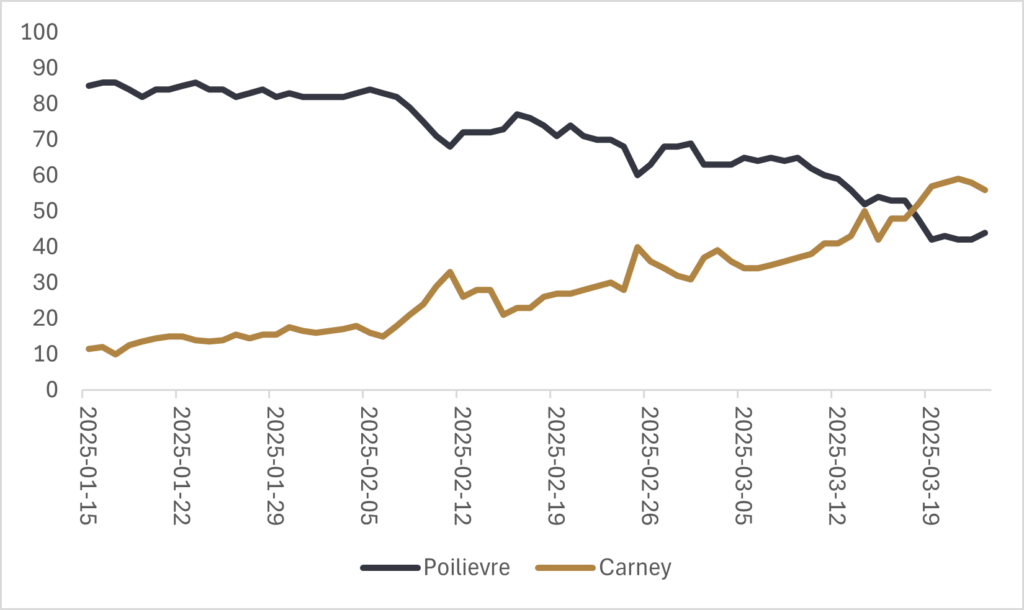

In what has already been a rollercoaster of a year, Canadians will be heading to the ballot boxes in a little over a month, with the aim of electing a leader to shepherd the country through an extremely tumultuous period. Not only is Canada in the midst of a trade war with one of its closest allies, but the country is also contending with weak business investment, stagnant productivity, and continued housing affordability issues. Frustration with Justin Trudeau’s Liberal party had propelled Pierre Poilievre and the Conservatives to a massive advantage in the polls just a few short months ago, with expectations the Conservatives would win in a landslide and form a majority government. However, a lot has changed since the start of 2025.

At the beginning of January, Justin Trudeau resigned as Liberal Party leader, while Mark Carney went on to win the leadership race and was sworn in as prime minister in early March. The reshuffling of the Liberal party’s leadership occurred as the U.S. launched a trade war with Canada, and as U.S. President Donald Trump continues to make remarks challenging Canada’s sovereignty. The combination of a firm stance towards the trade war with the U.S., along with Poilievre’s populist-style platform drawing similarities to Trump’s administration south of the 49th parallel, has resulted in a massive swing in the polls.

The statistical modelling of electoral projections website 338 Canada now shows Carney’s Liberal party with a two-percentage point lead, an unheard-of position given that the Conservatives had a 20%+ lead in the polls at the end of 2024. Betting markets are also projecting a tight race, with the Polymarket betting website giving Carney a 56% chance to Poilievre’s 44% of becoming the next prime minister.

As the campaign trail heats up, it’s likely that the emergence of more fulsome policy platforms will continue to swing voter preferences. Out of necessity, Carney has already unveiled several policy reforms aimed at moving the Liberal party closer to centre and away from Trudeau-era policies that focused on an expansion of government, higher taxes, and increased immigration. Since becoming the leader of the Liberal party, Carney has eliminated the consumer carbon tax and promised to cancel the proposed hike to capital gains taxes, two deeply unpopular Liberal policies. Last week, Carney also announced a raft of measures aimed at stimulating domestic investment and reducing provincial trade barriers as a way to boost GDP growth and blunt the damage a prolonged trade war with the U.S. could cause the Canadian economy. The announced measures included the development of a national trade and energy corridor for transportation of energy and critical minerals, legislation by July 1st that would remove federal barriers to the inter-provincial trade of goods, and a “one-window” approval process to help speed up domestic infrastructure investment. In conjunction with a streamlined approval process to expedite capital projects, Carney also committed to working with provinces to identify projects of national significance, citing investments in the port of Churchill, Manitoba and west coast LNG facilities like Cedar LNG and the second phase of LNG Canada.

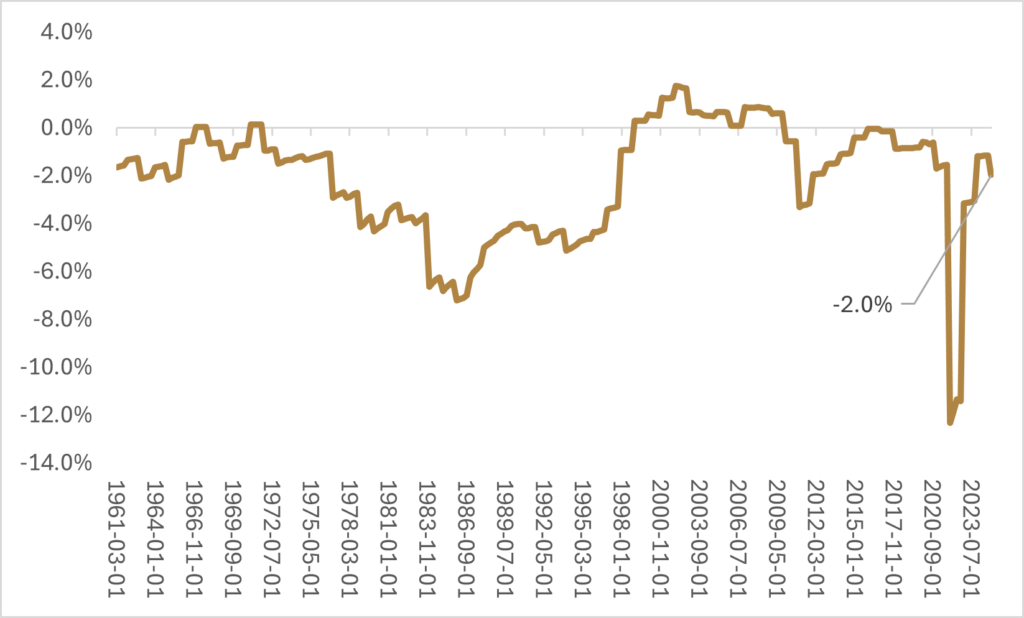

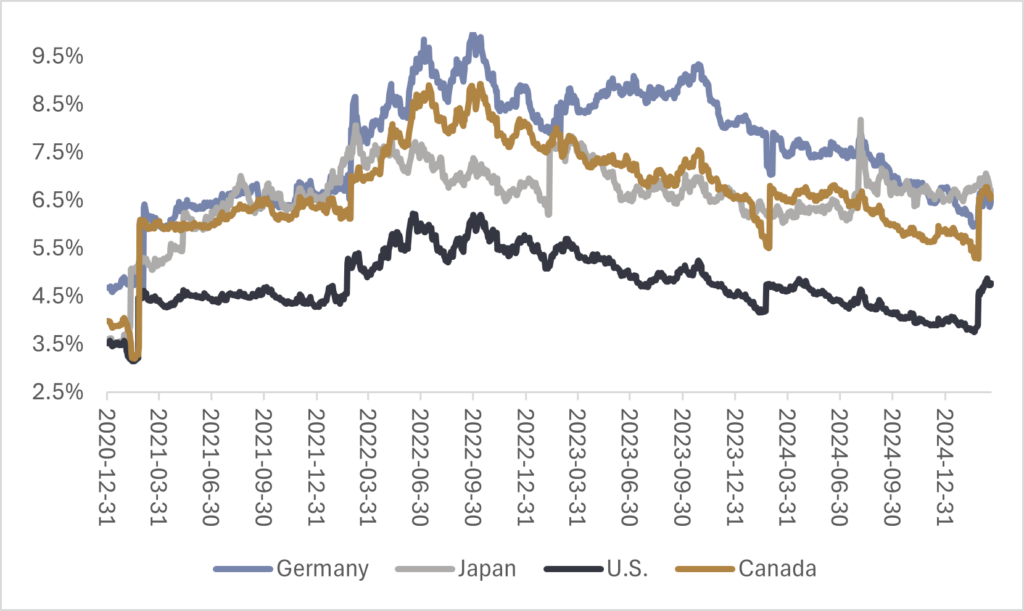

The domestic infrastructure announcements and the rollback of the more unpopular Liberal policies have moved the Liberal economic platform closer to that of Poilievre and the Conservatives, but not all the way. Poilievre is running on an economic platform of lower taxes and lower regulation to spur domestic investment and increase productivity, but Poilievre has promised to balance any new spending with savings in other areas, which would keep the federal deficit from widening and the country from taking on additional debt burden. Carney has proposed segmenting the budget in two buckets, an operating budget that would be balanced, and a capital-spending budget for infrastructure projects that would “carry a modest deficit.” When you combine federal and provincial debt for a total debt-to-GDP ratio, Canada is essentially middle of the pack relative to other G7 nations when it comes to overall debt burden. Canada has more fiscal capacity than Japan and Italy, roughly on par with France and the U.S., and less fiscal capacity than the U.K. and Germany. Widening the fiscal deficit isn’t necessarily irresponsible when a country is faced with a crisis; however, expansionary fiscal policy should be used for positive return-on-investment infrastructure projects to maximize its long-term effectiveness.

One of the largest gaps between the parties proposed economic platforms is how to deal with industrial carbon emissions, with Carney planning to keep the current carbon tax on heavy industrial emitters, as well as maintaining the federal policy of capping emissions from the production of oil and gas to 35% below where they were in 2019 by some point between 2030 and 2032. Poilievre has stated that he would cancel the industrial emitter carbon tax, and while he hasn’t explicitly confirmed he will reverse the oil and gas emissions policy, in a recent press conference, he did comment that Alberta Premiere Danielle Smith’s list of demands to the federal government was “very reasonable.” Poilievre has communicated that his stance towards industrial emissions would be more “carrot” and less “stick,” the opposite of how the Liberal party has aimed to reduce carbon emissions. Poilievre has outlined that his approach would be to offer tax credits to businesses who have a lower emission profile than the global average, creating a more competitive business environment for large, industrial companies operating in Canada.

The aim is to reverse the lackluster business investment in Canada, where the increased costs of doing business has led to companies relocating or passing those increased costs onto consumers. Poilievre has also argued that boosting Canada’s natural resource industry can play a role in reducing global emissions, citing the lower carbon intensity of manufacturing aluminum relative to other suppliers like China. We’ve made similar arguments about Canadian natural resources before, noting that Canadian crude is much more ESG friendly than many OPEC-producing nations, and that Canadian LNG can play a larger role in energy security for not only our European allies, but also in Southeast Asia where reliable baseload power continues to be heavily reliant on coal.

Carney has argued that an industrial carbon emissions tax is necessary for alignment with other export partners like the U.K. and the E.U. that have industrial carbon policies, and that this will be a requirement to forge closer trading ties with other nations if we aim to diversify our customer base away from the U.S. However, in the current environment where the U.S. is already the largest LNG exporter and is set to expand production capacity by 60% in the first half of Trump’s term, Canada is unlikely to be able to afford additional regulatory burdens that eat away at the competitiveness of Canadian LNG on the global market.

While there is an opportunity for Canada to seize this moment of crisis and take the necessary actions to boost productivity and increase business investment, the path ahead isn’t straightforward. While most provinces are onboard with dropping provincial trade barriers, which would be a boost to the Canadian economy and is estimated to more than offset the GDP hit from U.S. tariffs, the relationship between Alberta and the federal government could make national unity hard to achieve. The list of demands from Danielle Smith for the next prime minister included eliminating the oil and gas emissions cap, ending the federal industrial carbon policy, repealing Bill C-69, and lifting a tanker ban off the B.C. coast. Smith also communicated that Alberta is “no longer agreeable to subsidizing other large provinces,” and that if these issues weren’t addressed in the first six months of the prime minister’s first term, there would be a “national unity crisis.” It certainly seems like the relationship between the Alberta Conservative Party and the Federal Liberal Party is unlikely to get any better under Carney’s leadership, especially given the earlier remarks that the Federal Liberals will be keeping the industrial carbon tax and the oil and gas emissions cap. Poilievre and the Federal Conservatives seem more amenable to Alberta’s economic concerns and the value a strong natural resource sector can provide to all Canadians, but whether or not that message resonates across the rest of Canada, we will have to wait and see.

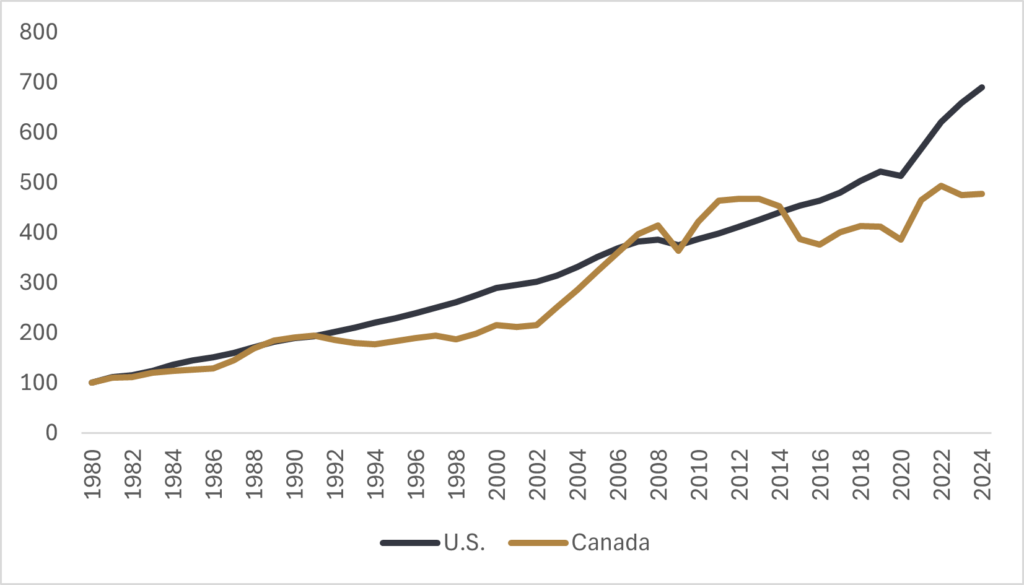

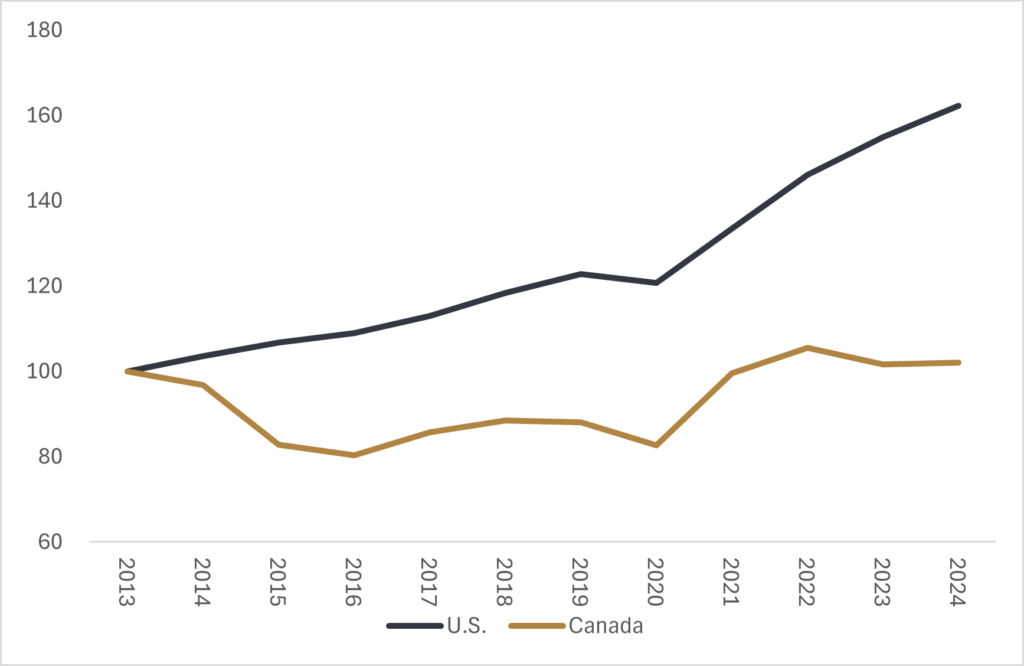

Despite the rollercoaster of the year so far, Canadian equities have held up reasonably well. Canadian equity markets are slightly positive on the year at +1.6%, lagging that of other international markets like Germany whose equity market is up +20% in CAD terms, but outperforming U.S. equities that are down -3.6% in CAD terms year-to-date. Canada is not set to release a fiscal bazooka like Germany has done after its recent election, but financial markets seem to be relatively sanguine that either candidate in the upcoming Canadian election will be keenly focused on tackling the issues that have been plaguing the Canadian economy, aiming to restore stagnating productivity growth, promoting inter-provincial trade, and boosting domestic investment to make the Canadian economy more resilient. Canadian equities remain attractive from a valuation perspective relative to that of U.S. equities and could see an additional boost to prices in the short term should the Conservatives rebound in the polls and form a more pro-business government.

Happy investing!

Scott Smith

Chief Investment Officer

DISCLAIMER:

This blog and its contents are for informational purposes only. Information relating to investment approaches or individual investments should not be construed as advice or endorsement. Any views expressed in this blog were prepared based upon the information available at the time and are subject to change. All information is subject to possible correction. In no event shall Viewpoint Investment Partners Corporation be liable for any damages arising out of, or in any way connected with, the use or inability to use this blog appropriately.