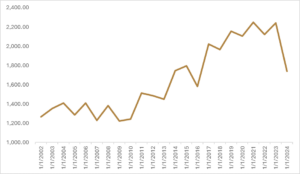

The cocoa market has been relatively quiet over the past few months, with volatility subsiding from the eye-watering levels in the late spring when the price of cocoa was going parabolic. Although volatility hasn’t completely disappeared, prices have been rangebound between $7,000 and $10,000 per ton as market participants try to gauge how the harvest for the upcoming main crop is shaping up. The lower end of the trading range at $7,000 per ton is still elevated relative to the $4,000 per ton price levels we saw near the end of 2023, before prices started to spiral out of control when it became evident that lower yields from the 2024 crop were going to lead to a third straight year of production deficit and continued scarcity of cocoa beans.

Cocoa buyers found some welcome relief in early October when the Cote d’Ivoire raised its production estimate for the 2025 crop to between 2.1 million and 2.2 million tons, which would be a dramatic bounce back from the dreadful 2024 season where production dropped to 1.8 million tons due to bad weather and disease. The Cote d’Ivoire accounts for roughly 40% of global cocoa production, so its harvest is viewed as the bellwether for the overall market. At the same time, Ghana expects its production output to increase back to 2023 levels at 650,000 tons, noting a much healthier crop than last year due to improved weather and the timely use of fertilizers and pesticides. Both the Cote d’Ivoire and Ghana have raised the farmgate price for cocoa this year in a bid to deter bean smuggling. However, the new price that the governments will pay to farmers is equivalent to approximately $3,000 per ton, which leaves many skeptical that another run-up in price won’t see similar bean trafficking.

The respite from higher prices for chocolatiers has been short lived, with cocoa futures resuming their upward climb and rising over 30% in November. What started out as an optimistic growing season has hit some weather-related snags, with heavy rain in Cote d’Ivoire flooding fields, increasing disease risk and affecting crop quality. The start of the harvest in Cote d’Ivoire is not off to a fantastic start, with recently harvested beans signaling smaller, lower quality yields, increasing worries that a forecasted production surplus for this upcoming year might be too optimistic.

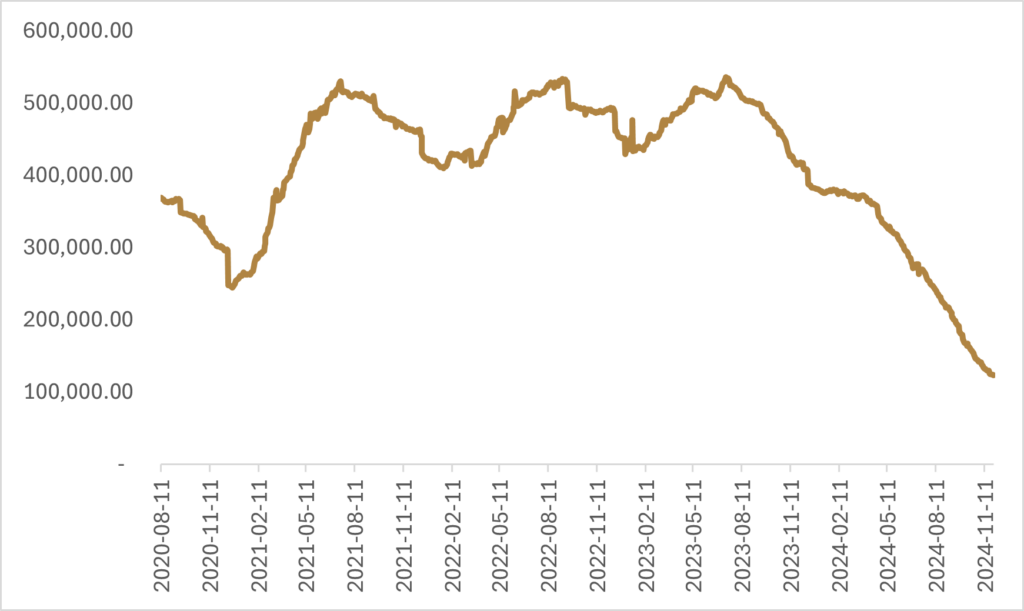

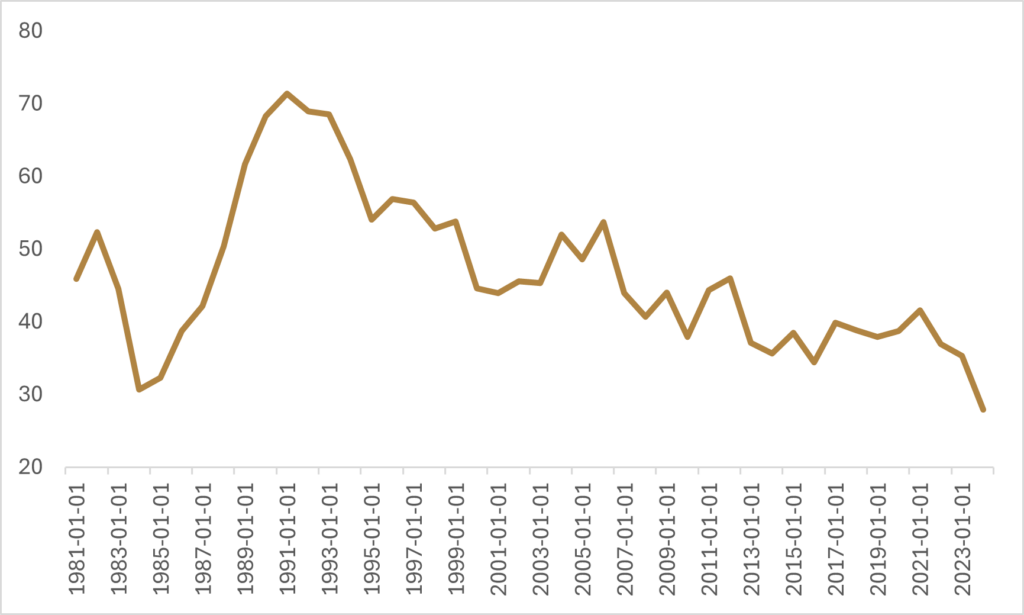

While still early in the main crop harvest, cocoa buyers are in precarious territory after having drawn down existing stock hoping to rebuild at lower prices. Not only are cocoa stocks in U.S. and London exchange warehouses at extremely low levels, but chocolate makers who hedge their input costs are more uncovered than usual. Normally cocoa buyers who hedge using futures contracts have their purchases covered eight to nine months out; right now, it’s around five and a half months. Citigroup released a note early last week raising their three-month price target to $10,000 per ton, highlighting the possibility that prices could re-test the highs seen in April of this year, which was just under $12,000 per ton. Citi believes that both the main and mid-crop estimates in West Africa are too optimistic, with concerns around crop maintenance and fertilizer application being lower than in previous years.

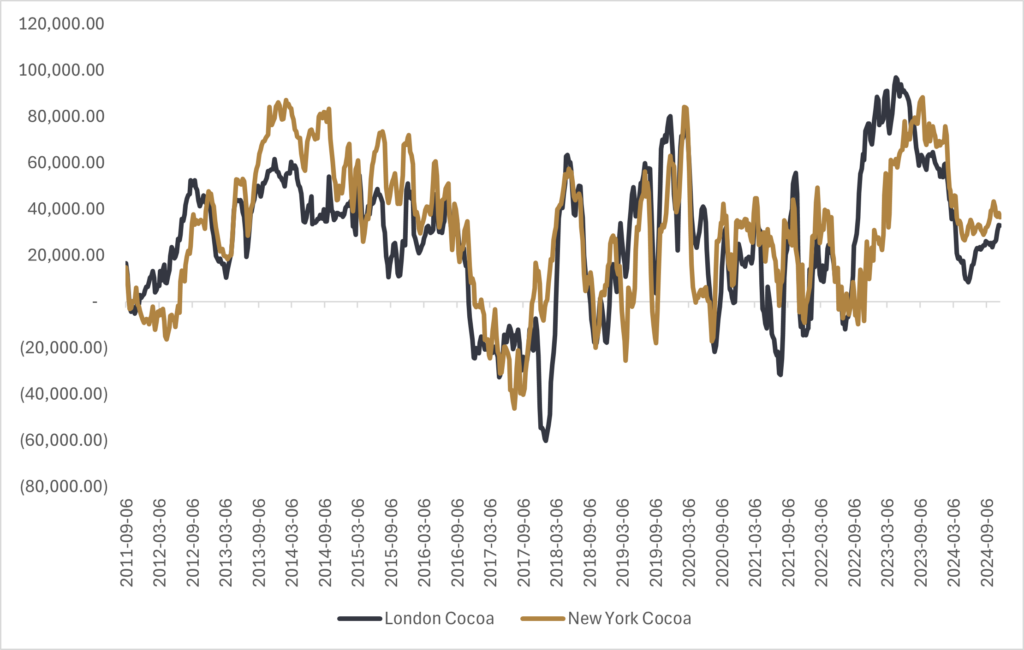

It will be interesting to see how the next few months shape up for the cocoa market, as hopefulness from buyers around a production surplus and potentially lower prices might be starting to fade. While I don’t have any on-the-ground insight on incoming production numbers and real-time weather, my view is that another year of production deficit runs the risk of a much more violent move higher in prices than what we saw earlier this year. The stocks-to-grindings ratio—effectively how much stock is outstanding relative to demand—is at record lows and another year of deficits would put further pressure on already depleted stock. Over the month of November, we’ve seen a notable uptick in implied volatility for options on front-month futures, with the deep out-of-the-money calls seeing the most demand. As far as speculative positioning goes in the futures market, non-commercial and managed money have relatively subdued net long positions, well off the highs we saw late in 2023 when it started to become evident another production deficit was on the horizon.

With front-month cocoa futures already trading up to the mid-$9,000 per ton range, there could be a decent air pocket if the production numbers and the forecast for the mid-crop harvest starts to improve. That being said, my perspective is that the balance of risks remains to the upside in this market; although to be long, you’ll likely need to withstand some volatility. Declining stocks and lack of buyer hedging have provided the environment where we could see an aggressive squeeze higher if production starts to teeter into deficit territory. Given the potential for a resurgence in volatility for this market, we continue to believe that a position sizing framework where capital is allocated based on volatility and correlation is the most effective way to actively manage this esoteric commodity exposure.

Happy investing!

Scott Smith

Chief Investment Officer

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.