Five years ago, I had the pleasure of taking a trip to Japan. A popular tourist destination, the country is well known for its culinary scene, cultural heritage, and beautiful landscapes. And, while I was excited to eat my weight in sushi and ramen, as well as explore the beautiful architecture in Kyoto, I was especially excited about something less commonly associated with Japan: whisky. That’s right, the spirit we normally think of in relation to Scotland and Ireland is something that has more recently drawn the attention of hobbyists and connoisseurs alike to the Land of the Rising Sun.

While whisky – or “whiskey,” if you prefer American Bourbon or Irish Single Malt – has a long history in Scotland and Ireland dating back to at least the 15th century, Japanese whisky in its current form is a more recent phenomenon. In 1923, after traveling to Scotland to learn the art of distilling Scotch whisky by both studying organic chemistry in Scotland and becoming an apprentice at various distilleries across the country, Masataka Taketsuru teamed up with a businessman by the name of Shinjiro Torii and modern Japanese single malt whisky was born. Torii was the founder of what would later become the Japanese whisky powerhouse, Suntory, and after 10 years of working together, Taketsuru eventually split off to launch the Nikka whisky company. It took decades for the spirit to become a staple in bars across a country where people were accustomed to less potent beverages like sake and plum wine. Even then, it was very much a local phenomenon. However, in 2015, Jim Murray – a world renowned whisk(e)y connoisseur – named Suntory’s Yamazaki 2013 Sherry Cask the best whisky in the world in his annual publication of the Whisky Bible. This launched a global craze that led to a worldwide shortage in the spirit estimated to last at least 10 years!

In Japanese, the word “Shokunin” roughly translates to “craftsman” and carries with it an underlying philosophy of never settling for less than your best, while always finding ways to hone and improve your ability to improve your craft. Taketsuru was the embodiment of this philosophy, as were the master distillers that followed him, allowing these two small distilleries to take on the juggernauts that are Scotch and Irish whisk(e)y – and win. The art of whisky distillation is incredibly complex with hundreds of variables available for manipulation, from the quality of the ingredients, to the shape of the stills, to the temperature of the casks and the time of maturation, all the way to the refinement of the palate of the master distillers whose job it is to mix different casks to create the end product. This is the dream of an aspiring Shokunin; so many things to refine, so many small manipulations in search of the perfect dram. As I walked through the famous Yamazaki distillery on a guided tour, I was in awe of what the aspirations of two young men had resulted in, but my mind wandered to what we were doing back home in Calgary at Viewpoint Investment Partners.

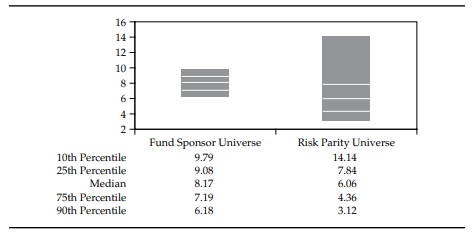

We were attempting to do in the world of quantitative investment management what Taketsuru and Torii had done a century ago in the world of whisky. Driven by a passion to bring an investment style pioneered by the likes of American powerhouses Bridgewater, PanAgora, and AQR to a new market – private investors in Canada – we keenly studied the vast literature in the space as we crafted our own unique solution to the purposeful allocation of risk to build uniquely diversified portfolios. Like the beautiful art that is whisky distillation, building a risk allocation engine to manage portfolios has hundreds – if not thousands – of variables that can be manipulated. Decisions include a much wider investible universe, the parameters of volatility forecasting models, or even something as nuanced as the accurate estimation of the covariance matrix. As was true for the Shokunins I have mentioned, this level of breadth is a craftsman’s dream. The Fundamental Law of Active Management tells us that the more breadth – that is, the more unique bets or independent decisions a manager can make – the more a manager’s skill and craftsmanship matter for investor outcomes. This was highlighted in the CFA Institute’s 2018 book on multi-asset strategies, where it showed a massive performance spread between the best and the worst risk-parity/risk allocation managers compared to a relatively small spread between the top and bottom in the entire fund sponsor universe. Figure 1 shows that the top 10% of risk parity managers outperformed the bottom 10% by more than 11% per year, contrasted by all funds within the universe that have a top/bottom decile spread of just over 3.5%.

Further to this, we estimate that more than $400 billion is managed using this investment philosophy in the United States, while there is approximately $1 billion under management in risk allocation strategies north of the border. We face a similar opportunity – and challenge – as the original proprietors of Suntory. The proposition of bringing a new and unfamiliar product to a market – one that we feel is of superior quality, especially if done with rigour and attention to detail – ignites our inner Shokunin and keeps us steadfastly dedicated to honing our craft through research and client education.

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.