liquid than private assets, because it is implemented in public markets, while a less than perfect correlation to equity markets helps to protect against concentration risk.

While the risk parity framework is by no means a silver bullet that will solve all the challenges that investors face in this unprecedented economic climate, it can help investors to diversify away from traditional asset classes that are expected to provide low nominal returns over the next ten years.

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.