The ongoing progress and focus on the energy transition in the Western world has created the perception that coal is an obsolete commodity, relegated to the history books as a dirty fossil fuel no longer required for power generation or industrial use. In June, Alberta powered down its last fully dedicated coal plant, with the Genesee 2 facility being fully converted to natural gas. The phaseout of coal power in the province was completed ahead of schedule, with Capital Power estimating the conversion to natural gas power will reduce its greenhouse gas emissions by 3.4 million tonnes per year.

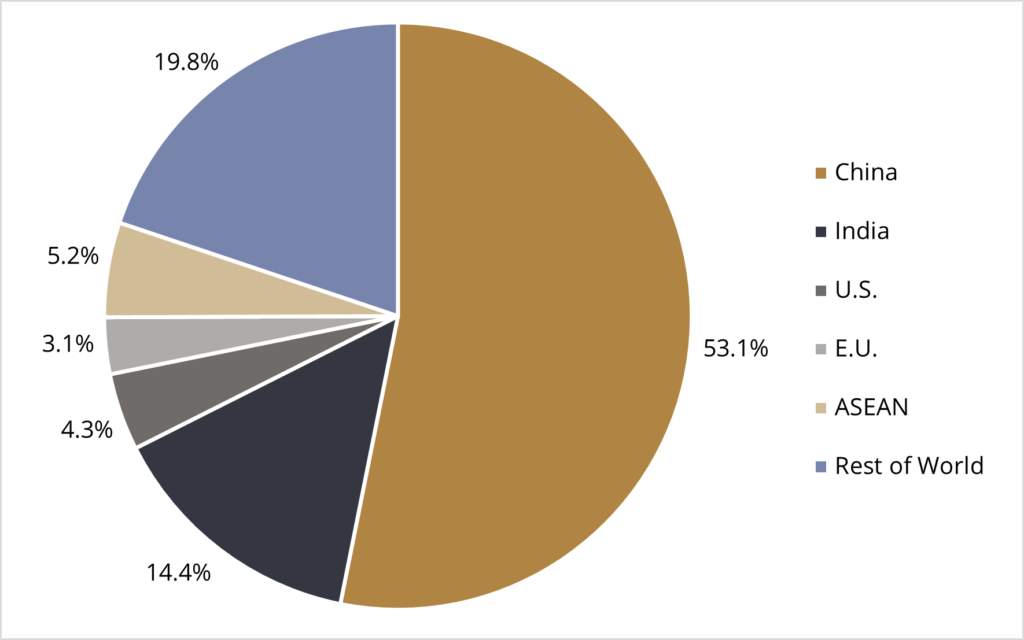

Despite the phaseout that is happening in the West and the perception that coal is an obsolete commodity, the reality could not be further from the truth. Global coal consumption reached a record level of 8.7 billion tonnes in 2023—up +2.6% from 2022—and the International Energy Agency (IEA) is anticipating that coal demand will remain stable in 2024, increasing by +0.4% on a year-over-year basis to a new record high. China and India were the biggest contributors to increases in coal demand over 2023 and are forecast to account for just under 68% of world demand in 2024. Despite the growing “greenification” of the Chinese economy through wind and solar power, electricity demand grew by +7% in 2023 and most of the growth in power usage was met with coal-fired power. India has also needed to rely more heavily on coal-fired power, as its strong economic performance has translated into power demand where renewable energy sources are not able to keep up with the increased consumption needs. Furthermore, the ongoing emergence of India’s middle class has also led to increased investment in infrastructure, which in turn has increased the consumption of steel, bolstering the demand for coking coal.

While the IEA is estimating that coal consumption will decline by a moderate -0.3% in 2025, this assumption is heavily reliant on a large stepdown in Chinese demand, forecasting that renewable energy will outgrow power demand. This Bloomberg opinion article from Javier Blas is pessimistic that we will see a dramatic decrease in global coal consumption in the coming years, noting that consumption growth in India will continue, as the country needs reliable baseload power to fuel their economic expansion. Southeast Asia is also unlikely to make the shift from coal to the cleaner natural gas, worried about natural gas availability after shortages experienced during the Russian invasion of Ukraine.

The other issue is that global coal consumption is largely driven by power demand, which accounts for more than two-thirds of global use, and power generation is highly affected by weather. Weather fluctuations are particularly important for weather-dependent renewable energy sources, and in a world where erratic weather is increasing, developing economies are likely going to continue to look for better reliability for their baseload power, making coal an attractive option. As Blas notes in his opinion piece, in an ironic twist, coal may be getting a boost from the energy transition itself. As the world continues to move towards the “electrification of everything,” demand for power is rising and coal is a dependable option to meet that demand. Additionally, the growing adoption of artificial intelligence will continue to drive demand for data centers, which will have a significant impact on electricity demand and therefore coal power in the coming years. The global energy transition battle continues to be challenging, as developing economies like India pursue strong economic growth and a transition of their population to middle class. As Blas states, “as long as coal consumption keeps increasing, the world isn’t performing an ‘energy transition’ but an ‘energy addition,’” where renewable energy only supplements fossil fuel demand.

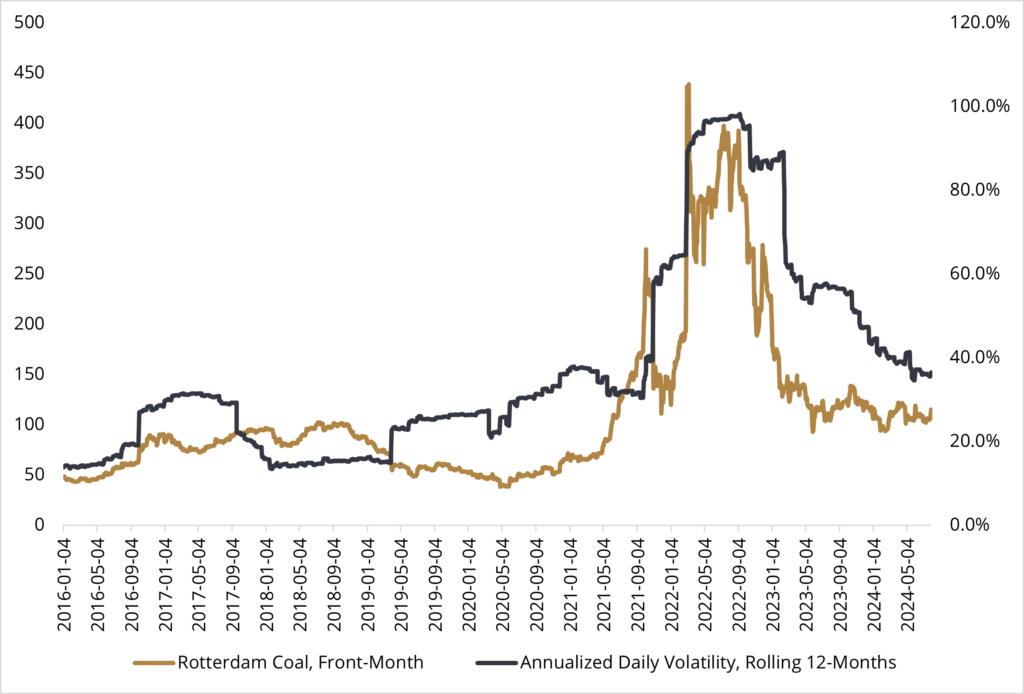

In the coming years, India and Southeast Asia are likely to continue to be drivers of increasing coal demand, leaving Chinese demand as the largest source of uncertainty, potentially deciding the global trend for coal demand. While prices (and volatility) have come down since Russia’s invasion of Ukraine created energy uncertainty in Europe, they have settled higher than the ranges experienced pre-COVID. The forward curve for Rotterdam thermal coal has also moved out of backwardation and is in slight contango, illustrating that demand is relatively balanced with that of supply. However, with developing economies continuing to drive coal consumption, we would expect to see an elevated risk premia incorporated into prices, a reflection of energy reliability from geopolitical and weather-related risks.

Happy investing!

Scott Smith

Chief Investment Officer

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.