Financial markets are a complex web of interconnected systems, and while the outcomes may seem simple in hindsight, making sense of the intricacies and the ramifications of political decisions is anything but clear in the heat of the moment. At Viewpoint, we launched our first global multi-asset strategy at the end of 2016, right after Trump was elected to his first term, and global equities were at all-time highs. There was a relatively somber outlook for risk assets at the time, given the uncertainty surrounding Trump’s economic policies combined with the fact that valuations in financial markets were “frothy.” Despite the worries about an anti-establishment president and elevated equity valuations, global equities powered higher and churned out a gain of +16.1% in CAD terms during 2017. I remember myself and the investment team having several conversations in early 2018, where industry colleagues in the space were congratulating us on the launch of the investment firm with the comment that 2017 was such a great time to launch a fund, given that markets essentially went up and to the right for the whole year. While the statements and sentiment weren’t wrong, it sure didn’t feel like a foregone conclusion at the time that financial markets would enjoy the rally they ended up having. In fact, it wasn’t until 2018 that we started to see the effects of Trump’s trade war volatility through late-night posts on Twitter.

Today is no different than it was eight years ago, and it may all seem so simple in hindsight. The year of 2025 has the potential to be defined as a great year for equities with pro-growth fiscal policies supporting consumer demand and corporate earnings. Alternatively, the implementation of an aggressive tariff policy has the potential to start a tit-for-tat trade war that raises consumer prices and slows global trade, weighing on equities and boosting safe-haven assets like bonds. The confirmation hearing for incoming Treasury Secretary Scott Bessent was held last week and was important for financial market participants to try and glean any clues as to the path dependency of the incoming administration’s economic agenda. There was little in the way of fireworks during Bessent’s confirmation hearing, where he reiterated his support for Trump’s tariff agenda, stiffer sanctions on Russia, and the maintenance of the U.S. dollar as the world’s reserve currency.

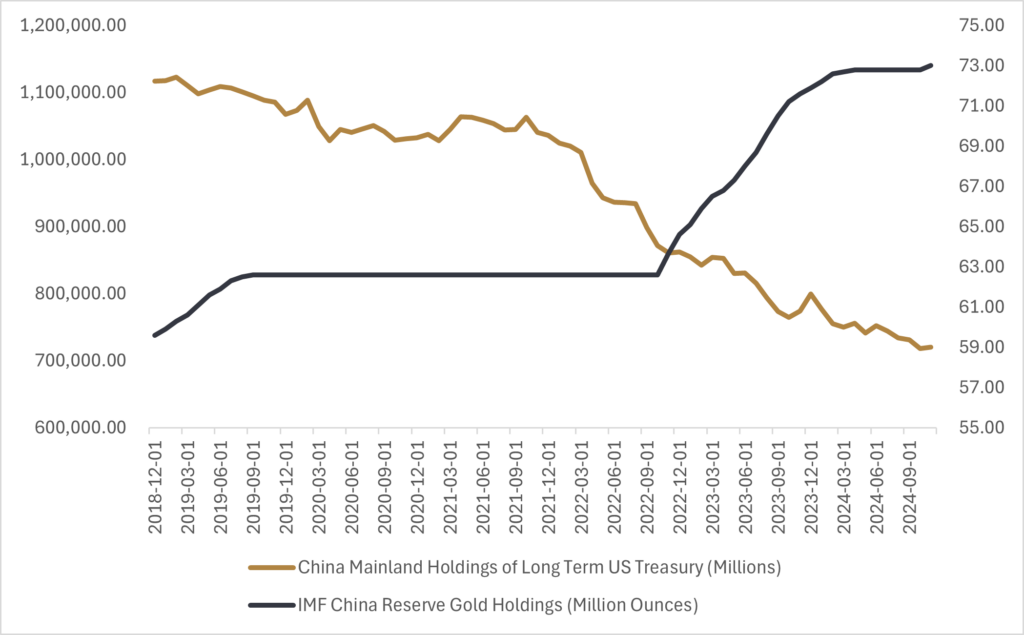

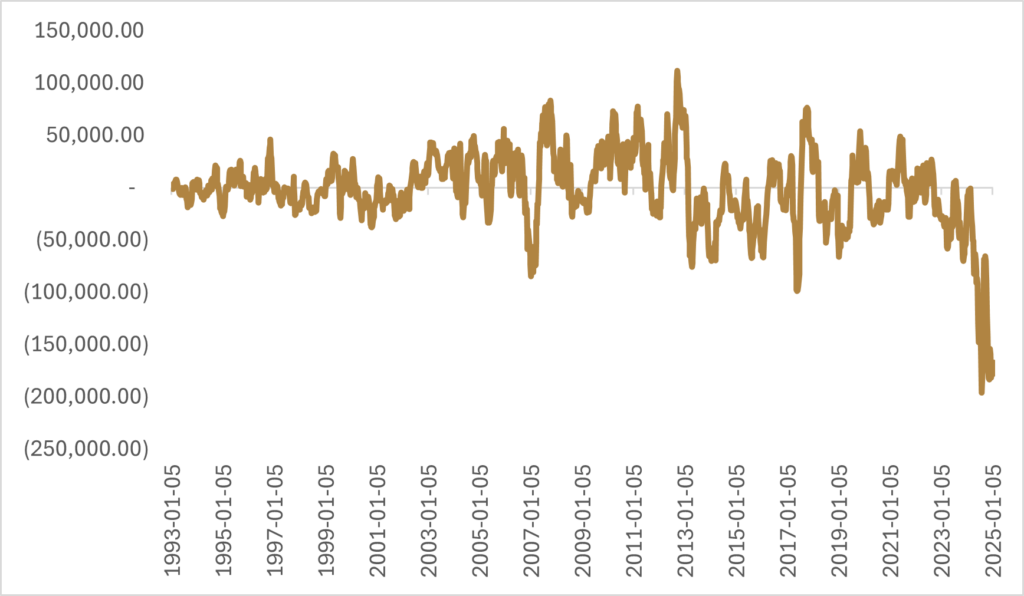

The challenge for Bessent and the Trump economic team will be how hard to push on trade policy, as being too aggressively focused on reducing the U.S. trade deficit could end up eroding the confidence in the U.S. dollar as the global reserve currency and the demand for U.S. assets. The exorbitant privilege of the U.S. dollar as the global reserve currency allows the U.S. to run a trade deficit (importing more goods than exporting) offset by a surplus in the capital account where the countries selling these goods to the United States recycle those U.S. dollars back into U.S. assets. The recycling of those U.S. dollars back into the U.S. economy through equity and bond markets helps to lift valuations and put downward pressure on bond yields, essentially allowing the United States to fund the trade deficit at a lower cost than a country that doesn’t have a global reserve currency. China has been steadily reducing their holdings of U.S. treasuries in favour of gold, and an escalation of a trade war with traditional U.S. allies could end up reducing the global demand for dollars as the U.S. narrows its trade deficit by slowing global trade. The goals of cutting the trade deficit and increasing the dominance of the U.S. dollar are contradictory in nature, and it’s unlikely that capital markets will respond favourably to trade war escalation. Tariffs aimed at reducing the U.S. trade deficit to increase manufacturing jobs in the U.S. may boost blue collar incomes enough to outweigh the increase in costs of manufactured goods. However, this also assumes little to no retaliation in tariffs and that there is a robust export market for U.S. manufactured goods.

While the U.S. is certainly holding all the cards as it relates to trade policy, the next few weeks will be interesting for Canadians and policymakers north of the 49th parallel. The loonie was able to breathe a sigh of relief yesterday, rallying higher after The Wall Street Journal reported that one of Trump’s executive orders will “direct federal agencies to study trade policies and evaluate U.S. trade relations with China and America’s continental neighbours – but stops short of imposing new tariffs on his first day in office.” However, this relief rally was short lived. When Trump was signing the executive order relating to trade policy later that evening, he commented that he expected to impose 25% tariffs on Mexico and Canada by February 1st, a move harkening back to Trump’s first term where policy was delivered off-the-cuff and in 140 characters. Trump’s first day in office was a stark reminder for financial market participants that we should expect volatility to remain elevated.

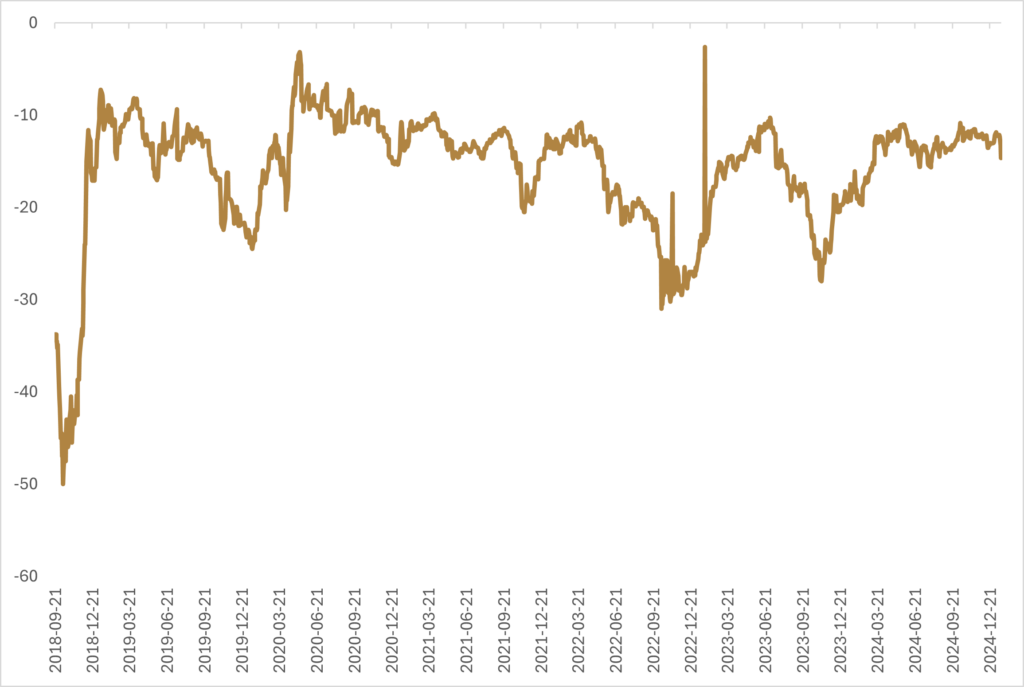

If the U.S. does decide to impose a 25% tariff on all Canadian products, without an exemption for oil exports, Canadian exports will receive some insulation from the reduction in U.S. import demand by a decline in the Canadian dollar. A paper from 2021 by Jeanne and Son looked at the China-U.S. trade war episode from 2018-2019 when the U.S. imposed an average of 15% tariffs on Chinese imports and found that 65% of the 7% depreciation in the value of the Chinese renminbi was a result of the tariff increase. The Canadian dollar has depreciated by over -4% against the U.S. dollar since Trump’s election in early November, and sentiment from speculators in Canadian dollar futures is at all-time lows. Tough trade negotiations between Canada and the Trump administration are nothing new, though the stage is set for this to be much more impactful than the tariffs on Canadian steel and aluminum that Trump implemented during his first term. Canada hit back with their own tariffs, but the ultimate result was in the re-writing of the North American Free Trade Agreement (NAFTA) into the United States-Mexico-Canada Agreement (USMCA). Unlike Trump’s first term where the trade war between the two allies was limited in scope, there are reports that if the U.S. was to implement tariffs of 25% on Canadian imports, it has been reported that Canada would fire back with retaliatory tariffs on a third of U.S. imports, which amounts to roughly $150 bn in Canadian dollars.

In conjunction with a decline in the Canadian dollar, the price for Canadian crude relative to U.S. benchmark WTI has started to wobble on the possibility the 25% across-the-board tariff won’t include any exemption for Canadian crude. I had previously written that any tariffs on Canadian goods would likely include an exemption for Canadian crude, given it didn’t seem rational to implement trade policy that would raise prices for energy products at a time when inflation is such a big concern for U.S. constituents. Canadian crude accounts for over half of American crude imports and almost a quarter of U.S. refinery throughput in 2023. The majority of the four million barrels per day of Canadian imports go to the Midwest region of the U.S. and there are few options to divert exports or substitute feedstock for those refineries, making it more likely that gasoline prices would increase without an exemption for Canadian crude. If Canadian crude isn’t exempt from the U.S. tariffs, Canadian energy producers will have some insulation in the form of a weaker Canadian dollar, and the fact that rhetoric around stiffer economic sanctions on Russian energy producers has given a slight lift to global oil benchmarks of WTI and Brent. The best-case scenario for the Canadian economy would be for policymakers to negotiate a way to buy more U.S. manufactured goods and bypass a trade war, which would be coming at an inopportune time for the Canadian economy where interest rates have already had to drop more than in the U.S. to stimulate aggregate demand, with little fiscal room to maneuver should a trade conflict spark a recession.

Regardless of how this plays out, policymakers in Canada should heed Rahm Emanuel who once said, “never let a good crisis go to waste.” The lack of diversification in Canada’s customer base for its natural resources should be revisited, especially when allies like Japan and Europe have expressed interest in securing reliable energy in the form of liquefied natural gas (LNG) from Canada. In addition to revisiting previously cancelled projects that would have opened new markets for Canadian energy products, policymakers should also be exploring domestic investments in refining capacity, not just limited to hydrocarbon products. Not only would refocusing domestic investment into raw material refinement create new jobs in Canada, but it would reduce the reliance on foreign parties to refine Canada’s raw materials which are then exported back to us at a premium. While a weak Canadian economy combined with the potential for a trade war with our closest ally is a dour combination of events, this period should spur Canadian policymakers to look for better solutions for economic security to protect against a shifting geopolitical landscape that is tilting towards greater protectionism and de-globalization.

Happy investing!

Scott Smith

Chief Investment Officer

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.