I wrote a note just over two years ago about the Chinese investment landscape, and how the sweeping regulatory reforms that were enacted in early 2022 would likely act as a drag on equity multiples and investor sentiment. Fast forward to today and investor sentiment has improved little. Since the end of 2021, the Hong Kong stock market has dropped -12.9% on an annualized basis (in USD terms), while the onshore Shenzhen index has fallen -18.8% over the same period. While developed market equity markets haven’t performed extraordinarily well over this period either, they have performed much better than the Chinese market, with the S&P 500 up +3.7% while the S&P TSX is flat (in USD terms). The real estate market in China continues to struggle, economic growth is below pre-COVID trend, demographics are challenging, and deflationary pressures are building.

Policymakers in China have stepped away from using “bazooka-style” stimulus to achieve their growth targets, opting for more strategic measures so as not to repeat the same mistakes of the post-GFC that left many local governments with dramatic debt burdens. Piling on to the economic growth concerns are geopolitical headwinds that have been picking up steam with the U.S. election cycle. Trump has been in the news pitching a potential 60% tariff on all Chinese imports if he is elected, upping the ante on the already hawkish foreign policy stance towards China. If implemented, the tariffs would likely grind trade between the U.S. and China to a halt, with Bloomberg estimating U.S. imports from China would drop from the current rate of 14% to 1%. Even without Trump’s proposed tariff escalation, the Biden administration is currently working on new measures around data security and there is chatter of higher tariffs on EVs and clean-energy products, showcasing pressure on China from Washington is unlikely to ratchet down regardless of who is in office.

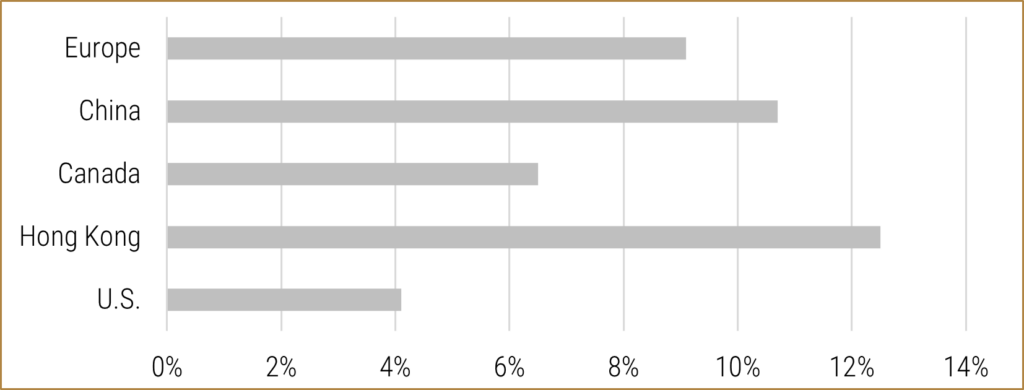

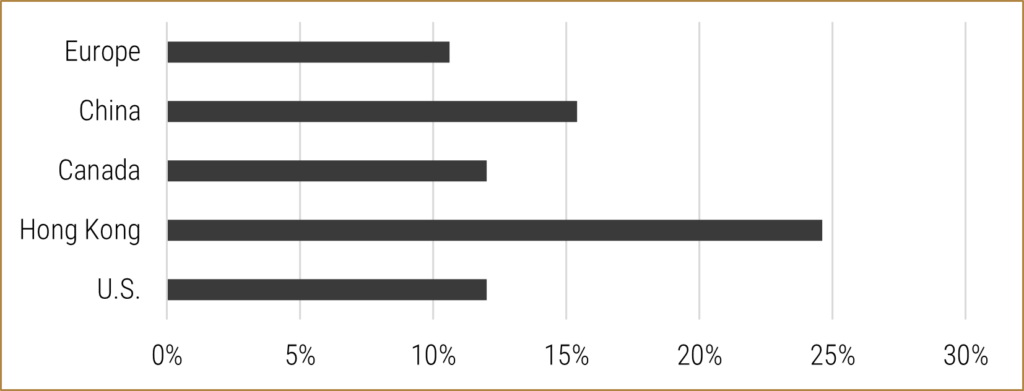

The confluence of events has led to the sell-off in Chinese equity markets intensifying, and valuations have fallen to where investors are contemplating whether the relative “cheapness” compared to developed markets like the U.S. are of sufficient value to start re-allocating to the region. Earlier this year, AQR doubled down on their call for Emerging Market equities to outperform U.S. equities over the next five to 10 years, and given that Chinese equities make up roughly 20% of the MSCI Emerging Market Index, the performance of Chinese equities will play a big part in whether this forecast is proven right. The forward price-to-earnings ratio (P/E) – effectively the price an investor is paying for a claim on future equity earnings – does look quite attractive relative to other developed equity markets. The current P/E ratio for the Hong Kong equity market and for the Shenzhen equity market is 8.5x and 12.4x respectively, which in absolute terms looks very cheap relative to 24.1x for the S&P 500, 16.5x for the TSX, and 13.5x for broad European equities. While the Hong Kong equity market, and to a lesser extent Shenzhen, might look like massive bargains, the “cheapness” could be a siren song. Once you risk-adjust the earnings yields (inverse of the P/E ratios) of the aforementioned equity markets, including any yield one receives from hedging the return stream back to USD so we can compare a common currency, the earnings yield per unit of volatility makes Hong Kong a lot less attractive. It is beyond the scope of this short note to get into the sector differences between the equity markets and how that would affect the earnings yields, but I wanted to highlight that once you factor in volatility, the bargain basement prices are brought back to reality (somewhat).

Even if Chinese equities don’t look as cheap as they might when looking at raw yields, I don’t think we’ve seen peak China. However, a rebound in Chinese economic growth doesn’t necessarily guarantee strong equity market performance. Policymakers in China have displayed that they are comfortable managing the economy to what they believe is for the best of their citizens, with capital markets taking a back seat. Since the end of 2013, China has grown nominal GDP by +6.3% annualized, while the Hong Kong stock market has compounded at +0.3% annualized and the Shenzhen stock market has grown by +4.5%. Compare this to the U.S. economy which has grown nominal GDP by +5.0%, while its stock market has increased by +12.0%. So, even if Beijing is able to steer its economy through this economic slump, it doesn’t necessarily mean capital markets will rebound.

The challenge for investors is whether all the current headwinds that have depressed valuations make it too good of a deal not to jump back in. My perspective is that for a risk-adverse investor, there is too much geopolitical risk to confidently move back to benchmark if you are underweight the region. For investors that are more risk-neutral (willing to stomach high levels of current volatility), increasing allocations to benchmark in China makes sense in that some thawing of U.S.-Sino relations should lead to improved investor sentiment, though I’d be more inclined to wait until there are signs that trend and momentum signals are turning up. Currently, Hong Kong, on-shore China, and broad Emerging Markets are at the bottom of our momentum scorecard when compared to developed markets, though some of the shorter-term momentum scores are showing some signs of moving into positive territory. At this juncture, overweighting the region seems like outsized risk relative to potential rewards, especially given the current macroeconomic environment where investors aren’t necessarily yield-starved. While a low probability, if there was a material escalation in tensions between China and Taiwan (e.g., China invades Taiwan), there is a non-zero possibility that those relatively cheap earnings get evaporated, much like when Russia invaded Ukraine and international investors saw their Russian investments go to zero. The one thing on which both sides of the aisle in the U.S. can agree is hawkish foreign policy directed towards China, which should provide little comfort for western investors.

Happy investing,

Scott Smith, Chief Investment Officer

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.